Category Archive: 6b) Austrian Economics

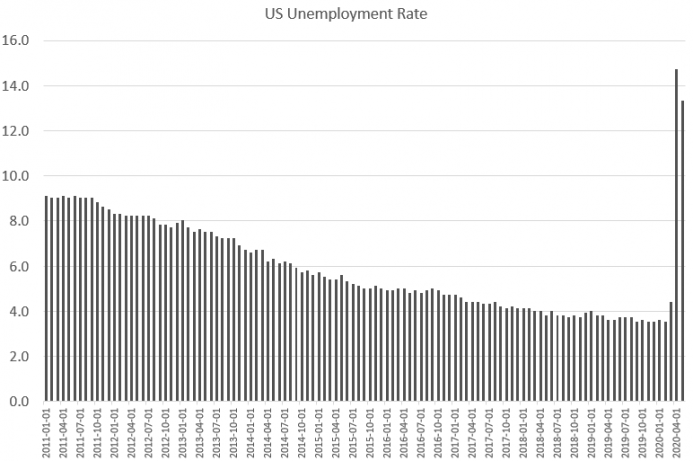

The Employment Situation Is Still a Disaster

Last Friday, the US Bureau of Labor Statistics released new unemployment data. The report surprised many because it showed a decrease in the unemployment rate, while many observers had expected an increase.

Read More »

Read More »

Reject the “Next Generation EU Plan”

The Václav Klaus Institute urging the Czech Government to reject the dangerous Ursula von der Leyen´s plan. It is rather rare that I share articles on my channel that are not from my own pen. The following article is therefore an exception and for good reason. It is written by none other than the former President of the Czech Republic Václav Klaus, with whom I have a long-standing relationship, based on great respect and many shared values.

Read More »

Read More »

Cashkurs präsentiert: PARADOGMA – Ein Film von Marijn Poels

Wir freuen uns, wenn Sie uns dabei helfen, den Film weiterzuverbreiten und wünschen allen, die PARADOGMA noch nicht gesehen haben, viel Spaß und Erkenntnisgewinn! PARADOGMA greift die wichtige Frage auf, wie freiheitlich wir uns in unserer vorgeblich so liberalen Welt wirklich äußern können, falls die eigene Meinung nicht den gesellschaftlich vorgegebenen Konsens trifft – und …

Read More »

Read More »

Banco De España, Debacle Económica Y La Falacia De La Reconstrucción

_______________________________________________________________________ Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales / Please subscribe to my channel and leave your comments below: ☑ Twitter – https://twitter.com/dlacalle ☑ Instagram – https://www.instagram.com/lacalledanie ☑ Facebook – https://www.facebook.com/dlacalle ☑ Página web – https://www.dlacalle.com ☑ Website –...

Read More »

Read More »

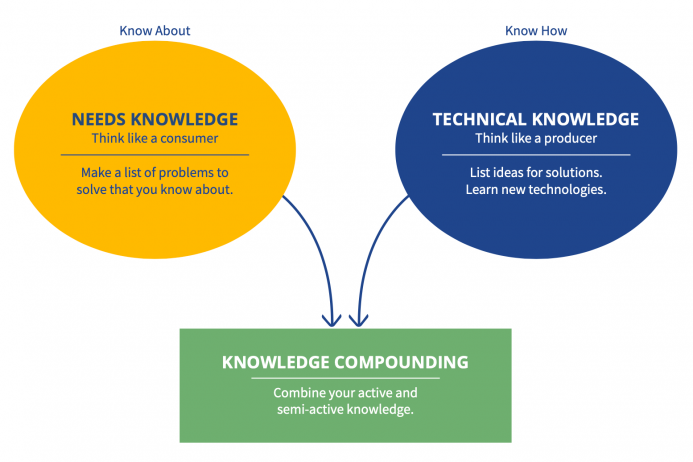

Mark Packard’s Value Learning Process: The Two Kinds of Knowledge Entrepreneurs Must Have

Key Takeaways and Actionable Insights. Innovation is one of the keys to business success. The world is changing at such a pace, and your customers’ preferences are changing so fast, that your business has to change at the same speed, or even faster. How to keep up is a part of the entrepreneurial challenge.

Read More »

Read More »

Economic Collapse Has Turned Many Europeans against the EU

Since the beginning of the year, the corona crisis has monopolized news coverage to the extent that a lot of very important stories and developments either went underreported or were ignored altogether. One such example was the very surprising ruling that came out of the German Constitutional Court in early May, which challenged the actions and remit of the European Central Bank (ECB).

Read More »

Read More »

MARKET EUPHORIA: Careful With Value Traps

_______________________________________________________________________ Please subscribe to my channel and leave your comments below: ☑ Twitter – https://twitter.com/dlacalle_IA ☑ Website – https://www.dlacalle.com/en ☑ My books at Amazon – https://www.amazon.com/Daniel-Lacalle/e/B00P2I78OG Thanks a lot!

Read More »

Read More »

Corona Bolsonaro Prof. Hendrik Streeck Hier=Alternative zu Markus Krall Hans-Werner Sinn. – Degrowth

496 Fridays for Future Christian Felber GWÖ Greta Thunberg Carla Reemtsma Luisa Neubauer Gradido Fridays for Future Niko Paech Degrowth Gemeinwohl-Ökonomie Postwachstum Bhutan Bruttonationalglück Permakultur Cradle2Cradle Bonobo-Kommunismus Quelle https://NextS4F.de Greta Thunberg Fridays for Future Markus Krall Christian Felber Gemeinwohl-Ökonomie GWÖ Hans-Werner Sinn Gradido Cradle2Cradle Permakultur Bhutan Bruttonationalglück Sahra Wagenknecht...

Read More »

Read More »

David Gordon Green, Craig Zobel – Zoom Call (05.28.20) | Coffee Talks | Film Independent

In this Coffee Talk, recorded 05.28.20, filmmakers and colleges David Gordon Green (HALLOWEEN, PINEAPPLE EXPRESS) and Craig Zobel (CONTROL, THE HUNT) talk about controversies, quarantine, filmmaker branding, horror movies and more. #davidgordongreen #craigzobel #filmindependent SUBSCRIBE TO FILM INDEPENDENT’S YOUTUBE CHANNEL: https://www.youtube.com/user/filmindependent FOLLOW US ON TWITTER: Tweets by filmindependent LIKE US ON FACEBOOK:...

Read More »

Read More »

The Fed Is Ignoring Asset Bubbles

_______________________________________________________________________ Please subscribe to my channel and leave your comments below: ☑ Twitter – https://twitter.com/dlacalle _IA ☑ Website – https://www.dlacalle.com/en ☑ My books at Amazon – https://www.amazon.com/Daniel-Lacalle/e/B00P2I78OG Thanks a lot!

Read More »

Read More »

Europe Will Not Recover As Fast As The United States

_______________________________________________________________________ Please subscribe to my channel and leave your comment: ☑ Twitter – https://twitter.com/dlacalle_IA ☑ Website – https://www.dlacalle.com/en ☑ My books on Amazon – https://www.amazon.com/Daniel-Lacalle/e/B00P2I78OG Thanks a lot!

Read More »

Read More »

Technocracy vs Liberty

“I prefer true but imperfect knowledge, even if it leaves much undetermined and unpredictable, to a pretense of exact knowledge that is likely to be false.” Friedrich August von Hayek

Read More »

Read More »

“Euro Can Only Be Saved If Germany Says Goodbye to Its Civil Liberties”, says Thorsten Polleit.

#euro #ecb #austrianschool #economics #germany #qe #fiatcurrency #gold #soundmoney #freemarket This is a conversation I had with Dr Thorsten Polleit about the current monetary and fiscal situation worldwide. Dr Thorsten Polleit is Chief Economist of Degussa and Honorary Professor at the University of Bayreuth. He also acts as an investment advisor. Our focus was on …

Read More »

Read More »

ABSTURZ der Wirtschaft (+ aktuelle Corona Zahlen)

Der Absturz der deutschen Wirtschaft ist historisch einmalig. Die aktuellen Zahlen sind verheerend. Haben wir mit dem Ende des Lockdowns das Tief gesehen oder ist das erst der Anfang? Was Marc Friedrich erwartet und wieso es wichtiger denn je ist sein Vermögen zu sichern.

Finanzen und mehr:

● Neues Buch: https://fw-redner.de/publikationen/buchbestellung/

● Unser Fonds: https://www.fw-fonds.de

● Website: https://www.friedrich-weik.de

● Newsletter:...

Read More »

Read More »

Wessen Plan=best? Widerstand2020 Markus Krall Christian Felber GWÖ Fridays for Future Niko Paech Deg

Degrowth Gemeinwohl-Ökonomie Postwachstum Greta Thunberg Carla Reemtsma Luisa Neubauer Gradido Hans-Werner Sinn Bhutan Bruttonationalglück Permakultur Cradle2Cradle Bonobo-Kommunismus Wähler, aber auch Fridays for Future – Schüler-innen und Greta Thunberg – Sympathisanten verstehen in youtube-Gesprächen den Welt-Sanierungs-Plan der https://NextScientistsforFuture.de !!! Sie verstehen, wie die Welt für ALLE(!!!) unendlich viel besser...

Read More »

Read More »

ABSTURZ der Wirtschaft (+ aktuelle Corona Zahlen)

Der Absturz der deutschen Wirtschaft ist historisch einmalig. Die aktuellen Zahlen sind verheerend. Haben wir mit dem Ende des Lockdowns das Tief gesehen oder ist das erst der Anfang? Was Marc Friedrich erwartet und wieso es wichtiger denn je ist sein Vermögen zu sichern. Finanzen und mehr: ● Neues Buch: https://fw-redner.de/publikationen/buchbestellung/ ● Unser Fonds: https://www.fw-fonds.de …

Read More »

Read More »

Hachazo De OCDE – Estimaciones De España Y El Error Del Proteccionismo

_______________________________________________________________________ Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales: ☑ Twitter – https://twitter.com/dlacalle ☑ Instagram – https://www.instagram.com/lacalledanie ☑ Facebook – https://www.facebook.com/dlacalle ☑ Página web – https://www.dlacalle.com ☑ Website – https://www.dlacalle.com/en ☑ Mis libros en Amazon –...

Read More »

Read More »

The Search for Yield

A no-holds-barred discussion of the economy after the coronavirus shutdown and George Floyd protests. Are we facing another Great Depression? Can there be a V-shaped recovery or is this wishful thinking? What will all the new money and credit created by Congress and the Fed mean for the dollar? What kind of economic mess will Trump or Biden inherit in 2021? How far will Fed chair Powell go to keep markets propped up?

Read More »

Read More »