Category Archive: 6b) Austrian Economics

BURBUJA EN BONOS DEL ESTADO: Por Qué Es Peligrosa

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Nicht jeder Preisanstieg ist Inflation

Immer wieder wird Inflation genannt, was keine ist – Markt- und inflationsbedingter Preisanstieg sind auseinander zu halten – Märkte, auf denen die Preise inflationsbedingt schon gestiegen sind.

Read More »

Read More »

Unfassbar! Die Inflation wird astronomisch sein! Die Krise des Geldes!

Videoinhalte: Banken, Wirtschaft, Finanzen, Geld, Kapital, Aktien, Börse, Immobilien, Politik, Medien, Gold, Silber, Edelmetalle, Bitcoin, Kryptowährung, Währungskrise, Währungsreform, Finanzpolitik, Finanzmarkt, Banken, Finanzcrash, Eurocrash, Bankencrash, Geldanlage, Eurokrise, Wirtschaftskrise, Pleite, Bankrott, Inflation, Kredite, Profit, Systemwechsel, Reset, Crash,

Read More »

Read More »

State Legislatures Are Finally Limiting Governors’ Emergency Powers. But only Some of Them.

Last week, Indiana Governor Eric Holcomb vetoed a bill that would limit gubernatorial authority in declaring emergencies. The bill would allow the General Assembly to call itself into an emergency session, with the idea that the legislature could then vote to end, or otherwise limit, a governor’s emergency powers.

Read More »

Read More »

Der spannendste Börsengang 2021! (Coinbase)

Die erste Kryptowährungs- Handelsplattform der Welt geht an die Börse. Soll man die Coinbase Aktie kaufen oder doch die Finger davon lassen? Ist der Erwerb von Bitcoin, Ethereum und Co. direkt besser oder reicht die einfache Aktie von Coinbase? Was spricht dafür was spricht dagegen und wie reagiere ich darauf?

Read More »

Read More »

MARKUS KRALL WARNT: ICH SEHE SCHWARZ! AKTUELLES SYSTEM IST NUN ENDGÜLTIG AM ENDE?!

Markus Krall gibt Einschätzung zu Gold, Immobilien & Geldanlage in der Wirtschaftskrise - Interessante Tipps & Strategien von Markus Krall aktuell im Video - Die wichtigsten Antworten zum Great Reset, Systemcrash & Wirtschaftszusammenbruch...

Read More »

Read More »

What Exactly Is Neoliberalism, and Is It a Bad Thing?

There are few things nowadays that ignite more hatred, especially within university campuses, than declaring oneself to be a neoliberal (if the reader is not convinced, he is invited to try it himself and see what happens).

Read More »

Read More »

Rock Y Libertad – FORTU charla con DANIEL LACALLE

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Entrevista al entrenador Andrew Moran del Miami Hoop School

¡Suscríbete a nuestro canal NexNoticias en Youtube y mantente actualizado con todo el acontecer nacional e internacional! Síguenos en todas nuestras redes sociales: NexNoticias en Instagram: http://instagram.com/nexnoticias NexNoticias en Twitter: https://twitter.com/NexNoticias NexNoticias en Facebook: https://www.facebook.com/NexNoticias Disfruta de nuestra programación en vivo: http://www.nexpanama.com/envivo

Read More »

Read More »

Exploring US presidential theory with Dr Andrew Moran

A five-minute masterclass from our Head of Politics and International Relations, Dr Andrew Moran.

Andrew talks you through the modern presidential theories of American politics and chats about why it's such an exciting time to be studying politics.

Read More »

Read More »

Weltweite Mindeststeuern: Eine brandgefährliche Idee

Grundsätzlich herrscht, abseits von Kreisen eingefleischter Marxisten, weitgehend Einigkeit darüber, dass der Wettbewerb zwischen den Anbietern von Waren und Dienstleistungen Kreativität freisetzt, Innovationen fördert, die Produktivität steigert und die Preise für die Konsumenten senkt. Ohne Wettbewerb bedeutet der Trabant den Gipfel der Automobilentwicklung; unter Wettbewerbsbedingungen entsteht der S-Klasse-Mercedes. Beides probiert – kein...

Read More »

Read More »

MARKUS KRALL UNGLAUBLICHE VORHERSAGEN TRETEN NUN STÜCK FÜR STÜCK EIN !!!

Hunger kennen wir in der westlichen Welt praktisch nicht. Klar, wenn man ohne Frühstück aus dem Haus geht, wird sich der Hunger im Verlaufe des Vormittags sicherlich bemerkbar machen. Doch richtigen Hunger, weil man seit Tagen nichts gegessen hat, dieses Gefühl kennen wir nicht hier bei uns. Und doch werden sich nachfolgende Generationen vielleicht daran gewöhnen müssen.

Read More »

Read More »

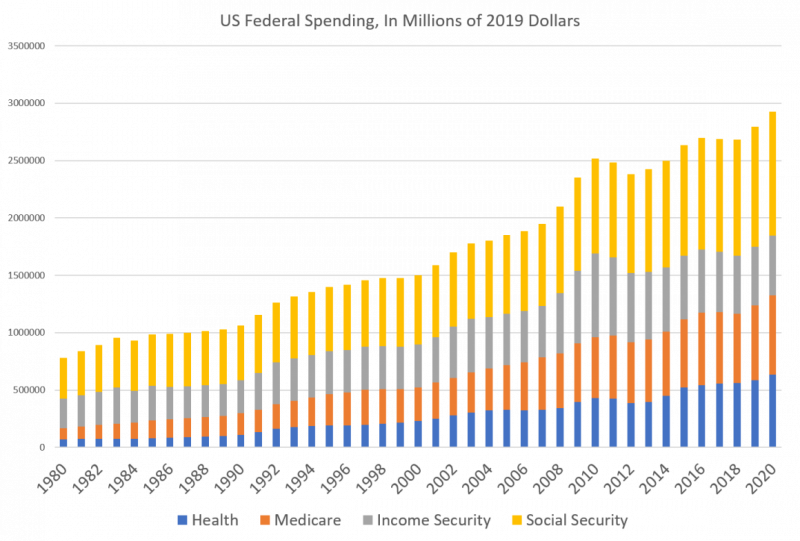

Biden’s New Budget Plan Means Trump-Era Mega Spending Will Continue

The reality of federal spending under Donald Trump did much to put to rest the obviously wrong and long-disproved notion that Republicans are the political party of “fiscal responsibility.” With George W. Bush and Ronald Reagan, it was pretty much “full speed ahead” as far as federal spending was concerned. Under George W. Bush, some of the biggest budget-busting years were those during which the Republicans also controlled Congress.

Read More »

Read More »

Wird BITCOIN verboten? Jetzt schnell verkaufen? (Heftig)

Droht ein Bitcoin Verbot? Der US-Milliardär Peter Thiel hat die US Regierung aufgefordert sich mit Bitcoin auseinander zu setzen. Er sieht Bitcoin als eine gefährliche geopolitische Waffe an, die China gegen die USA einsetzen kann. Fast alle haben diese Aussage falsch interpretiert - im Video wird seine Aussage ins richtige Licht gerückt und wird Dich überraschen!

Petition: https://bit.ly/3d6As12

► Mein neues Buch

Du möchtest "Die größte...

Read More »

Read More »

HACHAZO A LA RECUPERACIÓN – El FMI sitúa a España a la cola de la recuperación mundial

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

MARKUS KRALL WARNT: WAS TUN WIR DENN DA?! REITEN WIR UNS DADURCH IMMER WEITER REIN?

Markus Krall gibt Einschätzung zu Gold, Immobilien & Geldanlage in der Wirtschaftskrise - Interessante Tipps & Strategien von Markus Krall aktuell im Video - Die wichtigsten Antworten zum Great Reset, Systemcrash & Wirtschaftszusammenbruch...

Read More »

Read More »

How Federal Funding Is Used to Control Colleges and Universities

The Washington Post reports that a group of thirty-three current and former students at Christian colleges are suing the Department of Education in a class action lawsuit in an attempt to abolish any religious exemptions for schools that do not abide by the current sexual and gender zeitgeist sweeping the land.

Read More »

Read More »

Per Bylund en Juntos por Chile

Licenciado en Administración de Empresas y Máster en Informática en la Escuela Internacional de Negocios de Jönköping, Ph.D en Economía Agrícola de la Universidad Missouri-Columbia.

Read More »

Read More »

“Disciplina y Fortaleza En Tiempos Duros” ANGELICA DE LA RIVA charla con DANIEL LACALLE

Sigue a Angélica en:

Twitter: @delariva

https://www.angelicadelariva.com/

_______________________________________________________________________

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon -...

Read More »

Read More »

The Property-Based Social Order Is Being Destroyed by Central Banks

Private property is an institution central to civilization and beneficial human interaction. When central banks distort this institution with easy money, the social effects can be disastrous.

Read More »

Read More »