Category Archive: 6b) Austrian Economics

Dirk Müller: US-Immobilienmärkte & Privatverschuldung – Kollaps erwünscht

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Marktupdate_30Mai

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 30.05.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

Carl Menger and the Austrian School of Economics

What is known as the Austrian School of Economics started in 1871 when Carl Menger published a slender volume under the title Grundsätze der Volkswirtschaftslehre.

Read More »

Read More »

Cashkurs*Wunschanalysen: Hapag-Lloyd, Moeller-Maersk und Nutrien unter der Chartlupe

Cashkurs*Academy: Schnuppern Sie kostenlos in den Kurs Charttechnik rein – Jetzt den Code „Wunschanalysen“ einlösen und das erste Modul gratis belegen: https://bit.ly/CKA_charttechnik

In diesem Video bespricht unser Experte Mario Steinrücken die von der Cashkurs*Community gewünschten Titel am Chart: Heute sehen Sie hier die kurz, knackigen Analysen von Nutrien, Moeller-Maersk und Hapag-Lloyd. Weitere analysierte Aktien finden Sie im vollständigen...

Read More »

Read More »

Dirk Müller: Der perfekte Sturm – Plötzlich Mainstream statt Verschwörung

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Marktupdate_30Mai

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 30.05.2022 auf Cashkurs.com.)

???? ???? ?????????

Jetzt zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ?????? ????? ?ü? ??? ?,?? ???? - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

DAS WIRD WIE EIN FLUGZEUG ABSTURZ!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

Inflation, War, and Oil: How Today’s Crises Are Rehashing the 1970s

Persistently loose monetary policies always have negative growth and distributional effects that impair political stability. In extreme cases, there are civil wars and armed conflicts between countries.

Read More »

Read More »

The Backstory of the Great Reset, or How to Destroy Classical Liberalism

As should be clear by now, Francis Fukuyama’s declaration in The End of History: The Last Man (1992) that we had arrived at “the end of history” did not mean that classical liberalism, or laissez-faire economics, had emerged victorious over communism and fascism, or that the final ideological hegemony signaled the end of socialism.

Read More »

Read More »

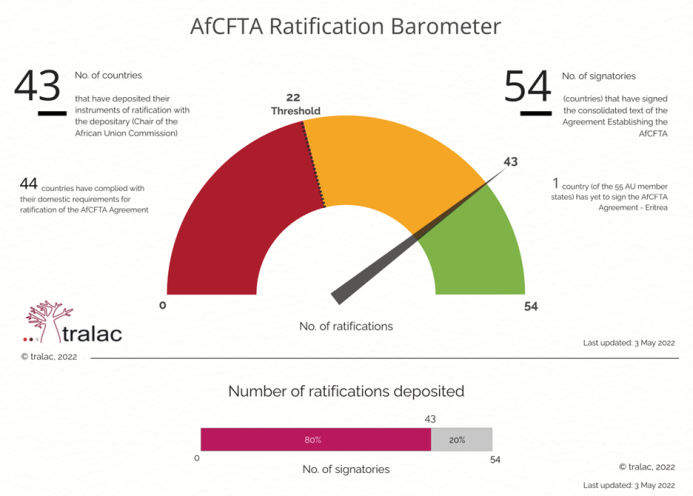

To Succeed, the AfCFTA Must Be about Actual Free Trade, Not Government-Managed “Free Trade”

The African Continental Free Trade Area (AfCFTA) is the world's largest free trade area by the number of countries. It is the most ambitious and, given demographic trends, the most promising free trade project on earth. The AfCFTA matters very much to Africa's economies separately and to the continent's collaborative and integrated economic development.

Read More »

Read More »

Regulations Vs Sovereignty to Maximize Wealth

Does the government or the central planners know what's best for us to maximize our wealth, or is it up to us to figure these things out? This is the battle between sovereignty and regulations.

Read More »

Read More »

Austrian Economists Are Not Surprised by the Shortages

While supporters of the Biden administration fault Putin for shortages, Austrian economists know the answer lies in Washington's monetary and economic mismanagement.

Read More »

Read More »

Corona-Insider: Es MUSS juristische Aufarbeitung geben! (Impfschäden)

Nachdem großen Erfolg des ersten Interviews mit Dr. Paul Cullen kommt jetzt die lang ersehnte Fortsetzung, nachdem das erste Gespräch der Zensur zum Opfer gefallen ist für eine Aussage, die man jetzt in der Zwischenzeit sagen darf.

Read More »

Read More »

Deirdre McCloskey Becomes a Fellow of the Erasmus Forum

The Austrian Economics Center and the Hayek Institut congratulate Deirdre McCloskey on becoming a Fellow of the Erasmus Historical and Cultural Research Forum.

Read More »

Read More »

Christianity and the Development of Human Capital: Challenging the Narratives

While the standard secular narrative is that Christianity held back science and human development, history tells a different story, one of literacy and the development of human capital.

Read More »

Read More »

REGLA : NO SE REDUCE LA INFLACIÓN SUBIENDO GASTO PÚBLICO

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

CRASH? LECCIONES DE INVERSIÓN EN UN MERCADO VOLATIL

HAZ CRECER TU DINERO, DISPONIBLE EN DEUSTO.

Presentación en la Fundación Rafael del Pino.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un...

Read More »

Read More »

Public Healthcare Threatens Liberty in the U.S.

Despite higher healthcare costs, Americans receive better healthcare, provided by the individually tailored healthcare plans, courtesy of the private sector.

Read More »

Read More »

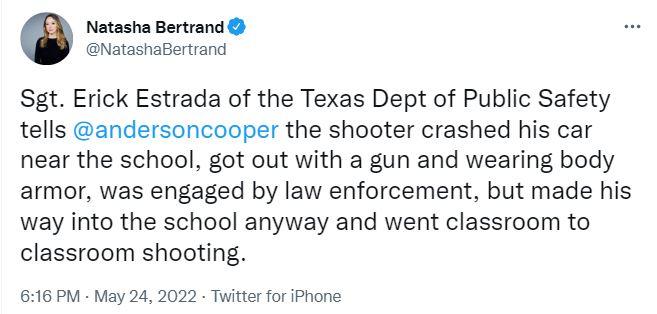

Police Botched the Uvalde Standoff. Now Gun Controllers Want to Give Police More Power.

First it was Columbine. Then it was Parkland. Now, we learn that at Robb Elementary School, police officers again stood around outside a school while the killer was inside with children.

Read More »

Read More »

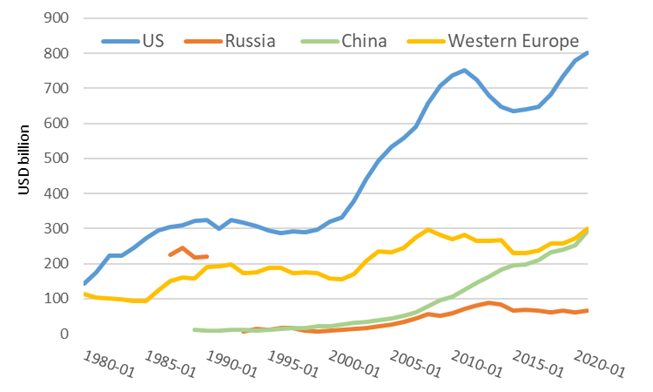

Peace through Strength? Excessive US Military Spending Encourages More War

The Russian invasion of Ukraine has brought America’s foreign policy interventions under the limelight once again. Ryan McMaken argues that the US administration’s claim that countries should not have the right to a sphere of influence, implicitly addressing Russia, is hypocritical.

Read More »

Read More »

Crash am Aktien- und Krypto-Markt – Was jetzt tun? Verkaufen oder Nachkaufen?

Wie du mit dem Krypto- und Aktiencrash umgehen solltest

Geldtraining: https://thorstenwittmann.com/geldsicherheit-garantiert/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Blitz-Crash und Blutbad, was nun?! Dieses Video ist bares Geld wert

„Alle Jahre wieder …“ dieses Weihnachtsslogan erinnert mich etwas an den aktuellen Blitz-Crash an den Aktien- und Kryptomärkten. Die großen Fragen sind dabei für dich:

Wie solltest du...

Read More »

Read More »