Category Archive: 6b) Austrian Economics

Cashkurs*Wunschanalysen: McDonalds, Etsy und Materialise unter der Chartlupe

Mario Steinrücken hat wieder die Aktienwünsche unserer Mitglieder unter die Chartlupe gelegt: Hier geht’s zum vollständigen Video mit weiteren spannenden Titeln wie Bakkafrost und Essity sowie einem allgemeinen Blick auf die Märkte - https://bit.ly/Wunschanalysen10Juni

Als Mitglied können Sie sich im Kommentarbereich auf https://www.cashkurs.com/ Ihren Favoriten für die nächste Runde wünschen - Unsere Experten nehmen jeden Freitag die Wunschaktien...

Read More »

Read More »

So überzeugst auch du dein Volk vom Krieg – Die 10 Grundsätze der Kriegspropaganda

Manipulationen erkennen und die 10 Regeln der Kriegspropaganda

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Thorsten Homepage: https://thorstenwittmann.com/

Die 10 Grundsätze der Kriegspropaganda

„Das erste Opfer des Krieges ist die Wahrheit.“ Dieses Zitat stammt von Lord Arthur Ponsonby.

Was er damit meint und welche 10 Grundsätze der Kriegspropaganda regelmäßig bei Kriegen angewendet werden, um das eigene Volk vom...

Read More »

Read More »

Respect the Fed? No, End the Fed

President Joe Biden has unveiled a three-part plan to fight inflation — or at least make people think he is fighting inflation. One part of the plan involves having government agencies “fix” the supply chain problems that have led to shortages of numerous products.

Read More »

Read More »

Degradation and Nationalization: The Inevitable Ways of Russian Autocratic Economic Policy

As Russian political scientist Gleb Pavlovsky has quite rightly said, one should not consider the five-thousand-plus sanctions imposed against the Russian Federation as of this writing as sanctions in the normal diplomatic and economic sense.

Read More »

Read More »

Emails between Austin St. John and Andrew Moran

Or, evidence of a cover up regarding Hollywood actor Isaac Kappy. You've all seen it now.

Go Austin!!! Sorry for the false title... but I have to "plug"... these people have killed others and they want me to kill myself. They are terrorists.

Hi, my name is Zachary McQuaid. Friends and business associates of actor Seth Green, which was unbeknownst to Isaac Kappy, falsely befriended Isaac Kappy and gained his trust after Isaac came out...

Read More »

Read More »

The Heat Death of the Economic Universe – Keith Weiner

In physics, the heat death of the universe occurs if all matter is moving apart. If it happens, it will be long after we're gone. But there's a troubling move towards the heat death of the economy. There is a diminishing return on debt.

Keith Weiner is the founder and CEO of Monetary Metals, an investment firm that is unlocking the productivity of gold.

Become an Ayn Rand Centre UK Member Here!

https://AynRandCentre.co.uk/become-a-

Check Out Our...

Read More »

Read More »

Dirk Müller – Alarmstimmung an der Wall Street

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Marktupdate220607

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige Finanzinformationsplattform zu den Themen Börse, Wirtschaft, Finanzmarkt von und mit Dirk Müller

??????? ???????? ??? ??? ???...

Read More »

Read More »

¿CRISIS ALIMENTARIA? Se dispara el riesgo.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

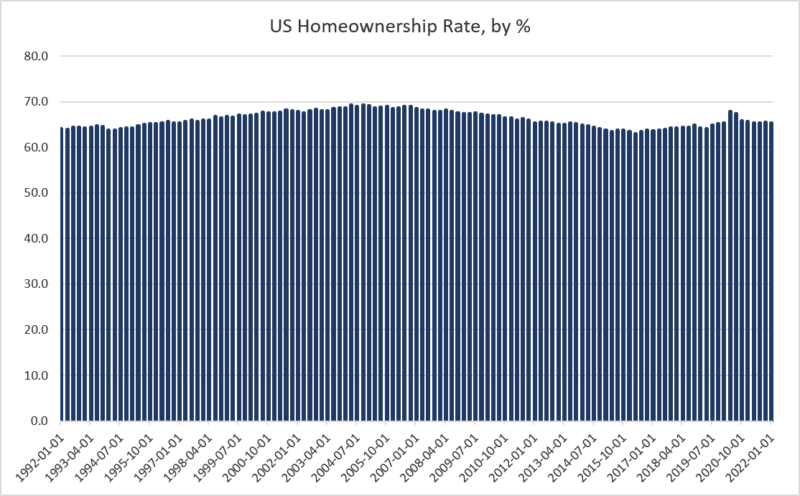

Are Today’s Homeownership Rates Sustainable?

There is scattered evidence that home prices are finally starting to slow down. But, if the phenomenon is system-wide, we’re still waiting to see the evidence in numbers. Last week, the most recent Case-Shiller national data, for example, showed that home prices in March rose an eye-popping 20 percent, year over year.

Read More »

Read More »

What If the U.S. Had Invaded Ukraine?

Let’s engage in a thought experiment. Suppose that Ukraine was headed by a pro-Russia regime. After repeated failed attempts at assassination by the CIA, the Pentagon finally decides to invade Ukraine for the purpose of bringing about regime change — i.e., ousting the pro-Russia regime from power and replacing it with a pro-U.S. regime.

Read More »

Read More »

INFLATION – REZESSION! Wie schützt du deine Kaufkraft? (Interview Jesse Felder)

Was kannst du gegen den Verlust deiner Kaufkraft tun?

Kann die FED noch einen Ausweg aus ihrer Geldpolitik finden? Wie steht es um unseren Makroökonomischen Ausblick, sehen wir bald einen Einbruch der Aktienmärkte und wie schützt Jesse Felder vom "The Felder Report" seine Kaufkraft? Wird die EZB der FED folgen oder doch weiterhin nur zusehen? Rudern wir volle Kraft auf eine Rezession, Depression zu oder befinden wir uns in einer...

Read More »

Read More »

Dirk Müller: Tesla & Elon Musk – Plötzlich im Visier der Machteliten

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Marktupdate220607

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 07.06.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

The Fed, and No One Else, Is Responsible for Inflation

According to commentators in the mainstream press and various federal officials, inflation is like the coronavirus. It spreads around the world, hitting different countries in different ways. Sometimes a country will experience only mild symptoms and sometimes more severe symptoms, like what happens with Covid.

Read More »

Read More »

Let’s Boycott Them!

Tom Woods’ bestseller Meltdown placed the blame for the financial debacle of 2008–09 on the government’s counterfeiter, the Federal Reserve. It was the Fed’s policies that created the problems, although most economists and economic talking heads didn’t see it that way. The Fed’s loose monetary policies funded the meltdown and became the “elephant in the living room” most pundits couldn’t see.

Read More »

Read More »

Does Capitalism Make Us More Materialistic?

There was a time when the advocates of socialism argued that it would lead man to material abundance, whereas free-market capitalism would lead only to increasing misery and would ultimately collapse under its own internal stresses. You don't hear that too much these days, and for good reason.

Read More »

Read More »

Das ändert alles!!! Große Veränderungen erwarten uns!!!

Ähnliche Meinungen teilen andere bekannte Experten, unter anderem: Mr. Dax, Dirk Müller, Dr. Markus Krall, Prof. Hans Werner Sinn, Marc Friedrich, Ernst Wolff, Dr. Daniel Stelter,

Read More »

Read More »

Finland and Sweden in NATO: Disregarding the Benefits of Neutrality

Finland and Sweden’s recent decision to apply for North Atlantic Treaty Organization membership is a major win for the military alliance, but a far more dubious one for these two countries. NATO badly needs a success at this moment, since neither the economic war on Russia nor the conflict in Ukraine seems to be going the West’s way.

Read More »

Read More »

Wirtschaft bricht ein – WAS TUN? (Bitcoin, Aktienmarkt, Inflation, Rohstoffe)

Was gehört in volatilen Zeiten unbedingt in DEIN Depot?

Wir stecken mitten drin in einer der wohl größten und faszinierendsten Zyklen unserer Zeit. Die FED und EZB wissen sich kaum zu helfen, die Inflation schießt auf neue Höhen und unsere Kaufkraft schmilzt beinahe täglich auf neue Niedrigstände. Was Du tun kannst, worauf Du achten musst und was ich in meinem Depot besitzen würde, erfahrt ihr in diesem Gastbeitrag von Inside Wirtschaft auf der...

Read More »

Read More »

Greenspan Would Be Proud: A Lesson in Fed Speak

It has become a familiar sight over the past decade and a half: a supposedly venerable member of the financial elite tells us with utmost calm that what we think we are seeing isn’t really all that bad. The Fed already knows all about it and has already taken all necessary steps. Further, they are monitoring the situation closely and are ready to make any necessary adjustments with ease and alacrity.

Read More »

Read More »

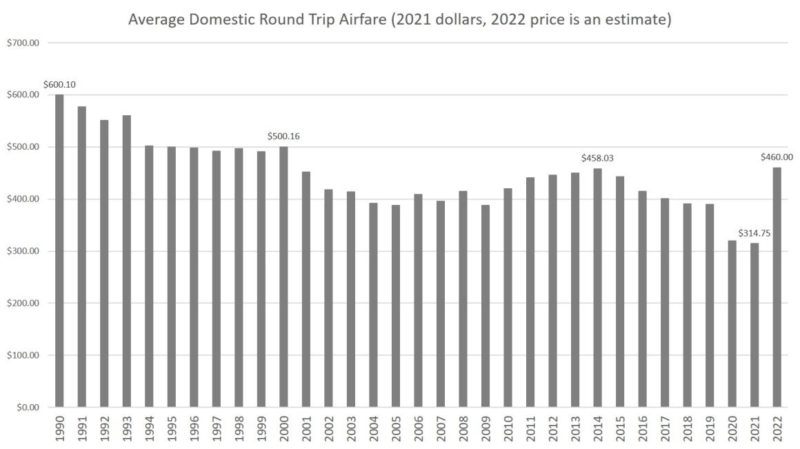

Debt-Fueled Demand and Oil Price Inflation Brings Airfares Roaring Back

If you’ve purchased any airline tickets lately, you’ve probably noticed that prices are up. It’s quite a reversal from the days of covid lockdowns, when airline tickets could be had for half the price of 2019 fares. Or even lower, in many cases.

Read More »

Read More »