Category Archive: 6b) Austrian Economics

Questioning the Military Necessity of Dropping Atomic Bombs on Japanese Cities

One of the most devastating moments in American history took place on August 6 and August 9, 1945, with the bombings of Hiroshima and Nagasaki. Approximately three hundred thousand civilians, forty-three thousand soldiers, forty-five thousand Korean slave laborers, and over a thousand American citizens (including twenty-three prisoners of war) would die.

Read More »

Read More »

Dirk Müller: Tesla-Aktie nach Zahlen – Brutale Käufe bei ausgeschlachtetem Kurs

?? Jetzt Cashkurs-Mitglied werden ►► 1 Monat für €9,90 statt €17,70 ►https://bit.ly/Cashkurs9_90

3️⃣ Tage gratis testen ►►► https://bit.ly/3TageGratis

? Gratis-Newsletter ►►►https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren ►►► https://www.youtube.com/@cashkurscom

Cashkurs.com - Wirtschaft. Finanzen. Börse. Ehrlich! Unabhängig! Direkt!

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Update230126

(Bei diesem Video...

Read More »

Read More »

DAS verändert ALLES #ai #chatgpt #ki

Die Künstliche Intelligenz ist im Vormarsch!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7...

Read More »

Read More »

Gefahr für Immobilien 2023: Preiseinbruch, Zwangshypothek und Nachbesicherung

Immobilien 2023 – Preise brechen ein und Gefahr Enteignung wächst

Kostenfreies Immobilien-Training: https://thorstenwittmann.com/kostenfreies-immobilien-training

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Immobilien 2023 – Preise brechen ein und Enteignungsgefahr steigt jeden Tag weiter an – was tun?

Einbrechende Preise, Gefahr von Zwangshypotheken und Nachbesicherung, CO2-Umlagen und einiges mehr … die Gefahren bei...

Read More »

Read More »

The Pentagon’s Perpetual Crisis Machine

Given President Biden’s decision to send 31 of its top-ranked M1 Abrams tanks to Ukraine, it is clear that the Pentagon has decided to escalate its war against Russia. Biden’s decision was followed by Germany’s decision to deliver 14 Leopard 2 A6 tanks to Ukraine.

Read More »

Read More »

WEF: Darüber wurde NICHT berichtet

Das Macht- und Elitetreffen WEF (World Economic Forum) ist vorbei, was wurde besprochen und geplant? Was wurde nicht in den Medien berichtet? Wir machen heute einen Deep Dive und haben einige krasse und widersprüchliche Aussagen gefunden.

Kapitel:

00:00:00 - Intro

00:03:38 - Cyber-Attacken & Corona-Virus

00:09:08 - Klimawandel

00:11:21 - Die Doppelmoral

00:14:05 - Einfluss auf die Politik

00:17:21 - Alternative Visionen

00:20:12 - Fazit

►...

Read More »

Read More »

300.000 Abonnenten sind geknackt!? #shorts

Die 300.000 Abonnenten sind geknackt, auf gehts zu den 500.000! Danke für all euren Support.

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media...

Read More »

Read More »

European Shadow Unemployment Is a Real Problem

The latest jobs report in the United States shows strengths and weaknesses. Total nonfarm payroll employment increased by 223,000 in December, and the unemployment rate fell to 3.5 percent. However, the United States job market continues to show negative real wage growth, the employment-to-population ratio is 60.1 percent, and the force participation rate is 62.3 percent.

Read More »

Read More »

Yes, the Minimum Wage Harms the Economy

The 2021 Nobel Prize in Economic Sciences was awarded to David Card, Joshua Angrist, and Guido Imbens. David Card received the award for his paper (coauthored with Alan Krueger) “Minimum Wages and Employment: A Case Study of the Fast-Food Industry in New Jersey and Pennsylvania.”

Read More »

Read More »

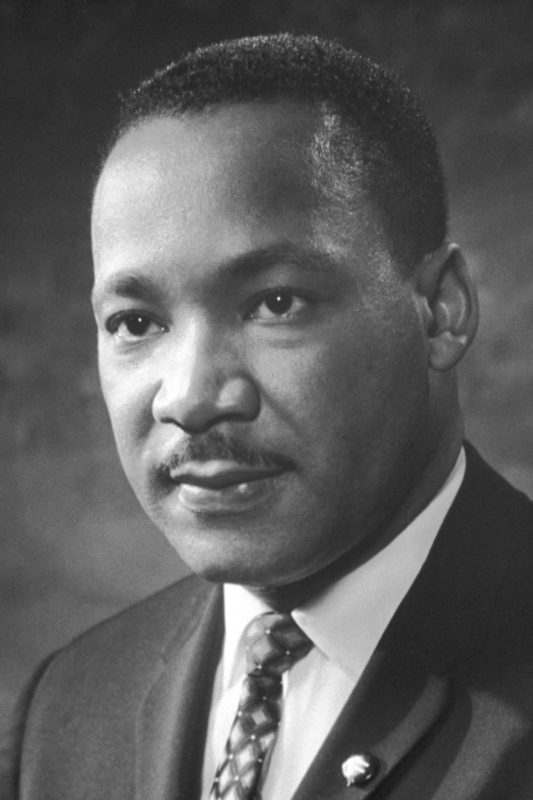

Was Martin Luther King a Russian Red?

Today, federal officials stumble over themselves to show how much they revere Martin Luther King. They’ve even created a federal holiday to honor him. Not so back when King was alive, however. During that time, U.S. officials were convinced that King was a Red, and they were also convinced that the Reds, especially the Russian Reds, were coming to get us.

Read More »

Read More »

The death of the middle class is the death of civil society

The middle class in the West has been shrinking for years, but after the covid crisis and especially after the inflation explosion, whatever was left of it is now basically under threat of extinction. This has immense sociopolitical implications.

Read More »

Read More »

How the Constitution Constrained Federal Spending and Debt

Given that the debt-ceiling debate is likely to continue for a few months, examining the Constitution provides us with the reasons our nation has been plunged into this monetary morass. Federal officials have now run up the federal government’s debt to more than $31.5 trillion. That’s a lot of money. And it’s also a lot of interest payments.

Read More »

Read More »

The Elusive International Order

The liberal international order was a screen and a sham. But this does not mean that liberalism is lost.

Read More »

Read More »

Sahra Wagenknechts Statement (Ukraine-Krieg) #shorts

Sahra Wagenknechts Meinung zu Waffenlieferungen, Ukraine-Krieg und USA als Gewinner der Situation.

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social...

Read More »

Read More »

Inflation, Rezession – wie steht es um 2023? (LIVESTREAM 23.01)

Wie würde ich investieren, was halte ich von unserer jetzigen Politik, würde ich immer noch Bitcoin empfehlen und wie ist eigentlich meine Prognose für 2023? Inflation, Rezession? All das und noch mehr, nachher. Ich freue mich auf euch!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder...

Read More »

Read More »

Inflation, Rezession, wie investieren? – 18 Uhr LIVE #FragMarc

Merkt euch 18 Uhr (23.01.2023), denn dann könnt ihr mich in einem neuen #FragMarc Livestream ausfragen! Wie würde ich investieren, was halte ich vom WEF, würde ich immer noch Bitcoin empfehlen und wie ist eigentlich meine Prognose für 2023? All das und noch mehr, nachher. Ich freue mich auf euch!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller...

Read More »

Read More »

Governments Will Make You Poorer Again

The International Monetary Fund (IMF) has warned about the optimistic estimates for 2023, stating that it will likely be a much more difficult year than 2022. Why would that be? Most strategists and commentators are cheering the recent decline in price inflation as a good signal of recovery.

Read More »

Read More »

A High Price is a Good Price – Under the Right Conditions

Overpaying for something that could be found in a different store (or online), under the right circumstances, makes both parties happier. After looking around a bit, I asked the cashier at a nearby convenience store if he had any nine-volt batteries because I didn’t see any on the shelf. To my good fortune, he did. I asked for two of them and pulled a $5 bill out of my wallet as he rang them up.

Read More »

Read More »