Category Archive: 6b) Austrian Economics

Will Biden’s Trip to the Border Win the War on Immigrants?

Immigration-control advocates are ecstatic over President Biden’s visit to El Paso. Maybe — just maybe — Biden’s trip will be what finally — finally! — brings victory in the decades-long U.S. war on immigrants. Except that it won’t. The hope of the immigration-control advocates will be dashed once again.

Read More »

Read More »

The Present Fiat Monetary System Is Breaking Down

The heart of economic growth is an expanding subsistence fund, or the pool of real savings. This pool, which is composed of final consumer goods, sustains individuals in the various stages of the production process. The increase in the pool of real savings permits the expansion and the enhancement of the infrastructure, and this strengthens economic growth.

Read More »

Read More »

Übersterblichkeit HILFT Rentensystem!

Die Rente ist sicher - dank Corona? Es scheint so, denn völlig überraschend vermeldet die hochdefizitäre Rentenversicherung plötzlich einen Überschuss. Grund ist u.a. die Übersterblichkeit. Was steckt dahinter? Sterben die Menschen an Corona oder sind es andere Gründe?

Read More »

Read More »

Ernst Wolff – Bald kommt alles raus! Das dicke Ende kommt! 4 Top Aussagen!

Wie wird sich die aktuell kritische Lage weiter entwickeln? Wir schauen uns regelmäßig an, was Experten wie Ernst Wolff, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

Ein «Preisdeckel» hat etwas gemeinsam mit einem «Klodeckel» – Dr. Markus Krall #wirtschaft #gas #eur

Ein «Preisdeckel» hat etwas gemeinsam mit einem «Klodeckel» - Dr. Markus Krall beim alphaTrio an der World of Value 2022.

Read More »

Read More »

AUF WIEDERSEHEN SCHOLZ! SEIN VERSAGEN IN EINEM VIDEO!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

Krypto Doom oder Boom 2023? So werden BILLIONÄRE gemacht!

Mein Geldanlage-Spezialtipp in 2023 und so werden Mi-l-l-ionäre gemacht. Diese Geldanlage ist einer meiner persönlichen Favoriten für 2023.

Read More »

Read More »

Rome’s Runaway Inflation: Currency Devaluation in the Fourth and Fifth Centuries

By the beginning of the fourth century, the Roman Empire had become a completely different economic reality from what it had been at the beginning of the first century. The denarius argenteus, the empire’s monetary unit during the first two centuries, had virtually disappeared since the middle of the third century, having been replaced by the argenteus antoninianus and the argenteus aurelianianus, numerals of greater theoretical value, but of less...

Read More »

Read More »

2023: You Wanted Endless Stimulus, You Got Stagflation.

After more than $20 trillion in stimulus plans since 2020, the economy is going into stagnation with elevated inflation. Global governments announced more than $12 trillion in stimulus measures in 2020 alone, and central banks bloated their balance sheet by $8 trillion.

Read More »

Read More »

El sistema de PENSIONES que hace AGUA // Economix

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Peter Schiff: Unser Geld stirbt, Gold siegt und Bitcoin ist wertlos!

Bitcoin hat am 3. Januar seinen 14. Geburtstag gefeiert. Anlass genug, um mit einem der größten Bitcoin Kritiker zu sprechen, nämlich niemand anderem als dem legendären Peter Schiff. Ich bin stolz in euch erstmalig auf einem deutschen Kanal präsentieren zu dürfen. Wir sprechen aber nicht über Bitcoin, sondern auch über Inflation, Rezession, das Fiat-Betrugssystem und warum der Euro und Dollar scheitern werden und Gold besser als Bitcoin ist.

Peter...

Read More »

Read More »

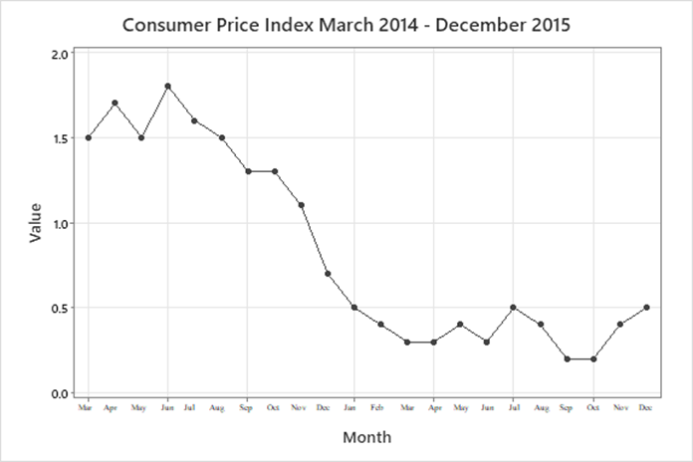

Central Bankers Are Poor Archers: The Problems and Failures of Inflation Targeting and Price Stability

The famous quote, “Insanity is doing the same thing over and over again and expecting different results,” is usually attributed to Albert Einstein. While intended as a parable for quantum insanity, such a quote could equally be a parable for inflation policy. With the Bank of England and the Federal Reserve seeking to maintain target rates of 2 percent, the UK inflation rate has only fallen to 10.7 percent from 11.1 percent.

Read More »

Read More »

WELTÄRZTE CHEF RUTSCHT WAHRHEIT RAUS!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

Michael Mross: Mit der Abrissbirne durch Deutschland

#michaelmross #freiheit #untergang #boom #aktien

Michael Mross ist ein bekannter deutscher Börsenexperte, Buchautor, Wirtschaftsjournalist und Moderator.

Read More »

Read More »

Dirk Müller: Dividenden-Champion BASF – Wird langsam richtig interessant

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Update230103

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Update vom 03.01.2023 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

Ferdinando Galiani, an Italian Precursor to the Austrians

The Austrian School of economics did not develop out of thin air. It built upon the work of a number of other economists and philosophers going back as far as Aristotle. Among the precursors of the Austrian School were a number of Spanish and Italian scholastic economists.

Read More »

Read More »

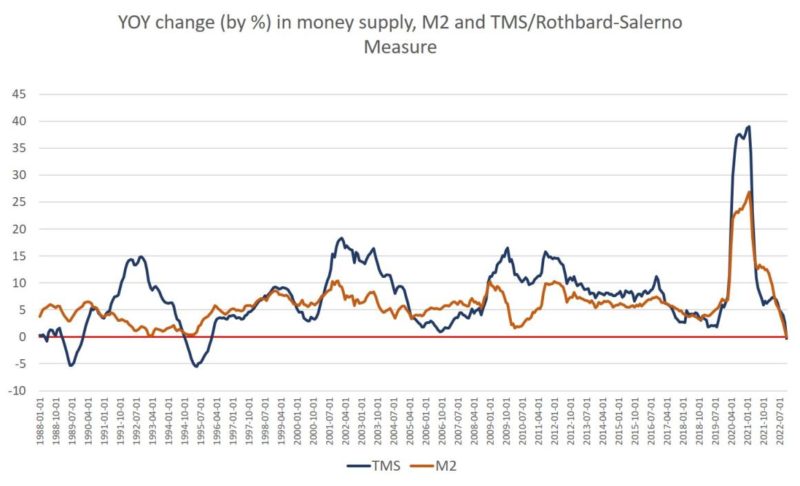

Money-Supply Growth Turns Negative for First Time in 33 Years

Money supply growth fell again in November, and this time it turned negative for the first time in 33 years. November's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years. During the thirteen months between April 2020 and April 2021, money supply growth in the United States often climbed above 35 percent year over year, well above even the "high" levels experienced from 2009 to...

Read More »

Read More »

Das Finanzamt weiß ab 2023 alles! (neues Gesetz)

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3EC3fqA oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram: https://www.instagram.com/marcfriedrich7/

TikTok:...

Read More »

Read More »

“Markets and civil society are win-win institutions, government and politics are zero-sum.”

Division, friction and polarization have been on the rise in the West for at least a decade, but the escalation we saw during the “covid years” was especially worrying. Over the last year, this “worry” has become a truly pressing concern, even a real emergency one might argue, as inflationary pressures and an actual war were added to the mix of political and social tensions.

Read More »

Read More »