Category Archive: 6b) Austrian Economics

The Outbreak of World War I: A Libertarian Realist Rebuttal

As you may have noticed, those dreaded “forces” seem to have rematerialized—in the headlines, in the journals, in the pages of bestsellers: those historical, material, political, or ideological forces that supposedly make conflict between some set of groups, classes, or states “inevitable.”

But as the great libertarian historian Ralph Raico never tired of telling, such collectivist narratives are often little more than convenient scapegoats or...

Read More »

Read More »

Bomba ¿Vuelven las preferentes? Bancos y Bonos convertibles

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

A Bank Crisis Was Predictable. Was the Fed Lying or Blind?

Welcome to Whose Economy Is It, Anyway?, where the rules are made up and the dollars don’t matter. Or at least that seems to be the view of the Yellen regime.

Original Article: "A Bank Crisis Was Predictable. Was the Fed Lying or Blind?"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Are Bank Failures a Sign of More Trouble Ahead?

The failure of Silicon Valley Bank (SVB) on March 10 was the second largest bank failure in US history. Just two days following SVB’s collapse, Signature Bank joined the record books as the third largest bank failure in US history. First Republic Bank also seemed on the edge of collapse until Bank of America, Citigroup, and other big banks agreed to jointly fund a bailout for it.

Major Swiss bank Credit Suisse was also teetering on the brink when...

Read More »

Read More »

Ist Geld auf dem Konto sicher? SAG-Gesetz erklärt!

? EVENT: Marc lädt Dich ein nach Schwäbisch Gmünd!

https://www.marc-friedrich.de/marc-laedt-ein

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung...

Read More »

Read More »

American Dissident: The Legacy of Murray Rothbard

Murray Newton Rothbard, perhaps the greatest enemy of the state in the second half of the twentieth century, would have recently celebrated his ninety-seventh birthday had he lived.

Men are not salmon, those unique creatures that swim against the current. Most people “go with the flow” and allow the pace of events to dictate their lives, at least in that few consciously choose to reject the current order of things, declare it to be profoundly...

Read More »

Read More »

Absurder Vorschlag der Grünen! (Namensrecht)

? Marc lädt Dich ein nach Schwäbisch Gmünd!

https://www.marc-friedrich.de/marc-laedt-ein

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

►...

Read More »

Read More »

Yes, the Latest Bank Bailout Is Really a Bailout, and You Are Paying for It.

The Fed is launching a new billionaire bailout designed to keep banks afloat, and the FDIC is promising to back potentially trillions in deposits. The taxpayer will ultimately be on the hook.

Original Article: "Yes, the Latest Bank Bailout Is Really a Bailout, and You Are Paying for It."

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Why Governments Waste Resources: The Case of Newfoundland’s Joseph R. Smallwood

A key principle in understanding Austrian economics is seeing the inefficiency of government spending. In an era of overbearing states and reckless fiscal policy, this principle must be emphasized repeatedly. Politicians might claim the best of intentions when dishing out funds for military defense, social welfare, and public works. Their civil servants might try to realize these plans efficiently and thriftily.

However, the very nature of...

Read More »

Read More »

Ist dein GELD sicher? (Credit Suisse) #shorts

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

Intenté Razonar con Pablo Iglesias en 2014 pero… NO ESCUCHA

#pabloiglesias #economia #podemos #inflación #devaluación

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

“La Inflación es SIEMPRE un Fenómeno Monetario” | La Pizarra de Daniel Lacalle

#inflación #dinero #crisis #macroeconomía #dolar #bancos

https://www.dlacalle.com/los-beneficios-empresariales-no-causan-la-inflacion/

https://www.dlacalle.com/el-dolar-y-la-inflacion-una-explicacion-monetaria/

https://www.dlacalle.com/el-estado-es-el-que-genera-beneficios-caidos-del-cielo-por-la-inflacion/

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

Government Is as Government Does

If we have learned anything from hundreds of years of government oppression and atrocities, one thing is certain: government isn't our friend.

Original Article: "Government Is as Government Does"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Donald Trump Is Wrong about Tariffs and Mercantilism

During the past few weeks, Donald Trump has been releasing some of his proposals if he were to win the election in 2024. While many of his positions pose great danger to personal liberty, such as his plan to “end crime and keep Americans safe,” his proposals on tariffs are up there in terms of ignorance.

In a video posted on February 27, Donald Trump released his plan to “end our reliance on China.” In the short video, Trump claims that his plan...

Read More »

Read More »

The Phillips Curve Is an Economic Fable

Keynesians and fellow travelers hold the Phillips curve to be sacrosanct. But because the Phillips curve cannot establish causality, it is useless as economic theory.

Original Article: "The Phillips Curve Is an Economic Fable"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Discutí con Yolanda Díaz hace 6 años… NO HA SERVIDO DE NADA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Dirk Müller: Credit Suisse-Rettung – Der neue „Lehmann“-Moment

????? ??? ??? ????? ?????? ??? ???? ?ü???? ????:

https://bit.ly/230320_Marktupdate

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 20.03.2023 auf Cashkurs.com.)

?Jetzt Cashkurs-Mitglied werden ►► 1 voller Monat für €9,90 ► https://bit.ly/Cashkurs9_90

3️⃣ Tage gratis testen ►►► https://bit.ly/3TageGratis

? Gratis-Newsletter ►►►https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren ►►►...

Read More »

Read More »

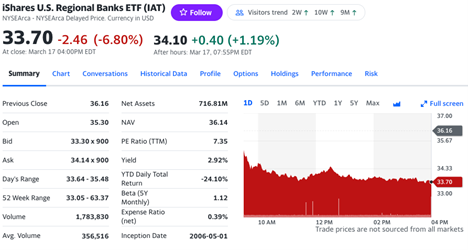

It Turns Out That Hundreds of Banks Are at Risk

It’s the weekend, but our fresh Financial Crisis does not sleep. And a recent study says we’ve only seen the tip of the iceberg.

The Washington Post yesterday wrote: “If banks were suddenly forced to liquidate their bond and loan portfolios, the losses would erase up to 91 percent of their combined capital cushion.” In other words, we were already right up against the edge.

The Post cites two studies that total unrealized losses in the system are...

Read More »

Read More »

Socialism Isn’t about Creating Economies. It Is about Amassing Political Power

Ludwig von Mises wrote Socialism: An Economic and Sociological Analysis, a small book published in 1922, which demonstrated that economic calculation in a socialist commonwealth is impossible. Of course, Mises assumed that the purpose of an economy, even a socialist one, was supposed to produce goods and services, which determined its success or failure.

Alain Besançon wasn’t an Austrian or a Misesian, but he wrote Anatomie d’un spectre: l’Économie...

Read More »

Read More »

Bankenkrise kurz erklärt #creditsuisse

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »