Category Archive: 6b.) Mises.org

The Corrupt Bargain and the Preservation of Slavery

The most important battle of the August days of the Constitutional Convention was waged, as had been the battle over the three-fifths clause, between the North and South and had at its heart the institution of slavery.

Read More »

Read More »

El progresismo | Jeff Deist

Jeff Deist habla sobre hasta qué punto el pensamiento progresista se está extendido en los actos y pensamientos de nuestra vida cotidiana.

Momento que tuvo lugar durante la reunión anual de la Property and Freedom Society que se celebró del 13 al 18 de septiembre de 2018 en el Hotel Karia Princess, Bodrum, Turquía.

Video cortesía de Centro Mises.

Página web de Centro Mises:

https://www.mises.org.es/

Te invito a colaborar con Menos...

Read More »

Read More »

How Markets Have Delivered More Economic Equality

People must still compete for resources in a socialist economy. In fact, the competition is intense. On the other hand, thanks to markets, basic necessities—and even basic luxuries—are now more more accessible than ever.

Original Article: "How Markets Have Delivered More Economic Equality"

This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Michael Stack.

Read More »

Read More »

The Bureaucrat as a Voter

The bureaucrat is not only a government employee. He is, under a democratic constitution, at the same time a voter and as such a part of the sovereign, his employer. He is in a peculiar position: he is both employer and employee. And his pecuniary interest as employee towers above his interest as employer, as he gets much more from the public funds than he contributes to them.

Read More »

Read More »

No, Conservatives Should Not Embrace MMT

Reading Jonathan Culbreath’s “Modern Monetary Theory for Conservatives” one can’t help but think of Murray Rothbard’s quip that “it is not a crime to be ignorant of economics … but it is totally irresponsible to have a loud and vociferous opinion on economic subjects while remaining in this state of ignorance.“

Culbreath’s case for modern monetary theory (MMT) rests on an ignorance of basic economic principles regarding the role of money in a free...

Read More »

Read More »

Geld, Politik, gekaufte Macht und der Weg in die Abhängigkeit!

Geld, Politik und Macht sind sehr eng miteinander verwoben. Enger als es den meisten Menschen bewusst ist.

Read More »

Read More »

Klimawandel und Corona. Was Mises und Hayek dazu sagen würden

Die Neuauflage der marxistischen "Verelendungstheorie":

Klimawandel und Corona. Was Mises und Hayek dazu sagen würden.

Aufzeichnung des Vortrags von Dr. Thorsten Polleit beim Hayek-Club Trier-Luxembourg e.V. am 22.4.2021

Read More »

Read More »

Episode 89 – Irreconcilable Differences with Jeff Deist

In this very special episode, we are joined by the coolest patriarch in the liberty world, Mr. Jeff Deist of the Mises Institute. He is a man whose rational and apt arguments have been called hateful by the Woke Mob, the man who coined "post-persuasion," and a pillar of freedom in a chaotic world. Join us as we explore our current paradigm and our dire need for decentralization and secession.

Read More »

Read More »

Thanks to the Fed, the High-Risk, Small-Time Borrower Is Becoming a Thing of the Past

Banks and accounting trickery go together. Last year, as I remember back to my banking days, financial institutions followed the advice once proffered by one of our board members, “If we’re going to the dump, let’s take a full load.”

When the pandemic struck, banks dumped plenty in their loan-loss provisions, $60 billion, expecting the worst.

Read More »

Read More »

United agree tabs’on talented attacking midfielder, 22 goal contributions at youth level this season

Man United are weighing up a possible move for Andrew Moran.

Ole Gunnar Solskjaer’s Manchester United have been built on developing youth. From Marcus Rashford to Scott McTominay, to the overflowing array of talent that’s knocking on the first-team door.

As the old saying goes, if it ain’t broke, don’t fix it. That’s exactly why the Old Trafford club continue to be linked with moves for talented players all across the globe. The latest prospect...

Read More »

Read More »

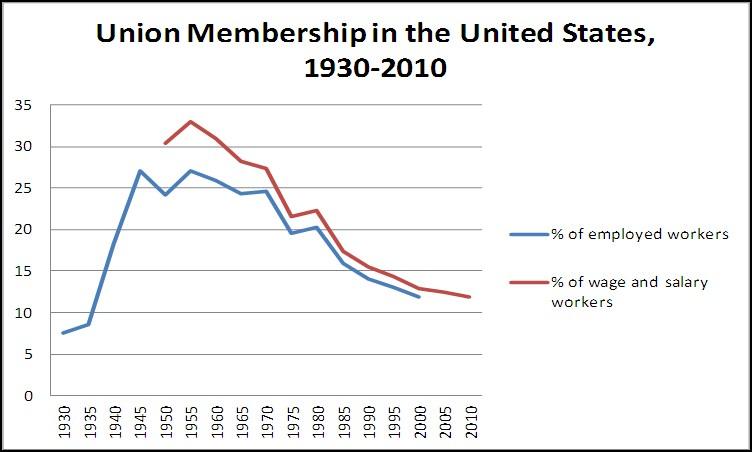

Why Empowering Organized Labor Will Definitely Not Help the Economy

Paul Krugman has a very prominent perch from the editorial page at the New York Times and he has used his influence, among other things, to shill for two things that are anathema to a strong economy: inflation and organized labor. My analysis examines what Krugman says about labor unions and explains why once again his economic prognostications are off base.

Read More »

Read More »

A Dozen Dangerous Presumptions of Crisis Policymaking

Congress and the president have adopted many critically important policies in great haste during brief periods of perceived national emergency. During the first “hundred days” of the Franklin D. Roosevelt administration in the spring of 1933, for example, the government abandoned the gold standard, enacted a system of wide-ranging controls, taxes, and subsidies in agriculture, and set in motion a plan to cartelize the nation’s manufacturing...

Read More »

Read More »

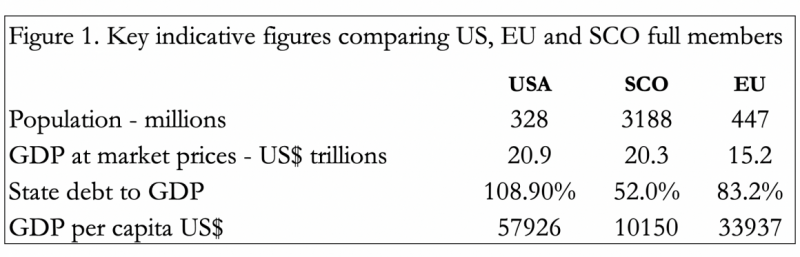

The Biggest Threat to US Hegemony: China, Russia, or Debt?

China and Russia are trying to build a Eurasion bloc that can break free of any American spheres of influence. The American regime obviously opposes this, but money printing and debt limits the American options.

Original Article: "The Biggest Threat to US Hegemony: China, Russia, or Debt?"

This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Michael Stack.

Read More »

Read More »

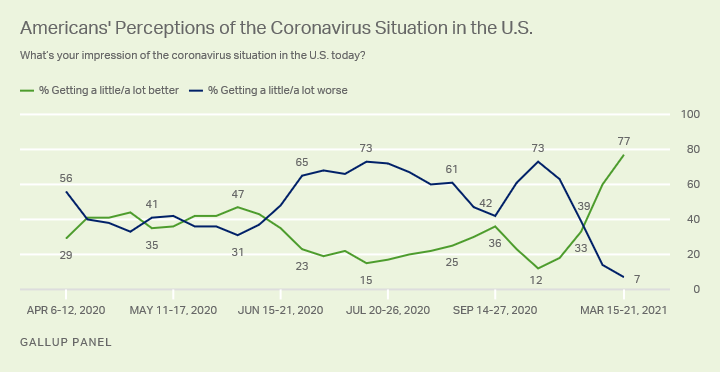

Not Even Gretchen Whitmer Wants More of the CDC’s Lockdowns

The US state with the fastest growing covid-19 caseload is a state that has experienced some of the harshest and longest lockdowns and covid restrictions: Michigan. As of April 20, the seven-day moving average for new covid cases in Michigan was 790 per million. This is higher than any other US state, and it is several times higher than the case rate for Michigan a year ago.

Read More »

Read More »

Per Bylund and The Economics of Charity – A Voluntary View 010

VIA welcomes Professor Per Bylund onto the show! Per Bylund is the Assistant Professor of Entrepreneurship and Records-Johnston Professor of Free Enterprise in the School of Entrepreneurship at Oklahoma State University. Jeff and Professor Bylund discuss the new book he’s writing for the Mises Institute, his work teaching the next generation of entrepreneurs, and the economics of voluntary charity vs. the welfare state.

Read More »

Read More »

The Biggest Threat to US Hegemony: China, Russia, or Debt?

Now that the Biden administration has settled in, it is time to reassess American policy towards Russia, China and the wider Asian scene. Is it going to be a continuation of the Trump administration’s policies, or is there something new going on? Given the continued tenure of staffers at the Pentagon from before the Trump presidency, it seems unlikely there will be much in the way of détente: it is game-on for the cold war to continue.

Read More »

Read More »

Me being stupid stupid

Go sub to Andrew Moran Linn, he inspired me to make my channel with his friend, Electronster789

Read More »

Read More »

Is Tucker Carlson Right About Replacement Theory?

Tucker Carlson seems to believe that if it weren't for immigrants, America would be dominated by religiously devout, tradition-minded, liberty-loving Americans in every corner of the nation. Perhaps he's not familiar with the effects of American universities and public schools?

Be sure to follow Radio Rothbard at Mises.org/RadioRothbard.

Read More »

Read More »

America’s “Great Men” and the Constitutional Convention

From the very beginning of the great emerging struggle over the Constitution the Antifederalist forces suffered from a grave and debilitating problem of leadership. The problem was that the liberal leadership was so conservatized that most of them agreed that centralizing revisions of the Articles were necessary—as can be seen from the impost and congressional regulation of commerce debates during the 1780s.

Read More »

Read More »

State Legislatures Are Finally Limiting Governors’ Emergency Powers. But only Some of Them.

Last week, Indiana Governor Eric Holcomb vetoed a bill that would limit gubernatorial authority in declaring emergencies. The bill would allow the General Assembly to call itself into an emergency session, with the idea that the legislature could then vote to end, or otherwise limit, a governor’s emergency powers.

Read More »

Read More »