Category Archive: 6b.) Mises.org

What Is the Purpose of the Economy? Carl Menger Explains.

This second part of the series about the Principles of Economics treats Menger’s exposition of the economy. In continuation of the first part, which covered the general concept of goods, the part on the economy treats the role of economic goods in relation to human wants.

Read More »

Read More »

Interview mit Dr. Thorsten Polleit – Degussa Goldhandel

Dr. Thorsten Polleit von Degussa Goldhandel über Corona, das Klima, „The Great Reset“ und mögliche Folgen für die Kapitalanlage auf dem PLATOW EURO FINANCE Family Office Forum.

Read More »

Read More »

Andy Moran – CM – 2003 – Brighton

Http://www.patreon.com/scoutsourced

http://www.twitter.com/scoutsourced

http://www.instagram.com/scoutsourced

Read More »

Read More »

Review: Sohrab Ahmari’s New Attack on Laissez-Faire Liberalism

Sohrab Ahmari’s new book The Unbroken Thread: Discovering the Wisdom of Tradition in An Age of Chaos is so disappointing I don’t know where to begin. This may seem to be a harsh invective, but in reality, it is a confession. My previous attempts to review this book have resulted in little more than hours and hours of frustration and discarded drafts.

Read More »

Read More »

Cryptocurrencies and China Imperil the Reserve Currency Status of the US Dollar

In his book Denationalisation of Money, F.A. Hayek argued that governments have never devoted their power to providing proper money over time. They “have refrained from grossly abusing it only when they were under such a discipline as the gold standard imposed.”

Read More »

Read More »

The Phillips Curve Myth

According to a popular way of thinking, the central bank can influence the rate of economic expansion by means of monetary policy. It is also held that this influence carries a price, which manifests itself in terms of inflation.

Read More »

Read More »

Keynes Said Inflation Fixed the Problems of Sticky Wages. He Was Wrong.

Britain’s economy had been suffering chronic unemployment for a decade prior to 1936. Economic theory as it was then understood clearly showed that the cause of a market surplus was sellers asking a price in excess of what buyers are willing to pay.

Read More »

Read More »

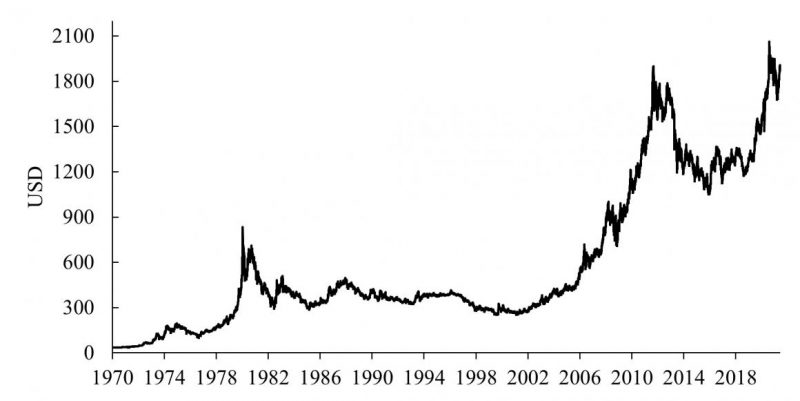

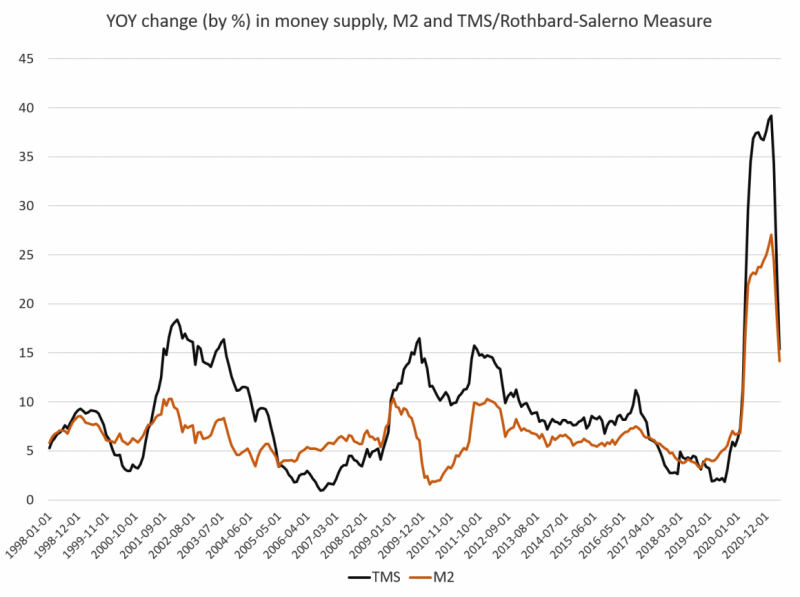

Money Supply Growth Dropped in May to a 15-Month Low

Money supply growth slowed again in May, falling for the third month in a row, and to a 15-month low. That is, money supply growth in the US has come down from its unprecedented levels, and if the current trend continues will be returning to more "normal" levels.

Read More »

Read More »

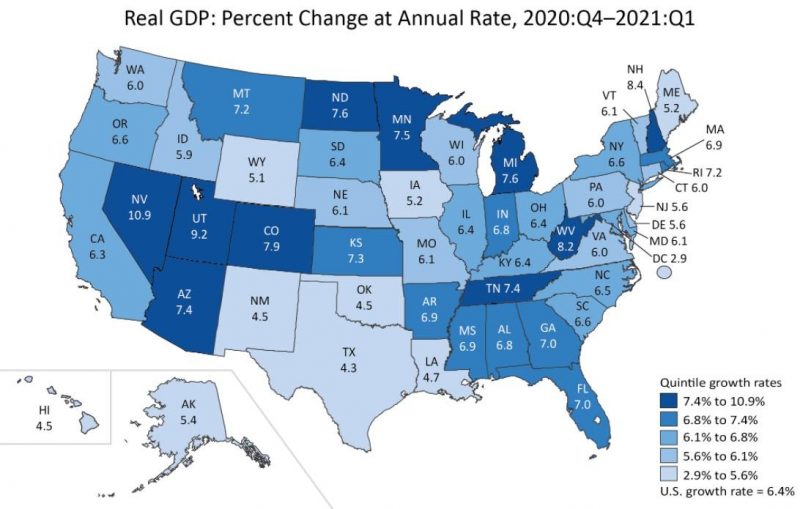

Experts Said Ending Lockdowns Would Be Worse for the Economy than the Lockdowns Themselves. They Were Wrong.

Here’s something we often heard in 2020 from experts who wanted long and draconian covid lockdowns: “Yes, these say-at-home orders are causing economic turmoil, but if you don’t lock everyone down now—and keep them locked down for a long time—your economy will be even worse off!”

Read More »

Read More »

Inflation Is a Form of Embezzlement

Monetary inflation is just a type of embezzlement. Historically, inflation originated when a country’s ruler such as king would force his citizens to give him all their gold coins under the pretext that a new gold coin was going to replace the old one. In the process of minting new coins, the king would lower the amount of gold contained in each coin and return lighter gold coins to citizens.

Read More »

Read More »

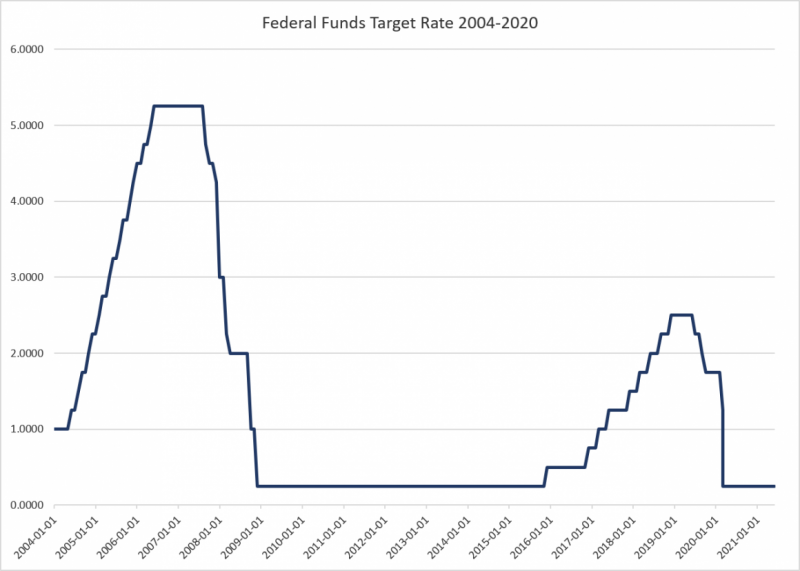

The Fed’s Power over Inflation and Interest Rates Has Been Greatly Exaggerated

It is widely held that the central bank is a key factor in the determination of interest rates. By popular thinking, the Fed influences the short-term interest rates by influencing monetary liquidity in the markets. Through the injection of liquidity, the Fed pushes short-term interest rates lower. Conversely, by withdrawing liquidity, the Fed exerts an upward pressure on the short-term interest rates.

Read More »

Read More »

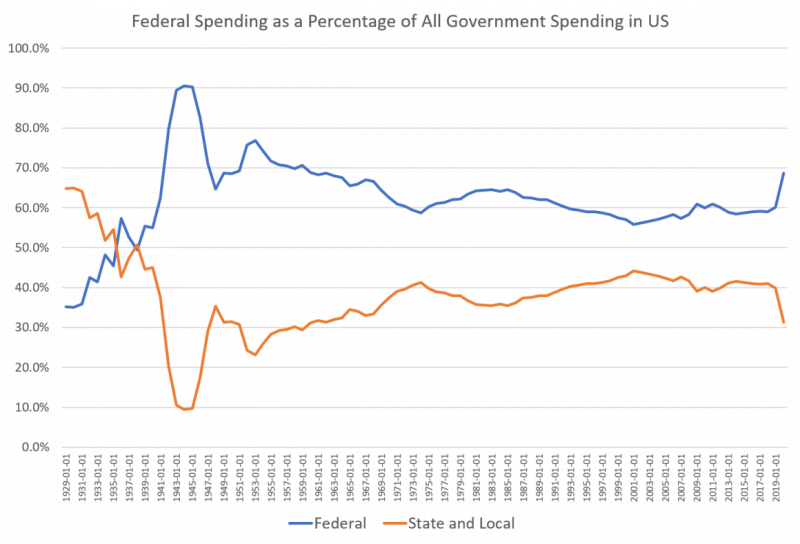

The Fed: Why Federal Spending Soared in 2020 but State and Local Spending Flatlined

In the wake of the Covid Recession and the drive to pour ever larger amounts of “stimulus” into the US economy, the Federal Government in 2020 spent more than double—as a percentage of all government spending—of what all state and local governments spent in 2020, combined.

Read More »

Read More »

Andrew Moran Evadé d’un tribunal anglais, arrêté en Espagne.

#Replay #Reportage #ReplayTv #belgium

#Police_Belge #Belgique #policebelges #France

#gendarmesfrançais #Gendarmes_français #Police

#100_jours avec #la_police #reportage,#reportage2021,#reportage_choc,#reportagem,#reportage_francais,

#reportage_complet,#reportage_comique,#reportage_documentaire,#documentaire,

#documentaire_français, #documentaire_politique, #reportage#complet_en_francais,

#reportage_complet_fr 2021...

Read More »

Read More »

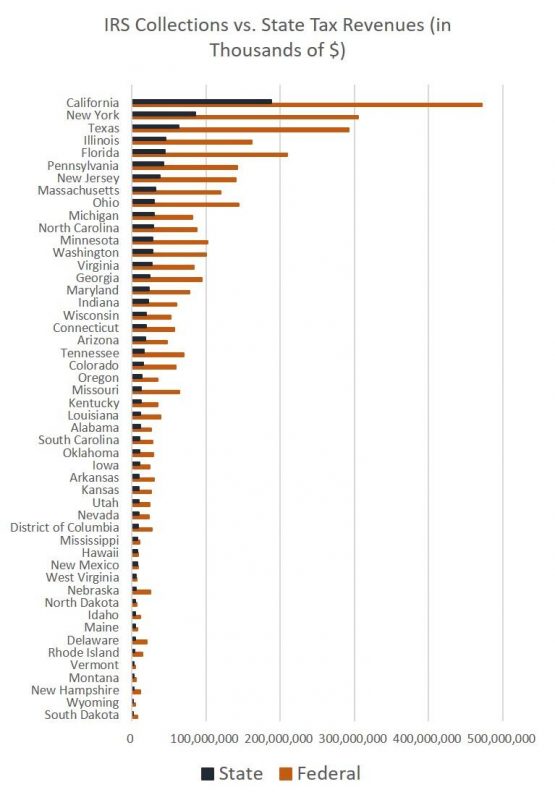

The Feds Collect Most of the Taxes in America—So They Have Most of the Power

In 2021, it's clear Americans now have thrown off any notions of subsidiarity and instead embraced the idea that the federal government should be called upon to fund pretty much anything and everything. From "stimulus checks" to "paycheck protection," it's assumed an entire national workforce can be propped up by federal spending.

Read More »

Read More »

Can Economics Save Medicine?

First, in a certain sense medicine in America is broken. Doctors and patients are unhappy, the quality of care deteriorates, and costs keep increasing. Even before covid, US life expectancy declined three years running. Even before covid, too many Americans were sick, depressed, fat, and unhappy with their physical and mental health.

Read More »

Read More »

The Fed Plans to Raise Interest Rates—Years from Now

On Wednesday, the Federal Reserve’s Federal Open Market Committee voted to continue with a target federal funds rate of 0.25 percent, and to continue with large-scale asset purchases. According to the committee’s press release:

Read More »

Read More »

Governments Are Failing at Their Most Basic Duties—While Promising Free Stuff

Three city blocks were systematically burned to the ground as hundreds of the local police stood by and viewed the violence. They were obeying orders not to harm the arsonists. The National Guard was called, adding more armed watchers. A passive gendarmerie consorting with open rebellion has rarely been seen in American history, until recently.

Read More »

Read More »

This Is What Could Trigger Big Growth in CPI Inflation

Many episodes of monetary inflation, some even long and virulent, do not feature a denouement in a sustained high CPI inflation over many years. Instead, these episodes have the common characteristics of asset inflation and the monetary authority levying tax in various forms – principally inflation tax or monetary repression tax.

Read More »

Read More »

The G7’s Reckless Commitment To Mounting Debt

Historically, meetings of the largest economies in the world have been essential to reach essential agreements that would incentivize prosperity and growth. This was not the case this time. The G7 meeting agreements were light on detailed economic decisions, except on the most damaging of them all. A minimum global corporate tax

Read More »

Read More »