Category Archive: 6b.) Mises.org

And Now for a Really Bad Response to Political Calamity: Autarky

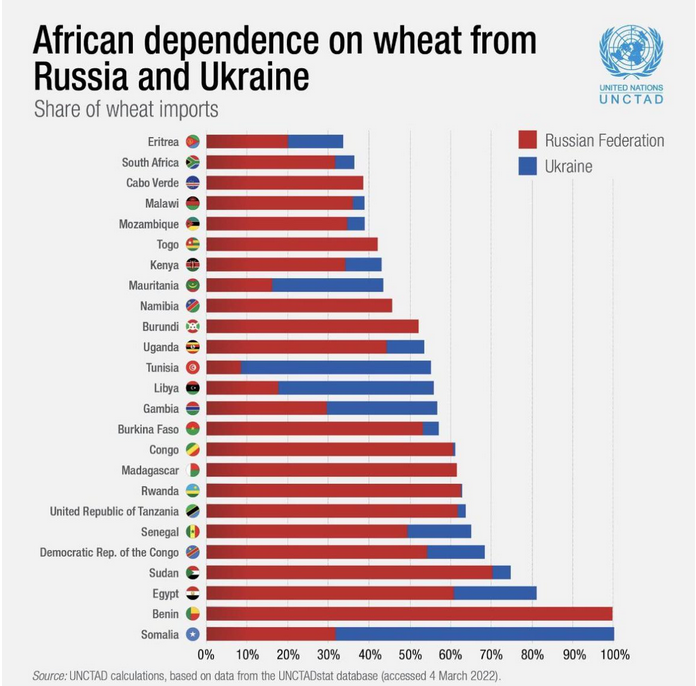

The invasion of Ukraine, the spike in inflation and the risks of supply shortages have made some politicians dust off some of the worst economic ideas in history: autarky and protectionism. Some believe that if our nation produced everything we needed we would all be better off because we would not depend on others. The idea comes from a deep lack of understanding of economics.

Read More »

Read More »

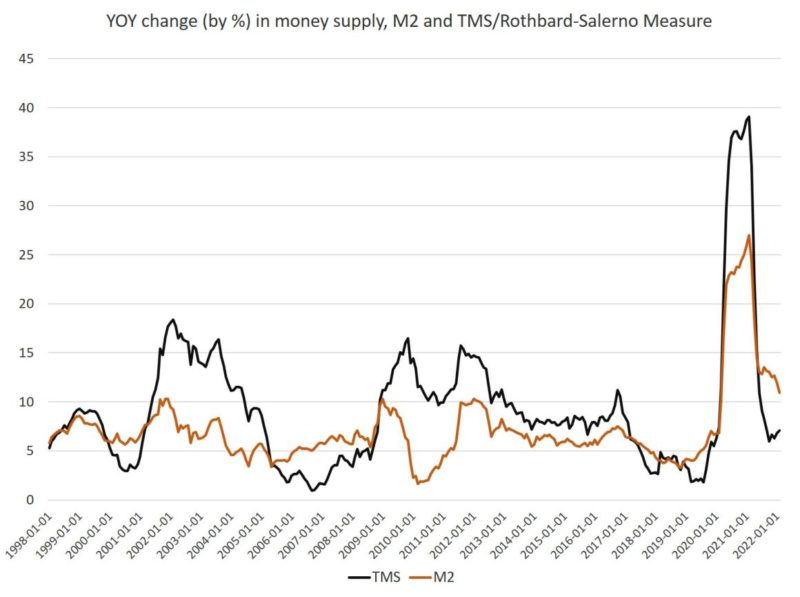

Money Supply Growth Heads Back Up: February Growth Up to 7 Percent

Money supply growth rose for the third month in a row in February, continuing ongoing growth from October's twenty-one-month low. Even with February's rise, though, money supply growth remains far below the unprecedented highs experienced during much of the past two years.

Read More »

Read More »

Putin’s Inflation? Homegrown Modern Monetary Theory Is to Blame

Prices of goods and services in the economy seem to be going through the roof, and both consumers and producers suffer from the falling value of their money. Unfortunately, the public turns to politicians in Washington and economists around the world for answers.

Read More »

Read More »

Über die Grundlagen von Freiheit, Frieden und Wohlstand

Ein Gespräch zwischen Hartmut Haase und Thorsten Polleit, aufgenommen von Henry Dreblow am 16. März 2022

Thank you for your interest! Please follow me on:

Youtube: https://www.youtube.com/channel/UCjiRvd7ek6nN-S2RHHf_ZTg/about

Telegram: https://t.me/freemarketinmoney

GETTR: https://gettr.com/user/thorstenpolleit

Twitter: https://twitter.com/ThorstenPolleit

Facebook: https://www.facebook.com/thorsten.polleit.1

Linkedin:...

Read More »

Read More »

The US Regime Pretends to Be Ukraine’s Ally

Radio Rothbard is a weekly podcast featuring a cast of Mises Institute voices and special guests. The show tackles politics, current events, culture, media, and of course the predatory state, all from an uncompromising Rothbardian perspective.

Read More »

Read More »

If Ukraine Joins the EU, It Will Be the Poorest Member by Far

Within days of the beginning of the Russian invasion of Ukraine, the Ukrainian regime applied for membership in the European Union. This is understandable from the perspective of Kyiv. If Ukraine is going to be denied membership in NATO—as increasingly looks to be the case—The Ukraine regime could nonetheless increase its geopolitical connections to the West by joining in the EU.

Read More »

Read More »

European Environmentalists Have Made Energy Independence Impossible

Europe is not going to achieve a competitive energy transition with the current interventionist policies. Europe does not depend on Russian gas due to a coincidence, but because of a chain of mistaken policies: banning nuclear in Germany, prohibiting the development of domestic natural gas resources throughout the European Union, added to a massive and expensive renewable rollout without building a reliable backup.

Read More »

Read More »

Central Banks: Who Needs Them? No One

As the Federal Reserve hikes its lending rate to a range of 0.25–0.50 percent, murmurs are heard around the world, with financial pundits predicting doom due to the increased pressures imposed on the cost structures of firms that are recovering from the pandemic lockdowns.

Read More »

Read More »

No, More Bureaucracy Would NOT Have Saved Trump’s Paycheck Protection Program

The Paycheck Protection Program (PPP) put in place under Donald Trump and extended by Joe Biden is a prime example of government wastefulness. A recent working paper by the National Bureau of Economic Research (NBER), "The $800 Billion Paycheck Protection Program: Where Did the Money Go and Why Did It Go There?" investigated the effectiveness of the PPP.

Read More »

Read More »

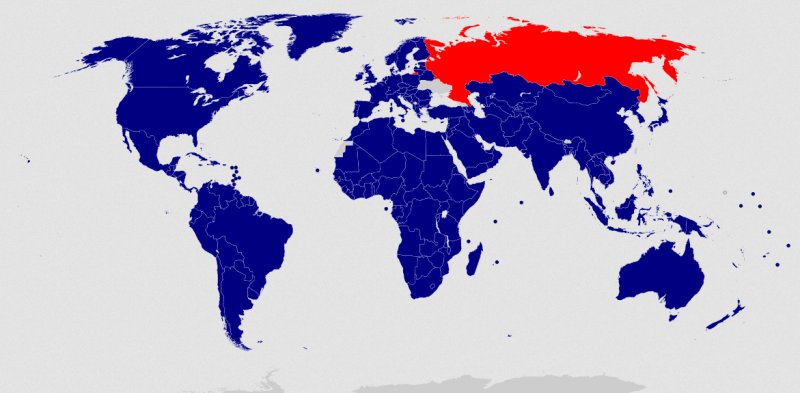

Will Biden Sanction Half the World to Isolate Russia?

The United States is no longer in any position to remake the world in its image. It's not 1945 or even 1970. Yet the US seems to be gearing up to bully half the world into compliance with the US Russia sanctions.

Read More »

Read More »

Why Saudi Arabia Won’t Abandon Dollars for Yuan

There are numerous articles mentioning that Saudi Arabia may use the yuan, China's domestic currency, for its oil exports. How much does Saudi Arabia export to China? According to the Organisation of Economic Co-operation and Development, the kingdom's main exports are to China ($45.8B), India ($25.1B), Japan ($24.5B), South Korea ($19.5B), and the United States ($12.2B). Exports of crude oil reached $145 billion in total.

Read More »

Read More »

Central Banks Have Broken the True Savings-Lending Relationship

Most people believe lending is associated with money. But there is more to lending. A lender lends savings to a borrower as opposed to "just money." Let us explain. Take a farmer, Joe, who has produced two kilograms of potatoes. For his own consumption, he requires one kilogram, and the rest he agrees to lend for one year to another farmer, Bob. The unconsumed kilogram of potatoes that he agrees to lend is his savings.

Read More »

Read More »

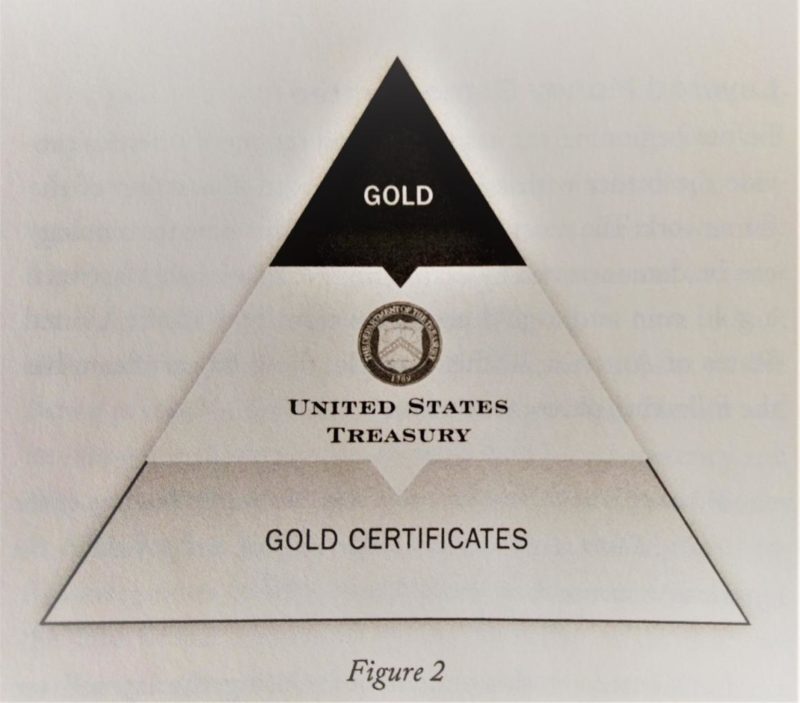

A Review of Nik Bhatia’s Layered Money: From Gold and Dollars to Bitcoin and Central Bank Digital Currencies

For understanding our modern monetary troubles, Nik Bhatia’s pamphlet-sized book from last year hits exactly the right intersection between money and banking, between the past and the future. Clocking in at around 150 pages of easy prose, it’s accessible but not dumbed down, revealing but not inaccurate. It has a simple framework that Bhatia explains and explores with great expertise.

Read More »

Read More »

Russia Isn’t Nearly as Isolated as Washington Wants You to Believe

Those gloating about Russia being "cut off" are overstating the case. In fact, many of the world's largest countries have shown a reluctance to participate in the US's sanction schemes, and even close US allies aren't going along with it.

Original Article: "Russia Isn't Nearly as Isolated as Washington Wants You to Believe"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

The West’s Russia Sanctions Show Why States Want to Weaponize the Financial System

States continue to seek new ways to make the financial system an “economic chokepoint” enabling the state to crack down on specific organizations, individuals, or activities.

Original Article: "The West's Russia Sanctions Show Why States Want to Weaponize the Financial System"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

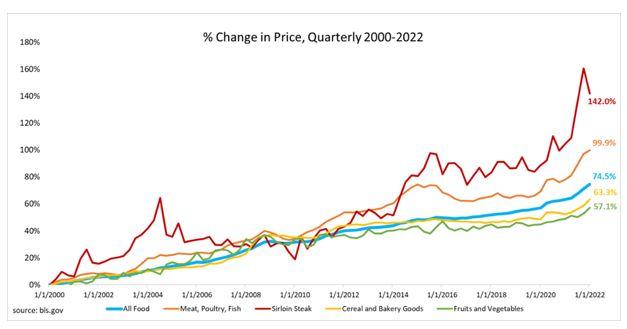

How Agriculture Bureaucrats Are Manipulating Food Prices—and Our Diets

With inflation at a forty-year high, it is the topic on everyone’s mind. US core inflation has reached 7.5 percent year over year, and the prices of certain goods, such as used cars and steak, are up as much as 50 percent over the past year. This is a major threat to the current administration, with a recent poll showing that 70 percent of Americans disapprove of Joe Biden’s handling of inflation.

Read More »

Read More »

It Didn’t Begin with FDR: Currency Devaluation in the Roman Empire

The phenomenon of currency devaluation and its consequences is a process that not only occurred in modern times, but has much deeper roots, going back to antiquity. With the collapse of the Roman Republic, Caesar's grandnephew Gaius Octavianus, renamed Augustus, rose to power and soon implemented a far-reaching monetary reform for the Roman common market.

Read More »

Read More »

Markets and Private Property, Not Government, Protect the Environment

Each century presents its unique set of problems for lovers of freedom, peace, and prosperity. While the great vanguards of liberty in the twentieth century dealt with the looming shadow of centralization and were engaged in a battle against socialists and statists who argued for centralization and adjudication of individual liberty for the sake of universal material opulence, free markets with the fall of the curtain on the twentieth century have...

Read More »

Read More »

Biden Admits that Sanctions Don’t Work and they Make Us Poorer

President Biden on Thursday made two big admissions about the US-led economic sanctions on Russia. The first is that the sanctions will lead to food shortages for many countries other than Russia, and that this is simply the price that Americans ought to be forced to pay.

Read More »

Read More »