Category Archive: 6b.) Mises.org

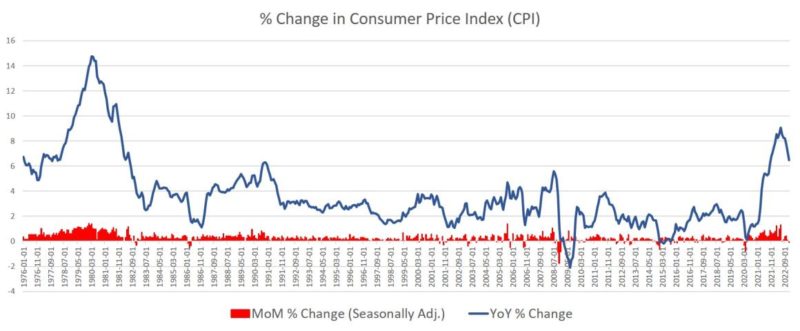

Real Wages Fall for the Twenty-First Month as Rent and Food Prices Keep Rising

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data today, and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in fifteen months.

Read More »

Read More »

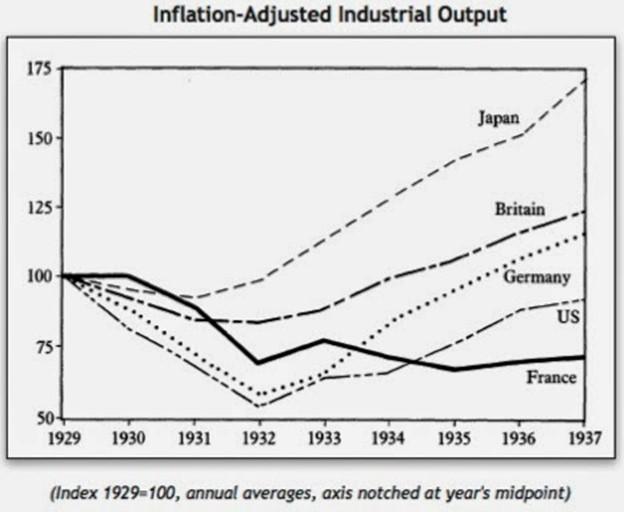

The Great Depression’s Patsy

The culprit responsible for the Wall Street crash of 1929 and the Great Depression can be easily identified—the government. To protect fractional reserve banking and generate a buyer for its debt, the US government created the Federal Reserve System in 1913 and put it in charge of the money supply.

Read More »

Read More »

The Government Throws Money at Heart Disease, but Prevention Is Better than Cure

You’re more likely to die of heart disease than anything else, partly because, well, if nothing else gets you, your heart will give out. And a heart attack could cost you upwards of $760,000 these days, when you consider hospital charges, prescription drugs, additional care for the rest of your life, and then indirect costs like loss of time at work.

Read More »

Read More »

The Chimera of a Postpandemic Postwar Return to Monetary Normal

The monetary regime in power now—the so-called 2 percent inflation standard—is promising us a “return to normal” after the great pandemic and war inflation of 2021–22. At this time of powerful propaganda—the dismal accompaniment of natural disaster and war—we should be on our guard against such messaging.

Read More »

Read More »

Micronations in International Law: How US Policy Could Improve the Fortunes of Upstart Libertarian Countries

After years spent toiling as an activist against the tide of Czech politics, Vít Jedlička concluded that it would be easier to build a libertarian nation from scratch somewhere else. In April 2015, he declared that a new country called the Free Republic of Liberland would be founded on unclaimed land on the Danube River.

Read More »

Read More »

The Senator Who Didn’t Know (but Thought She Did)

Legislators have a strange relationship with magic. To achieve that which physically cannot be done, they like to wave magic wands and pretend that it can. Reality puts a limit on political power, a realization that always sits poorly with those in charge of our trillion-dollar bureaucratic machinery.

Read More »

Read More »

America, Brazil, and the Illegitimacy of Weaponized Democracy

In recent years, it has become popular in parts of conservative discourse to discuss the “Brazilianization of America,” a reference to the challenges a large country faces in governing an increasingly multicultural “universal nation.” But this weekend, it was the Americanization of Brazilian politics that took center stage as pro-Bolsonaro forces rose up in aggressive protest against the newly inaugurated Lula regime, in a move reminiscent of what...

Read More »

Read More »

The Constitution Failed. It Secured Neither Peace nor Freedom.

If one cares to look, it's not difficult to find numerous columns written for mainstream news outlets announcing that the US Constitution has failed. This ought to raise the question of "failed to do what?" The answer depends largely on the one claiming the constitution has failed.

Read More »

Read More »

Keegan and Bale retire, Andy Moran & Colm Boyle, John Hartson, Sarah Rowe | Tuesday’s OTB AM

Remember that time Lee Keegan & Gareth Bale retired on the same day? Ger & Shane are responding in kind with a jam-packed show on Tuesday’s #OTBAM

Here’s what’s coming up today:

7:30: Kickoff with Ger, Shane & Kathleen

7:50: Lee Keegan’s Top 5 Moments w/Cameron Hill

8:05: John Hartson

8:20: Colm Boyle & Andy Moran

8:50: John Duggan

8:50: Sarah Rowe

9:10: Sam Mulroy

9:30: James Horan

@GilletteVideosUK | #EffortlessFlow...

Read More »

Read More »

LEE KEEGAN RETIREMENT: Mayo legends Andy Moran & Colm Boyle pay tribute

Mayo legends Andy Moran & Colm Boyle join Ger & Shane on #OTBAM after Lee Keegan called time on a glittering career for the Green and Red

@GilletteVideosUK | #EffortlessFlow

Have you downloaded the OTB App?

- Search for OTB Sports in the Google Play store:

https://play.google.com/store/apps/de...

- Search for OTB Sports in the app store if you're on iOs: https://apps.apple.com/ie/app/otb-spo...

SUBSCRIBE to the Off The Ball...

Read More »

Read More »

Why Economic Stimulus Can’t Work

President Barack Obama returned from the 2010 G20 Summit held in Toronto having failed to convince world leaders that more “economic stimulus” was needed to cure what ails the world’s economies. Walking a seeming tightrope between too much spending and spiraling deficits, on the one hand, and too little spending and economic recession, on the other, world leaders reluctantly agreed to err on the side of fiscal and monetary caution and to halve...

Read More »

Read More »

The Present Fiat Monetary System Is Breaking Down

The heart of economic growth is an expanding subsistence fund, or the pool of real savings. This pool, which is composed of final consumer goods, sustains individuals in the various stages of the production process. The increase in the pool of real savings permits the expansion and the enhancement of the infrastructure, and this strengthens economic growth.

Read More »

Read More »

Rome’s Runaway Inflation: Currency Devaluation in the Fourth and Fifth Centuries

By the beginning of the fourth century, the Roman Empire had become a completely different economic reality from what it had been at the beginning of the first century. The denarius argenteus, the empire’s monetary unit during the first two centuries, had virtually disappeared since the middle of the third century, having been replaced by the argenteus antoninianus and the argenteus aurelianianus, numerals of greater theoretical value, but of less...

Read More »

Read More »

2023: You Wanted Endless Stimulus, You Got Stagflation.

After more than $20 trillion in stimulus plans since 2020, the economy is going into stagnation with elevated inflation. Global governments announced more than $12 trillion in stimulus measures in 2020 alone, and central banks bloated their balance sheet by $8 trillion.

Read More »

Read More »

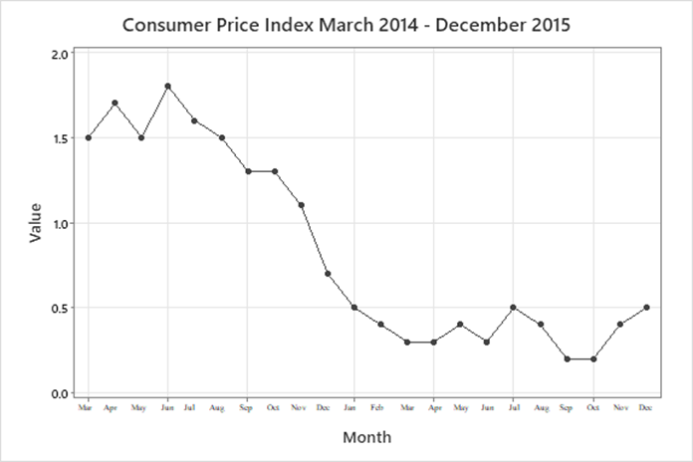

Central Bankers Are Poor Archers: The Problems and Failures of Inflation Targeting and Price Stability

The famous quote, “Insanity is doing the same thing over and over again and expecting different results,” is usually attributed to Albert Einstein. While intended as a parable for quantum insanity, such a quote could equally be a parable for inflation policy. With the Bank of England and the Federal Reserve seeking to maintain target rates of 2 percent, the UK inflation rate has only fallen to 10.7 percent from 11.1 percent.

Read More »

Read More »

Ferdinando Galiani, an Italian Precursor to the Austrians

The Austrian School of economics did not develop out of thin air. It built upon the work of a number of other economists and philosophers going back as far as Aristotle. Among the precursors of the Austrian School were a number of Spanish and Italian scholastic economists.

Read More »

Read More »

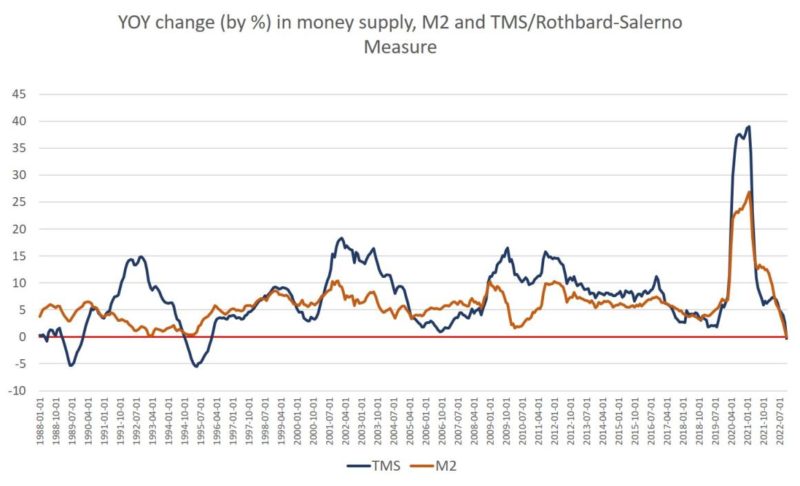

Money-Supply Growth Turns Negative for First Time in 33 Years

Money supply growth fell again in November, and this time it turned negative for the first time in 33 years. November's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years. During the thirteen months between April 2020 and April 2021, money supply growth in the United States often climbed above 35 percent year over year, well above even the "high" levels experienced from 2009 to...

Read More »

Read More »

Paradise Valley, Montana: A Study in Free Market Land Conservation

I first became aware of the Property and Environment Research Center (PERC) after moving to Montana and was immediately intrigued by their work. The more I dug into PERC’s research, the more I realized they aligned with my worldview of free market conservation.

Read More »

Read More »

The Friction Ahead in 2023

Introduction: Division, friction and polarization have been on the rise in the West for at least a decade, but the escalation we saw during the “covid years” was especially worrying. Over the last year, this “worry” has become a truly pressing concern, even a real emergency one might argue, as inflationary pressures and an actual war were added to the mix of political and social tensions.

Read More »

Read More »