Category Archive: 6b.) Mises.org

Will Powell’s Pivot Bail Out Biden?

With a doveish pivot, Jerome Powell is declaring victory over inflation. It would be extraordinarily naive to ignore the influence of next year’s presidential election on the Fed’s new outlook.

Original Article: Will Powell's Pivot Bail Out Biden?

Read More »

Read More »

Political Authorities and Covid: Creating Crises in the Name of Public Health

In the name of dealing with a so-called public health crisis, U.S. political and medical elites created even more crises. David Gordon reviews Tom Woods' new book that deconstructs the disastrous decisions made by progressive politicians and medical authorities.

Original Article: Political Authorities and Covid: Creating Crises in the Name of Public Health

Read More »

Read More »

Sustainability of Eden: Can the UN’s Sustainability Agenda Succeed in a World Full of Conflict?

To achieve sustainability, the world needs stability. Yet two-thirds of countries are facing major economic, political, and social problems. Most of them are also experiencing ethnic or civil conflicts, mass migration and poverty crises. The question is whether the UN's sustainability agenda can succeed in the context of ongoing or simmering conflicts.

Paradoxically, preventing wars and conflicts isn't one of the UN's seventeen sustainable...

Read More »

Read More »

The Economic Wisdom of Antony C. Sutton’s The War on Gold

I.

Antony C. Sutton (1925–2002) was a British economist and economic historian who taught at California State University, Los Angeles. Sutton was also a research fellow at the Hoover Institution at Stanford University.

His work focused primarily on the financial and commercial cooperation between major United States banks and corporates (call it “Wall Street interests”) and foreign states that were openly hostile to America.

In his book Wall Street...

Read More »

Read More »

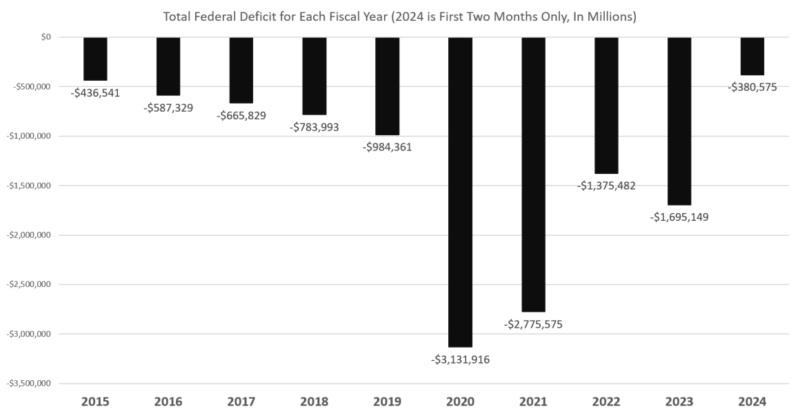

2024’s Deficit Is Already on Track to Be the Worst Since Covid

Weakness in the US economy continues to hide behind surging debt levels and government spending. As noted last month by Daniel LaCalle,

[A] large part of the growth in GDP came from bloated government spending financed with more debt and inventory revaluation, adding 0.8 and 1.4 percentage points to GDP growth. ...

The increase in gross domestic product between the third quarter of 2022 and the same period of 2023 was a mere $414.3 billion,...

Read More »

Read More »

The Christmas Truce of World War I

The Christmas truce, which occurred primarily between the British and German soldiers along the Western front in December 1914, is an event the official histories of the "Great War" leave out, and the Orwellian historians hide from the public. Stanley Weintraub has broken through this barrier of silence and written a moving account of this significant event by compiling letters sent home from the front, as well as diaries of the soldiers...

Read More »

Read More »

Can a Libertarian Find Hope in Prison? Maybe

One usually does not equate libertarian thinking with a US prison, but prison life does offer some surprises, especially when it comes to internal governance

Original Article: Can a Libertarian Find Hope in Prison? Maybe

Read More »

Read More »

Africa Doesn’t Need More Government Aid; It Needs Free Markets

Africa, while being rich in natural resources, is hobbled by government corruption, socialistic policies, and a lack of economic freedom. One only can hope for change.

Original Article: Africa Doesn't Need More Government Aid; It Needs Free Markets

Read More »

Read More »

Unraveling the Roots of the German Mark’s Collapse

A century ago, the German reichsmark went into freefall as the most famous hyperinflation in history exploded the German economy. The repercussions still are with us.

Original Article: Unraveling the Roots of the German Mark's Collapse

Read More »

Read More »

Murray N. Rothbard: A Legacy of Liberty

"On the free market, everyone earns according to his productive value in satisfying consumer desires. Under statist distribution, everyone earns in proportion to the amount he can plunder from the producers."

Murray N. Rothbard (1926-1995) was just one man with a typewriter, but he inspired a world-wide renewal in the scholarship of liberty. During 45 years of research and writing, in 25 books and thousands of articles, he battled every...

Read More »

Read More »

The Fed Pivot

Stock and bond markets are abuzz this week over Chairman Jay Powell's hints of a "Fed Pivot" in interest rate policy. Mark Thornton explains why this optimism is badly misplaced.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Get your free copy of Murray Rothbard's Anatomy of the State at Mises.org/IssuesFree.

Read More »

Read More »

Dean Baker Debates Bob Murphy on Recession Outlook

On a recent installment of the Pynx debate series, Bob had a friendly debate with Dean Baker on a soft or hard landing in 2024. In this episode of the Human Action Podcast, Bob comments on the key disputes, underlying the differences between the Austrian and Keynesian frameworks.

Bob's Debate with Dean Baker: Mises.org/HAP427a

Bob's Paper on the Inverted Yield Curve: Mises.org/HAP427b

Join Tom DiLorenzo, Joe Salerno, and Patrick Newman in Tampa...

Read More »

Read More »

Henry Kissinger: War Criminal and Enemy of Mankind

Get ready to see George W. Bush, Michelle Obama, Mitch McConnell, and Hillary Clinton all mourn together at Kissinger's funeral as they hail one of the regime's most devoted apologists.

Original Article: Henry Kissinger: War Criminal and Enemy of Mankind

Read More »

Read More »

Authorities in Jamaica Endorse Cancel Culture

The trend of punishing people in Jamaica for being disrespectful is becoming troubling. Citizens support penalizing uncouth characters without recognizing that sanctions violate free speech. During the apex of lockdown hysteria, one man was coerced by the police to apologize after daring to criticize the prime minister. This act of overreach by the police was unsurprisingly lauded by a wide cross-section of society. Although this act was condemned...

Read More »

Read More »

The Anatomy of the Statist

Statists reveal their belief in the almighty state in many different ways, but they all want the same outcome: more government control over our lives.

Original Article: The Anatomy of the Statist

Read More »

Read More »

President Biden Is Wrong. Military Spending Does Not Produce Wealth

In his latest defense of bloated military spending, President Joe Biden claims that the military budget creates real wealth. Instead, military spending is destroying it.

Original Article: President Biden Is Wrong. Military Spending Does Not Produce Wealth

Read More »

Read More »

How the Free Market Drove History’s “Great Enrichment”

Beyond Positivism, Behaviorism, and Neoinstitutionalism in Economicsby Deirdre Nansen McCloskeyUniversity of Chicago Press, 2022; 222 pp.

Deirdre McCloskey is a great economic historian, and in Beyond Positivism, she makes a number of valuable points that draw from her immense learning in this field. I’d like to concentrate on a few of these insights in this week’s column.

She stresses the importance of the “Great Enrichment,” the process by which...

Read More »

Read More »

The Immorality of Protectionism

Protectionists are no better than any run-of-the-mill Progressive who wants more taxes on one group in order to subsidize some other group. There's no moral high ground here for the protectionists, just unfounded self-righteousness.

Original Article: The Immorality of Protectionism

Read More »

Read More »

Government Prohibitions on Raw Milk Are Ignorant and Dangerous

“Salus populi suprema lex.” The health of the people is the supreme law.

As ruling ideals go, this is a good one. Unfortunately, the governing class in America decided long ago that raw milk—one of nature’s most perfectly nutritious substances—must be regulated and prohibited to the point of making it nearly impossible to obtain. In its place, they teamed with the dairy industry to promote pasteurized milk, a lifeless liquid so devoid of the...

Read More »

Read More »

The Evil of the Residential Property Tax

According to the Case-Shiller index, home prices have increased 44 percent since February 2020. That's just an average, of course, and some markets have seen increases in prices that are far higher. Even in middle-American housing markets, however—where home prices are supposedly more reasonable than on the coasts—prices have soared. In Cleveland, for example, the index is up 40 percent since early 2020. During the same period, the index rose 50...

Read More »

Read More »