Category Archive: 6b.) Mises.org

Who Really Works Against the Public?

“The public be damned” is a statement by railroad magnate William Henry Vanderbilt that has been twisted out of context. While the American ruling classes insist that private enterprise is the enemy of the people, it really is our government that bears that distinction.

Read More »

Read More »

Personal Medical Bankruptcy: Made in DC

[unable to retrieve full-text content]When the government wants to make something more affordable, that usually means new subsidies, laws, and regulations that drive up the real price. Higher medical prices will mean more medical bankruptcies.

Read More »

Read More »

Failing to Make the Case for Race-Based Reparations

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

CNN Is Wrong. Deflation Is a Good Thing

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Carl Menger’s Overlooked Vital Evolutionary Insights

Carl Menger is widely recognized as one of the economists leading the so-called marginalist revolution along with William Stanley Jevons and Léon Walras. There are two other contributions by Menger that are relatively underappreciated and are vital for making sense of the socioeconomic order, including why mankind remains so lost in economic ignorance and tribalistic warmongering.They are, first, his insights into the proper method or way to study...

Read More »

Read More »

Is Gold Overpriced or Can Its Price Go Even Higher?

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions solely based on the current...

Read More »

Read More »

Banking’s Unique Business Model, And Why Capital is not a “Rainy Day Fund”

Banks are highly regulated businesses, as expected of entities to which we entrust our money, and from which we may expect to borrow someday to buy a home or start a business. Bankers interact with regulators daily. Investors wishing to establish a bank must first obtain capital pledges from future shareowners and apply for a bank charter from either federal or state government regulators. Once in business, a bank is overseen by one or more of the...

Read More »

Read More »

The Rise of Populism Reflects the Decline in Individual Freedom

So-called populist political parties and politicians gained considerable traction with Western voters in recent years, despite being dismissed in many cases as “a threat to democracy” and “extremists” by mainstream politicians. With the election of Donald Trump in the US and of Javier Milei in Argentina, the surge in polls and electoral wins of right and far-right parties in several European countries sent shockwaves through the political...

Read More »

Read More »

California’s Crony Capitalist Minimum Wage Law

On April 1, California raised the minimum wage for large fast food restaurant franchises to $20 an hour. This law will threaten seven hundred thousand jobs by destroying the state’s food franchising business; however, there is one notable fast food franchise exempted from this minimum wage hike: Panera.Greg Flynn is the second-largest Panera franchisee in the world, but he is also known for his close relationship with California governor Gavin...

Read More »

Read More »

The Tariff of Abominations and the Era of Good Stealings

Few Americans seem aware of the fact that it was the New England Federalists who plotted to secede from the union a half century before the 1860-61 secession of the Southern states. Their efforts culminated in the Hartford secession convention of 1814 where they decided in the end to remain in the union after all, confident that they would eventually dominate national politics to their economic advantage. The leader of the New England secessionists...

Read More »

Read More »

Yes, We Still Need the First Amendment

Government censorship has shifted to the forefront of American conversation with the recent passing of H.R. 752, which would essentially ban TikTok; this development, which has passed the House and is on its way to the Senate, is igniting debating on how much involvement the government should have in social media.This debate is not new, considering the government has been intervening in social media for years. For example, this is not the first...

Read More »

Read More »

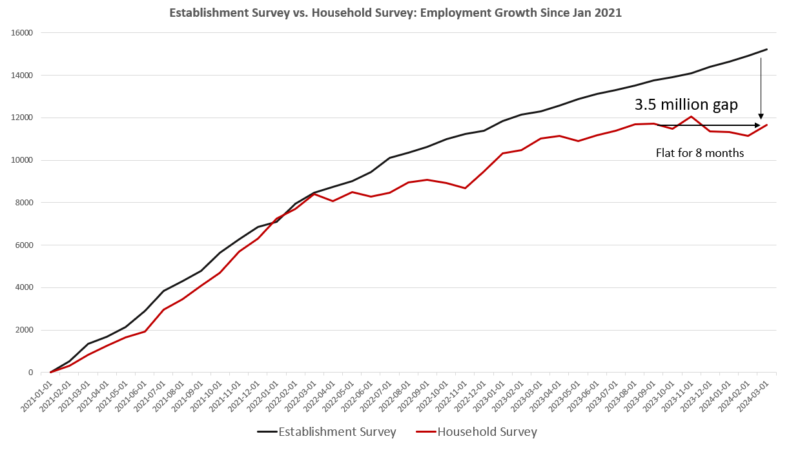

March Report: The Recession In Full-Time Jobs Is Here

According to a new report from the federal government's Bureau of Labor Statistics this week, the US economy added 303,000 jobs for the month of March while the unemployment rate fell slightly to 3.8%. In what has become a familiar pantomime, reporters from the legacy media were sure to declare this a "blowout jobs report" while Richmond Fed president Tom Barkin described the report as "quite strong." This report showed,...

Read More »

Read More »

More Easy Money Will Plunge Us into Stagflation

Thirty major central banks are expected to cut rates in the second half of 2024, a year when more than seventy nations will have elections, which often means massive increases in government spending. Additionally, the latest inflation figures show stubbornly persistent consumer price annualized growth.In the United States, headline PCE inflation in February will likely grow by 0.4%, compared with a 0.3% rise in January, and consensus expects a 2.5%...

Read More »

Read More »

Understanding the History of African Slavery: The Europeans Were not the Only Slave Traders

In the vast pantheon of history, black people have been both victims and oppressors. Yet history has been so politicized that we hear endlessly about the former and almost never about the latter. Rhetoric has eclipsed facts. It is a fact, for example, that Africans participated in the transatlantic slave trade. History is now frequently used as a cudgel to hammer white people into submission.Instead of recognizing nuance and complexity, many who...

Read More »

Read More »

The Nigerian People vs. NYSC Decree No. 24 of 1973: An Austro-libertarian Review

Every year, thousands of Nigerian youths who are below the age of thirty and who’ve completed their undergraduate studies—whether in Nigeria or abroad—are compelled by law to give up one year of their working time in active duty to the country under the auspices of the National Youth Service Corps (NYSC), an agency of the government.It has now been fifty years since the establishment of the NYSC mandatory program under Decree No. 24 of May 22, 1973...

Read More »

Read More »

Chokepoints

What happens when war shuts down the Strait of Hormuz? Mark looks at the economics and causes of a growing list of problems with the "chokepoints" of international trade: the Panama Canal, the Suez Canal, and Baltimore harbor. Will these chokepoints become scapegoats for the Federal Reserve, and could war closing the Strait of Hormuz become a genuine world crisis?Be sure to follow Minor Issues at Mises.org/MinorIssues.Get your free copy...

Read More »

Read More »

The CRE Bust is a Slow-Moving Train

Day-to-day we don’t hear much about the commercial office property crash. As The Fed’s Michael Barr said at an event hosted by the National Community Reinvestment Coalition in Washington, “This is the kind of thing where it’s likely to be a very slow-moving train as the financial sector and commercial real estate market move forward,” he said, adding that refinancing deals will play out in the next few years. “It’ll take some time.”Barr, the vice...

Read More »

Read More »

Butler, Butt Out!

Who’s Afraid of Gender?by Judith ButlerFarrar, Straus and Giroux, 2024; 308 pp.Judith Butler is a well-known feminist theorist, and one approaches her latest book with interest, all the more so because of its puzzling title. By “gender,” Butler means the view that the roles of men and women in society are not determined by biology but vary in different cultures and times and, further, that there are some people who do not fit within the “binary”...

Read More »

Read More »

Gaza: What If America Were the Good Guy?

“Genocide Joe” and the foreign agents knowns as the “American Israel Public Affairs Committee (AIPAC), whose Israel-First focus makes them a fifth column; Trump with Jared Kushner and his better-half: These are America’s 2024 election options.The Biden-AIPAC bloc has begun whispering sweet nothings in the ears of Israel’s Benny Gantz (National Unity Party), ostensible rival of Bibi Netanyahu (Likud). The AIPAC-run Biden bloc would like you to...

Read More »

Read More »

The Consequences of Good Intentions

Between the ongoing war in Gaza and Houthi attacks on Western shipping in the Red Sea, the media has had plenty of gruesome foreign policy fodder for the content mill. However, this coverage has come at the expense of the ongoing grinding conflict in Ukraine, which has quickly gone from a euphoric cause célèbre to a now embarrassing catastrophe that is best shoved in the closet and forgotten like all the rest of America’s decades of costly foreign...

Read More »

Read More »