Category Archive: 6b.) Mises.org

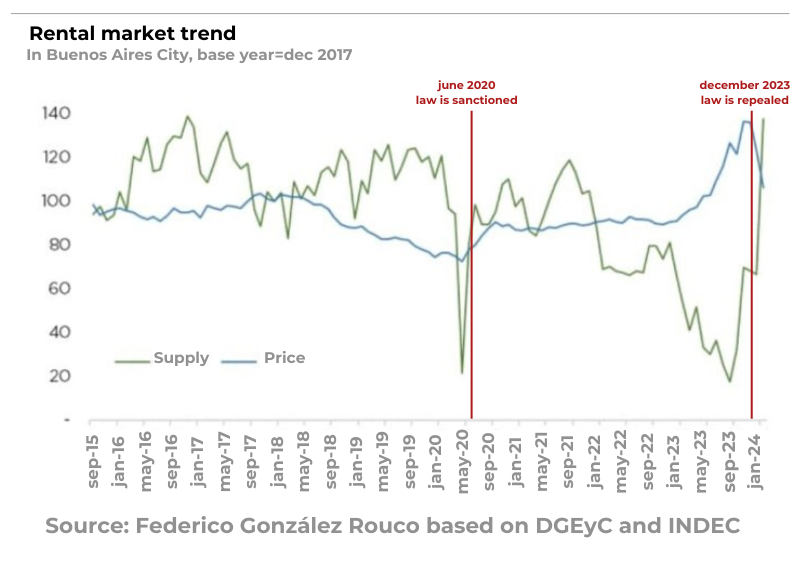

Milei Tries to Tackle Rent Control in Argentina

The major cities of the world have been facing housing problems for years. With the increase of immigrants and of people experiencing homelessness, the discussion about housing regulation has intensified.The West, once a bastion of ideas of freedom and free markets, continues to harbor central planners whose delusions of omnipotence are paid for by the misfortune of ordinary people as the regulation attempts of these planners fail because such...

Read More »

Read More »

The Population Explosion Disaster that Never Happened

I do not hear much talk about world population these days, the way I did growing up in the 1960s and ’70s. People were supposedly starving, dying, with tens of millions more sure to die. The problem back then was that there were just too many, well, people.Population numbers coming out of China and India were unthinkable, and projections indicated many more people were going to be born into this dire situation. There were over twenty thousand...

Read More »

Read More »

On 100-Percent Reserves, Milei, and Argentina

Unsurprisingly, Javier Milei´s monetary reform plans are discussed intensively in libertarian circles. For the first time, a real libertarian reform of the monetary and financial system is in sight. One of the main issues of contentions is Milei´s plan to introduce a 100% reserve banking system. Such a move would be truly revolutionary. The Argentinian banking system would be sound and stable. Harmful credit expansion would be ruled out....

Read More »

Read More »

Unmasking Democracy: A Moral Virtue or a Flawed Tool?

This year, more than sixty countries will hold or have already held elections; a quarter of the population will participate in democracy. Most people in the free world would consider that a victory for liberalism (“liberalism” in the traditional meaning of the word, not the corrupted definition used in the United States). Democracy is often staged as the epitome of freedom and prosperity, a noble system where the voices of the people not only reign...

Read More »

Read More »

Why Libertarianism Is Flourishing in Polish Universities

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Trump Is Right about Abortion and Lindsey Graham Is Wrong

Donald Trump last week said he opposes any national legislation on abortion, and said he supports state governments adopting their own policies. According to USA Today: "Former President Donald Trump said individual states should choose their own abortion restrictions, avoiding talk of any kind of federal government ban and drawing criticism from Democrats and anti-abortion Republicans alike on a pivotal election issue. ...At the end of the...

Read More »

Read More »

Summer 2024 Virtual Mises Book Club

In June 2024, the Mises Institute will hold its next Mises Book Club, a program that promotes deep reading in Austrian economics.The reading for this book club will be one of Ludwig von Mises's most popular works: Economic Policy: Thoughts for Today and Tomorrow. This year marks the 45th anniversary of its publication.This work is one of the best introductions to the ideas of Ludwig von Mises. It is based on six lectures he gave in 1959, covering a...

Read More »

Read More »

The Siren Song of Equality

The “racial equality” debates are characterized by evolving concepts and terminology in a constant search for better ways to express the ideals and values of the protagonists. The mantras of “diversity, equity, and inclusion” (DEI) are now under increasing attack as several states move to ban DEI programs. In search of an alternative conceptual foundation for their equality schemes, many liberals (both progressive and conservative) who wish to...

Read More »

Read More »

Finklestein’s Folly: How Not to Discredit One’s Opponents

The ongoing Israeli-Palestine conflict continues to captivate podcasters and listeners. So, Lex Friedman tapped into this interest by assembling a panel of experts to debate the issue. However, his decision to invite online personality Destiny as a commentator to defend Israel elicited criticisms, as Destiny is a college dropout who was parachuted to fame as a videogame streamer before becoming a political commentator.Since then, he has established...

Read More »

Read More »

“Desire Paths” and the Problem with Central Planning

I recently attended the Austrian Economics Research Conference, which is held annually at the Mises Institute on the campus of Auburn University. After an inspiring day of presentations, I began my trek back to the Auburn University Hotel. As I made my way down the sidewalk, I found myself walking along a well-trodden dirt path. Soon enough I was back on the sidewalk, and I turned around, quickly realizing I had taken the “wrong” path. The correct...

Read More »

Read More »

McConnell Cannot Stop the Non-Interventionist Tide

Even Republican stalwarts like current Senate Minority Leader Mitch McConnell are starting to notice that something is shifting in the party. While McConnell announced recently that he would step down as Republican leader in the US Senate, in an interview last week he was adamant that he would continue to serve out his term in the Senate with one purpose in mind: “fighting back against the isolationist movement in my own party.”He sounds...

Read More »

Read More »

Invasion Alert

Many Americans care about the dangers of mass immigration. Are they right to be concerned? In what follows, I’ll try to show that they are right. Immigration of elements hostile to American values does indeed pose a grave threat. But, if we are libertarians, don’t we have to defend “open borders”? I will argue that we don’t.One of the most obvious reasons mass immigration is a problem is its immense cost—hundreds of billions of dollars. A post from...

Read More »

Read More »

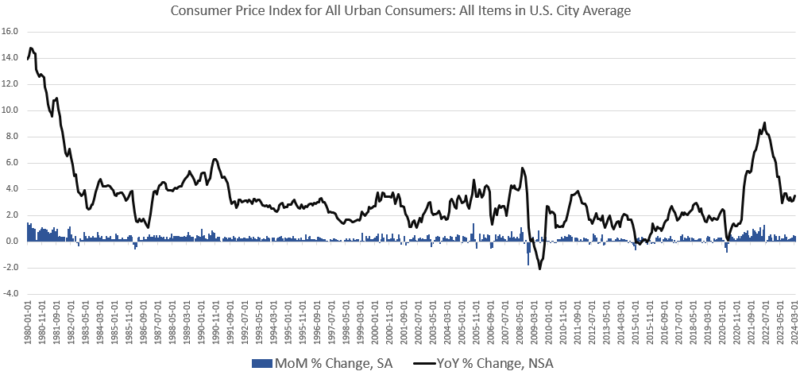

Biden’s Inflation Narrative Dies as Price Growth Rises to a Seven-Month High

According to the Bureau of Labor Statistics' latest price inflation data, CPI inflation in March rose to a seven-month high, and price inflation hasn't proven nearly as transitory as the regime's economists have long predicted. According to the BLS, Consumer Price Index (CPI) inflation rose 3.5 percent year over year during March, without seasonal adjustment. That’s the thirty-seventh month in a row of inflation well above the Fed’s arbitrary 2...

Read More »

Read More »

Let’s Be Honest: The Economy Is NOT Doing Well

The American economy is not all right. But to see why, you need to look beyond the dramatic numbers we keep seeing in the headlines and establishment talking points.Take, for instance, the latest jobs report. For the third month in a row, the American economy added significantly more jobs than most economists had been expecting—a total of 303,000 for March. On its face, that’s a good number.But as Ryan McMaken laid out over the weekend, things...

Read More »

Read More »

Watch Our New Fed Documentary Teaser Now!

Dr. Paul is right! People need to look at the money issue. Wars, spending, debt accumulation, subsidies, and foreign aid are intimately linked to the money machine known as the Federal Reserve.Central banks have two main purposes: inflate the money supply and bail out the big financial firms. By inflating the money supply, governments can finance their operations cheaply and surreptitiously at our expense. If we wish to expose the state and all its...

Read More »

Read More »

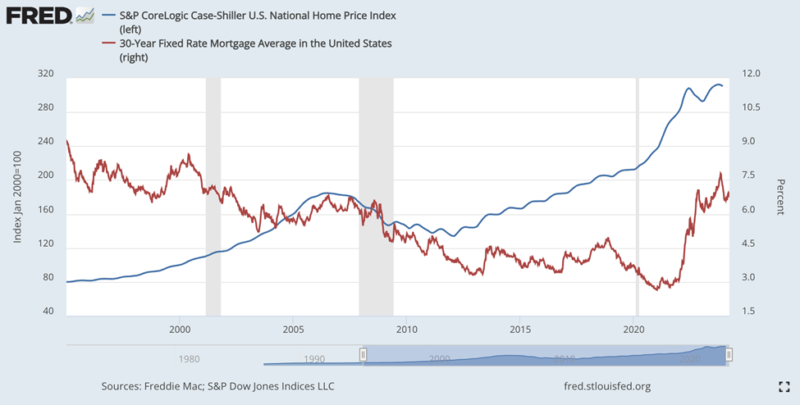

Hair of the Dog — Progressives in Congress Need Another Hit of Low Interest Rates

Bernie Sanders, Elizabeth Warren, and the Congressional Progressive Caucus recently sent an open letter to the chairman of the Federal Reserve, Jerome Powell, demanding lower interest rates.The letter is full of the economic illiteracy one would expect from progressives, especially those in Congress. For example, it misreads price inflation data and argues that the failure to lower interest rates endangers home affordability and increases income...

Read More »

Read More »

Failing to Make the Case for Race-Based Reparations

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

CNN Is Wrong. Deflation Is a Good Thing

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

California’s Latest Hustle: Utility Bills Based on Ratepayers’ Income

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Police Dogs Have Abolished Constitutional Due Process

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »