Category Archive: 6b.) Mises.org

Chapter 18. When Immigration Policy Was Decentralized

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Introduction: Universal Rights, Locally Enforced

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Preface

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Chapter 20. Sovereignty for Cities and Counties: Decentralizing the American Statesbal Sovereignty Is Important

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Postscript: A Tale of Two Megastates: Why the EU Is Better (In Some Ways) than the US

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Breaking Away: The Case for Secession, Radical Decentralization, and Smaller Polities Audiobook

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Does Libertarianism Reject Communities? Libertarianism Actually Strengthens Them

Many opponents of libertarianism claim to reject its philosophy because of its extreme individualist tendencies or because they believe it encourages selfishness. While there are libertarians who are individualistic in every sense of the word, libertarianism does not naturally reject community. Additionally, libertarianism does not encourage selfishness but recognizes that most humans are selfish and thus are wary of giving humans too much power....

Read More »

Read More »

MMT: Believe in the “Incredible Power” of the State

Jordan Klepper: You need to-- you know what you need to do? You need to take some-- some THC or some DMT and let the MMT just wash over you. Let the paradigm shift come to you, Ronny Chieng.Ronny Chieng : Yeah, I think I’m in it right now.Klepper: I think you’re in it.Stephanie Kelton appeared on The Daily Show to promote her documentary, “Finding the Money,” which is set to be released on May 3. The documentary promises to take viewers on a...

Read More »

Read More »

Cowardice, Not Courage, Led House Republicans to Side with the Democrats

Over the weekend, the House of Representatives passed four foreign aid bills that will allocate a combined $95 billion to Ukraine, Israel, Taiwan, and other “national security priorities.” House Republicans followed Speaker Mike Johnson’s (R-LA) lead and joined with Democrats to deliver all the foreign aid President Joe Biden wanted without requiring much of anything in return.The passage came after House Republicans had handed the president...

Read More »

Read More »

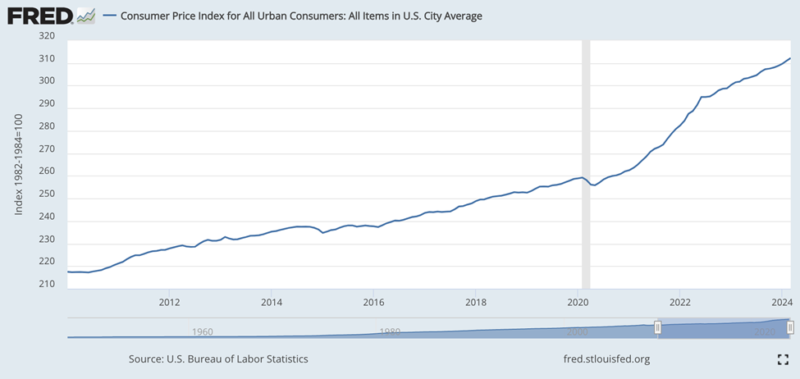

Take the Clear Pill on Inflation

On April 10th, the Bureau of Labor Statistics reported figures for the March Consumer Price Index (“CPI”). CPI purports to represent changes in the overall price level of the American economy – an obscenely vague abstraction in a country of 350 million people. Let’s pretend for a moment that it does that.In March, overall CPI grew at 3.5 percent from a year ago and so-called “core CPI,” which excludes food and energy items, increased by 3.8 percent...

Read More »

Read More »

Iran’s Attack on Israel Provides an Opportunity to De-escalate

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

California’s Crony Capitalist Minimum Wage Law

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Anarchy, State and Utopia: Robustly against Redistributive Taxation for 50 Years

Robert Nozick’s classic of political philosophy Anarchy, State, and Utopia turns fifty this year. His blasting of the redistribution of wealth shook academia to its core in 1974, and its intellectual tremors are arguably still being felt to this day. Nevertheless, Nozick’s arguments are clearly lost in the “real world”; high taxes and high benefits still run amuck. Indeed, even in the heyday of neoliberalism—the 1980s—Margaret Thatcher often...

Read More »

Read More »

Ireland’s Progressives Lose Big in the Irish Family and Care Constitutional Referenda

Two constitutional referenda were held in Ireland on the 8th of March to revise the wording of the constitution, to widen the definition of family and redefine gender roles in the provision of care. The Irish government claimed that this would modernize the constitution and align it to current views and needs.The proposed changes were as follows:The Thirty-ninth Amendment would add the text between brackets to Article 41.1.1:“The State recognizes...

Read More »

Read More »

Conservatives Are Wrong on Economics. Here’s How to Fix the Problem.

Argentinian president Javier Milei didn’t settle for advocating free market ideals to the cronyist elite attendees at the World Economic Forum. He also delivered a remarkable speech at the Conservative Political Action Conference, reaffirming his commitment to Austrian economics and libertarian theory. He critiqued neoclassical models, quoted economists like Ludwig von Mises and Murray Rothbard, and exposed flaws in socialist economic...

Read More »

Read More »

The FBI and CIA Are Enemies of the American People

Joe Rogan and Tucker Carlson sat down for a three-hour-plus discussion on the Joe Rogan Show last week, covering everything from UFOs, to religion and artificial intelligence. But perhaps the most important topic they covered was the insidious and dangerous role played by the US regime's intelligence agencies in America. Specifically, Carlson suggested the CIA continues to lobby for keeping the JFK files secret, possibly because the CIA had a role...

Read More »

Read More »

Final Nail in America’s Coffin?

When future historians go searching for the final nail in the US coffin, they may well settle on the date April 20, 2024.On that day Congress passed legislation to fund two and a half wars, hand what’s left of our privacy over to the CIA and NSA, and give the US president the power to shut down whatever part of the Internet he disagrees with.The nearly $100 billion grossly misnamed “National Security Supplemental” guarantees that Ukrainians will...

Read More »

Read More »

UK Railways Are Reverting to the Disaster of State Ownership

Transport for the North, a collection of the Northern Transport Authorities and some business leaders, will be calling for Avanti West Coast’s rail franchise to be stripped from it after continued disruption to services that sometimes leads to journeys lasting hours longer than they should, which, as you can imagine, leads to rather a lot of disgruntled and angry train users. They want the railway to be taken under control of the government on a...

Read More »

Read More »

The UK Is Reverting to Railway Socialism

Transport for the North, a collection of the Northern Transport Authorities and some business leaders, will be calling for Avanti West Coast’s rail franchise to be stripped from it after continued disruption to services that sometimes leads to journeys lasting hours longer than they should, which, as you can imagine, leads to rather a lot of disgruntled and angry train users. They want the railway to be taken under control of the government on a...

Read More »

Read More »

Countering the Neoconservative Defense of the British Empire

One of the worst novels of the nineteenth century, aesthetically and politically, is Julius Vogel’s Anno Domini 2000 (1889). It is stylistically absurd because the author was a statesman with no literary prowess. It is appalling politically because it envisions a future in which the British Empire survives into the second millennium. It remains in print to this day.Vogel’s novel is relevant because it challenges recent scholarly attempts to portray...

Read More »

Read More »