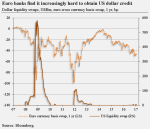

On Friday, July 7, 2023, news broke in the financial market media that the “BRICS” (that is, Brazil, Russia, India, China, and South Africa) will implement their plan to create a new international currency for trading and financial transactions, and that this new currency will be “gold-backed”.

Most recently, on June 2, 2023, the foreign ministers of the BRICS – as well as representatives from more than 12 countries – met in Cape Town, South Africa (interestingly at the “Cape of Good Hope”). Among other things, it was emphasized that they wanted to create an international trading currency. Undoubtedly, this is an undertaking that could have consequences of epic proportions.

After all, the BRICS countries represent about 3.2 billion people, approximately 40 per cent of the world’s

Read More »