| The Investec Global Investment Strategy Group discusses the global market outlook for the next 18 months. Get more insights from the #InvestecWealth Forum here: invest.ec/2wWpkwK

The Global Investment Strategy Group brings together the finest investment minds at Investec Wealth & Investment across the different geographies, to set the overarching positioning and investment strategy for the investment portfolios of clients.

John Haynes, head of research at Investec Wealth & Investment UK and chairman of the Global Investment Strategy Group, chaired a panel at the recent Investec Wealth Forum in Cape Town and Johannesburg.

The panel ran through the Global Investment Strategy Group’s positioning over the next 18 months. Topics covered included Trump, Brexit and the role of central banks.

Panel participants included:

• Brian Kantor, Chief Strategist & Economist, Wealth & Investment SA

• Chris Hills, Chief Investment Officer, Investec Wealth & Investment UK

• Annelise Peers, Chief Investment Officer, Investec Bank Switzerland

Here are some of the highlights:

• 00:06: The role of Investec Wealth & Investment’s Global Investment Strategy Group in setting the risk budget for the firm

• 00:40: “Serial optimist” Prof Brian Kantor on the role of the Central Reserve Banks in alleviating financial crisis

• 03:06: Prof Brian Kantor on the need for Central Banks’ balance sheets to contract, shrinking the cash reserves of the banking system

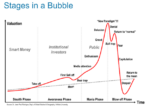

• 03:26: John Haynes on the victory of the Central Banks and how equity risk was rewarded

• 04:10: Chris Hills on why he’s started to “soften his risk enthusiasm”

• 06:06: Chris Hills expects the US Federal Reserve to start shrinking their balance sheet, while Mario Draghi, President of the European Central Bank, will also expand the balance sheet a lot slower than in previous years in 2018

• 06:40: Chris Hills on why he doesn’t want to be underweight on equities

• 07:28: John Haynes on “transition risk”

• 07:46: Annelise Peers on the importance of having bonds in your portfolio

• 08:58: Annelise Peers on what interest rates will look like going forward

• 10:12: 10-year bonds to be between 2-3%, according to Annelise Peers

• 10:20: John Haynes on the valuation question – “we should be looking at equities against inflation”

Get more insights and videos from the Investec Wealth Forum here: http://invest.ec/2wWpkwK |