Monthly Archive: November 2024

Yes, Senator Cruz, Elon Musk should read Mises’s Bureaucracy

On his podcast “Verdict” November 13, Ted Cruz mentioned one of my favorite books by Ludwig von Mises: Bureaucracy. He mentioned it in reference to the “Department of Government Efficiency” that was also announced by President-elect Donald Trump on the same day. Cruz brings up a crucial point to the conversation surrounding this plan, pointing at Mises for getting it right. The idea lingers that this Department will make government efficient; that...

Read More »

Read More »

Fragile and Consolidative Tone Starts the Week in FX

Overview: The US dollar has begun the new week consolidating in a mixed fashion against the G10 currencies. Bank of Japan Governor Ueda remains circumspect and did not provide guidance about next month's central bank meeting. Without positive guidance, the market sold the yen, but the swaps market shows about 13 bp of tightening has been discounted, up a couple of basis points from a week ago. Leave aside the New Zealand dollar, which is also under...

Read More »

Read More »

Destroying Creative Destruction: The DMA against Innovation

In the ever-evolving landscape of economic theory and policy, few concepts have been as influential and controversial as Joseph Schumpeter’s “creative destruction.” This powerful idea, which describes the process by which innovation continuously reshapes markets, challenges conventional wisdom about competition, monopolies, and the role of government intervention. As we grapple with the complexities of the digital age, the tension between creative...

Read More »

Read More »

The $100 Trillion Global Debt Bomb and Financial Shock Risk.

Last month, the IMF stated that “our forecasts point to an unforgiving combination of low growth and high debt, a difficult future,” emphasizing that “governments must work to reduce debt and rebuild buffers for the next shock, which will surely come, and maybe sooner than we expect.”This advice comes with a warning. At the current rate of spending, the US debt to GDP will reach 198% by 2050 even without expecting a recession. The G-7 public debt...

Read More »

Read More »

Swiss billionaires oppose closer EU ties

The Compass Initiative calls for important treaties to be approved by the people and the cantons.

Keystone / Peter Klaunzer

Listen to the article

Listening the article

Toggle language selector...

Read More »

Read More »

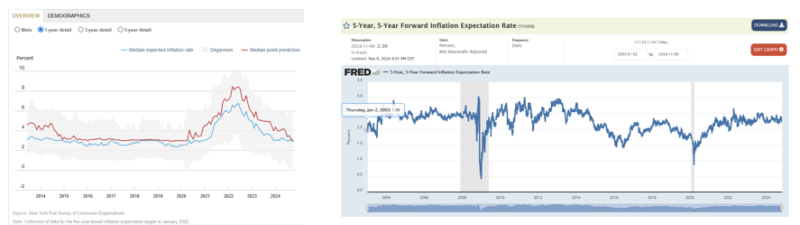

5X5 Inflation Expectations: A New Benchmark To Follow

At the last FOMC meeting, Jerome Powell was asked if they were concerned that inflation expectations are “de-anchoring, or put another way, are anchoring at a slightly higher level?” His answer specifically referenced the 5x5 forward inflation expected rate. He could have used many data points to answer the question. However, the fact that he …

Read More »

Read More »

The Inflationists’ Narrative Is Crumbling

The United States 10-year government bond yield reached a low of 3.6% in September but has rapidly creeped up to 4.2%, erasing all the rate cut impact. The primary cause is the out-of-control public spending and the lack of confidence among bond investors in the government’s ability to manage its public finances. Therefore, it is logical that investors fear an inflation bounce.The United States’ government is obsessed with doping GDP with...

Read More »

Read More »

Ethereum: Analyst rechnet nach Trump-Sieg mit hohem Kursziel – Widerstandsmarke überwunden

• ETH steigt nach Trump-Sieg<br> • Anleger scheinen optimistisch zu sein<br> • Widerstandsmarke überwunden<br> <!-- sh_cad_1 --> Nach dem US-Wahlsieg von <!--#BNL#topicId#98-->Donald Trump<!--#ENL--> verzeichnete <a href="/devisen/ethereum-dollar-kurs" target="_blank">Ethereum</a> (ETH) einen deutlichen Anstieg und notiert derzeit bei...

Read More »

Read More »

Kryptowährungen-Umfrage: Händler-Akzeptanz gegenüber Bitcoin wird bis 2025 massiv zulegen

• Wachsendes Interesse an Bitcoin-Zahlungen<br> • Naher Osten mit höchster Akzeptanz<br> • Bedürfnis nach breiteren Finanzdienstleistungen<br><!-- sh_cad_1 --> Aus einem aktuellen Bericht von <a href="/devisen/ripple-dollar-kurs" target="_blank">Ripple</a> und dem US Faster Payments Council geht hervor, dass die <a...

Read More »

Read More »

Political Bias in Academia

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

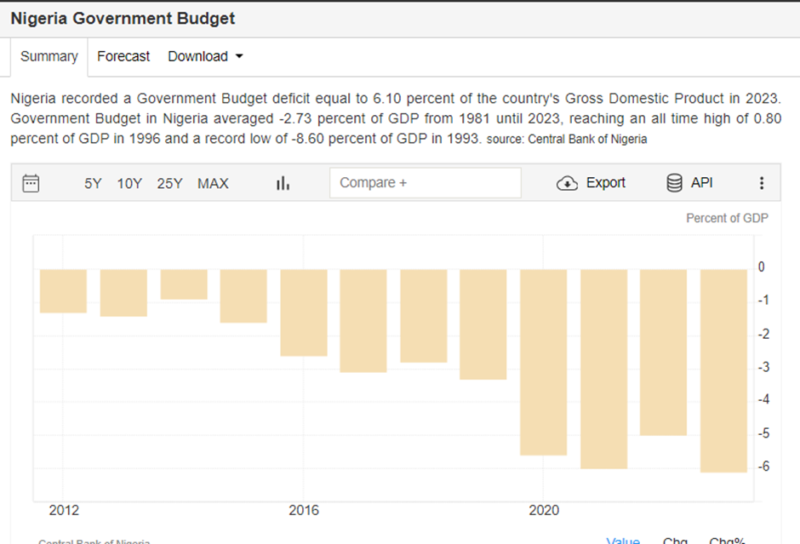

Despite Its Oil Wealth, Nigeria Is an Economic Basket Case

Americans are outraged. Gas prices have risen over 30 percent in four years, electricity has risen by over 30 percent in the last four years, and groceries have risen by over 20 percent. This is infuriating and Americans are well in the right to be disgusted by it. Now, imagine living in a country where gas prices have risen by 350 percent—yes, 350 percent!—in the last year, electricity prices have doubled in one year, and egg prices doubled in the...

Read More »

Read More »

A Walk on the Supply Side

[Editor’s note: In this article, originally published in October 1984, Murray Rothbard critiques a problem with the economics of Republicans and conservatives. Namely, its proponents think they can have it both ways by cutting tax rates and increasing government spending, while somehow not running up huge deficits. Much of this is based on the so-called Laffer curve idea, which Rothbard regards with skepticism. Moreover, Rothbard notes that when...

Read More »

Read More »

Why FEMA Makes Things Worse: Theory and History

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Week Ahead: Powerful Forces Rippling Through the Capital Markets Do Not Appear Exhausted

There are powerful forces in the capital markets, and they do not appear exhausted even if there is some near-term consolidation. The Dollar Index has risen for seven weeks, which is to say that it has not fallen on a weekly basis so far here in Q4. The US two-year yield has risen for the past four weeks and six of the past seven. It has surged from about 3.55% at the end of September to 4.38% last week. The US 10-year yield has fallen in only two...

Read More »

Read More »

“Trump Trade” Sends Investors Into Overdrive

Inside This Week's Bull Bear Report A Pause That Refreshes? Last week, we discussed that with the election over and the Federal Reserve cutting interest rates, many market headwinds were put behind us. To wit; "As a result, the market surged higher, hitting our year-end target of 6000 on Friday. Furthermore, since election day, the …

Read More »

Read More »

Erasing Black Confederates

In 2019 The New York Times launched their 1619 project, which “aims to reframe the country’s history by placing the consequences of slavery and the contributions of black Americans at the very center of our national narrative.” In the NYT retelling of American history, black troops who fought for the Union in the 1861-65 war are to be commemorated, but black Confederates must be summarily erased. The aim of this article is to argue against this...

Read More »

Read More »

Caplan’s Errors on the UAE and Open Borders

Arguments advanced to support a political position often fail to withstand the slightest scrutiny. Rather, they are meant to make an impression on the impressionable—those who lack the context required to make an evaluation—and draw large numbers of the uninformed to one side of a political debate. Such is the case with libertarian economist Bryan Caplan’s recent article in favor of unrestricted immigration, wherein he uses the United Arab Emirates...

Read More »

Read More »

USD/CHF Price Forecast: Reaches overbought levels

USD/CHF is in a strong uptrend which keeps making higher highs.

However it has reached overbought levels according to the RSI momentum indicator

This means bulls should be aware of the increased risk of pullbacks.

USD/CHF continues rising in its established uptrend but it has now reached overbought levels (above 70) according to the Relative Strength Index (RSI) momentum indicator. When this occurs it advises long-holders not to add to their...

Read More »

Read More »

Price Inflation Accelerated in October Following the Fed’s Rate Cut

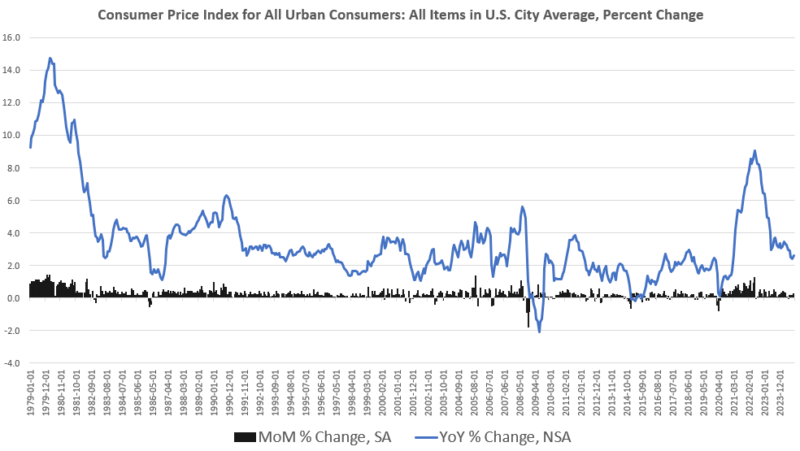

According to the Bureau of Labor Statistics’ latest price inflation data, CPI inflation in October accelerated and month-to month increases in CPI inflation hit multi-month highs.The seasonally adjusted Consumer Price Index (CPI) rose 0.24 percent month over month in October, rising to a six-month high. Year over year, the CPI rose 2.49 percent in October, not seasonally adjusted. That’s a three-month high.The ongoing price increases largely...

Read More »

Read More »

“NAFTA Fever” and the Myth of Government-Created Free Markets

Left or right, the enemy is the free market. Every problem is the fault of the free market. On the left, the supposed radical deregulation of the 1980s paved the way for the financial crisis and the destruction of the environment. On the right, free trade is responsible for the gutting of manufacturing. The free market is made out in this mythos to have had its heyday in the 1980s and ‘90s and destroyed everything. Even free market advocates fall...

Read More »

Read More »