Monthly Archive: January 2024

Navigating the Complexity of Climate Change: A Closer Look at the Scientific Method and Its Challenges

The physical sciences have greatly advanced knowledge by elucidating the workings of simple phenomena. In a simple phenomenon, we have a limited number of important variables, all of which are identifiable and measurable. This allows us to run a scientific experiment. In such an experiment, we hold all other variables constant and examine the influence of one variable on the phenomenon. We can therefore measure this variable’s direction and how...

Read More »

Read More »

Secession’s Opponents Embrace Colonialism and “Enlightened” Central Governments

The idea of secession for some regions of the United States—sometimes simplistically called "national divorce"—has increasingly been mentioned as a way to deal with the apparent growing divide between what are crudely called "red states" and "blue states." Polls suggest that perhaps a third of the American population "indicated a 'willingness to secede'"

Vehement opposition to the idea remains plentiful,...

Read More »

Read More »

Biden’s Absurd New Economic Messaging Strategy

After spending months trying to sell his economic agenda under the banner of “Bidenomics,” the president’s team is frustrated. Voters aren’t believing them when they say that the economy is doing excellent and that Joe Biden deserves the credit.

Rather than make a meaningful attempt to understand the American people’s economic pain and recognize why it isn’t being detected by traditional economic indicators, the president’s team has settled on a...

Read More »

Read More »

US Tech Sell-Off Challenges Risk Appetites Ahead of the FOMC

Overview: Ahead of the US Treasury's quarterly

refunding announcement and the outcome of the FOMC meeting, the dollar is

trading higher against all the G10 currencies. With US high-flying tech stocks

posting steep losses after disappointing earnings reports, the currencies most

sensitive to risk-appetites, the dollar bloc and the Norwegian krone are the

weakest. Emerging market currencies are mixed. The South African rand,

Philippine peso, and...

Read More »

Read More »

Reflections on the Libertarian Role in Society

As the recent election of Javier Milei in Argentina shows us, there still is a place in the political world for libertarian thinking. Liberty is a goal still worth pursuing.

Original Article: Reflections on the Libertarian Role in Society

Read More »

Read More »

The War on Producers and Entrepreneurs Is Based on False Notions of Profits

Since Adam Smith, economic thinkers have failed to understand that profits in a market economy are not extractions of wealth from laborers. In truth, profits lead to higher wages and higher living standards for those workers.

Original Article: The War on Producers and Entrepreneurs Is Based on False Notions of Profits

Read More »

Read More »

Does Government Spending and Money Expansion Create New Wealth or Destroy It?

Government efforts to expand “aggregate demand” involve new spending and money creation. In reality, these activities destroy wealth in the name of expanding it.

Original Article: Does Government Spending and Money Expansion Create New Wealth or Destroy It?

Read More »

Read More »

What is Money? Who Controls Money?

What Is Money? Who Controls It?

Gold is money! Silver is money! Everything else is credit!

J. P. Morgan famously said this in his testimony before Congress in 1912: “Gold is money. Everything else is credit.”

J. P. Morgan was the founder of JPMorgan Chase & Co., an American multinational financial services company headquartered in New York City. It is the largest bank in the United States and the world’s largest bank by market capitalization as...

Read More »

Read More »

Contra Krugman, Policies of Countering Unemployment Are Costly

When the economy goes into a recession, most economic commentators believe that the government and the central bank should take steps to counter the rise in unemployment. Some economists believe that lowering unemployment can be achieved without any cost, given that the unemployed workers are idle. According to Paul Krugman, “If you put 100,000 Americans to work right now digging ditches, it is not as if you are taking those 100,000 workers away...

Read More »

Read More »

EMU Q4 23 GDP Stagnates, Underscoring Divergence with the US

Overview: The US dollar is mixed ahead of the start

of the FOMC meeting and is mostly in its recent ranges. The euro, which was

sold below $1.08 yesterday for the first time since mid-December is holding

above it today. The less-than-expected projection of US Treasury borrowing

requirements for Q1 and Q2 weighed on US rates, which, in turn, dragged the

greenback lower against the yen. It is trading near a four-day low, a

little above JPY147.00. The...

Read More »

Read More »

US Foreign Policy Is a Far Cry from the Founders Intent

In July 2021, the Watson Institute of Public Affairs at Brown University reported that since September 11, 2001, 7,057 US military personnel have been killed in military operations in Iraq and Afghanistan alone. Civilian contractor deaths reached 8,000, although the institute admits this is an estimate considering many contractors were not US citizens, so some deaths went unreported. Finally, 30,177 US service members would commit suicide after...

Read More »

Read More »

Washington’s Planned Theft of Credit Card Benefits

Our vacation airline tickets in September were funded by accumulated miles on our Alaska Airlines credit card. While on vacation this summer, my brother-in-law graciously hosted eight of us for dinner. He tried to downplay the generous hospitality by saying he had just gotten his “cash back” award from his credit card company. The “cash back” credit card had accumulated a tidy sum of money, paying for a very nice dinner.

At home in Brookfield, a...

Read More »

Read More »

Oil Retraces Initial Surge, Euro Slips to Marginal New Low, while Sterling Hugs $1.27

Overview: Key developments today include the Hong

Kong court ordered liquidation of China's Evergrande and the reversal of oil

prices after a sharp rally initially in Asia after separate attack in the

Middle East that killed US troops in Jordan and struck a Russian oil tank in

the Red Sea. March WTI, which settled near $78 ahead of the weekend, its best

level since the end of last November, rallied to about $79.30 before returning

to almost $77.50...

Read More »

Read More »

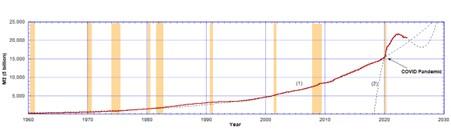

Can Classical Economics Explain the Approaching Fiscal Disaster?

There is a lack of buyers for US Treasury debt. Rating agencies have recently downgraded the US debt, and entitlement benefits’ “trust funds” will go into the red in a few years. The classical economists offer few answers to the depth of this problem.

Original Article: Can Classical Economics Explain the Approaching Fiscal Disaster?

Read More »

Read More »

The Decisive Driving Force to Victory for Javier Milei

Javier Milei has begun his presidency by taking action against much of Argentina’s vast welfare state. One hopes it is the beginning to a successful term in office.

Original Article: The Decisive Driving Force to Victory for Javier Milei

Read More »

Read More »

The Government Is Making the Economy Appear Better than It Is

By borrowing money and “creating” new jobs, the government is creating the illusion of a strong economy. This does not end well.

Original Article: The Government Is Making the Economy Appear Better than It Is

Read More »

Read More »

The December Jobs Report Is Mostly Bad News

The job market is still hanging on—but not nearly as well as the headline numbers and media pundits would have you believe.

Original Article: The December Jobs Report Is Mostly Bad News

Read More »

Read More »

February 2023 Monthly

The coming weeks will

likely continue the correction of the trends that began last month. The markets

recognize that tightening cycle is over. However, they swung hard, pricing in

aggressive easing by most of the G10 central banks, including the Federal

Reserve and the European Central Bank. Official comments and some

high-frequency economic data have encouraged participants to rein in their

expectations, reducing the odds of a rate cuts in Q1 and...

Read More »

Read More »

Measure 110 and Property Rights

In this week's episode, we replay Mark's recent appearance on the Rob Taylor Report. Mark and Rob take a deep look at the practical impact of socialist ideology in Oregon when mixed with the partial "decriminalization" of all hard drugs in the state. The main issues they discuss are the lack of respect for private property rights, and woke government causing social chaos in Oregon; but, it's a lesson for everyone, everywhere....

Read More »

Read More »

Are Free Market More Dangerous than Regulated Markets?

As a frequent X/Twitter user, I follow a variety of accounts that touch on a number of niches: whether that is economics, finance, Catholicism, college football . . . or in this case, Lord of the Rings. A popular Twitter account that regularly shares content related to J.R.R. Tolkien’s work broke from character to offer an insight on another tweet. In the tweet he refers to, a food inspector is shown interrupting the business of a diner, which the...

Read More »

Read More »