Monthly Archive: May 2023

June 2023 Monthly

June is a pivotal month. The US debt-ceiling

political drama cast a pall over sentiment even if it did not prevent the

dollar from rallying or the S&P 500 and NASDAQ from setting new highs for

the year. It is as if the two political parties in the US are playing a game of chicken

and daring the other side to capitulate. Both sides are incentivized to take to

the brink to convince their constituents that they secured the best deal

possible. No...

Read More »

Read More »

Where Is That Darn Recession?

Mark takes a look at all the wrong predictions of recession in recent years, including those of Austrian School economists. While the MSM and Fed officials try to downplay the coming of a recession, many of the statistics and facts that Austrian consider important are indicating a looming recession, if not a full-blown economic crisis.

Check out Anatomy of the Crash: The Financial Crisis of 2020, edited by Tho Bishop:...

Read More »

Read More »

Can We Protect Ourselves from Inflation?

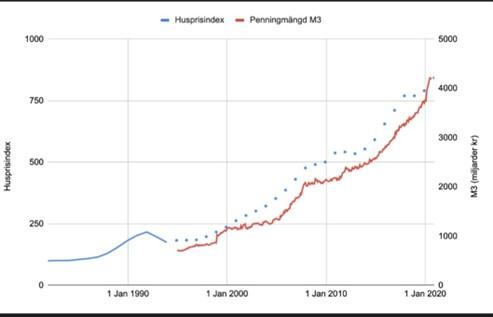

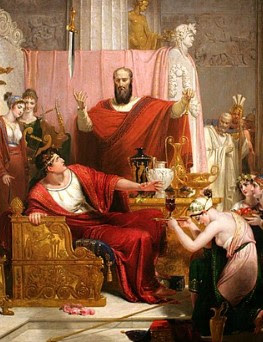

Rulers found out early on that they could debase gold and silver coins for their own gain. As a consequence, the money supply increased, whereas money’s purchasing power fell. This pseudoalchemy is the true definition of inflation and has been a policy for more than a thousand years.

What’s more, an increase in the money supply leads to rising prices. This symptom of inflation is often mistaken as inflation itself. The correct term, though, is...

Read More »

Read More »

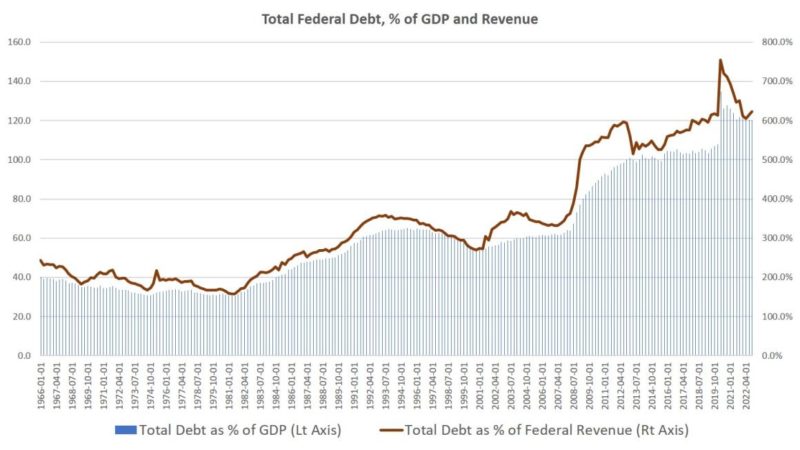

As Interest Rates Rise, the Era of “Deficits Don’t Matter” Is Over

Back in 2002, then-Vice President Dick Cheney claimed "Reagan proved deficits don't matter" and went on to push for tax cuts combined with more federal spending. Indeed, the Bush administration would go on to push immense amounts of new spending, supporting a huge Medicare expansion and blowing hundreds of millions of dollars on costly and pointless occupations in Iraq and Afghanistan. The national debt grew by 70 percent during Bush's...

Read More »

Read More »

Overcoming Government Intervention in the Economy

Once again, the economic system is trying to adjust to political and monetary interventions. The year 2023 marks the end of a historical period characterized by zero-cost credit.

The monetary expansion that began in the early 2000s led to the great financial crisis of 2008 and the emerging markets boom. Exaggerated demand expectations and easy access to capital caused an overexpansion of production capacity and the subsequent industrial...

Read More »

Read More »

Rothbard’s Button Doesn’t Exist, but It Needs to Be Invented

In 1948, Ludwig Erhardt rescued a German economy that was in shambles simply by invoking free markets and currency reform. Our economy needs its Rothbard moment.

Original Article: "Rothbard’s Button Doesn’t Exist, but It Needs to Be Invented"

Read More »

Read More »

Mises Book Club

In September 2023, the Mises Institute will hold the inaugural meeting of the Mises Book Club, its newest program to promote deep reading in Austrian economics.

In celebration of the 50th Anniversary of Murray Rothbard's For a New Liberty: The Libertarian Manifesto, this iconic Austrolibertarian text will be the focus of our inaugural meeting.

For eight riveting weeks, ten to fifteen specially selected undergraduate students will partake in rich...

Read More »

Read More »

Fear-Mongering Over the Debt Ceiling

Heritage Fellow Peter St. Onge joins Bob to set the record straight on several popular talking points about the debt ceiling.

Bob on selling Gov't resources to reduce the National Debt: Mises.org/HAP397a

[embedded content]

Read More »

Read More »

An Austrian Perspective vs the Financial Mainstream

This episode of Good Money with Tho Bishop features guest Ryan Griggs of Griggs Capital Strategies. During the show, Ryan discusses his work with Bob Murphy on an Austrian understanding of inverted yield curves as a signal for recessions and how it differs from the mainstream analysis. He also discusses Nelson Nash's infinite banking strategy as a means for capital accumulation, in contrast to traditional investment approaches.

Ryan and Bob Murphy...

Read More »

Read More »

Don’t Get on the Nationalist Bus

America and the Art of the Possible: Restoring National Vitality in an Age of Decayby Christopher BuskirkEncounter Books, 2023; xxv + 162 pp.

Christopher Buskirk is the publisher and editor of the magazine American Greatness, and the title of that magazine, like that of the book, shows his principal concern. How can the American people regain the sense of optimism and purpose which we once had but have now lost?

Buskirk says that in

the public...

Read More »

Read More »

Is There an Optimum Growth Rate of Money?

Monetarists believe there is an optimum growth rate of money. However, a fiat money system itself is unstable, so there is no optimum growth rate.

Original Article: "Is There an Optimum Growth Rate of Money?"

Read More »

Read More »

The Boston Brahmins, WASPs, and Nazis: The Pursuit of Eugenics

During the progressive era, academia hastily adopted the inhumane pseudoscience of eugenics, and its results on the world were devastating. The influence of the Boston Brahmins in New England can explain the fervent adoption of this malignant belief. This elite and well-educated class of white Anglo-Saxon Protestants reeked of pomp and snobbery.

The origin of the term “Boston Brahmin” came from Oliver Wendell Holmes Sr. in his 1861 novel Elsie...

Read More »

Read More »

The Greenback Stalls after Yesterday’s Surge as US Negotiators Move Closer to Last-Minute Deal

Overview: Yesterday's dollar surge has stalled. It is

consolidating its gains and is softer against all the G10 currencies. After

popping above JPY140 yesterday, there were no follow-through greenback buying

in Tokyo. Most emerging market currencies are also firmer, including the South

African rand, which plummeted by 2.8% yesterday on the back of the central

bank's warning of downside currency risks as it delivered a 50 bp hike. The

Chinese yuan...

Read More »

Read More »

Socialism, Minority Groups, and Personal Liberties

People from socially and economically marginized groups in the USA tend to support socialism. Yet socialists have a long and bloody history of suppressing these very groups.

Original Article: "Socialism, Minority Groups, and Personal Liberties"

Read More »

Read More »

The Regime’s Lies Over the Debt Ceiling

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop tackle the debt ceiling debate. As negotiations continue in Washington, the corporate financial press is hard at work warning about the potential for disaster. Ryan and Tho cut through the nonsense to look at the real state of America's finances, potential ramifications in the short term, and US defaults of the past and the inevitable future.

[embedded content]

New Radio...

Read More »

Read More »

Taxation as a Weapon against Prosperity

The Economist magazine in a recent editorial painted a rather positive image of the American economy. After encountering setbacks, the American economy often registers a buoyant recovery. Despite competition from rivals, America has retained her position as the world’s top economy. Some are bewildered by America’s enduring prosperity, but is it reasonable to expect less from a country designed to do business?

The American Constitution is a fierce...

Read More »

Read More »

Comprehensive Reform versus Piecemeal Reform

Should political reform be the result of a much-discussed comprehensive plan? Or should it come about through decentralized decision-making that deals with the situations at hand?

Original Article: "Comprehensive Reform versus Piecemeal Reform"

Read More »

Read More »

There Is No Moral Right to Strike

Americans are in a time of rising labor unrest and activism, including multiple unionization campaigns, regulatory and legal changes to make it easier for unionization efforts to succeed, the “Fight for $15” minimum wage agitation, and the Hollywood writer’s strike. However, such discussions and campaigns seldom approach the issues involved from a moral perspective, beyond the implicit presumption that trying to force others to give you a raise...

Read More »

Read More »

Fitch Puts US on Negative Credit Watch and the Dollar Extends its Gains

Overview: Concerned about the political wrangling over servicing US

debt, Fitch put the US on negative credit watch. Besides chin

wagging and finger pointing, it has had little perceptible impact. The dollar

is mostly higher, reaching new highs for the year against the Japanese yen,

Chinese yuan, and the Antipodean currencies. The euro and sterling met

retracement objective we have targeted (~$1.0735 and $1.2435, respectively).

The greenback is...

Read More »

Read More »

The Bud Light Boycott and Clueless Corporate Executives

In perhaps one of the most unexpected and sudden shifts in consumer demand in recent years, sales of Bud Light have now fallen sizably for six weeks in a row, with no end in sight. The New York Post reported on Monday that "Sales of the US’s No. 1 beer were down 24.6% for the week ended May 13 compared to a year ago — slightly worse than the 23.6% dip they suffered a week earlier."

But it's not just Bud Light. Sentiment has turned...

Read More »

Read More »