Monthly Archive: April 2023

Politics Is Turning Us into Idiots

From race to gender to nearly everything else, decisions about what is correct or incorrect are made according to politics. This is a recipe for social destruction.

Original Article: "Politics Is Turning Us into Idiots"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Who Are the Wealth Destroyers, Politicians or Billionaires?

Thinking that billionaires are a policy failure has become pervasive in the United States. Politicians like Alexandria Ocasio-Cortez and Elizabeth Warren are leading the charge in the demonization of billionaires. Left-leaning politicians and their allies think that billionaires corrode society by accumulating large fortunes, which amplify inequality. As such, many propose taxation as a tool to promote fairness by redistributing resources, yet such...

Read More »

Read More »

Pressure Returns to Bank Shares and seems to Help Propel Gold Higher

Overview: There are three themes today. First, the

sharp decline in US rates seen yesterday (-14 bp on the two-year yield) on the

back disappointing economic data seemed a bit exaggerated and the two-year

yield has bounced back to almost 3.90% from around 3.81%. This appears to be

helping the dollar consolidate today. Second, bank shares are coming under

renewed pressure. The US KBW bank index fell almost 2% yesterday after a 0.5%

decline on...

Read More »

Read More »

Incore Bank Signs Maerki Baumann as First Client For SDX Ethereum Staking

InCore Bank can now offer Ethereum staking capabilities that are fully compliant with Know-Your-Client (KYC) and Anti-Money-Laundering (AML) regulations to their clients.

In this collaboration, InCore Bank provides crypto brokerage, banking operations and custody services, while SDX Web3 provides crypto custody and non-custodial-staking services.

The Zurich-based private bank Maerki Baumann launched its crypto strategy in 2019. Apart from corporate...

Read More »

Read More »

Postfinance Partners With Sygnum Bank to Offer Cryptocurrencies

PostFinance partners with Sygnum, the world’s first digital asset bank, to offer its customers a range of regulated digital asset banking services via Sygnum’s B2B banking platform.

PostFinance’s partnership with Sygnum Bank enables the launch and ongoing expansion of regulated, bank-grade digital asset products and services for its customers

PostFinance’s customers will be able to buy, store and sell leading cryptocurrencies such as Bitcoin and...

Read More »

Read More »

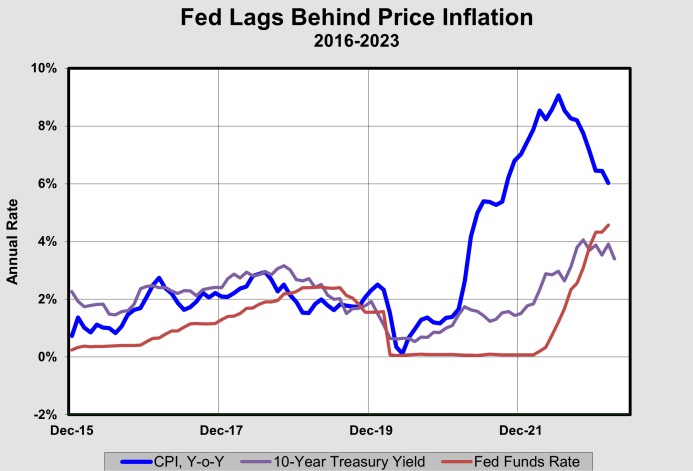

The Fed’s Capital Goes Negative

The Federal Reserve’s new report of its balance sheet shows that in the approximately six months ended March 29 it has racked up a remarkable $44 billion of cumulative operating losses. That exceeds its capital of $42 billion, so the capital of the Federal Reserve System has gone negative to the tune of $2 billion—just in time for April Fools’ Day.

This event would certainly have surprised generations of Fed chairmen, governors, and, we’d have...

Read More »

Read More »

To Fight the State, Build Alternatives to the State

The challenge at hand is more than simply opposing the state. Rather, it is necessary to build up, reinforce, and sustain institutions that can offer alternatives to the state.

Original Article: "To Fight the State, Build Alternatives to the State"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

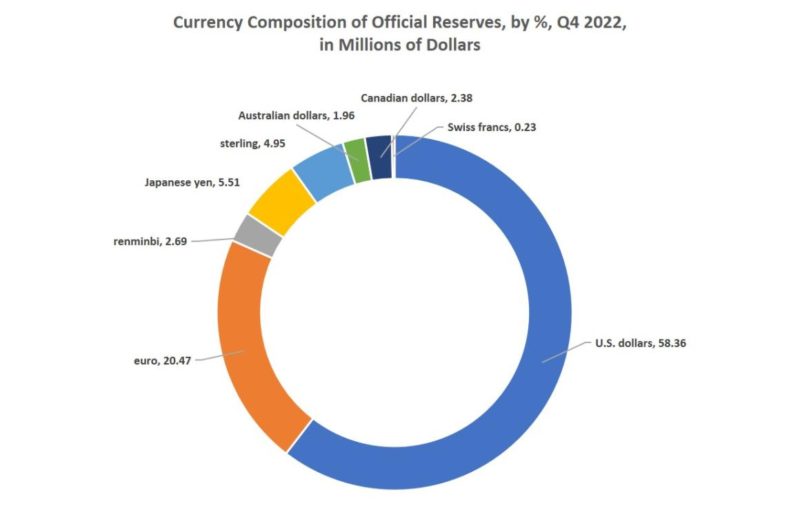

Why the Regime Needs the Dollar to Be the Global Reserve Currency

Last week, Fox News aired a segment discussing the possibility that the US dollar will cease to be the global reserve currency and what that would mean for Americans. The tone of the piece suggested that a “catastrophic” decline of the US dollar was not only possible, but perhaps even imminent. CNN last week also aired its own segment suggesting the US will face “a reckoning like none before” if the “dollar’s dominance” in the global economy falls...

Read More »

Read More »

What Our Energy Future Be? A Few Ideas

Access to energy has long been taken for granted as society became quite used to relatively stable prices and the ample abundance of energy. Meanwhile, the business side of energy was relegated to industry insiders, policymakers, and market traders dealing with the matter as a profession. However, the perceptible rise in prices and the fear of supply shortages have pushed energy considerations to the forefront of societal consciousness.

This crunch...

Read More »

Read More »

Is the Fed Trying to Bail Out the World? Sure Looks Like It

Like the arsonist who then heroically fights the fire he set, the Fed is increasing its efforts to bail out banks both at home and abroad. This does not end well.

Original Article: "Is the Fed Trying to Bail Out the World? Sure Looks Like It"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

SVB’s Failure Is Not an Excuse for More Regulation

Recently, Silicon Valley Bank (SVB), a bank that was heavily involved in cryptocurrency, collapsed. Naturally, Democrats want to exploit the situation to rush through new regulations. But that will only make the problem worse.

The failure of Silicon Valley Bank, a forty-year old, $200 billion bank, has caused many to worry about the country’s economic stability. Among the concerned is Senator Elizabeth Warren, who wants to reinstate some of the...

Read More »

Read More »

Cancel Culture: The Digital Panopticon

The panopticon is a hypothetical surveillance and control system first imagined by philosopher Jeremy Bentham in the eighteenth century. It’s envisioned as a tool to control the behavior of a large number of people with as little effort as possible. Here is one description: “The panopticon is a disciplinary concept brought to life in the form of a central observation tower placed within a circle of prison cells. From the tower, a guard can see...

Read More »

Read More »

RBA Holds Fire, Sterling Reaches Best Level since last June, and the Dollar Struggles to Find Much Traction

Overview: The jump in oil prices is the newest shock and the May

WTI contract is holding above $80 a barrel as it consolidates yesterday's

surge. A week ago, it settled near $73.20. Australian and New Zealand bond

yields moved lower, partly in catch-up and partly after the RBA stood pat. South

Korean bonds also rallied on the back of softer inflation (4.2% vs. 4.8%). But

European and US benchmark yields is 2-4 bp higher. The large equity markets...

Read More »

Read More »

UBS Completes Cross-Border Intraday Trade On Broadridge’s Blockchain-Powered Platform

Global financial technology company Broadridge Financial Solutions announced that UBS and a global Asian bank have successfully executed a cross-border intraday repo transaction on its blockchain-enabled platform.

This intraday trade marks the launch of the next phase in the rollout of Broadridge’s Distributed Ledger Repo (DLR) platform.

This platform provides a utility where market participants can agree, execute, and settle repo transactions,...

Read More »

Read More »

Why Most of the World Isn’t on Board with the NATO-Russia War

Many governments support continuing the Ukraine war, but ordinary people in Europe, America, and the developing world fear the war will bring economic disaster.

Original Article: "Why Most of the World Isn't on Board with the NATO-Russia War"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Peasants, Rise Up! The Croquants of the 17th Century

Seventeenth-century French kings and their minions did not impose an accelerating burden of absolutism without provoking grave, deep, and continuing opposition. Indeed, there were repeated rebellions by groups of peasants and nobles in France from the 1630s to the 1670s. Generally, the focus of discontent and uprising was rising taxes, as well as the losses of rights and privileges. There were also similar rebellions in Spain in mid-century, and in...

Read More »

Read More »

Canada’s Impotent Justice System Is the Product of Dysfunctional Canadian Democracy

Conservatives have been pressuring “the Liberal government to address what they term a violent crime wave, citing the killings of five police officers in five months and a surge of violence in cities across Canada.” Conservative leader Pierre Poilievre said that violent crime is up 32 percent, gang killings are up 92 percent, and “Police tell us that often they have to arrest the same people multiple times in the very same day because they are...

Read More »

Read More »

Bipartisanship Is Not a Substitute for Voluntary Exchange

Politicians tout "bipartisanship"—that often just means one's pocket will be picked even more cleanly.

Original Article: "Bipartisanship Is Not a Substitute for Voluntary Exchange"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Would Stress Tests Have Prevented the Failure of SVB? Probably Not

“This is all about regulation and the fact that at some point in time there was great advocacy for making sure that the regional banks and the smaller banks didn't have to comply with some of the rules that perhaps would not have allowed them to get into this situation because there would've been stress testing and more oversight and more watching of what was going on.”

~ Rep. Maxine Waters (D), Financial Services Committee, March 15, 2023

As fate...

Read More »

Read More »

OPEC+ Surprises while Manufacturing Remains Challenged

Overview: News of OPEC+ unexpected output cuts saw May WTI gap

sharply higher and helped lift bond yields. May WTI settled near three-week

highs before the weekend near $75.65 and opened today near $80. It reached

almost $81.70 before stabilizing and is straddling the $80 area before the

North American session. The high for the year was set in the second half of

January around $83. Benchmark 10-year yields are up 2-5 bp points. The 10-year

US...

Read More »

Read More »