Monthly Archive: April 2023

Chapter 7: Economic Calculation

Part II: Market, Chapter 7: Economic Calculation

How to Think about the Economy: A Primer. Narrated by John Quattrucci.

Read More »

Read More »

How to Think about the Economy: A Primer Audiobook

How to Think about the Economy was written to accomplish something big: economic literacy. It is intentionally kept very short to be inviting rather than intimidating. You will gain a life-changing understanding of how the economy works in practically no time.

Narrated by John Quattrucci.

Download the complete audiobook (12 MP3 files) in one ZIP file here. This audiobook is also available on Soundcloud and via RSS.

Purchase the Audiobook on...

Read More »

Read More »

Chapter 1: What Economics Is

Part I: Economics, Chapter 1: What Economics Is

How to Think about the Economy: A Primer. Narrated by John Quattrucci.

Read More »

Read More »

Chapter 5: Production and Entrepreneurship

Part II: Market, Chapter 5: Production and Entrepreneurship

How to Think about the Economy: A Primer. Narrated by John Quattrucci.

Read More »

Read More »

Chapter 4: A Process, Not a Factory

Part II: Market, Chapter 4: A Process, Not a Factory

How to Think about the Economy: A Primer. Narrated by John Quattrucci.

Read More »

Read More »

Conclusion: Action and Interaction

Conclusion: Action and Interaction, How to Think about the Economy: A Primer.

Narrated by John Quattrucci.

Read More »

Read More »

Chapter 8: Monetary Intervention

Part III: Intervention, Chapter 8: Monetary Intervention

How to Think about the Economy: A Primer. Narrated by John Quattrucci.

Read More »

Read More »

Chapter 6: Value, Money, and Price

Part II: Market, Chapter 6: Value, Money, and Price

How to Think about the Economy: A Primer. Narrated by John Quattrucci.

Read More »

Read More »

Chapter 9: Regulatory Intervention

Part III: Intervention, Chapter 9: Regulatory Intervention

How to Think about the Economy: A Primer. Narrated by John Quattrucci.

Read More »

Read More »

Invading Mexico in the Name of the Drug War Is a Really Bad Idea

Following the violent attack on Americans in the Mexican border city of Matamoros in early March, South Carolina Republican senator Lindsey Graham stated that he was prepared to get tough and introduce legislation to set the stage for US military intervention in Mexico. The move would be a significant escalation in the long-running war on drugs that has been raging under the auspices of the United States for many decades to the dismay of many Latin...

Read More »

Read More »

Credit Suisse and the War Against Swiss Culture

I hope you will enjoy my latest interview with Maneco64.

[embedded content]

Claudio Grass, Hünenberg See, Switzerland

This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for my articles by clicking here

Read More »

Read More »

The Great Reset: Mises in Birmingham

Students apply for an admission scholarship here.

In recent years, Americans have suffered from the horrors of covid tyranny, government-directed corporate censorship, and now our current banking crisis. The global elite have never been more obvious in their intentions for the greater control over society. Their aim is further consolidation of power and wealth into the hands of radical ideologues and to transform almost every aspect of human...

Read More »

Read More »

How Australia and New Zealand Helped Provoke and Escalate the First World War

Every year on April 25, Anzac Day is observed in Australia and New Zealand. It originally commemorated Australians and New Zealanders who served and died during the First World War. It has since become a day of remembrance for all Australians and New Zealanders who have served and died in military conflicts.

One can understand the desire to mourn the dead. However, the loyalist nature of the commemorations—military and government figures are...

Read More »

Read More »

The Extended Holiday Makes for Subdued Price Action

Overview: The holiday continues. In the Asia Pacific

region, Hong Kong, Australia, and New Zealand, and the Philippines markets were

closed. The regional bourses advanced but China. European markets remain

closed. US equity futures are narrowly mixed. The 10-year US Treasury yield is

off nearly three basis points to about 3.36%. The dollar is trading quietly

mostly within ranges seen before the weekend. It is slightly softer against

most of the...

Read More »

Read More »

Jeff’s Farewell To The Human Action Podcast

Jeff and Bob review the history and impact of The Human Action Podcast—formerly Mises Weekends—and discuss where the podcast is headed.

Get Jeff's new book A Strange Liberty: Politics Drops Its Pretenses: Mises.org/Strange

[embedded content]

Read More »

Read More »

US and Chinese Inflation Highlight the Week Ahead, While the Bank of Canada Stands Pat

Bank

shares rose in Japan and Europe for the second consecutive week, but the KBW US

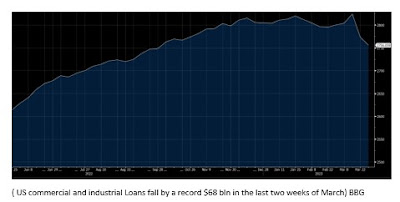

bank index fell nearly 2% after increasing 4.6% in the last week of March. Emergency borrowing from the Fed remains elevated ($149 bln vs. $153 bln). Bank lending has fallen sharply (~$105 bln) in the two weeks through March 29. This appears to be a record two-week decline. Commercial and industrial loans had fallen a little in the first two months of the year...

Read More »

Read More »

The Gold Family

This episode explores precious metals. Gold (Au) is the main precious metal, followed by Silver (Ag), Platinum (Pt), and Palladium (Pd). These are distinct from valuable industrial metals such as copper (which served as money historically), nickel, and zinc, which have served as token coins in modern times. There are many different ways and forms you can own precious metals.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Read More »

Read More »

Were Recent Bank Failures the Result of Lax Regulation? In a Word, No

With the recent collapse of Silicon Valley Bank and Signature Bank, financial markets all around the world are on edge. Despite promises from the Federal Reserve that a “soft landing” of the economy is on the way, all signs point to an imminent “crash landing”! While the full consequences of these bank failures are yet to fully play out, a prized and popular scapegoat has already been trotted out to explain the current crisis: deregulation of...

Read More »

Read More »