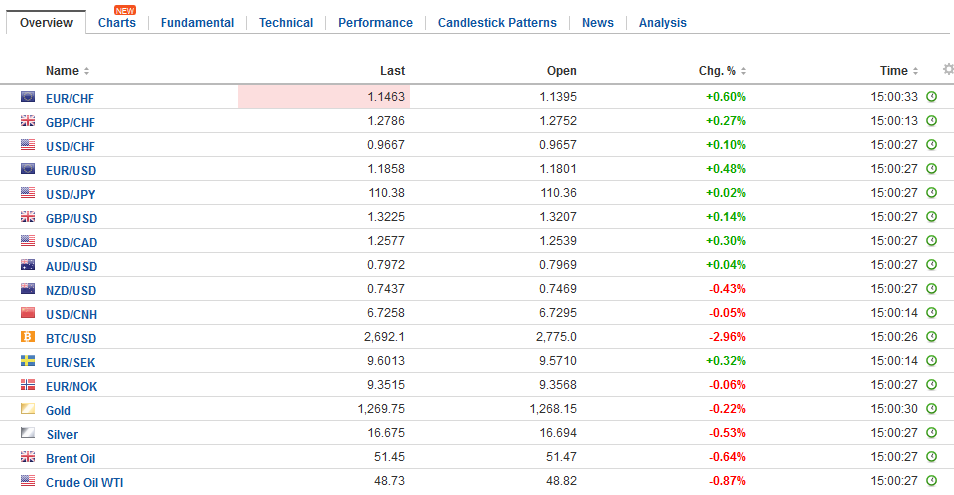

Swiss FrancThe Euro has risen by 0.68% to 1.472CHF. |

EUR/CHF and USD/CHF, August 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX TrendsThe euro’s strength is surely partly a reflection of US dollar weakness, but it is also a reflection of the improved sentiment among investors. The initial dollar losses at the start of the year was largely a correction that is common after a Fed hike. This is more or less what happened at the start of 2016 as well, following the Fed hike in December 2015. However, the correction morphed into something more profound beginning in late April as it became clear that the National Front was going to be defeated in France. We had suggested that there was not populist-nationalist wave sweeping across the world, though that was the consensus narrative. Instead, we argued that the center-right party in the two-party systems in the UK and US adopted some of the rhetoric and policies of the populist-nationalists, but that the multi-party systems in Europe served to dilute the same forces. The center-right in Europe ran away from the populist-nationalists, even if appropriating some of the anti-immigration rhetoric. Meanwhile, the economic outlook of the US was questioned. The prospect for supply-side deregulation, tax reform, and infrastructure spending, promised by the new US President, whose party enjoyed a majority in Congress has dimmed, as the legislative process has become stymied not so much by the opposition Democrats, but by the inability of the Republican Party to harness its majority. The strategy of using its majority to ride roughshod over the minority is at the core of both the health care efforts and tax reform. |

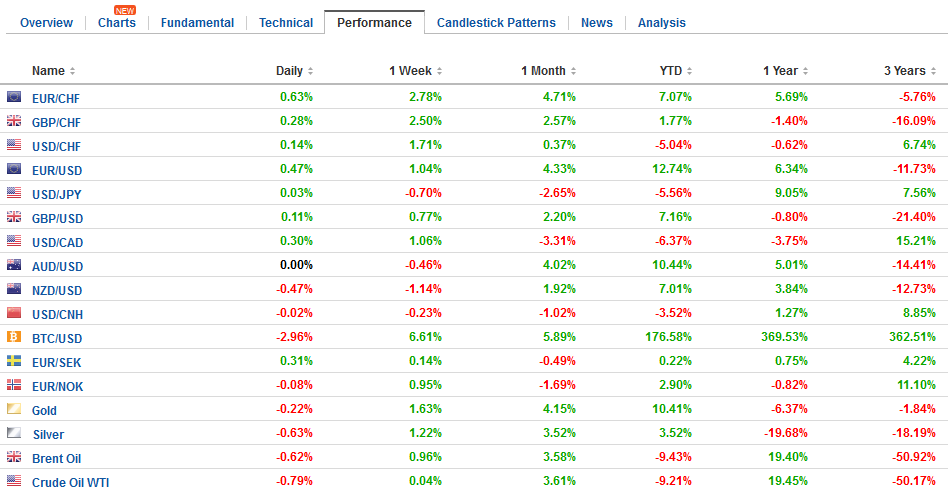

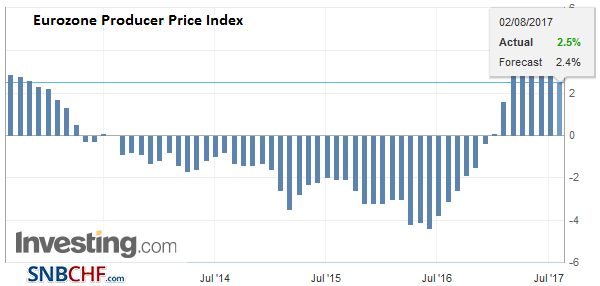

FX Daily Rates, August 02 |

| The New Zealand dollar is weakest of the major currencies today. It is off 0.6% following news of a weaker than expected employment report. Although the unemployment rate dipped to 4.8% from 4.9%, the participation rate fell to 70.0% from 70.6%, and the employment contracted 0.2% in Q2, while the median Bloomberg forecast was for a 0.7% increase.

The dollar dipped below JPY110.00 briefly in North America yesterday but was already recovering late in the session. It finished NY near JPY110.35. Asia bid it up to almost JPY111.00. Europe has seen consolidation but provided JPY110.60 holds; it can make another run at the JPY111.35 high seen before the weekend. Details of the long-rumored cabinet reshuffle have been apparently leaked ahead of the official announcement expected in Tokyo on Thursday. Essentially, it is a reshuffle in the literal meaning of the word, with senior officials taking new roles rather the introduction of new faces. For investors, indications that Trade Minister Seko and Finance Minister Aso will retain their posts speaks to continuity. On the other hand, Foreign Minister Kishida will be given a senior party post (LDP policy chief), from which, people will speculate, could be a challenger to Abe next year. Motegi, responsible for supervising the clean-up of the Fukushima Dai-ichi nuclear reactor during would take over as Economy Minister from Ishihara. The euro has reached a new two-year high near $1.1870. Initial support is seen around $1.1780, which corresponds to last week’s high and near yesterday’s low. The change recently has been that after new highs are made, a bout of profit-taking is seen, which seemingly reflects the nervousness of the long euro longs. This pattern seems to be unfolding again ahead of the beginning of the US session. |

FX Performance, August 02 |

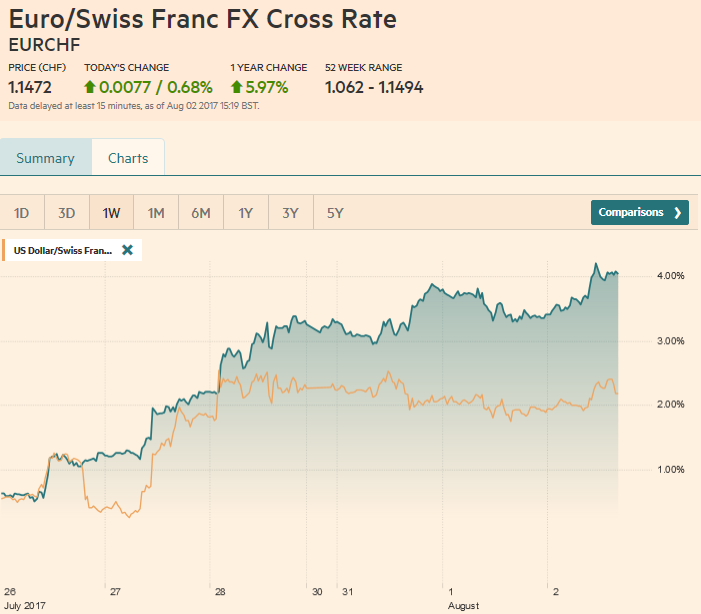

EurozoneAt the same time, investors seem to put much stock in the forward guidance of some central banks, including the ECB, which have signaled a less accommodative stance is going forward. Yet, they give little weight to the Federal Reserve, which has indicated it will most likely begin shrinking its balance sheet and continuing the gradual normalization of monetary policy. The ECB’s balance sheet will likely be expanding for nearly another year (mid-2018), and its deposit rate is likely to still be negative in late 2018. |

Eurozone Producer Price Index (PPI) YoY, July 2017(see more posts on Eurozone Producer Price Index, ) Source: Investing.com - Click to enlarge |

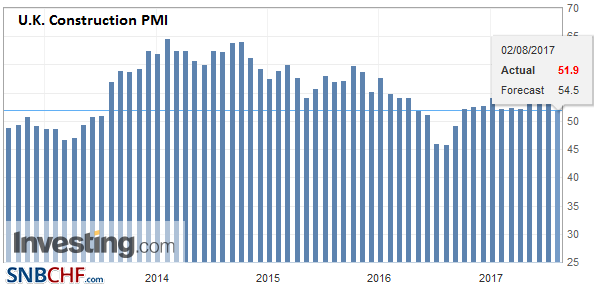

United KingdomWhile the UK reported a better than expected manufacturing PMI yesterday, the construction PMI disappointed today. It fell to 51.9 in July from 54.8 in June. It is the lowest since last August. It is a relatively small part of the UK economy, and tomorrow’s service sector reading is considerably more important. The Bank of England meets tomorrow, and it will release its Quarterly Inflation Report along side the minutes of its meeting at the conclusion. While rates on hold, the question is how close of a decision was it. Sterling is up about 0.3% in late morning turnover in London. It held yesterday’s low near $1.3190 and tested the $1.3250 area again, which is nearly a cent above last week’s high. The next target is $1.3430-$1.3500, which houses several important technical objectives, including the 50% retracement of the post-referendum losses. The euro is flat near GBP0.8950. |

U.K. Construction PMI, July 2017(see more posts on U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

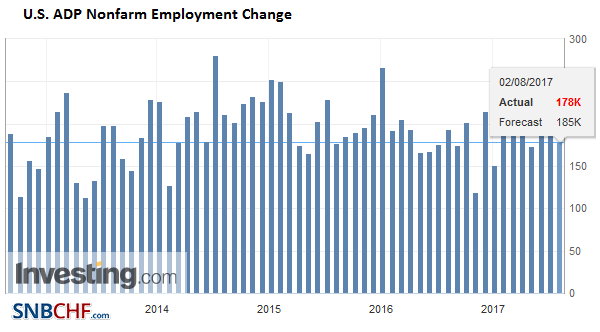

United StatesIn the US, the labor market comes into focus. Today is the ADP estimate, which is expected to show a jump to 190k from 158k. Its ability to track the month-to-month changes in the BLS estimate is weak even if it catches the overall patterns. Tomorrow the US reports the weekly jobless claims, and then Friday is the non-farm payroll report itself. The Fed’s challenge is not so much the real economy as it is the softer price pressures. After falling from February through May, the June core CPI and PCE deflator stabilized. The Fed’s Mester and Williams speak today. |

U.S. ADP Nonfarm Employment Change, July 2017(see more posts on U.S. ADP Nonfarm Employment Change, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Eurozone Producer Price Index,newslettersent,NZD,U.K. Construction PMI,U.S. ADP Nonfarm Employment Change,USD/CHF