Hans Werner Sinn has formulated his critique with Piketty. Sinn says that

The French economist Thomas Piketty claims that we are in a long-lasting period during which the return on capital r is bigger than economic growth g, a period of rising inequalities just like during the French Belle Epoque or the American Gilded Age from 1870 to 1914. With his new “world formula” r > g, Piketty has become a sort of “economic rock star”.

In the FAZ, Hans Werner Sinn has presented his critique of Piketty. He says that Piketty used a similar theory as the one used by Karl Marx, the law of the rising organic composition of capital.

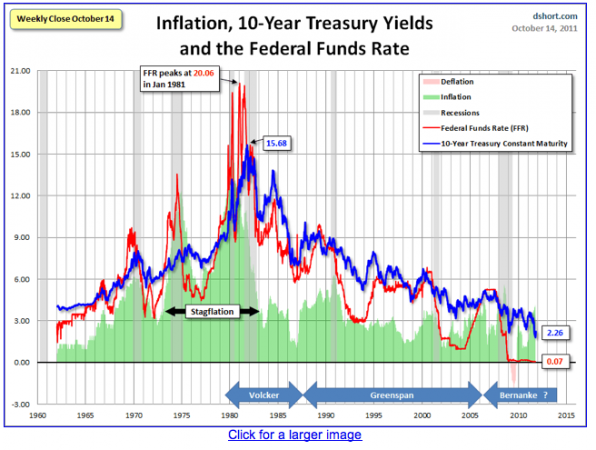

According to Sinn, it is clearly true that the yield on investments or interest i is often higher than economic growth g. We give an example: the 10 year treasury yields are in most periods higher than the inflation rate, while the inflation rate was in most periods about as high as Piketty’s nominal economic growth g. Investors seek a compensation for spending later and not today. The result: i > g

According to Sinn, Thomas Piketty states that the growth of wealth r increases with the interest rate i. Essentially Piketty implies that r = i.

Sinn however refutes that wealth grows with the speed i, in which r is equal to i. People save only a part of what they obtain through interest payments and capital incomes. Hence

The background

Hans Werner Sinn has formulated his critique with Piketty. Sinn says that: r ≠ i > g, hence Interest rates i are usually higher than economic growth g, but r is not the same as i. Hence r can be higher or lower than g. - Click to enlarge

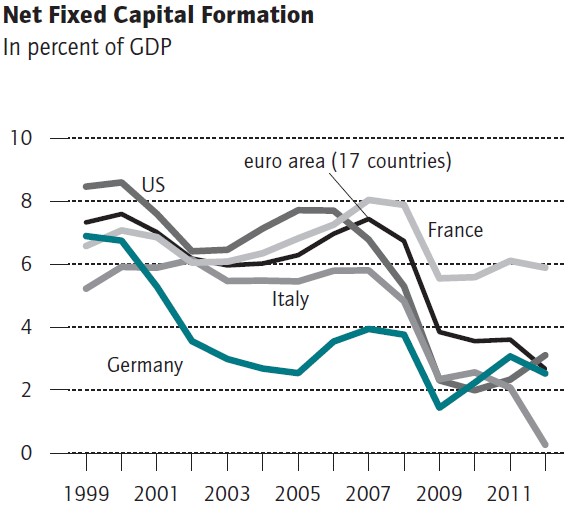

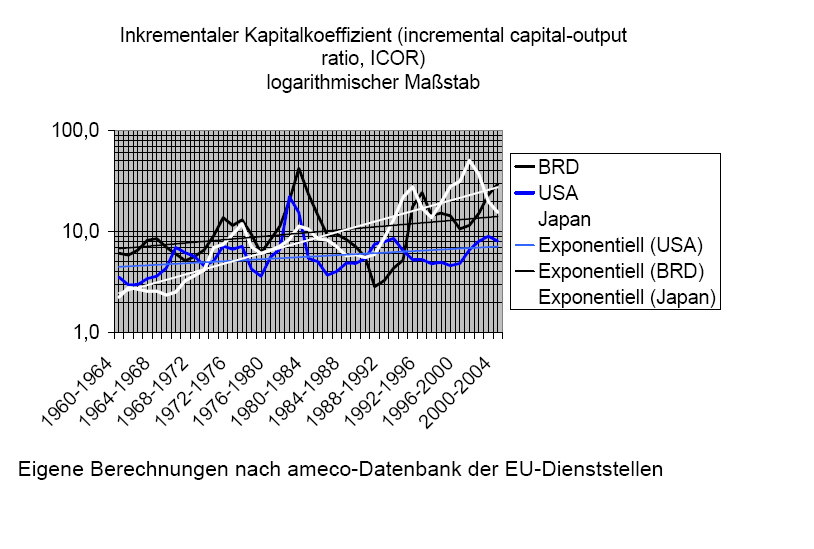

In the following we will give some background to understand Sinn’s arguments. The “capital coefficient” is the ratio between the capital stock and BIP. This ratio changes each year with annual investments (or Net Fixed Capital Formation, NFCF) to annual GDP increase. This ratio is also called incremental capital-output ratio, ICOR.

![]()

The net fixed capital formation (NFCF) is obtained after the replacement of older investments.

According to Sinn, the capital coefficient and its yearly change, the ICOR, are exactly the numbers Piketty speaks of. Developing countries achieve a higher capital coefficient with time, the graph to the right shows a quickly improving ICOR for Japan between 1960 and 1995, while it was constant or falling for the United States. With rising availability of capital and investments, productivity improves. When an economy is fully developed and the most advanced technology is used, then the capital coefficient is relatively big. “Buying growth” with capital and new investments becomes increasingly difficult.

Hans Werner Sinn has formulated his critique with Piketty. Sinn says that: r ≠ i > g, hence Interest rates i are usually higher than economic growth g, but r is not the same as i. Hence r can be higher or lower than g. - Click to enlarge

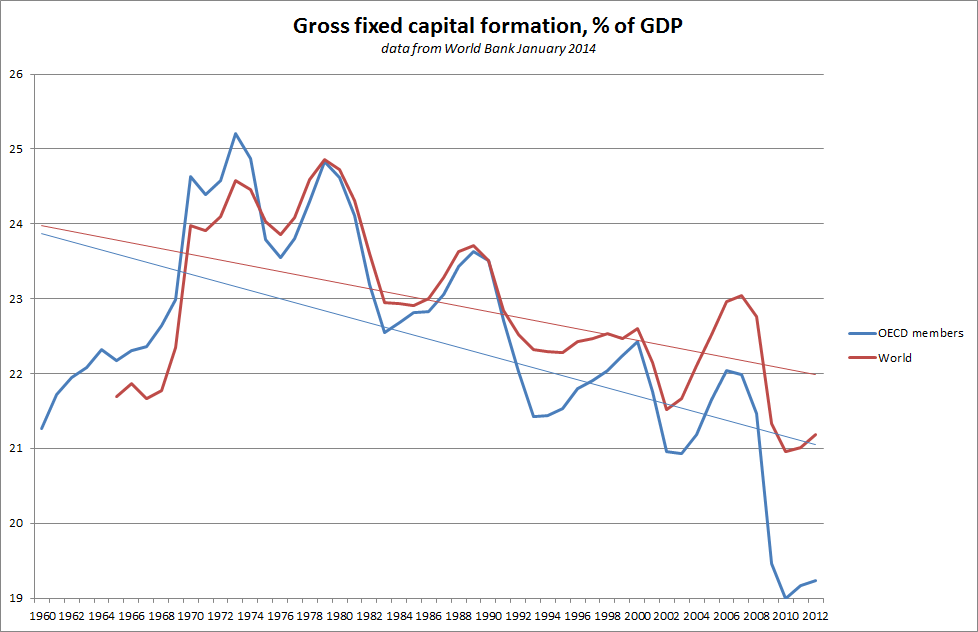

Between 1945 and 1970 the GFCF/GDP growth ratio augmented to 25%, it was somehow a Gilded Age. This period exhibited rising inequalities between developed economies and the 3rd world, but less between classes in one economy. Then in the 1970s rising wages and consumption started to drive GDP more and more and investments did less. With the close relationship between wages and inflation, and due to high interest rates, the ICOR fell rapidly in the 1970s and 1980s. Till today the share of GFCF in the GDP growth has fallen from 25% to 21.3%, and in the more advanced OECD countries even from 25 to 19.3%.

In Europe and the U.S. the net ICOR, namely the NFCF to GDP ratio has become very small. In particular, German companies preferred to use their cash to invest abroad instead of in Germany. Germany NFCF was fallen to 2%. NFCF in the Gilded Age between 1870 and 1900 was 15% and GFCF around 23% according to Piketty’s tables adopted from Simon Kutznets.

The NCFC for China today is around 35%. It becomes clear that there is no issue in monetary transmission in global finance, but one in European (and possibly also in US American) monetary transmission. The reason is a simple competitiveness issue: investments and money are, still, more useful in many Emerging Markets.

Coming back to Sinn’s arguments

Sinn states, that according to the capital coefficient theory by the German economist Ernst Helmstädter, the interest rate i in dependence of the savings rate s tends to be at the level where r = g , hence

.However, the time frame when this is achieved may be decades; temporarily r may be higher than g.

Immigration countries like the United States are able to raise the quantity of labor and thereby lower the ICOR. Consequently the wealthy have become richer and a rising supply of labor via immigration helps to keep salary increases small. We see that Germany with the integration of East German work force, but also Switzerland followed that tendency.

Sinn sees remediation for inequality issues in facilitating ways to climb up the economic ladder or – similar to Piketty – introduce progressive taxation. However, in Europe progressive taxation would be already excessive. Finally it remains that Piketty serves a certain public desire to have political recommendations with an economic “world formula”. But that formula does not imply what Piketty claims it does.

Which ICOR is Sinn speaking of?

Sinn identified with Piketty’s r the capital coefficient and the ICOR. The question remains if he speaks of the net ICOR of 2% in the German case or of the 35% of the Chinese case. Our view is that German entrepreneurs and capitalists were able to profit on low salaries and investments in China and other emerging markets in the past.

How can middle-income earners increase their incomes when r > g?

Spending in these countries is rising now, enabled by rising wages, by nominal yearly wage increases of 5% and more. When you look at the weak Chinese stock market and rising bankrupties, you will understand that in China, the capitalists are getting squized now:

g > r

Consequently at a global scale, Piketty is wrong, not in the long-run as Sinn claims: Globally, the middle-income earners have increased their incomes considerably, as visible here.

True that Gini coefficients may have increased in many countries, but was this sufficient to move r more upwards more quickly than g?

Or was it just an isolated problem of the 30 or 40% of global GDP (in PPP) produced in the United States and most European countries?

See more for