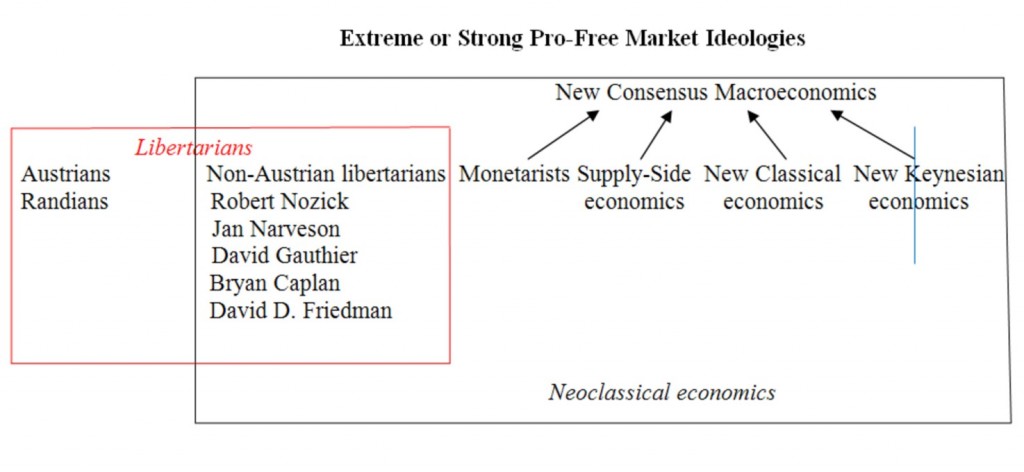

Libertarian Theories

An overview:

Austrians

The Austrian school of economics is on the opposite side of the Post Keynesians, even if many things seems to be in common.

The differences between Austrians and neoclassical economists are the following (partially source wikipedia).

- Methodology is where Austrians differ most significantly from other schools of economic thought. Mainstream schools, such as Keynesians and Monetarists, that adopt empirical, mathematical, and statistical methods. Austrians focus on deduction to construct and test theories, the so-called “Praxeology”. Austrians reject empirical statistical methods, natural experiments, and constructed experiments as tools applicable to economicsarguing that while it is appropriate in the natural sciences where factors can be isolated in laboratory conditions, the actions of humans are too complex for such a treatment because humans are not passive and non-adaptive subjects. They reject the constancy principle, that humans will react always similarly go given stimuli, the basis for modern empirical macro-economics (on our site see short run, medium run). Therefore they advocate an axiom-based approach and laissez-faire.

- The Austrian Business Cycle Theory, the also called “Boom & Bust Theory” reject the central bank’s artificially low interest rate, because it allows projects to be undertaken that normally would not. Low rates and money printing, like advocated by Post Keynesians, artificially inflates asset prices, that will end up boom-bust cycles.The following video explains the wrong incentive Alan Greenspan’s cheap money provided:

- Austrians generally argue that inherently damaging and ineffective central bank policies, including unsustainable expansion of bank credit through fractional reserve banking, are the predominant cause of most business cycles, as they tend to set artificial interest rates too low for too long, resulting in excessive credit creation, speculative “bubbles“, and artificially low savings.

- Austrians reject the notion that interest rates are determined by liquidity preference.Instead the Austrian economist Rothbard argued that interest rates are instead determined by time preference.

- Inflation is for Austrians always monetary inflation, i.e. an increase of the money supply by the central banks and not price inflation, a rise of the Consumer Price Indices (CPI). Still Austrians believe that monetary inflation causes sooner or later price inflation (similarly like the neoclassical Hick’s IS-LM model). The maybe most important difference between today’s central bankers

(including the SNB) and Austrian economists is that Austrians reject

inflation-targeting and insist that deflation is good because it is a sign of productivity and a high savings rate (the later two are consistent with main-stream economics in the long-run).

Mainstream 16.10.1929: “Stocks have reached what looks like a permanently high plateau.” – Irving Fisher, celebrated neoclassical economist

Austrians 02.1929: “The boom will collapse within a few months.” – Friedrich von Hayek, Austrian Institute of Economic Research

Mainstream 20.10.2005: “House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals, including robust growth in jobs and incomes, low mortgage rates, steady rates of household formation, and factors that limit the expansion of housing supply in some areas.” – Ben Shalom Bernanke, future FED chairman

Austrians 06.04.2004: “Higher price inflation should not have been a surprise given that the Fed has increased the money supply by 25% during the period 2001–2003. (…) Given the government’s encouragement of lax lending practices, home prices could crash, bankruptcies would increase, and financial companies, including the government-sponsored mortgage companies, might require another taxpayer bailout.” – Mark Thornton, Mises Institute.