FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude of the regional losses. At one point the CSI 300 of the large Chinese mainland shares was off more than 6% before closing off 4.3% (and 10% for the week). The H-shares index was down 3.9% and 12% for the week.

|

|

|

|

|

|

Great Graphic: FX Vol Elevated, but Still Modest

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

With the substantial swings in the volatility of equities that have captured the imagination of journalists and punished investors who bought financial derivatives that profited from the low vol environment, we thought it would be helped to look at the implied volatility of the leading currencies against the US dollar. The Great Graphic looks at the three-month implied volatility for the euro (white line), the yen (yellow line), and sterling (green line) over the past year.

|

|

|

|

|

|

Swiss real estate risk falls two quarters in a row, says UBS

|

|

Author: Le News

Categories: Property, Swiss Markets and News

|

|

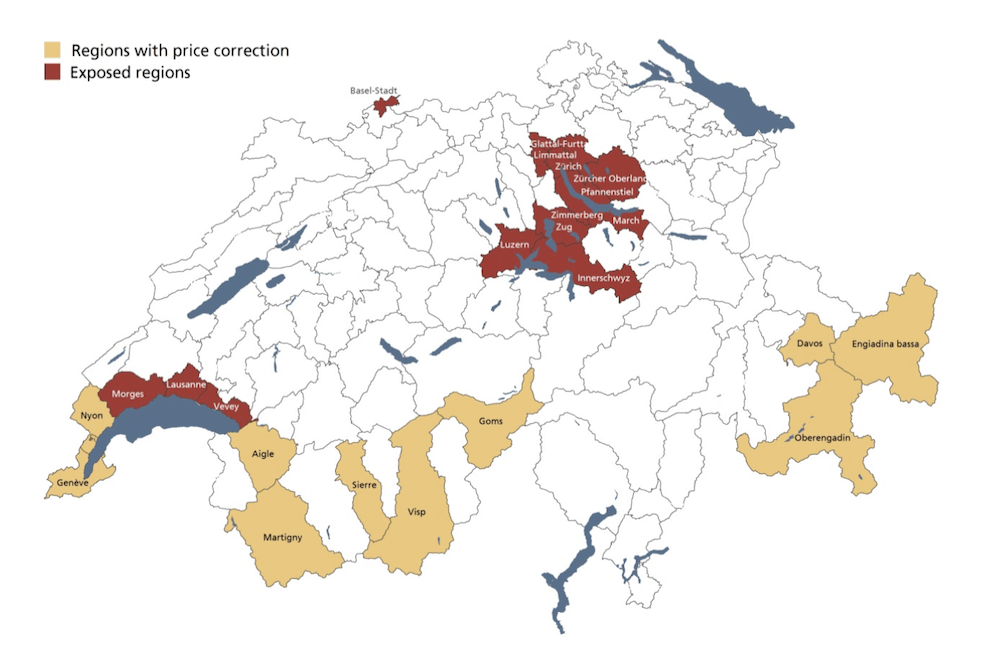

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction.

|

|

|

|

|

|

Swisscom reports job cuts, data breach

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

The Swiss telecom company, whose majority shareholder is the government, announced plans to reduce up to 700 jobs by the end of the year as part of cost-cutting measures. It also revealed a data breach of client information. “By the end of 2018, Swisscom expects to have a headcount of around 17,000 FTEs in Switzerland, around 700 fewer than at the end of 2017,” said a company statementexternal link released on Wednesday.

|

|

|

|

|

|

Brexit Risks Increase – London Property Market and Pound Vulnerable

|

|

Author: Jan Skoyles

Categories: GoldCore

|

|

Brexit Risks Increases – London Property Market and Pound Vulnerable. Brexit uncertainty deepens as UK government in disarray. BOE warns of earlier and larger rate hikes for Brexit-hit UK. UK property prices fall second month in row, London property under pressure. No deal Brexit estimated to cost UK £80bn according to government analysis. Transition period causing major uncertainty for UK and pound. Pound expected to fall as Brexit fears remain into 2018.

|

|

|

|

Global Asset Allocation Update:

|

|

Author: Joseph Y. Calhoun

Categories: The United States

|

|

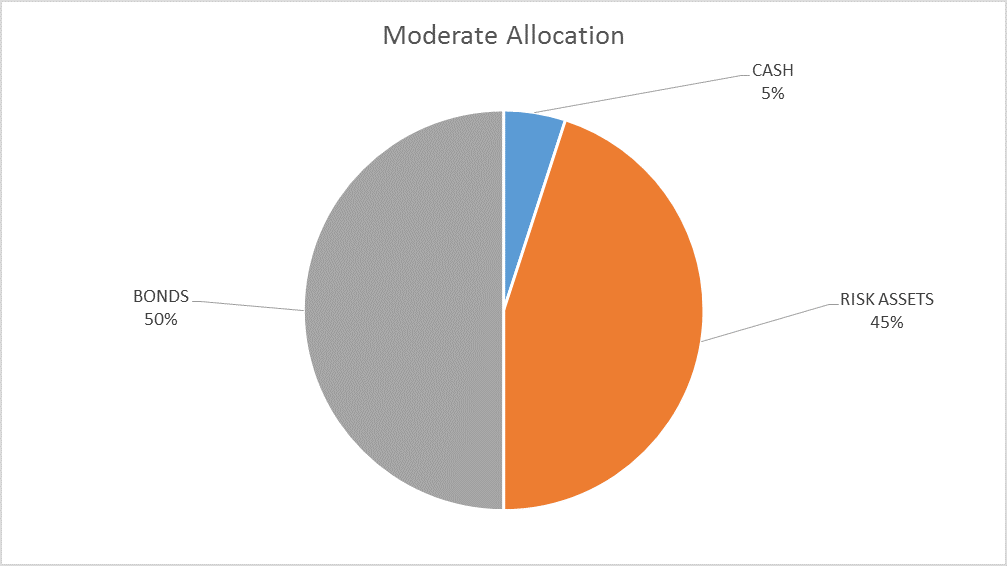

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in correction territory, down 10% from the recent highs.

|

|

|

|

|

|

|

|