FX Daily, December 11: Dollar Mixed to Start the Week, While Equities Firm

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

The US dollar is narrowly mixed in relatively quiet activity. Year-end adjustment is well underway, and the news stream is light to start the week that sees more than a dozen central bank meetings. There is little doubt in the market that the Federal Reserve will hike rates for the third time this year at mid-week.

|

|

|

|

|

|

FX Weekly Preview: FOMC and ECB Highlight Central Banks' Last Meetings of the Year

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

No fewer than thirteen central banks meet in the week ahead. The UK and the US report the latest inflation figures, and the US and eurozone report industrial production. The eurozone sees the flash PMI for December, and the Japan's latest Tankan business survey will be released.

|

|

|

|

|

|

EU tax grey list splits Federal Council

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

It’s “hardly a tragedy” that the European Union has placed Switzerland on a grey list of non-cooperative jurisdictions for tax purposes, says Finance Minister Ueli Maurer. Economics Minister Johann Schneider-Ammann, on the other hand, says he is “irritated” by the move.

|

|

|

|

|

|

What Is Money? (Yes, We're Talking About Bitcoin)

|

|

Author: Charles Hugh Smith

Categories: Gold and Bitcoin

|

|

What is money? We all assume we know, because money is a commonplace feature of everyday life. Money is what we earn and exchange for goods and services. Everyone thinks the money they’re familiar with is the only possible system of money—until they run across an entirely different system of money.

|

|

|

|

|

|

Emerging Markets: Preview of the Week Ahead

|

|

Author: Win Thin

Categories: Emerging Markets

|

|

EM FX closed on a firm note, though most currencies were down for the entire week. TRY and ZAR outperformed, but we do not think that will be sustained. FOMC meeting this week will provide some event risk for EM.

|

|

|

|

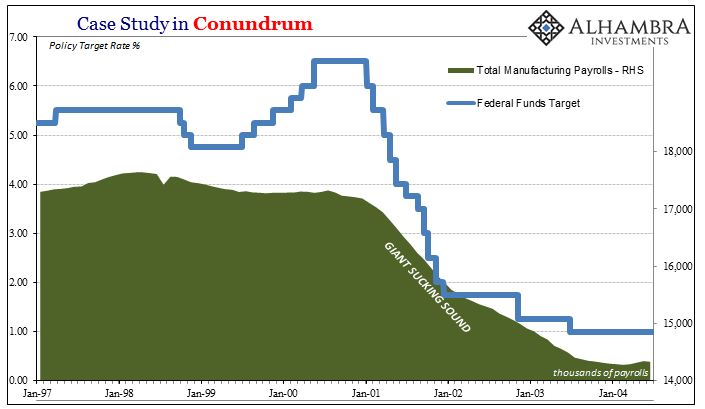

Giant Sucking Sound Sucks (Far) More Than US Industry Now

|

|

Author: Jeffrey P. Snider

Categories: The United States

|

|

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really are buying at a healthy pace, just not with the same eagerness from China and the rest anymore.

|

|

|

|

|

|

|

|