Emerging Markets: What Changed

|

|

Author: Win Thin

Categories: Emerging Markets

|

|

China State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. Korean officials warned that it will take stern steps to prevent one-sided currency moves. Bulgaria is talking “intensively” with the ECB and other EU representatives about entering the Exchange Rate Mechanism by mid-year.

|

|

|

|

|

|

Swiss companies leaking executives abroad

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

Multinational companies based in Switzerland are increasingly moving experienced executives abroad to run production sites in lower-cost countries, according to a jobs placement company. The trend has been blamed on regulatory uncertainty in the Swiss marketplace.

|

|

|

|

|

|

Great Graphic: Euro Monthly

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

The euro peaked in July 2008 near $1.6040. It was a record. The euro has trended choppily lower through the end of 2016 as this Great Graphic, created on Bloomberg, illustrates. We drew in the downtrend line on the month bar chart. The trend line comes in a little below $1.27 now and is falling at about a quarter cent a week, and comes in near $1.26 at the end of February.

|

|

|

|

|

|

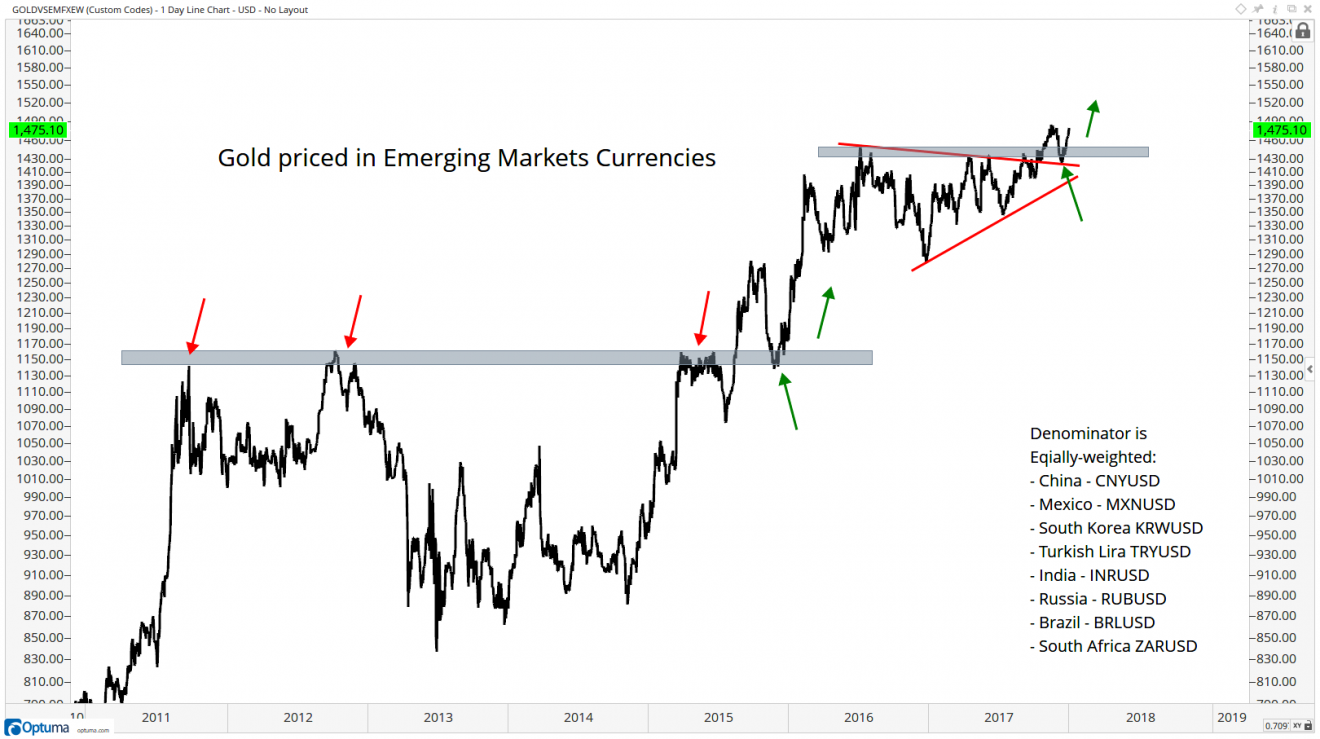

Gold Hits All-Time Highs Priced In Emerging Market Currencies

|

|

Author: Jan Skoyles

Categories: GoldCore

|

|

Gold Hits All-Time Highs Priced In Emerging Market Currencies. Gold at all time in eight major emerging market currencies. A stronger performance than seen when priced in USD, EUR or GBP. As world steps away from US dollar hegemony expect new gold highs in $, € and £. Gold is a hedge against currency debasement and depreciation of fiat currencies.

|

|

|

|

|

|

2018: The Weakest Year in the Presidential Election Cycle Has Begun

|

|

Author: Dimitri Speck

Categories: Debt and the Fallacies of Paper Money

|

|

Our readers are probably aware of the influence the US election cycle has on the stock market. After Donald Trump was elected president, a particularly strong rally in stock prices ensued. Contrary to what many market participants seem to believe, trends in the stock market depend only to a negligible extent on whether a Republican or a Democrat wins the presidency.

|

|

|

|

|

|

|

|