Fed rate unlikely to move much above 2% next year

|

|

Author: Thomas Costerg

Categories: Pictet Macro Analysis, Swiss and European Macro

|

|

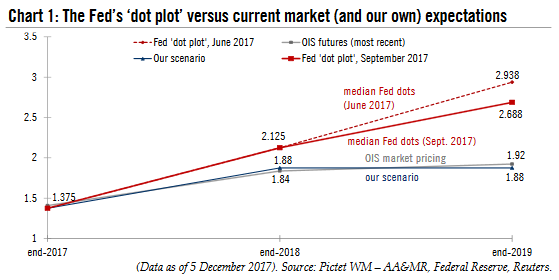

The Federal Reserve is probably looking back at 2017 with satisfaction. After on the rate rise expected on 13 December, it will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by markets. In fact, broader financial conditions have eased this year despite the Fed’s monetary tightening. Corporate bond spreads, for instance, have remained very tight and bond issuance has flourished.

|

|

|

|

|

|

Uber to stop offering budget service in Basel

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

The ride-sharing firm Uber has announced it will abandon its UberPop service in the city of Basel from June 1, 2018, as it is not profitable enough. UberPop has already been discontinued in Zurich and Lausanne. According to the company, the decision was taken due to feedback from its partners, who wanted to earn more money through the more expensive UberX service. Economic success was not possible through its cheapest service UberPop, the company stated.

|

|

|

|

|

|

Bitcoin vs Fiat Currency: Which Fails First?

|

|

Author: Charles Hugh Smith

Categories: Gold and Bitcoin

|

|

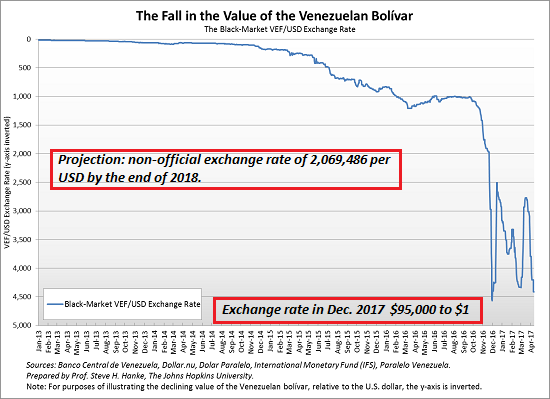

What if bitcoin is a reflection of trust in the future value of fiat currencies? I am struck by the mainstream confidence that bitcoin is a fraud/fad that will soon collapse, while central bank fiat currencies are presumed to be rock-solid and without risk. Those with supreme confidence in fiat currencies might want to look at a chart of Venezuela's fiat currency, which has declined from 10 to the US dollar in 2012 to 5,000 to the USD earlier this year to a current value in December 2017 of between 90,000 and 100,000 to $1.

|

|

|

|

|

|

Chart of the Week: Collateral

|

|

Author: Jeffrey P. Snider

Categories: The United States

|

|

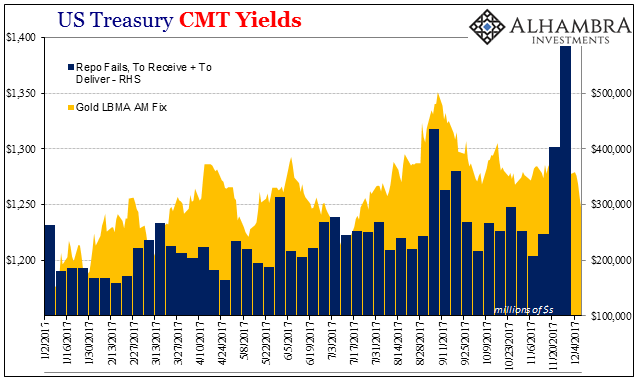

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week.

|

|

|

|

|

|

China Exports and Industrial Production: Revisiting Once More The True Worst Case

|

|

Author: Jeffrey P. Snider

Categories: China

|

|

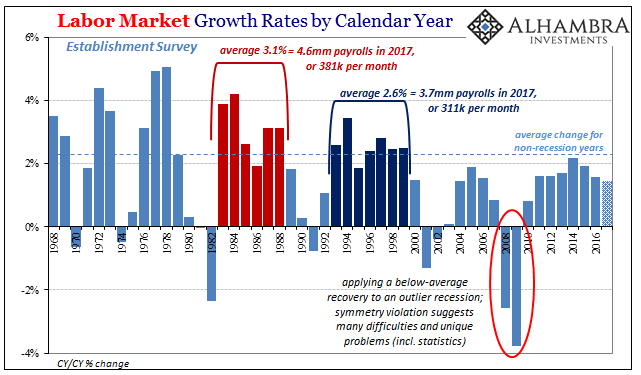

As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s negative it’s bad (though in 2015 lots of negatives were shrugged off as immaterial so as to avoid any acknowledgement of bad) but if it’s positive it can only be good.

|

|

|

|

The Stock Market and the FOMC

|

|

Author: Pater Tenebrarum

Categories: Debt and the Fallacies of Paper Money

|

|

As the final FOMC announcement of the year approaches, we want to briefly return to the topic of how the meeting tends to affect the stock market from a statistical perspective. As long time readers may recall, the typical performance of the stock market in the trading days immediately ahead of FOMC announcements was quite remarkable in recent decades. We are referring to the Seaonax event study of the average (or seasonal) performance across a very large number of events, namely the past 160 monetary policy announcements and the 10 trading days surrounding them. It looks as follows.

|

|

|

|

|

|

|

|