Tag Archive: Japan

From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and...

Read More »

Read More »

FX Daily, May 27: China and Hong Kong Pressures are Having Limited Knock-on Effects

Overview: The S&P 500 gapped higher yesterday, above the recent ceiling and above the 200-day moving average for the first time since early March. The momentum faltered, and it finished below the opening level and near session lows. The spill-over into today's activity has been minor. The heightened tensions weighed on China and Hong Kong markets, but Japan, South Korea, Taiwan, and Indian equity markets rose.

Read More »

Read More »

There Was Never A Need To Translate ‘Weimar’ Into Japanese

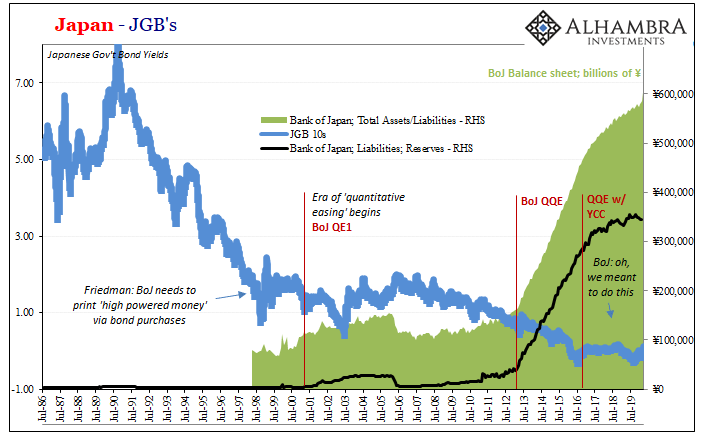

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates.No, stupid, declared Milton Friedman.

Read More »

Read More »

FX Daily, April 6: Glimmer of Hope Lifts Markets

Overview: Reports suggesting that some of the hot spots for the virus contagion appear to be leveling off, and this is helping underpin risk appetites today. The curve seems to be flattening in Italy, Spain, and France. In the US, there are some early signs of leveling off in NY, and now, the number of states with infection rates above 20% is less than 10 from over 40 last week.

Read More »

Read More »

FX Daily, April 2: Optimism on Oil Deal Steadies Risk Appetites…for the Moment

Overview: After US stocks dropped more than 4% yesterday, investor sentiment has improved, apparently sparked by ideas that the pain will force oil producers to find a way to reduce supply. Oil prices have surged, with the May WTI contract rallying around 7%. Asia Pacific equities were mostly higher, with Japan and Australia the notable exceptions.

Read More »

Read More »

FX Daily, March 25: Relief, but…

Overview: Global equities are marching higher. While the Dow Jones Industrials posted its biggest advance since 1933, the US is lagging behind other leading benchmarks. The MSCI Asia Pacific advanced, led by Japan's Nikkei's 8% gain. It was third consecutive gain, during which time the Nikkei has rallied 17%. Europe's Dow Jones Stoxx 600 is up about 3.5% after bouncing 8.4% yesterday.

Read More »

Read More »

What Happens When Central Banks Buy Stocks (ETFs)? Well, We Already Know

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way.

Read More »

Read More »

FX Daily, March 10: Markets Stabilize after Body Blow

Overview: It appears after a few days of miscues, US officials struck the right chord, and the global capital markets seemed to stabilize shortly after the US session ended. President Trump's press conference today is expected to spell out in greater detail relief for households and businesses. Asia Pacific equities rallied, led by a 3% surge in Australia.

Read More »

Read More »

FX Daily, March 06: Panic Deepens, US Employment Data Means Little

The sharp sell-off in US equities and yields yesterday is spurring a mini-meltdown globally today. Many of the Asia Pacific markets, including Japan, Australia, Taiwan, and India, saw more than 2% drops, while most others fell more than 1%. The MSCI Asia Pacific Index snapped the four-day advance had lifted it about 2.8% coming into today.

Read More »

Read More »

Economy: Curved Again

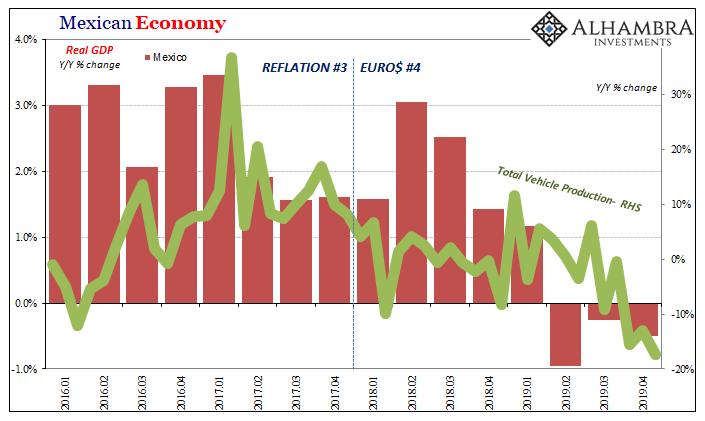

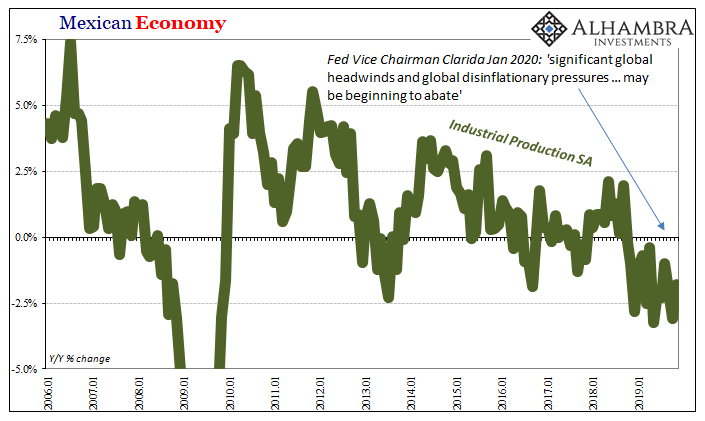

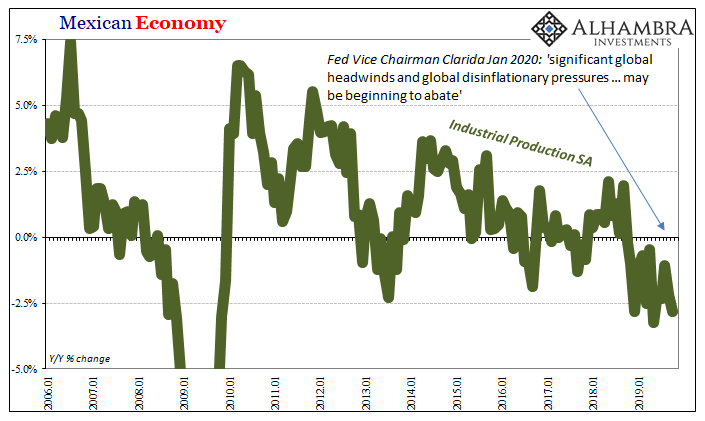

Earlier today, Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) confirmed the country’s economy is in recession. Updating its estimate for Q4 GDP, year-over-year output declined by 0.5% rather than -0.3% as first thought. On a quarterly basis, GDP was down for the second consecutive quarter which mainstream convention treats as a technical recession.

Read More »

Read More »

FX Daily, February 21: Covid-19 Contagion Outside China Keeps Investors on the Defensive

Overview: The spread of Covid-19 outside of China and early signs of the economic consequences again emerged to weigh on investor sentiment. Poor Japanese and Australian preliminary February PMI reports and some trade indications from South Korea saw most Asia Pacific equities sell-off. China was an exception. The small gain (0.3%), lifted the Shanghai Composite 4.2% on the week.

Read More »

Read More »

FX Daily, February 17: Dismal Q4 Japanese GDP Fails to Spur Yen Movement

Overview: It is only a US holiday today, but the global capital markets are subdued. In the Asia-Pacific region, equities traded lower with China and Hong Kong, the main advancers. The MSCI Asia Pacific Index has fallen in only two weeks since the end of last November, and that was during the last two weeks of January. Europe's Dow Jones Stoxx 600 slipped in the previous two sessions but is recouping the losses fully today.

Read More »

Read More »

Two Years And Now It’s Getting Serious

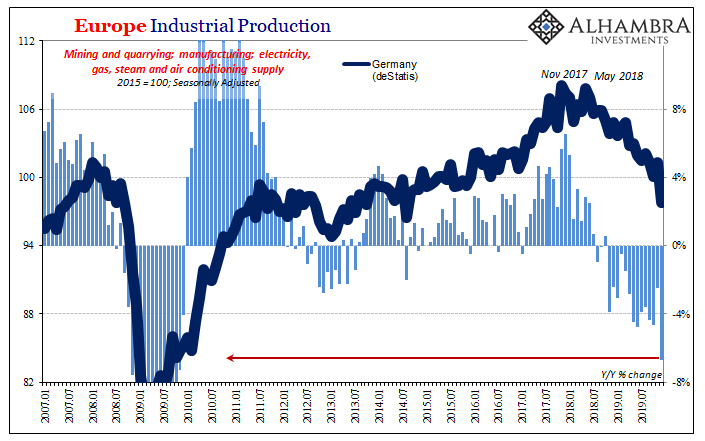

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot.

Read More »

Read More »

FX Daily, January 31: Stocks Finishing on Poor Note, while the Dollar and Bonds Firm

Overview: It was as if the World Health Organization's recognition of that the new coronavirus is an international health emergency was the catalyst that the markets needed. US equities recovered smartly and managed to close higher on the session. However, the coattails were short, and follow-through buying of US shares fizzled.

Read More »

Read More »

FX Weekly Preview: The Week Ahead and Why the FOMC Meeting may not be the Most Interesting

The week ahead is arguably the most important here at the start of 2020. The Federal Reserve and the Bank of England meet. The US and the eurozone report initial estimates of Q4 19 GDP. The eurozone also reports its preliminary estimate of January CPI. China returns from the extended Lunar New Year celebration and reports its official PMI. Japan will report December retail sales and industrial production.

Read More »

Read More »

FX Daily, January 23: ECB’s Strategic Review and the Coronavirus Command Investors’ Attention

The spread of the coronavirus and the lockdown in the epicenter in China has again sapped the risk-taking appetite in the capital markets. Asia is bearing the brunt of the adjustment. Tomorrow starts China's week-long Lunar New Year celebration when markets will be closed, which may have also spurred today's drama that aw the Shanghai Composite tumbled 2.75%, bringing the week's loss to 3.2%, the most in five months.

Read More »

Read More »

The Big And Small of Leading Japan

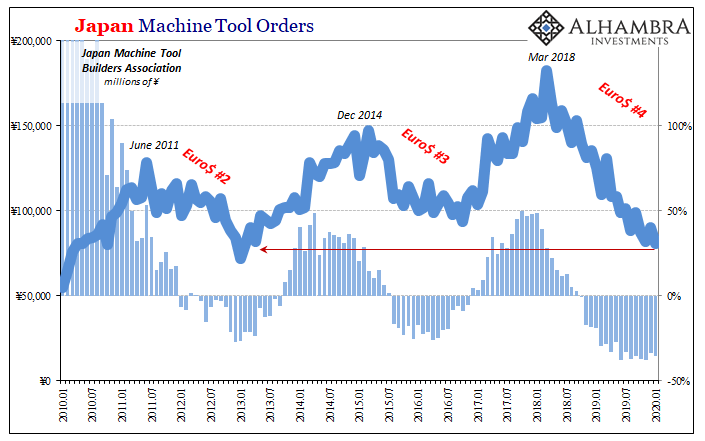

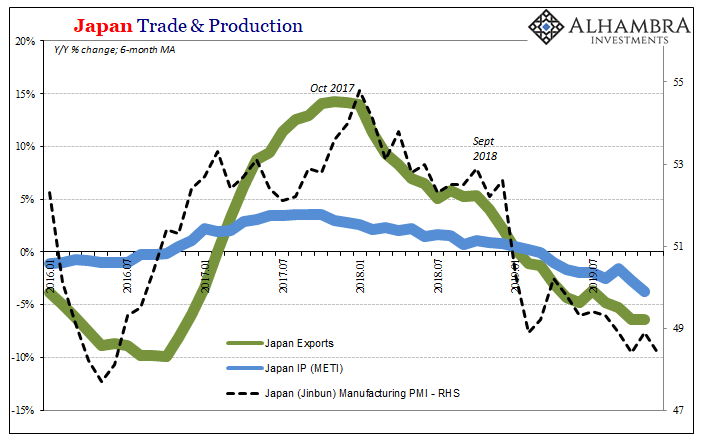

In the middle of 2018, Japan, they said, was riding so high. Gliding along on the tidal wave of globally synchronized growth, Haruhiko’s courage and more so patience had finally delivered the long-promised recovery. The Japanese economy had healed to a point that its central bank officials believed it time to wean the thing off decades of monetary “stimulus.”

Read More »

Read More »

Not Abating, Not By A Longshot

Since I advertised the release last week, here’s Mexico’s update to Industrial Production in November 2019. The level of production was estimated to have fallen by 1.8% from November 2018. It was up marginally on a seasonally-adjusted basis from its low in October.

Read More »

Read More »

Global Headwinds and Disinflationary Pressures

I’m going to go back to Mexico for the third day in a row. First it was imports (meaning Mexico’s exports) then automobile manufacturing and now Industrial Production. I’ll probably come back to this tomorrow when INEGI updates that last number for November 2019. For now, through October will do just fine, especially in light of where automobile production is headed (ICYMI, off the bottom of the charts).

Read More »

Read More »

FX Daily, January 8: Hopes of De-Escalation Help Markets Stabilize

The Iranian retaliatory missile strike on Iraqi-bases housing US forces initially sparked a dramatic risk-off response throughout the capital markets. The muted response by the US coupled with signals from Tehran that it had "concluded" its proportionate measures saw the markets retrace the initial reaction. It was too late for equities in the Asia Pacific region, and several markets (Japan, China, Korea, Malaysia, and Thailand) fell more than 1%.

Read More »

Read More »