Tag Archive: $CNY

FX Daily, September 26: The Dollar Index has Fallen Four of the Five Times the FOMC met this Year

The US dollar is trading with a softer bias in tight ranges. The euro and sterling have been confined to yesterday's ranges, while the greenback briefly traded above JPY113.00 for the first time in two months. The South African rand and Turkish lira are leading the most emerging market currencies higher. Asian equities moved higher, led by Hong Kong, which returned from yesterday's holiday.

Read More »

Read More »

FX Weekly Preview: Next Week’s Drivers

It is a testament to the Federal Reserves communication and the evolution of investors' understanding that we can say that the rate hike that the central bank will deliver is not as important as what it says. A rate hike is a foregone conclusion. According to the CME's model, there is about an 85% chance of December hike discounted as well.

Read More »

Read More »

FX Daily, September 7: Emerging Markets Stabilize While Euro Shrugs Off Disappointing Data

The global capital markets are finishing the week on a more stable note than it began. Indeed, since the middle of the week, many of the besieged emerging market currencies, like the South African rand, Turkish lira, and Argentine peso have posted some corrective upticks. Today, the MSCI Emerging Market Index is snapping a seven-day slide register a modest gain, ahead of the Latam session.

Read More »

Read More »

FX Weekly Preview: Trade Trumps US Jobs and Rising Stress in Spain and Italy is More Important than the PMI

The first week of a new month features the US jobs data. It is the most important economic report of a new month. It sets the broad tone for much of the economic data over the next several weeks, including consumption, industrial production, and construction spending. However, there are two reasons why it may not pack the punch it has in the past.

Read More »

Read More »

The Big Picture 18-24-Month Outlook: Some Preliminary Projections

The winding down of the North's summer provides a suitable time to consider not the near-term outlook, which many investors do on a daily basis, but to reflect on where we are heading down the road a bit. What will the next 18-24 months hold? Of course, we harbor no illusions of prescient vision and accept the hazards of the assignment and so should the reader.

Read More »

Read More »

FX Daily, August 31: Month-End Adjustments and Tentative Stabilization in Emerging Markets Ease Demand for Dollars but Not Yen

The dramatic price action seen yesterday among several emerging market currencies is eased today, but here at month-end, demand for risk-assets is tentative at best. The macro backdrop, including the increase in US core inflation, expectations for continued hikes by the Federal Reserve, and unambiguous signals that trade tensions will increase in the coming weeks dampens the risk appetite.

Read More »

Read More »

FX Daily, August 30: Brexit Optimism Underpins Sterling

The US dollar is mostly firmer, while global equities are softer and bonds little changed. The Turkish lira and South African rand remain under pressures. However, there does not appear to be an overall theme in today's markets.

Disappointing data from Australia and New Zealand has seen the Antipodean currencies move lower. New Zealand's business confidence fell to a ten-year low, and this sent the Kiwi tumbling. Its nearly 0.9% fall...

Read More »

Read More »

FX Daily, August 28: Greenback Remains On Defensive

Corrective forces continue to weigh on the US dollar. Sometimes the narratives drive the price action and sometimes the price action drives the narratives. Currently the latter appears to hold sway. The dollar's downside correction began around the middle of the month, well before Powell's August 24 Jackson Hole speech.

Read More »

Read More »

FX Daily, August 24: Greenback Marks Time Ahead of Powell

The US dollar is paring some of yesterday's gains in quiet turnover ahead of Fed Chief Powell's speech at Jackson Hole, the week's last highlight. The euro and sterling are trading inside yesterday's ranges, which the dollar has extended its gains against the yen to reach a two-week high near JPY111.50.

Read More »

Read More »

FX Daily, August 21: Trump Comments Hit Dollar, Little Impact on Rates

The US dollar is broadly lower following President Trump's comments yesterday, criticising Fed policy and reiterating his previously made claim that China and the EU are manipulating their currencies. We suggested that last week's presidential tweet that identified strong capital inflows into the US may not have been written by President Trump.

Read More »

Read More »

FX Daily, August 20: Greenback Consolidates Pre-Weekend Pullback in Quiet Turnover

The US dollar is slightly firmer against most of the major currencies, as the light participation and lack of fresh news see a consolidative tone emerge after the pullback at the end of last week. Although markets in Turkey are closed for a nearly week-long holiday, it has not prevented the lira from weakening. After closing a little below TRY6.02 before the weekend, the greenback has moved to TRY6.15 in the European morning.

Read More »

Read More »

FX Weekly Preview: Five Traps in the Week Ahead

Officials have taken steps to make it more difficult and more expensive to short the lira, but that did not prevent a 5% slide ahead of the weekend. There is no interest rate, within reason, that can compensate for such currency risk.

Read More »

Read More »

FX Daily, August 17: Dollar Limps into the Weekend

The US dollar is trading heavily against most of the world's currencies today. The main exceptions come from the emerging markets where the Turkish lira, Russian ruble, and Mexican peso are the chief exceptions, and their losses are modest. This week's dollar gains are being pared in largely corrective activity and amid a light news stream.

The threat of more sanctions on Turkey if it does not release the American pastor is helping the...

Read More »

Read More »

FX Daily, August 16: Emerging Markets Stabilize, Dollar Eases a Little

Two developments have helped turned sentiment, or at least arrested the markets' momentum. First, the developments in Turkey, where officials have taken a few measures that will make it somewhat more difficult to access the lira.

Read More »

Read More »

FX Daily, August 14: Brief Respite but Little Relief

Corrective pressures grip the capital markets today, helped by the easing of the selling pressure on Turkey, but its more a respite than a relief as no new policy initiatives are behind the lira's upticks. The implication of this is that it is unlikely to last. In fact, the dollar's low in early Europe a just above TRY6.41 after trading a little above TRY7.23 yesterday may be about the most that can reasonably be expected.

Read More »

Read More »

FX Daily, August 13: Turkey Drives Risk-Off, but Pressure Abating

The failure of Turkey to grab the bull by the horns, so to speak, and come to grips with the situation saw the dollar soar above TRY7.23(from TRY6.43 at the end of last week) and to ZAR15.55 (from ZAR14.09). The Mexican peso, the strongest currency this year, and which has been partially protected by prospects of a new NAFTA agreement has suffered as well.

Read More »

Read More »

The Yin and Yang of the US-China Relationship

Chimerica always seemed like an oversimplification of a complex and dialectic relationship between the US and China. However, it did express an underlying truth, that China's rise over the last 40 years has been predicated on Deng Xiaoping's political and economic reforms and, importantly, the world of free-trade (a reduction in tariff barriers to trade) promoted by the United States.

Read More »

Read More »

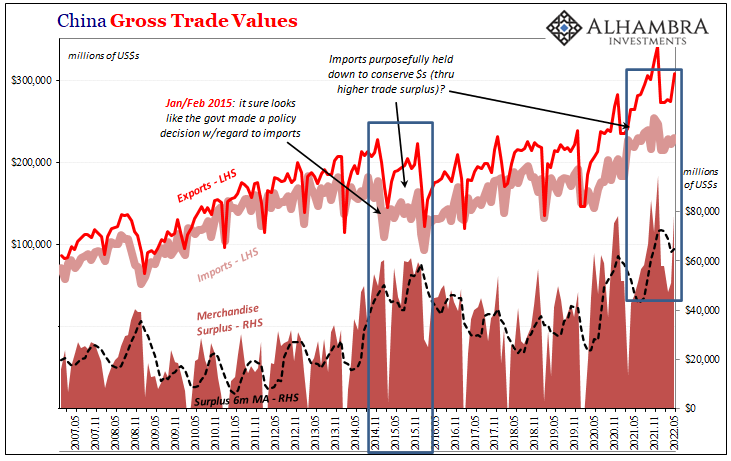

What Chinese Trade Shows Us About SHIBOR

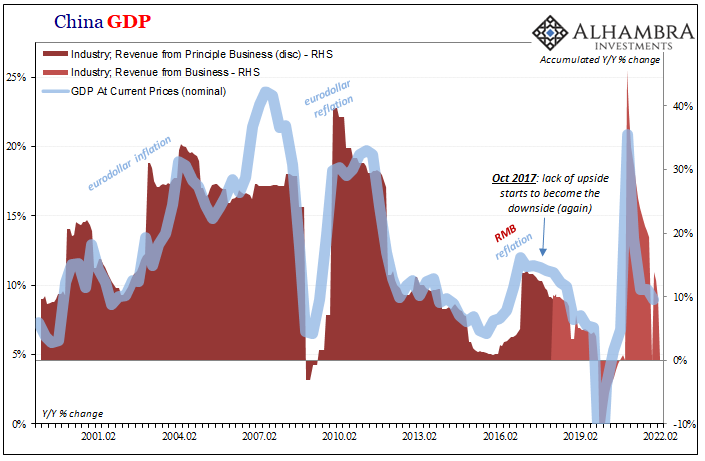

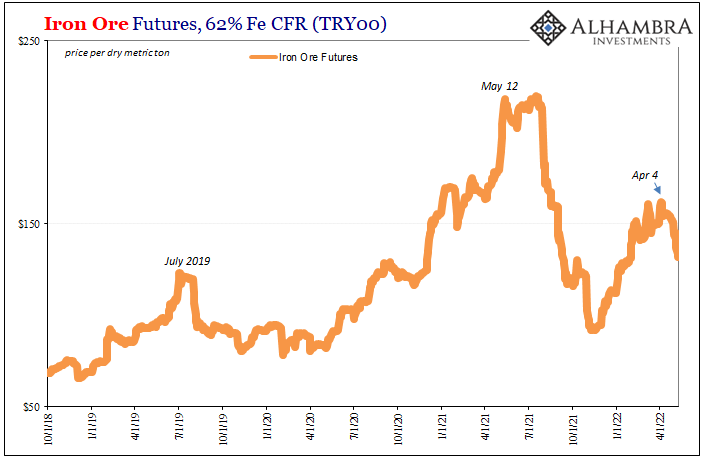

Why is SHIBOR falling from an economic perspective? Simple again. China’s growth both on its own and as a reflection of actual global growth has stalled. And in a dynamic, non-linear world stalled equals trouble. Going all the way back to early 2017, there’s been no acceleration (and more than a little deceleration). The reflation economy got started in 2016 but it never went anywhere. For most of last year, optimists were sure that it was just the...

Read More »

Read More »

FX Daily, August 09: Sterling Remains Under Pressure, while the Greenback Firms Broadly

The global capital markets are mostly quiet. US sanctions on Turkey and Russia are pressuring their respective currencies, and the New Zealand dollar has slumped nearly 1.5% on the back of a dovish hold by the central bank. The Kiwi is at 2.5-year lows near $0.6650.

Read More »

Read More »

FX Daily, August 08: Sterling Can’t Get Out of Its Own Way, While Dollar and Yen Catch a Bid

Fears that the UK could leave the EU in a little over six months without an agreement continues to drag sterling lower. Recall that over the weekend, the UK's International Trade Minister Fox suggested there was a 60% chance of a no-deal Brexit.

Read More »

Read More »