Found 1,380 search results for keyword: label

Ending Fiat Money Won’t Destroy the State

A certain meme has become popular among advocates of both gold and cryptocurrencies. This is the “Fix the money, fix the world” meme. This slogan is based on the idea that by switching to some commodity money—be it crypto or metal—and abandoning fiat currency, the world will improve greatly.

Read More »

Read More »

Why Did the World Choose a Gold Standard Instead of a Silver Standard?

Among those who support the end of government fiat money, it’s not uncommon to hear and see claims that gold is “the best money” or “natural money” or the only substance that’s really suited to be commodity money. In many of these cases, when they say “gold” they mean gold, and not silver, platinum, or any other precious metal.

Naturally, one can expect to encounter these claims among those who have made a living out of promoting gold and...

Read More »

Read More »

Pandemic pushes Swiss house prices higher

The value of residential property in Switzerland continued to rise strongly in 2021 in the wake of Covid-19. Property prices are likely to rise further this year, according to an analysis.

Read More »

Read More »

Annual consumer price inflation hits 0.6 percent

Consumer prices in Switzerland increased by 0.6% on average last year, according to the Federal Statistics Office. and +0.4% respectively.The consumer price index fell by 0.1% in December

Read More »

Read More »

SNB profitiert von starker Aktienmarktperformance

Die SNB dürfte laut UBS für das Gesamtjahr 2021 einen Gewinn von fast 20 Mrd. Franken ausweisen. Dieser ist einer starken Aktienmarktperformance zu verdanken trotz belastender Zins- und Währungsveränderungen. Im letzten Quartal hingegen dürfte die Nationalbank wegen der deutlichen Aufwertung des Frankens gegenüber den meisten Währungen einen Verlust von über 20 Mrd. Franken erlitten haben.

Read More »

Read More »

Fonds Im Fokus: DWS Concept DJE Responsible Invest

„Entscheidend ist das persönliche Gespräch“

Der DWS Concept DJE Responsible Invest ist ein offensiver Mischfonds, der bei der Auswahl der Aktien- und Anleihenwerte strengen Nachhaltigkeitskriterien folgt, zum Beispiel einem CO2-Emissions-Grenzwert von 900t pro 1 Mio. Umsatz, wodurch Unternehmen aus energieintensive Branchen nicht für den Fonds in Frage kommen. Fondsmanager Richard Schmidt erläutert im Interview, welche Wertpapiere aus welchen...

Read More »

Read More »

The Truth about Tulipmania

When the economics profession turns its attention to financial panics and crashes, the first episode mentioned is tulipmania. In fact, tulipmania has become a metaphor in the economics field. Should one look up tulipmania in The New Palgrave: A Dictionary of Economics, a discussion of the seventeenth century Dutch speculative mania will not be found.

Read More »

Read More »

How a secretive central bankers’ club responds to crises

Every other month, the world’s most influential central bank governors gather in Basel to swap notes, reinforce personal ties and untangle the technical details of keeping money flowing around the world.

Read More »

Read More »

Podcast mit Maximilian-Benedikt Köhn: Kurzfristig boostern, langfristig Zucker bekämpfen

Nach beinahe zwei Jahren Corona-Pandemie scheint der Weg zurück in die Normalität immer noch lang. Doch auch andere Herausforderungen sind für den Healthcare und Pharma Sektor von großer Bedeutung und sollten nicht in Vergessenheit geraten. Welche das sind und welche zukünftigen Entwicklungen Anleger unbedingt im Blick behalten sollten, darüber wir im aktuellen Podcast mit Maximilian Köhn. Er ist der Experte für den Bereich Healthcare im DJE...

Read More »

Read More »

Can Dikes Be Private?: An Argument against Public Goods Theory

According to many economists, we need the state to provide public goods.2 The assertion seems to be so crystal-clear that it is not even worth discussion in the mainstream. One typical and popular example of public goods in Germany is the case of dikes or levees.

Read More »

Read More »

Falcon bank fined for money laundering, ex-CEO acquitted

A Swiss court has found the Zurich-based Falcon Private Bank guilty of money-laundering offences. The Federal Criminal CourtExternal link on Wednesday ordered the Abu Dhabi-owned bankExternal link to pay a fine of CHF3.5 million ($3.8 million) for failing to set up the necessary controls. It was the first time that a Swiss bank was taken to court over accusations of money laundering.

Read More »

Read More »

DJE – Marktausblick 12/2021 mit Stefan Breintner & Markus Koch: Value vor Growth im Seitwärtsmarkt

Die US-Notenbank zieht die Zügel schneller an als gedacht. An den Bond- und Aktienmärkten dürfte es im neuen Jahr zu stärkeren Schwankungen kommen, und die Zinsen könnten steigen. Value-Werte und Dividendenaktien könnten hochbewerteten Wachstumstiteln den Rang ablaufen.

Seit über vier Jahrzehnten setzt die DJE Kapital AG Maßstäbe in der Vermögensverwaltung und in Fonds.

Die DJE Kapital AG (DJE) ist seit 45 Jahren als unabhängige...

Read More »

Read More »

How the Classical Gold Standard Fueled the Rise of the State

Throughout much of the past century, the idea of a gold standard for national currencies has been routinely linked with laissez-faire economics and "classical liberalism"—also known as "libertarianism." It's not difficult to see why.

Read More »

Read More »

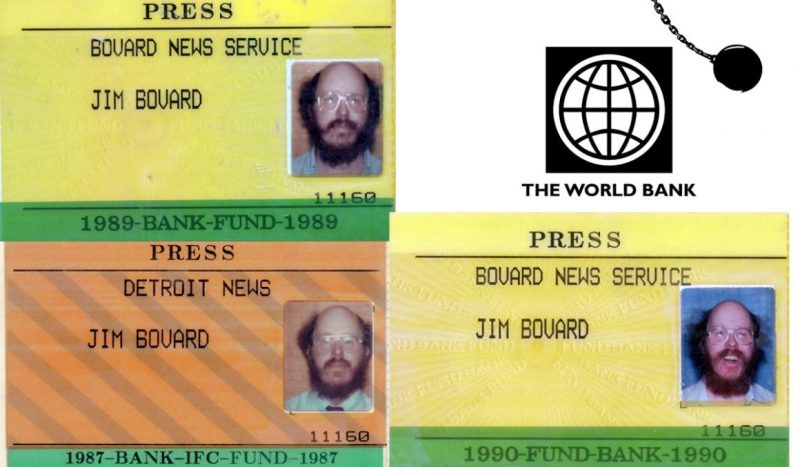

Raiding the World Bank: Exposing a Fondness for Dictators

I have always had a bad attitude toward official secrets regardless of who is keeping them. That prejudice and John Kenneth Galbraith are to blame for an unauthorized withdrawal I made from the World Bank. When I lived in Boston in the late 1970s, I paid $25 to attend a series of lectures by Galbraith on foreign aid and other topics.

Read More »

Read More »

Podcast mit Dr. Ulrich Kaffarnik: Die Fed und ihre Tapering-Pläne

Mit Auftauchen der neuen Omikron-Variante im November erhielten auch die Aktienmärkte einen spürbaren Dämpfer. Doch wie groß ist das Risiko für die Kapitalmärkte, das von der neuen Mutation ausgeht? Außerdem steht weiterhin die große Frage im Raum, wie sich die aktuelle Notenbank-Politik mit verstärktem Tapering und den erwarteten Zinsanhebungen im kommenden Jahr auswirken wird. Mögliche Szenarien diskutieren Dr. Ulrich Kaffarnik, Vorstand und...

Read More »

Read More »

DJE-plusNews Dezember 2021 mit Mario Künzel: Inflation, Zins & Omikron

In dem monatlich stattfindendem DJE-plusNews reflektiert Mario Künzel, Referent Investmentstrategie, die Marktgeschehnisse der vergangenen vier Kalenderwochen und gibt Ihnen einen Ausblick auf die kommenden Wochen.

Das nächste DJE-plusNews findet am 18. Januar 2022 statt.

Hier kostenlos anmelden: https://bit.ly/3IS0HGd

Seit über vier Jahrzehnten setzt die DJE Kapital AG Maßstäbe in der Vermögensverwaltung und in Fonds.

Die DJE Kapital AG (DJE)...

Read More »

Read More »

Has the Market Carried the Fed’s Water? Is the Dollar Vulnerable to Buy the Rumor and Sell the Fact?

Overview: The US dollar is trading with a bit of heavier bias against most of the major currencies as the focus turns to today's FOMC meeting, where a clear consensus has emerged in favor of faster tapering and a dot plot pointing to a steeper pace rate hikes. Emerging market currencies led by Turkey and South Africa are mostly lower. The JP Morgan Emerging Market Currency Index is lower for the third straight session. The US 10-year Treasury...

Read More »

Read More »

Dr. Jens Ehrhardt im Interview mit Bernd Heller – China wird ein Risiko!

Die #Inflation geht immer weiter durch die Decke: Müssen die Notenbanken jetzt handeln? Börsenlegende Jens Ehrhardt erklärt, warum wir Gegenwind von der monetären Seite sehen werden. Wie er #China gerade als Investor einschätzt und welches #Risiko ihn am meisten umtreibt

Seit über vier Jahrzehnten setzt die DJE Kapital AG Maßstäbe in der Vermögensverwaltung und in Fonds.

Die DJE Kapital AG (DJE) ist seit 45 Jahren als unabhängige...

Read More »

Read More »

‘The definition of a tax haven is changing’

A major global corporate tax deal agreed by more than 130 countries in October aims to curb tax abuse by multinational companies, but many important details remain on how this will be implemented.

Read More »

Read More »

Arm wrestling over the control of money

The Swiss National Bank (SNB) is doing its best to keep up with the fast-evolving world of cryptocurrencies and decentralised finance.

Read More »

Read More »