Update August 2013: Breakdown of the Carry Trade

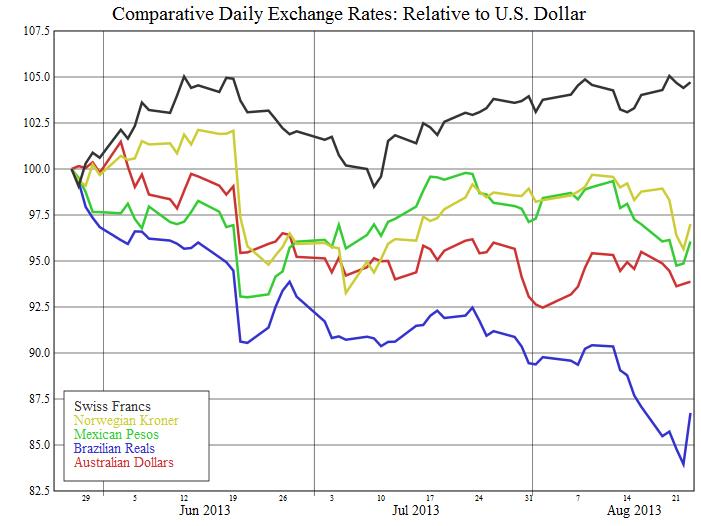

The Breakdown of the Carry Trade has continued while the Swiss franc is doing exactly the opposite. It appreciates, while even the “sexiest” currency NOK is weakening against EUR and USD.

Bob Savage’s company, the hedge fund FX Concept has filed for bankruptcy.

CHF as Funding Currency: Where is the Carry Trade, Bob Savage?

It was an interesting shoot-out between Robert Savage, currency strategist at FX Concepts, and George Dorgan, financial editor and consultant at SFC Consulting, at the yearly Euromoney Swiss Franc Forum.

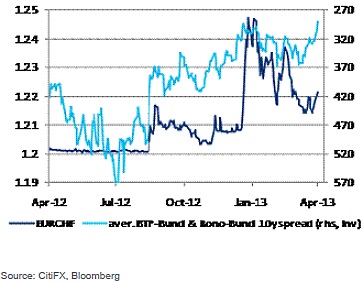

Robert Savage (third from right side). Robert’s thesis was that, similar to the Japanese yen between October 2012 and March 2013, the Swiss franc would become a funding currency for the carry trade. Consequently the EUR/CHF should appreciate to 1.25 or 1.30 this year.

Robert Savage (third from right side). Robert’s thesis was that, similar to the Japanese yen between October 2012 and March 2013, the Swiss franc would become a funding currency for the carry trade. Consequently the EUR/CHF should appreciate to 1.25 or 1.30 this year.

George Dorgan (second from the left), as well as the other speakers from Switzerland, did not fully agree. Dorgan’s counter-argument was that the inflation difference between the euro zone and Switzerland will further narrow. Effectively this gap has fallen from 4% in 2011/2012 to 1.6% most recently. European inflation rates are rapidly falling, while the Swiss CPI remains stable, still in slightly negative territory.

According to Dorgan, without the expectation of ECB rate hikes, a realization of a EUR/CHF carry trade is difficult. If the euro appreciates to 1.25 or 1.30, then Swiss inflation would rise through more expensive imports, with the consequence that bets on an SNB rate hike could emerge. Therefore, euro gains would be limited.

Moreover, Dorgan emphasized that a carry trade phase cannot directly follow a period of high risk aversion, there must be a consolidation period in between. And, last but least, in the longer-run exporters like the Swiss will take profit on the Fed’s printed money and increased US consumer spending. The Swiss franc is mostly driven by Swiss exporters and investors, while the valuations of commodity currencies are driven by foreign investments.

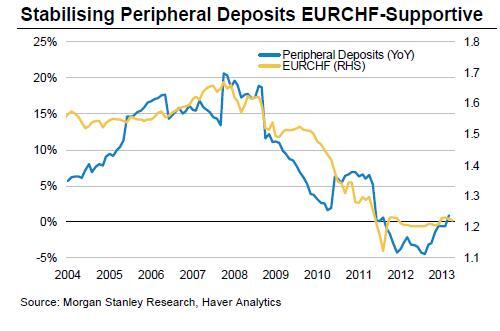

Morgan Stanley confirms that CHF is an attractive founding currency.

No carry trade till now, the opposite

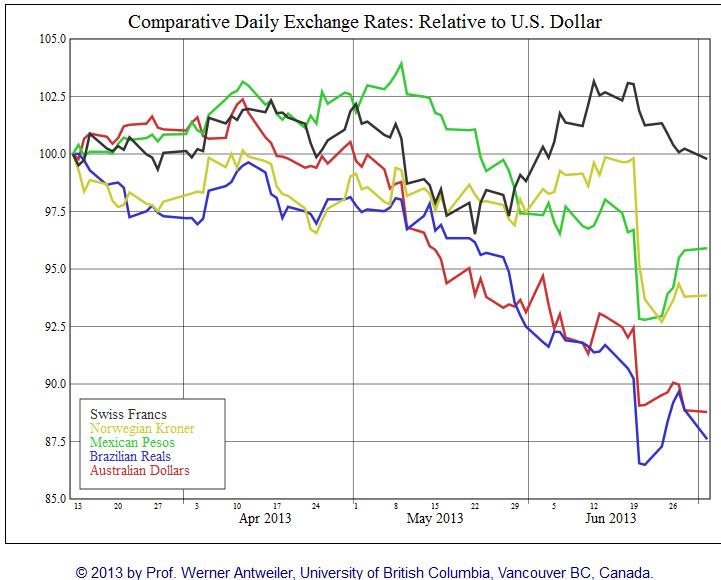

As usually, FX rates moved differently than the strategists had expected. There was no carry trade at all, but we saw months of disinflation and logically the US dollar appreciated. All investment currencies for the carry trade were in the red.

Since the Euromoney forum, the best performing carry trade currency was the Mexican Peso with slight losses against the dollar, while the Aussie fell 13% and the Kiwi about 7%. The Swiss franc was unchanged against the dollar. Even the Societé Génerale’s sexiest currency, the Norwegian Kroner, lost ground.

source Euromoney

A weakening China and falling commodity prices took the carry trade currencies with them. The main winners since March were the dollar, the euro and stocks.

Was the slump of the carry trade foreseeable?

We judge that this movement was foreseeable. The 40% appreciation of the yuan against the yen since last August and lower demand from the austerity-hit Europe considerably weakened Chinese manufacturers. Since Chinese demand is mostly responsible for commodity prices, the slump was foreseeable.

. As we explained here, the Swiss franc is partially a proxy for the Chinese economy and therefore a sort of investment currency for a carry/commodity trade, but not a funding currency. The strong correlation of the franc with the commodity gold is known.

As we explained here, the Swiss franc is partially a proxy for the Chinese economy and therefore a sort of investment currency for a carry/commodity trade, but not a funding currency. The strong correlation of the franc with the commodity gold is known.

The EUR/CHF has risen because of European disinflation and consequently falling peripheral bond yields; hence, CHF was somehow a funding currency for bond investments.

Still the euro did not appreciate thanks to the expectation of an ECB rate hike that could justify a real carry trade.

What happens when China recovers?

It will be interesting to see what happens when China recovers, when commodity prices and global inflation will rise again. We judge that in this case peripheral bond yields will go up again, provided that these countries still show weak growth. Consequently the CHF should appreciate together with the “Swiss friends”, AUD, gold and German DAX.

Yes, Bob, it will be a very long time before the Swiss franc becomes a real funding currency again.

See more for