Category Archive: 3) Swiss Banks

Art Basel and UBS Global Art Market Report: Online sales reached record highs in 2020, doubling in value

Art Basel and UBS announced today the publication of the fifth Art Basel and UBS Global Art Market Report, authored by renowned cultural economist Dr Clare McAndrew. The report integrates insight from a recent survey of 2,569 high-net-worth (HNW) collectors, conducted by Arts Economics and UBS Investor Watch, across ten markets: the United States, United Kingdom, France, Germany, Italy, Hong Kong, Taiwan, Singapore, Mexico, and for the first time...

Read More »

Read More »

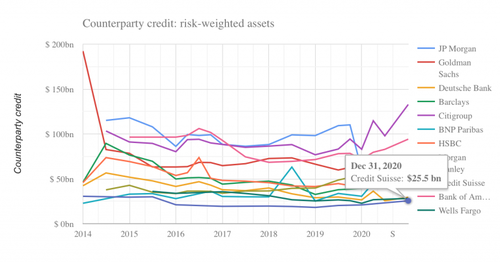

Credit Suisse Launches Probe Into Collapsed Greensill Trade-Finance Funds

Roughly a weekand a-half has passed since Credit Suisse gated funds containing $10BN in assets packaged by Greensill, the troubled financial innovator that suckered in former British PM David Cameron, SoftBank and legions of clients and investors with its stated mission to "democratize" supply-chain finance.

Read More »

Read More »

UBS publishes Annual Report 2020

The Annual Report 2020 provides comprehensive and detailed information on the firm, its strategy, business, governance and compensation, financial performance and risk, treasury and capital management, as well as on the regulatory and operating environment for the 2020 financial year.

Read More »

Read More »

SocGen Slashes Banker Bonuses Amid ECB Pressure

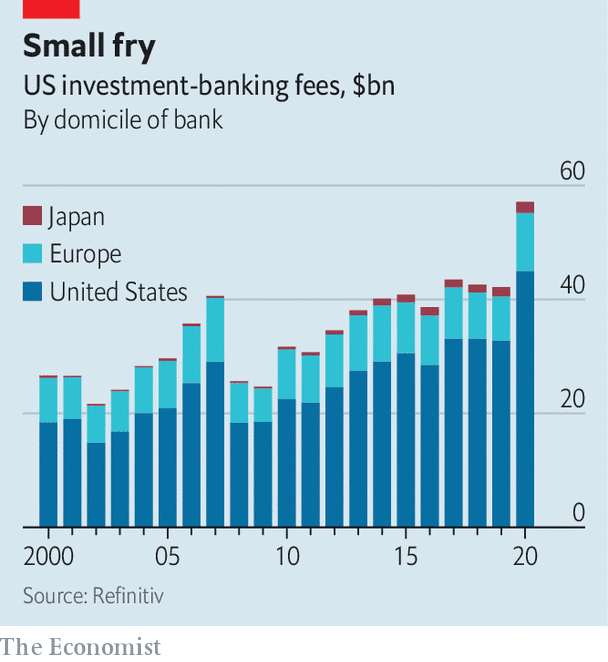

Despite banks, broadly speaking, having a banner year in 2020 as central-bank-liquidity more-than-washed over the losses due to COVID and policy restrictions, banker bonuses have come under pressure.In Europe, the picture is more uncertain as banks' performance has been mixed.

Read More »

Read More »

European banks need new chiefs

EUROPEAN BANKS’ fourth-quarter earnings, releases of which are clustered around early February, have been surprisingly perky. Those with trading arms, such as UBS or BNP Paribas, rode on buoyant markets. State support helped contain bad loans; few banks needed to top up provisions.

Read More »

Read More »

UBS Multibanking available to corporate clients throughout Switzerland

UBS has successfully completed the pilot phase of its new multibanking function and is now gradually rolling out the offering across Switzerland. UBS Multibanking will now also give SMEs full transparency over all their accounts and allow them to execute payments debited from accounts with third-party banks directly in UBS E-Banking.

Read More »

Read More »

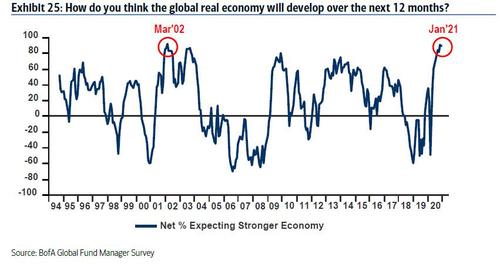

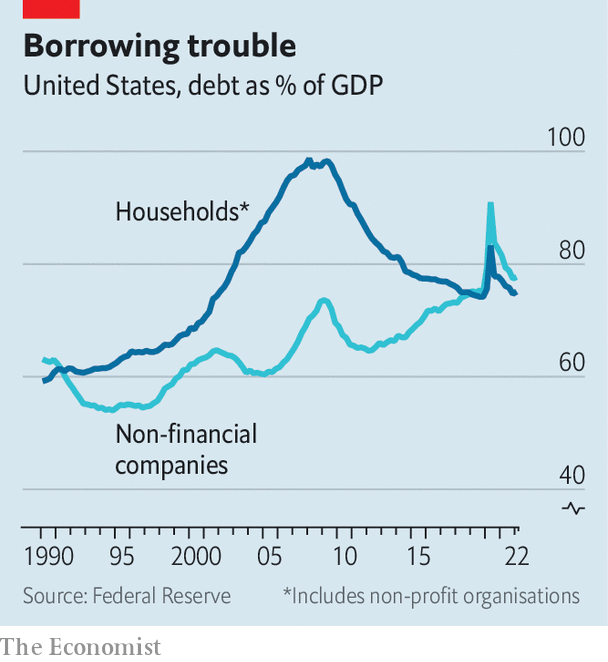

Goldman Lists The Three Things That Could Go “Really Wrong” In 2021

On Saturday, we showed why according to observations from Credit Suisse and BofA, the "US Economy Is Set To Overheat As Households Are Flooded With $2 Trillion In Excess Savings." Then, in a note this morning from Morgan Stanley asking "What To Do About All This Optimism" the bank said that "in November, December and now January, no question or concern has come up more often than 'everyone is optimistic'." Finally, the...

Read More »

Read More »

Change to the UBS Board of Directors

The UBS Board of Directors announced today that Beatrice Weder di Mauro is not standing for re-election to the Board of Directors of UBS Group AG and UBS AG. She has informed the Board of her decision to step down after serving since 2012.

Read More »

Read More »

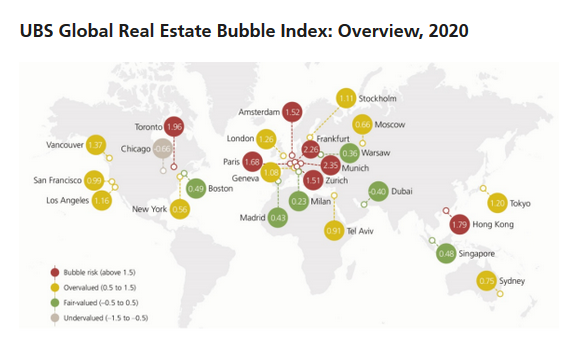

UBS Global Real Estate Bubble Index 2020: Munich and Frankfurt are the most overvalued housing markets globally

The UBS Global Real Estate Bubble Index, a yearly study by UBS Global Wealth Management's Chief Investment Office, indicates bubble risk or a significant overvaluation of housing markets in half of all evaluated cities.

Read More »

Read More »

Art Basel and UBS art market survey shows online sales and millennial collectors increasingly important to an art market hit hard by COVID-19

Art Basel and UBS today published a 2020 mid-year survey 'The Impact of COVID-19 on the Gallery Sector' written by renowned cultural economist Dr. Clare McAndrew, Founder of Arts Economics. The survey findings present an analysis of how the COVID-19 pandemic has impacted 795 galleries operating in the Modern and contemporary gallery sector, representing 60 different markets across all levels of turnover, throughout the first six months of 2020.

Read More »

Read More »

UBS Investor Sentiment and ElectionWatch: Politics and US elections temper wealthy investors’ rising optimism

Most wealthy investors and business owners globally have said they plan to adjust their portfolios based on who wins the US election, with almost half seeing November’s vote as one of their top concerns, according to the new Investor Sentiment study by UBS, the world's leading global wealth manager.

Read More »

Read More »

UBS Secures Naming Rights to New York’s Next Premier Entertainment and Sports Venue and Future Home of the New York Islanders

State of the art UBS Arena at Belmont Park, developed in partnership with Oak View Group, the New York Islanders, and Sterling Project Development, is projected to open for the 2021-22 National Hockey League season.

Read More »

Read More »

New UBS report reveals that joint financial participation is the key to gender equality

Significant majority of men and women believe women need to be equally involved in long-term financial decisions to achieve true gender equality, yet half of women let their spouses take the lead .

Read More »

Read More »

UBS raises USD 440 million for Rockefeller sustainable investment fund

Zurich, June 24 2020 – UBS is investing in Rockefeller Asset Management's Global Environmental, Social and Governance (ESG) Equity fund, broadening the sustainable investment opportunities that it offers to clients. UBS, the world's largest global wealth manager, has allocated directly to the fund through its 100% sustainable multi-asset portfolio, which surpassed USD 10 billion in size earlier this year.

Read More »

Read More »

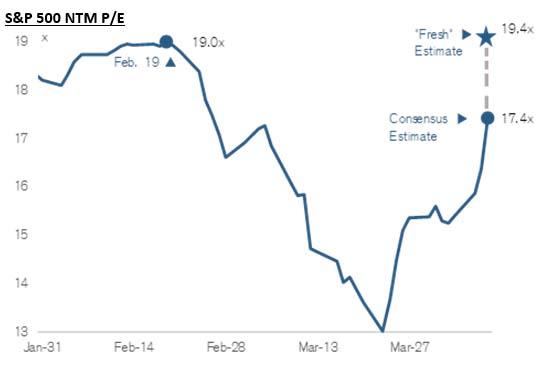

Insanity: As The US Enters A Depression, Stocks Are Now The Most Overvalued Ever

Two days ago, when a platoon of clueless CNBC hacks said that stocks were extremely undervalued, and must be bought (on their fundamentals, not because the Fed was about to nationalize the entire bond market and is set to start buying equity ETFs in the next crash), we showed just how "undervalued" the market was.

Read More »

Read More »

UBS: Does Anyone Know What Is Happening?

Does anyone know what is happening? Economic data is likely to become increasingly unreliable as a result of the coronavirus lockdown. We know the global economy will be bad. We will not know, with much accuracy, just how bad.

Read More »

Read More »

As COVID-19 Drives People Into Isolation, Wall Street’s New ‘Virtual Workplace’ May Become The Norm

As governments take drastic measures to slow the spread of the Wuhan coronavirus pandemic, Wall Street - much like a plethora of other industries - has embraced the virtual workplace, according to Bloomberg.

Read More »

Read More »

When It Comes to Raw Power, Few Have More of It Than Central Bankers

A common retort to the claim that in voluntary exchange both parties expect to become better off (or they wouldn’t do it) is that exchanges are seldom, if ever, a matter of horizontal, equal exchange of values. Instead, any such interaction between people is ultimately a matter of their exercising power over one another. The implication, and often explicitly stated conclusion, is that there is no voluntariness, that exploitation is always present,...

Read More »

Read More »

Credit Suisse MD Dies In Freak Accident After Slipping Through Chairlift And Being Suffocated By His Own Jacket

Almost exactly 10 years ago, we detailed the tragic death of Gerard Reilly in a skiing accident - the point man on Repo 105, the point person for E&Y's "investigation" into the Matthew Lee whistleblower campaign, Lehman's Level 2 and Level 3 asset valuation, the brain behind the idea to spin off Lehman's commercial real estate business, Lehman's Archstone investment, and likely so much more.

Read More »

Read More »

UBS Tumbles After Biggest Swiss Bank Misses Key Targets As Investors Pull Money

The rift between the US (where rates are still positive) and European banks (where rates have never been more negative) continues to grow. While US banks have so far reported mostly better than expected results for Q4, the same can not be said for Europe, where UBS shares are down 5% as the bank misses fiscal year profitability and cost targets in addition to trimming its mid-term goals.

Read More »

Read More »