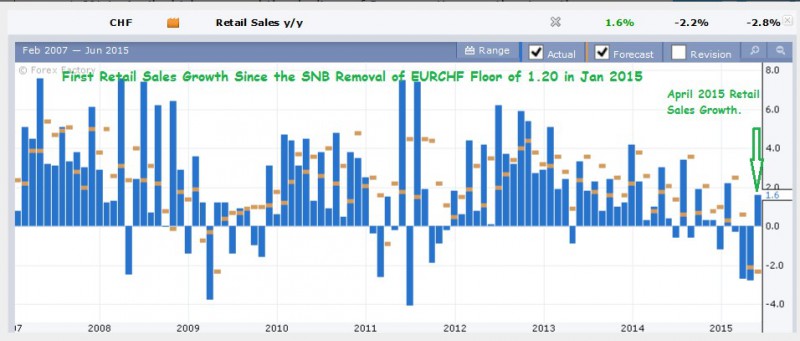

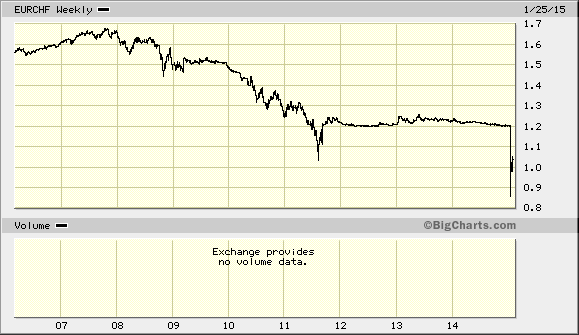

Retail data shows that the SNB peg removal in January 2015 as early as April 2015 with minimal adverse impact on the economy.

Trade surplus showed that Switzerland had fully recovered its lost trade surplus in May and expectations crossed an important threshold into positive territory in June.

CHF strengthened since May end, as the market caught wind of the Swiss recovery, and the Grexit would further strengthen the CHF if it were to occur.

Read More »

Category Archive: 1.) CHF End of Peg

Q1/2015: Swiss Real GDP Rises by 15 percent … in Euro Terms

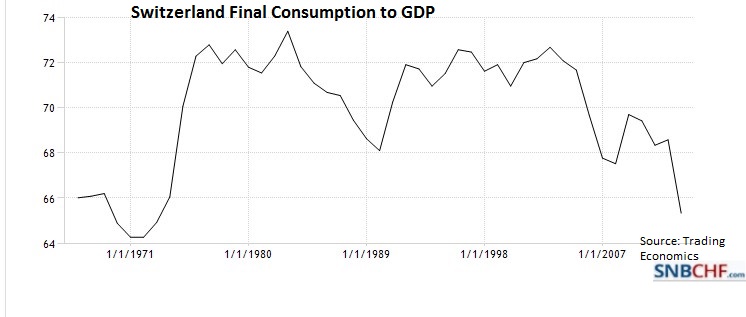

George Dorgan shows that Gross Domestic Product (GDP) is a measurement in the local currency. Effectively, Swiss real GDP rose by 15% in Euro terms, but fell slightly in CHF. He also emphasizes that Switzerland needs a big rebalancing of its economy, away from exports towards consumption. The Swiss National Bank was right to remove the euro peg. The move towards consumption is only possible when the Swiss franc is stronger because consumers will...

Read More »

Read More »

Is the Swiss Franc Really so Expensive or is Swiss Consumption anemic?

One of the most predictable consequences of the Swiss National Bank’s decision to stop suppressing the exchange rate between the franc and the euro was the whinging of Swiss exporters. That doesn’t mean the policy change was an error. If anything, it may help rebalance the Swiss economy away from its excessive dependence on exports towards greater levels of domestic consumption.

Read More »

Read More »

Colin Lloyd on the end of the EUR CHF peg

Colin Llyod gives a detailed explanation of the end of the EUR/CHF peg on Seeking Alpha. Most extracts come from George Dorgan, on snbchf.com

Read More »

Read More »

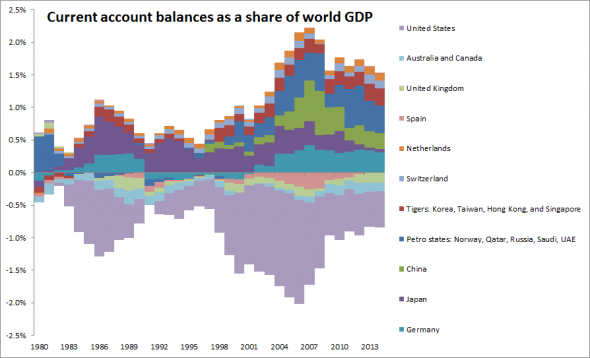

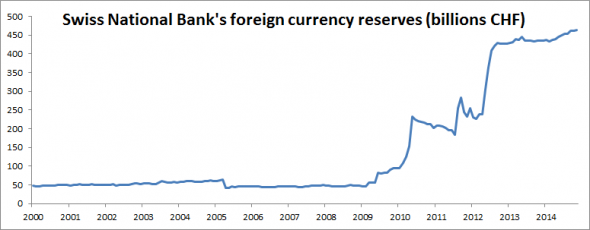

Why did the Swiss franc spike? Lack of Capital Outflows

There is a straightforward answer to the question in the headline: more money has been trying to get into Switzerland than get out, which didn’t affect the exchange rate as long as the Swiss National Bank bought foreign currency. As soon as they stop...

Read More »

Read More »

End of Peg Buiter Critique

In a Citi research note, Willem Buiter discusses the SNB’s decision to discontinue the exchange rate floor of the Swiss Franc vis-a-vis the Euro. His main points are: Buiter refers to his earlier work on removing the lower bound on nominal interest r...

Read More »

Read More »

What Caused The Swiss Financial Tsunami? Three Reasons, One Trigger, One Chain Reaction

In this post we give our (Swiss) view for the financial tsunami on January 15.

The SNB has preferred its secondary mandate, namely financial stability, and the elimination of risks on its own balance sheet caused by ECB QE.

It will not obey its primary target, price inflation, for the next three to five years. While in the mid-term (5 -10 years) inflation should move up.

Differing perceptions between Switzerland and the Anglophone world about...

Read More »

Read More »