Category Archive: 9a.) Real Investment Advice

Is Gold Warning Us Or Running With The Markets?

Having risen by about 40% since last October, Gold is on a moonshot. Many investment professionals consider gold prices to be a macro barometer, measuring the level of anxiety in the economy, inflation, currency, and geopolitics.

Read More »

Read More »

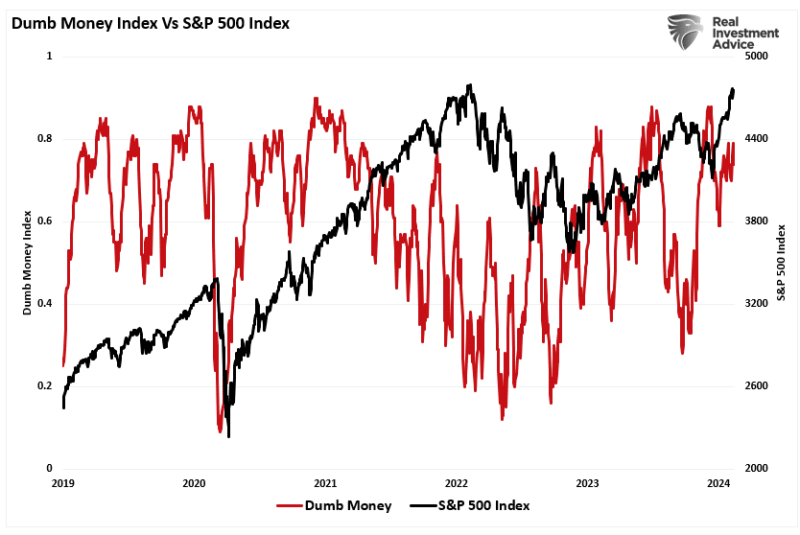

4-9-24 Margin Debt Surges As Bulls Leverage Bets

Margin debt levels have surged as bullish investors leverage their bets in the equity market. The increase in leverage is not surprising, as it represents increased risk-taking by investors in the stock market. Unsurprisingly, as consumer confidence improves, so does the speculative demand for equities. As stock markets improve, the “fear of missing out” becomes more prevalent. Such boosts demand for equities, and as prices rise, investors take on...

Read More »

Read More »

Is the Inflation Scare Over-Blown?

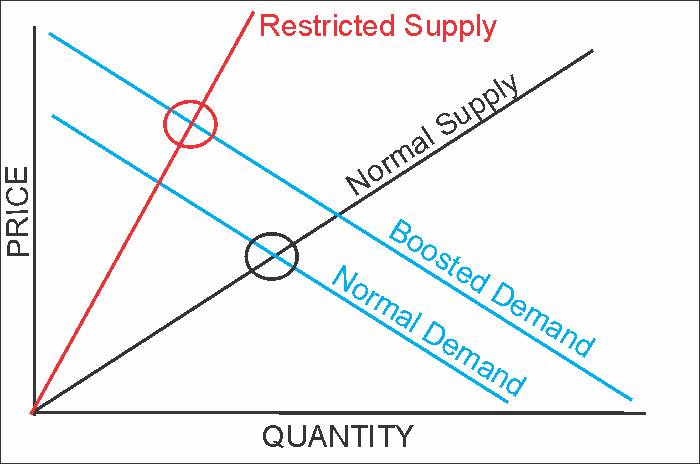

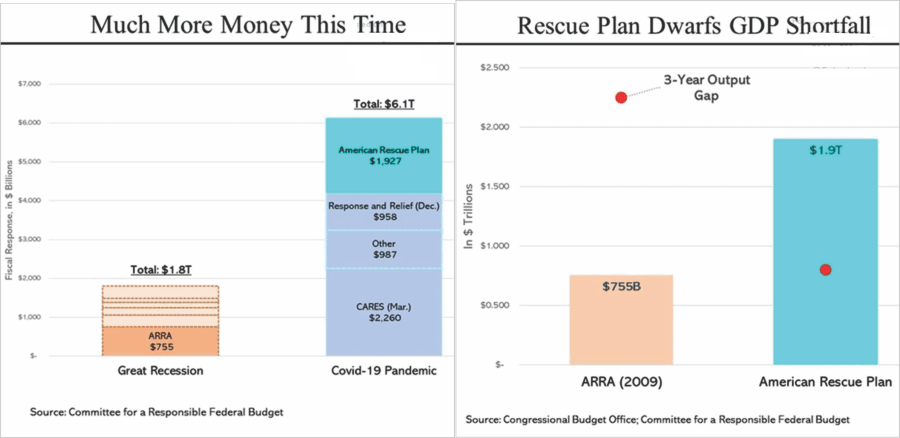

Eclipse-mania is out of control. Fed speakers confirm they'll cut rates, but in no rush to do so. Jobs numbers tantalize markets; the impact of immigration on employment. Boomers & Gen-Z plans to splurge on groceries in 2024. Markets takeout the 20-DMA; will the break be confirmed this week? Putting Inflation into proper perspective; the three measures of inflation. The economic basics of Supply & Demand (and their impact on inflation)....

Read More »

Read More »

Are You Really Ready for Tax Day?

It's the Financial Fitness Friday episode of The Real Investment Show, hosted by RIA Advisors Senior Financial Advisors, Danny Ratliff, CFP, and Jonathan McCarty, CFA, CFP

Produced by Brent Clanton, Executive Producer

-------

Articles mentioned in this report:

"Japans Lost Decades: Are We On The Same Path"

https://realinvestmentadvice.com/japans-lost-decades-are-we-on-the-same-path/

"Market Corrections Matter More Than You...

Read More »

Read More »

Is America Mirroring Japan’s Lost Decades?

In this week's Fedapolooza, Fed spokespersons seem to be growthin less hawkish about rates. Inflation is simply a function of supply & demand. There is a high correlation between GDP/CPI and interest rates. When inflation comes down, so will rates. Watching tomorrow's employement report: ADP is a poor predictor of BLS data. The Bernie Madoff trendline remains intact in markets; bullish sentiment is very high; bear sightings on Wall Street are...

Read More »

Read More »

Could Powell Eclipse Market Expectations?

The JOLTS survey rate continues to slow, coincident with a slowing economy; interestingly, retail hiring has dropped sharply, despite increased retail demand (another example of divergent indicators). The data might not be as strong as we think. The difference between Fed promises and predictions can be vast. Markets remain in a "perfect" trend channel; what happens when the 20-DMA is broken? Commentary on the coming solar eclipse, and...

Read More »

Read More »

Market Corrections Matter More Than You Think

Markets delivered a post-April Fool's drop, while manufacturing metrics moved back into the expansion zone. Markets have now dropped the chances of a June interest rate cut to 50%; markets continue to trade in a particular range. The April 15 Tax Day bump may not materialize this year with the expiration of previous tax law. Gold is on a catch-up trade; will rotation trades continue? Investor sentiment remains high. The bullishness of Ken Fisher;...

Read More »

Read More »

What To Look For in Q1 Earnings

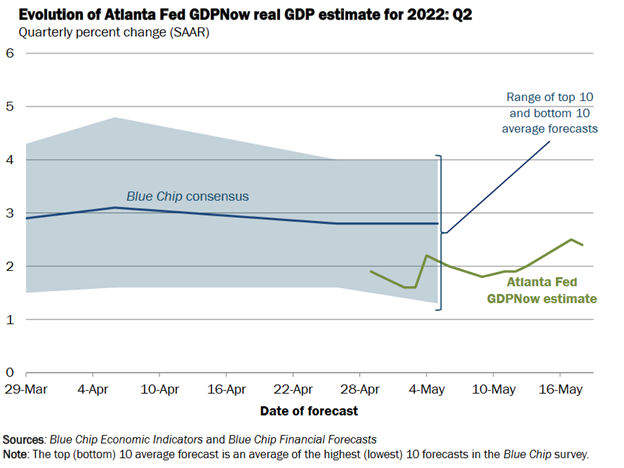

PCE Inflation is weaker, yet consumer spending remains robust; the Atlanta Fed is forecasting 2.3% GDP for Q2. Is this period nirvana for the Fed? The Relative Strength Index is stuck at 70. Markets continue a low-volatility advance, seemingly floating higher. The current environment typically leads to market correction. The next round of earnings commences next week; it will be unsurprising that to see a high percentage of companies “beat” Wall...

Read More »

Read More »

When Financial Conditions Butt Heads With Borrowing Conditions

If Fed Chairman Jerome Powell doesn’t appreciate the difference between financial and borrowing conditions, we must assume most investors do not either. The current combination of easy financial conditions and tight borrowing conditions makes monetary policy difficult for the Fed to balance. At times, like today, financial and borrowing conditions can be at odds with each other, which makes the Fed’s job of managing monetary policy more...

Read More »

Read More »

Wall Street Wants to Save Your Retirement

The Sentiment Index is hanging in, despite weakening regional surveys; economists see no recession in sight; bank reserves have been rising since October 2022. End of quarter rebalancing is generating some activity; after three-days of selling, market futures are positive this morning. Watch markets' steep angle of ascent; this is not sustainable, and correction will result sooner or later. Lance's unique inflation indicator... Markets still act...

Read More »

Read More »

Do Technical Measures and Valuations Really Matter?

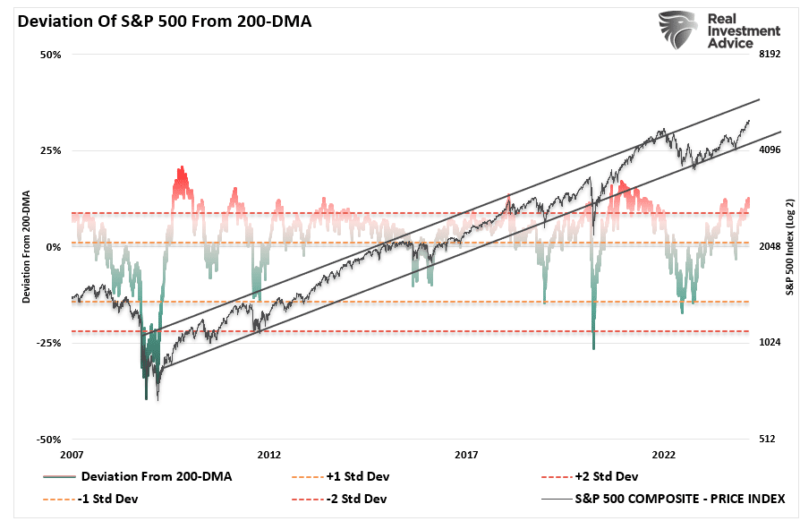

Baltimore Harbor is closed following the collapse of the Francis Scott Key Bridge, hit by an out of control freighter. Weaker Regional Economic Surveys are in contrast to economists ratcheting-up growth expectations: No one is expecting a recession. Liquidity continues to boost bullish mood on Wall Street. The market has steadily climbed for past 5-months, creating record deviations; for now, no fear. Valuations are a measure of market psychology:...

Read More »

Read More »

Are Market Bubbles a Function Of Psychology?

There are three components of a “market bubble.” The first two, price and valuation, often get dismissed or rationalized during the inflation phase. That rationalization is due to investor psychology and the “Fear Of Missing Out (F.O.M.O.)

Stop the re-makes of '80's movies (Roadhouse)! Markets are going into 5th straight month of gains, remaining over-bought and trading in a very narrowly-defined trend channel. Money going into cryptocurrency...

Read More »

Read More »

Beware the Risks in Medicare Advantage Plans 2024

What do the Three Stooges and the Fed's rate cut plans have in common? Risk appetites are on the rise with the Reddit IPO; what if inflation heats up and the Fed cannot cut rates? We're living in a government-driven economy. The challenges to withdrawal rates: Goal-harvesting. Goal shifting when retirement guardrails change. The Reddit IPO: Let the euphoria burn away. Risks to Medicare Advantage plans in 2024: Pre-existing clauses. We now have to...

Read More »

Read More »

How Will the Fed Rate Announcement Affect You?

Markets respond to the Fed rate announcement, indicating at least three rate cuts this year, the first one coming as soon as June. Danny & Jonathan discuss Bond behaviors in the aftermath and investor response to the Fed rate announcement. Changes to the Child Tax Credit for 2024 (it's not a deduction, but a credit against the tax you owe); caveat: It's not indexed for inflation. What about using insurance products as an investing tool. Danny...

Read More »

Read More »

Is Your Ex Worth More Dead than Alive?

It's Fed Day: Danny Ratliff provides a preview in Lance's absence; mortgage rates are pricing-out most buyers. Is your ex- worth more dead than alive? Taking a look at SS survivors' benefits: There are some caveats. How to incorporate inflation hedging into your portfolio. Making buying choices to better manage inflation in household budgets. Why some are accessing 401-k funds (and what about those who do not have one?) Understanding target date...

Read More »

Read More »

The Fed’s New Form of QE

There's a definite correlation between changes in stock buybacks and changes in market performance. With the closure of the stock buyback window by the blackout period, the effects will be interesting, especially with the prevailing attitudes in an over-extended market. We also notice Bitcoin is having an excellent correction. ance and Michael discuss the Fed's Dot Plot and plans for Quantitative Easing: Which problem is easier to fix: Creating...

Read More »

Read More »

Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote.

Read More »

Read More »

The Bull Market is Showing Some Cracks

We are back from Vacation!

Over the last two weeks, the market's advance has begun to taper off, and a more rounded top may be forming. While the 20-DMA continues to act as support, a violation of that level could well trigger additional selling. Momentum and relative strength have also shown continued weakness, and both registered “sell signals” on Friday.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO

Produced by Brent...

Read More »

Read More »

Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

Read More »

Read More »

Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies.

Read More »

Read More »