Category Archive: 6a.) Gold Standard

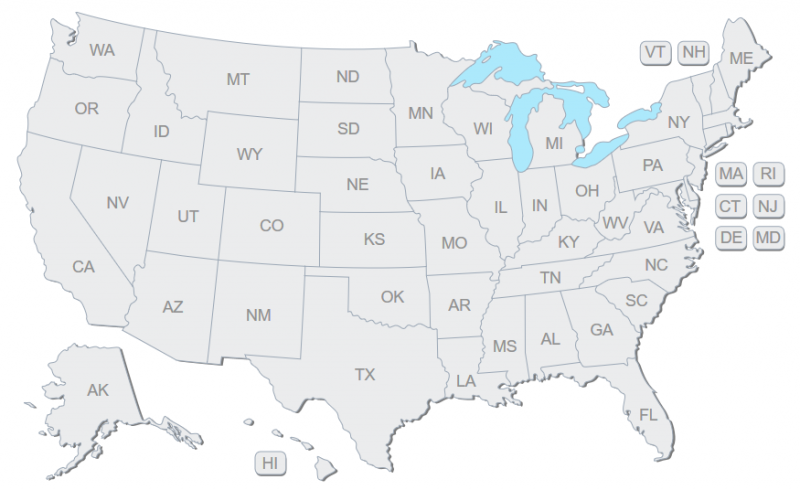

West Virginia Joins Growing Sound Money Movement – Six Other States Now Weighing Their Own Bills to End Taxes on Gold & Silver

Before the ink could even dry on West Virginia Governor Jim Justice’s signature on a repeal of sales taxation on gold, silver, platinum, and palladium bullion and coins, legislators in Wisconsin and Maine introduced similar measures in their own states.

Read More »

Read More »

U.S. Congressman Introduces Bill to Remove Income Taxation from Gold and Silver

The battle to end taxation of constitutional money has reached the federal level as U.S. Representative Alex Mooney (R-WV) today re-introduced sound money legislation to remove all federal income taxation from gold and silver coins and bullion. The Monetary Metals Tax Neutrality Act (H.R. 1089) backed by the Sound Money Defense League and free-market activists – would clarify that the sale or exchange of precious metals bullion and coins are not to...

Read More »

Read More »

Congressman Demands CFTC Explain Its Failure to Find Silver Market Manipulation Where DOJ Did

Washington, DC (February 5, 2018) – A member of the U.S. House Financial Services Committee today pressed the Commodities Futures Trading Commission (CFTC) on its conspicuous failure to uncover the very silver market manipulation now being prosecuted by the U.S. Department of Justice.

Read More »

Read More »

Tennessee Considers Removing Tax on Gold and Silver

Several bills introduced in the Tennessee legislature would eliminate sales and use tax against gold, silver, platinum, and palladium. Introduced by Representative Ron Gant (R-Rossville), House Bill 212 removes sales and use tax against platinum, gold and silver bullion, some numismatic coins, and numismatic coins sold at trade show.

Read More »

Read More »

Trump’s Backdoor Power Play to Rein In the Fed

“Just run the presses – print money.” That’s what President Donald Trump supposedly instructed his former chief economic adviser Gary Cohn to do in response to the budget deficit. The quote appears in Bob Woodward’s controversial book Fear: Trump in the White House.

Read More »

Read More »

Rep. Alex Mooney: Bring Back Gold!

Washington has been quite the circus lately. Bret Kavanaugh’s appearance in front of the Senate Judiciary Committee prompted dozens of interruptions from Democrats and numerous protests from leftists. During Twitter CEO Jack Dorsey’s testimony to the House Commerce Committee, journalist Laura Loomer demanded to be verified on the social media platform, and Representative Billy Long (R-MO) held an auction.

Read More »

Read More »

Idaho House Votes Overwhelmingly to Remove Income Taxation from Gold & Silver

Boise, Idaho (February 12, 2018) – The Idaho State House today overwhelmingly approved a bill which helps restore constitutional, sound money in the Gem State. State representatives voted 60-9 to pass House Bill 449 sending the measure introduced by House Majority Leader Mike Moyle and Senate Assistant Majority Leader Steve Vick to the Senate for a hearing in the Local Government and Taxation Committee.

Read More »

Read More »

Time to Hedge State Reserve Funds with Gold?

Financially prudent individuals set aside surplus funds to protect against unforeseen expenditures. This way, when faced with loss of income, house repairs, car trouble, or anything else, they will have a buffer against unanticipated downturns. In the same vein, almost every state in the United States has established a “savings account” for government operations.

Read More »

Read More »

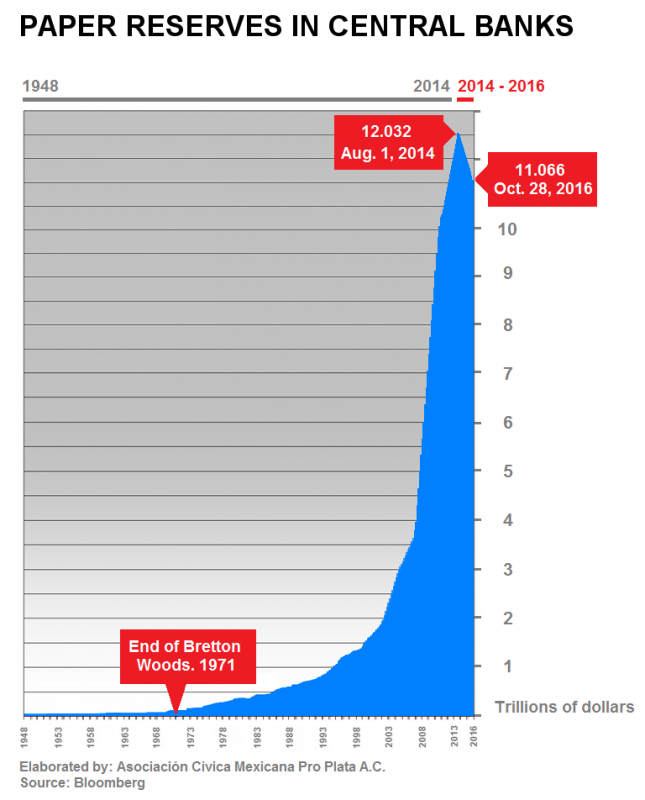

If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…

The U.S. will never go back on a gold standard. The notion that a U.S. Dollar backed by gold would solve our financial problems is pure folly. Why? Because, if the U.S. Empire didn’t abandon the gold standard in 1971, it would have collapsed decades ago. Unfortunately, some of the top experts in the precious metals community continue to suggest that revaluing gold much higher, to say…. $15,000-$50,000 an ounce, would bring confidence back into the...

Read More »

Read More »

Sound Money and Your Personal Finances

Sound money principles can serve to help grow the economy and restrain government. The political class, however, doesn’t particularly want to restrain itself. Washington, D.C. is addicted to the easy money policies that have enabled $20 trillion in national debt accumulation and tens of trillions more in unfunded liabilities.

Read More »

Read More »

Pension Funds Need Gold before It’s Too Late

Tens of millions of Americans and their employers pour money into pension plans each month, counting on those funds to grow and to be there when needed at retirement. But a time bomb awaits. The bulk of U.S. pension funds are dangerously underfunded, and the assets are often invested in securities that have bleak prospects for providing income that keeps up with a general decline in purchasing power.

Read More »

Read More »

How Trump Can Bring Outside-the-Box Thinking to Bear on the Fed

President-elect Donald Trump will soon have the opportunity to put his stamp on the Federal Reserve. And that is making the elite body of central bankers nervous. On the campaign trail, Trump harangued Fed chair Janet Yellen for pumping up financial markets with cheap money – accusing the Obama appointee of being politically motivated. Trump also called for the Federal Reserve to be audited.

Read More »

Read More »

We Should Take Our Cues From Markets – Not Politicians

I grew up a block away from the 7-train, where I’d take a short ride from the 90th Street station to the Willets Point–Shea Stadium station to watch my favorite team, the New York Mets. Sitting in the stands as a young child, I learned quickly that there were a number of ways to obtain and interpret information. I could watch the umpire and immediately have known whether Al Leiter threw a strike or a ball. Another option was to watch the scoreboard...

Read More »

Read More »

Don’t Expect a Return to a Gold Standard Any Time Soon

Despite trillions of paper currency units poured into the world economies since the start of the financial crisis, there has been no recovery, in fact, all legitimate indicators have shown worsening conditions except, of course, for the pocketbooks of the politically – connected financial elites.

Read More »

Read More »

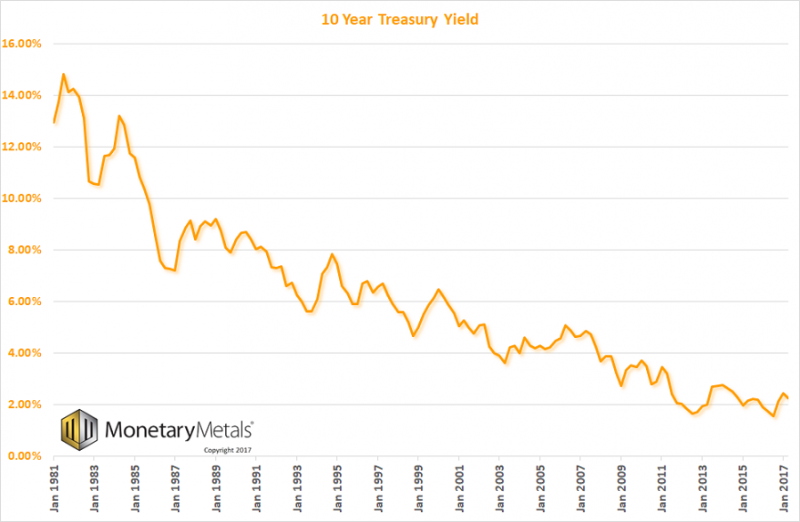

Real vs. Nominal Interest Rates

What is the real interest rate? It is the nominal rate minus the inflation rate. This is a problematic idea. Let’s drill deeper into what they mean by inflation. You can’t add apples and oranges, or so the old expression claims. However, economists insist that you can average the prices of apples, oranges, oil, rent, and a ski trip at St. Moritz. This is despite problems that prevent them from agreeing on what should be included.

Read More »

Read More »

Alan “Bubbles” Greenspan Returns to Gold

Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit.

Read More »

Read More »