Category Archive: 6a.) Gold Standard

Virginia Ends All Taxes on Purchases of Gold and Silver

(Richmond, Virginia - April 12, 2022) - By signing sound money legislation last night, Virginia Governor Glenn Youngkin has ended Virginia’s discriminatory practice of assessing sales taxes on smaller purchases of gold, silver, platinum, and palladium bullion and coins.

Read More »

Read More »

Should Investors Fear Fed Rate Hikes?

The prospect of Federal Reserve rate hikes continues to rattle Wall Street and cloud the outlook for precious metals. On Wednesday, the central bank strongly signaled it will raise its benchmark Fed funds rate for the first time in three years – likely at its March policy meeting.

Read More »

Read More »

Oklahoma to Consider Holding Gold and Silver, Removing Income Taxes

(Oklahoma City, Oklahoma -- January 20, 2022) - An Oklahoma state representative introduced legislation today that would enable the State Treasurer to protect Sooner State funds from inflation and financial risk by holding physical gold and silver.

Read More »

Read More »

Pro-Sound Money Lawmaker Wants To End Income Taxes on Gold and Silver in Oklahoma

(Oklahoma City, Oklahoma, USA – January 20, 2022) - Oklahoma ended sales taxes on purchases of precious metals long ago, but now a representative from Broken Arrow wants to eliminate yet another tax on on gold and silver transactions.

Introduced by Sen. Nathan Dahm, Senate Bill 1480 would end capital gain transactions on the exchange of gold and silver.

Read More »

Read More »

Will 2022 Be “The Year of Sound Money” in the States?

Last year was a good year for state-level sound money legislation across the United States. 2022 could be even better. Building on the success enjoyed by sound money advocates in Arkansas and Ohio last year, more than a half dozen states are now considering legislation that rolls back discriminatory taxes and regulations on the sale, use, and purchase of gold and silver.

Read More »

Read More »

Alabama to Consider Extending Sales Tax Exemption on Sound Money

(Birmingham, AL, USA – January 10, 2022) – Alabama currently exempts precious metals from state sales tax, however this exemption is set to expire in 2022. A senator in the Yellowhammer State hopes to extend this popular exemption.

Read More »

Read More »

U.S. Treasury Refuses to Answer Questions about Disposition of Its Own Gold

Recent correspondence between U.S. Rep. Alex X. Mooney, R-West Virginia, and the U.S. Treasury Department suggests that the department has given the Federal Reserve and International Monetary Fund unfettered control of a portion of U.S. gold reserves.

Read More »

Read More »

Fed’s Stunning Inflation Abdication; Gold Gearing Up

When will precious metals markets finally make their move? It’s a question that has frustrated many investors in 2021. Gold and silver prices have remained stubbornly rangebound for the past several months.

There is no way to know exactly when this consolidation period will end. Long-term investors would be wise to hold their core positions regardless of market conditions (and grow them when feasible).

Read More »

Read More »

The Inflation Tax Is Bearing Down on Investors Too

The post-COVID inflation surge that was supposed to be “transitory” is looking a lot more permanent.On Friday, the Bureau of Economic Analysis Friday released data on Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred inflation gauge.

Read More »

Read More »

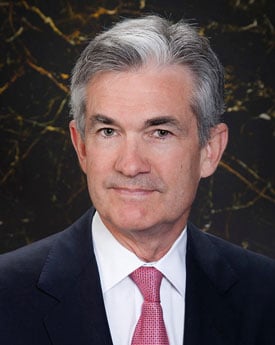

The Fed’s ‘Dangerous’ Path Toward Debt Monetization

A prominent U.S. Senator just called the head of the nation’s central bank “dangerous.” Unfortunately, the true dangers of U.S. monetary and fiscal policy were lost on everyone involved.

On Tuesday, Federal Reserve Chairman Jerome Powell testified before the Senate banking committee, where Senator Elizabeth Warren led the left wing of the Democratic Party’s attack.

Read More »

Read More »

Moving from Gold-Redeemable to Irredeemable Currency

When we saw the following comment from a prominent otherwise-free-marketer, we knew it was time to write this article. “…the value of the Fed's "liabilities"(which are so in name only) [scare quotes and parenthetic comment in original] bears only a very loose connection to the value of its assets.”

Read More »

Read More »

Biden’s Dangerous Inflation Denials

President Joe Biden is in denial about inflation. This week he superficially addressed the problem by admitting the obvious – that prices have been rising rapidly this year – while denying that the inflation surge represents anything out of the ordinary.

Read More »

Read More »

Ohio House Votes to Fix Blunder, Remove Sales Tax on Sound Money

The Ohio House of Representatives just approved a bill which helps Buckeye State citizens protect themselves from the loss of monetary purchasing power caused by federal money printing. Introduced by Representative Oeslager, House Bill 110 includes a provision to eliminate the sales and use tax on purchases of gold, silver, platinum, and palladium coins and bullion in Ohio.

Read More »

Read More »

Stefan Gleason: The Big Inflation Scam

Tom welcomes Stefan Gleason, president of Money Metals Exchange, to the show. The idea of sound money is something that holds it’s value over time in contrast to fiat currencies. The market has chosen gold and silver over thousands of years as the money that sustains and preserves purchasing power.

Read More »

Read More »

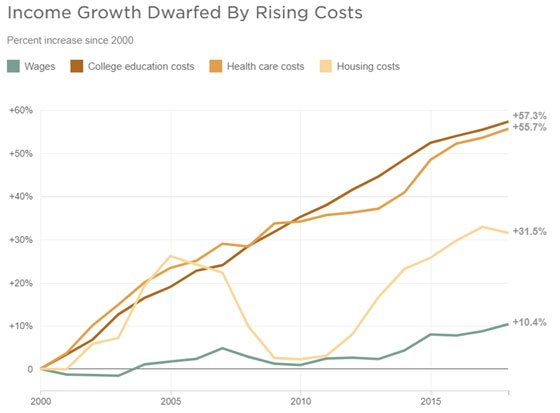

Rising Debt Means a Weaker Dollar

Americans appear to be growing more concerned about the skyrocketing national debt level – officially $28.1 trillion and counting. The Peter G. Peterson Foundation’s monthly Fiscal Confidence Index recently shed five points, dropping to a level of 47, in the wake of the Biden Administration’s latest $2 trillion stimulus package.

Read More »

Read More »

Prices Are Set to Soar

"Government,” observed the great Austrian economist Ludwig von Mises, “is the only institution that can take a valuable commodity like paper and make it worthless by applying ink.” Mises was describing the curse of inflation, the process whereby government expands a nation’s money supply and thereby erodes the value of each monetary unit—dollar, peso, pound, franc, or whatever.

Read More »

Read More »

A Georgia Gold Rush Story: The Rise and Fall of America’s First Private Gold-Coin Mint

(Note: This article is dedicated to the memory of Carl Watner, who died on December 8, 2020 at the age of 72. A long-time defender of individual liberty and free markets, his 1976 article in Reason magazine, “California Gold, 1849-65,” helped renew awareness and appreciation for private money in American history).

Read More »

Read More »

Fed Recommits to Misleading the Public About Inflation

Did the Federal Reserve just usher in the next phase of the U.S. dollar’s decline? On Wednesday, the central bank recommitted to leaving its benchmark interest rate near zero for the foreseeable future. Fed officials also vowed to keep pumping cash into financial markets.

Read More »

Read More »

Media Celebrates after Trump’s Pro-Gold Fed Nominee Gets Blocked

It was only after he entered politics that President Donald Trump began to fully grasp the bias, dishonesty, and fakeness that runs throughout the so-called mainstream media.

Read More »

Read More »

A New World Monetary Order Is Coming

The global coronavirus pandemic has accelerated several troubling trends already in force. Among them are exponential debt growth, rising dependency on government, and scaled-up central bank interventions into markets and the economy.

Central bankers now appear poised to embark on their biggest power play ever.

Read More »

Read More »