Category Archive: 6b.) Bawerk

Macht oder ökonomisches Gesetz? | Eugen von Böhm-Bawerk | Political Science | Audiobook | 3/3

Audible Summer Promo: https://amzn.to/2B8RhYz It helps us get our channel up and running with ease: https://bit.ly/TubePricelessAudiobooks What jobs can I do working from home?

http://bit.ly/3FREEAUDIOBOOKS

http://bit.ly/Grow_Into_Partner

http://bit.ly/Litres

http://bit.ly/Enjoy2free

Search Books: http://bit.ly/BooksSearch

AbeBooks: http://bit.ly/OLD_BOOKS

As a member of the partnership program, I earn from purchases that meet the requirements....

Read More »

Read More »

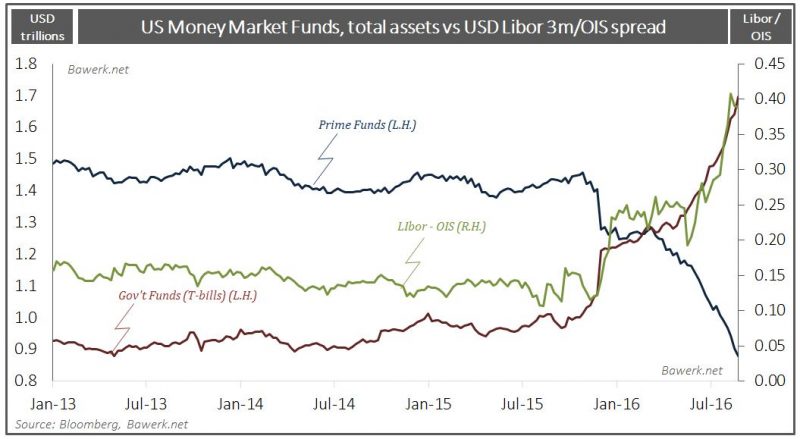

Necessity is the Mother of Invention – Retirees Desperate Reach for Yield

Ben Bernanke’s creativity inspired a generation of economists and central bankers. QE, ZIRP and NIRP established a new class of economics that is mathematically sound but practically disastrous. Billions of dollars were transferred from savers to investors to boost the economy, but the wizards of quant forgot that something has to give. In this case, it was the formation of a pension crisis that threatens the golden years of millions of retirees...

Read More »

Read More »

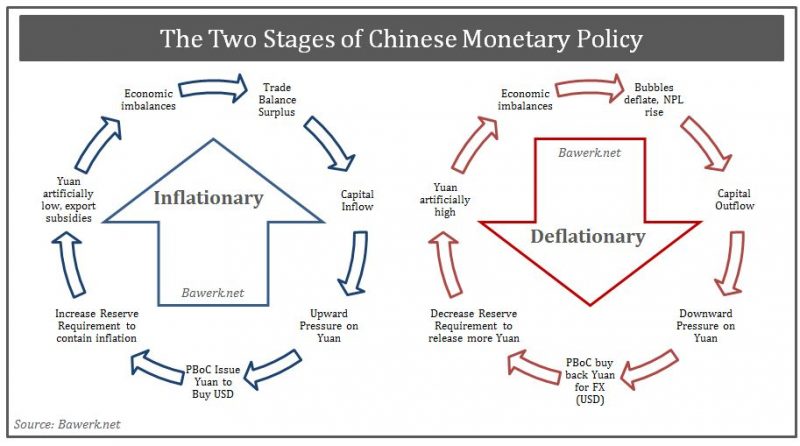

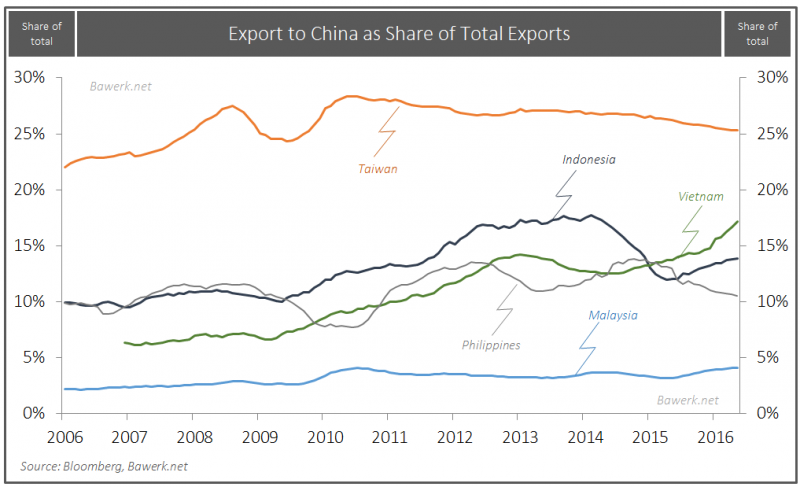

Chinese Philosopher Kings, Losing their Yuan FX Religion?

It took a while, but the world are slowly coming to grips with the simple fact that the red-suzerains in Beijing are not the infallible leaders en route to a new superior economic model as they thought they were. All the craze that emanated from the spurious work of Joshua Cooper Ramo, which eventually led to works like “How China’s Authoritarian Model Will Dominate the Twenty-First Century,” are slowly catching up to reality.

Read More »

Read More »

How to Invest in the New World Order

In our latest Toward a New World Order, Part III we ended by promising to look closer at investment implications from the political and economic shift we currently find ourselves in; and that story must begin with the dollar.

Read More »

Read More »

Toward A New World Order, part III

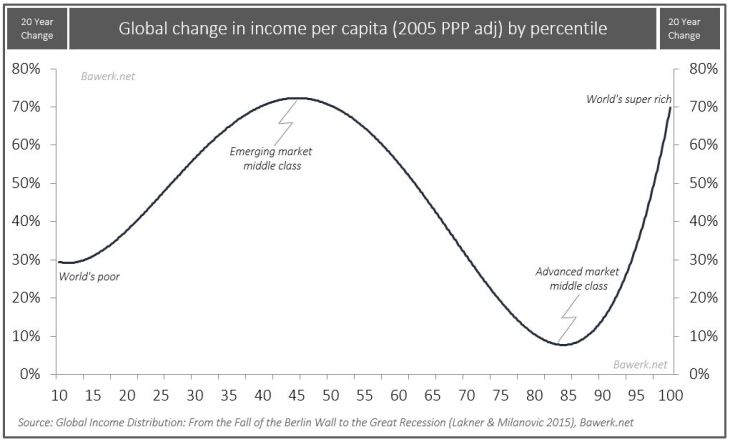

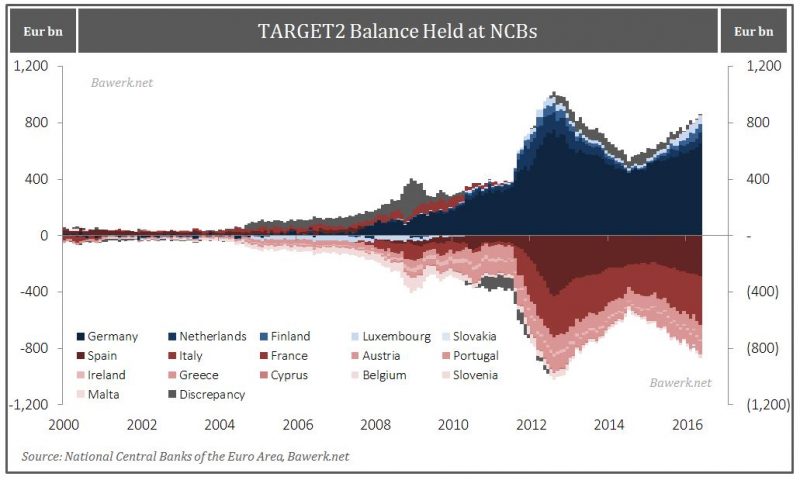

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

Toward a New World Order, Part II

One of the most widespread misconceptions in the realm of politics is the notion of a left-right axis. This has been used over and over to explain political outcomes and paint the various factions as polar opposites. For example, in the US the two main parties, the Republicans (right) and Democrats (left), are often portrayed as a fight between good and evil.

Read More »

Read More »

Toward a New World Order?

A Brave New World is coming? Perhaps. We had a recent discussion with a group of people in the hopeless business of doing long term forecasting. This made us think about what the world will look like over the next 20 to 40 years. A pretty thankless task, but the bottom line is without a damn good war, Asia will be the way of the future.

Read More »

Read More »

“Subtle forward guidance”: The marriage between best practice central banking and commodity markets

In the years following the 2008 crash and today, the use of forward guidance from central banking policy makers has become increasingly important. What this nonsense ultimately has translated into is a ridiculous track record in posting upbeat assessments on the economic environment, aimed at trying to fool the marginal investor into believing “there are no need for worry, central bankers have everything under control”.

Read More »

Read More »

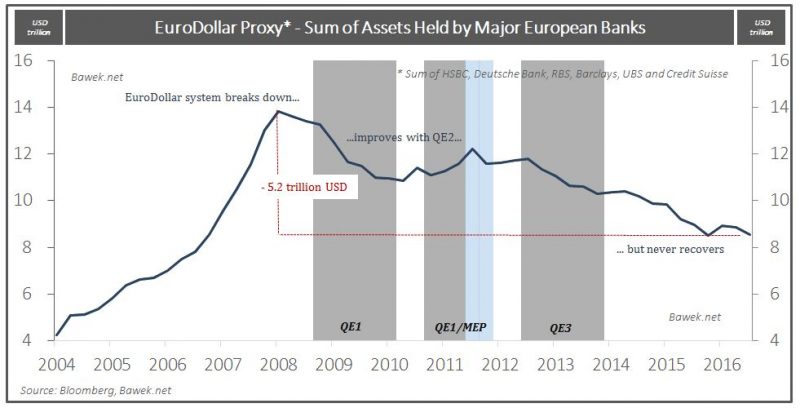

USD ready for a second leg higher – then what?

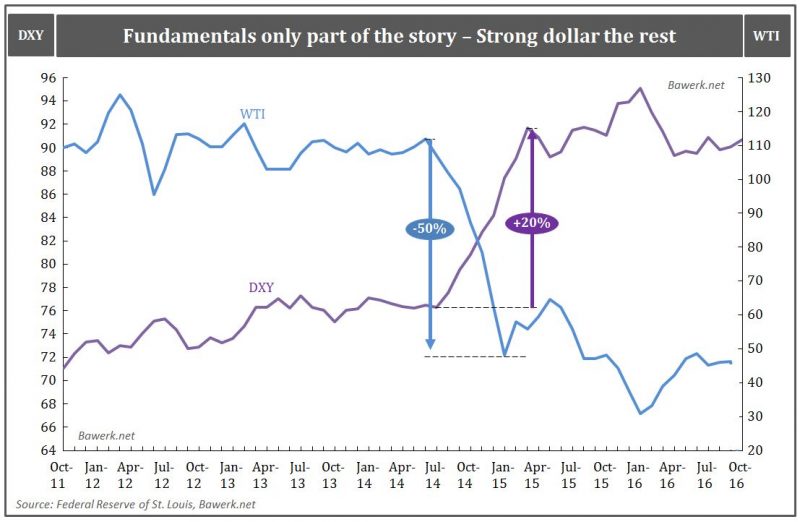

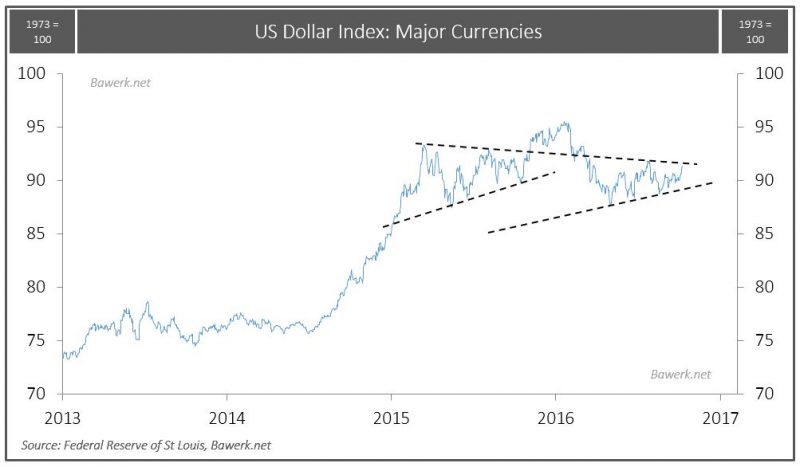

One year ago we showed the following chart to explain the relative strong dollar that was on everyone’s mind at the time. With a second leg higher in the US dollar imminent, this particular chart will be more important than ever. Claims to dollars, such as demand and time deposits, or even more opaque money-like products created by the shadow banking system is just that, a claim or derivative on the final mean of payment, namely base money.

Read More »

Read More »

Do our money managers really believe this will end well?

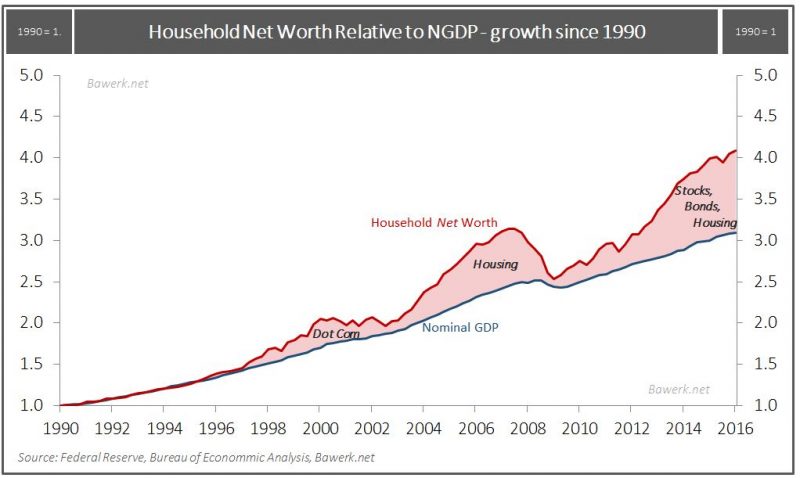

An economic bubble is essentially an economic activity that cannot sustain itself without a continuous influx of new money and credit to bid away real resources from self-funding endeavors. Financial bubbles are obviously closely related as financial...

Read More »

Read More »

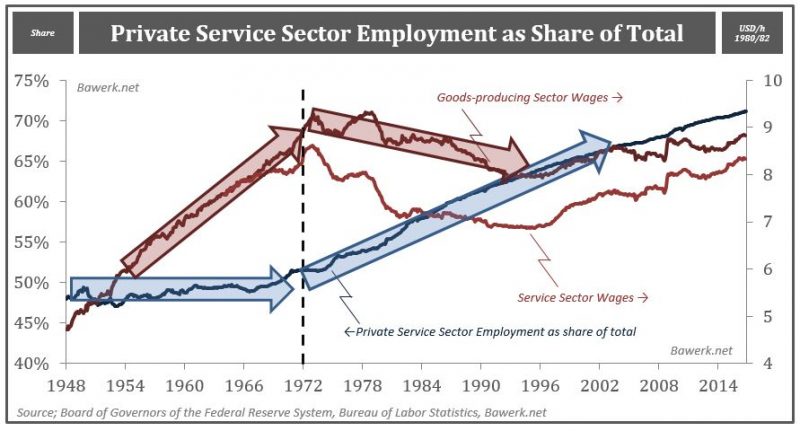

The Road to Fascism in Just Two Charts

Laws of politics have been turned upside down. The Intellectuals Yet Idiots can make no sense of it. The underdog who ‘tell it how it is’ appeal to people while established reasoning does not.

Read More »

Read More »

Labour Productivity, Taxes and Okun’s Law

The great “science” of economics once discovered an empirical relationship between GDP and unemployment that has been dubbed Okun’s Law. It simply states that the unemployment rate rises as GDP contracts, or vice versa, as production shrinks less peo...

Read More »

Read More »

Mission Creep – How the Fed will justify maintaining its excessive balance sheet

FOMC have changed their normalizing strategy several times and we now see the contours of yet another shift. The Federal Reserve was supposed to reduce its elevated balance sheet before moving interest higher as it would be impossible to increase the fed funds rate in the old fashioned way when the market was saturated with trillions of dollars in excess reserves.

Read More »

Read More »

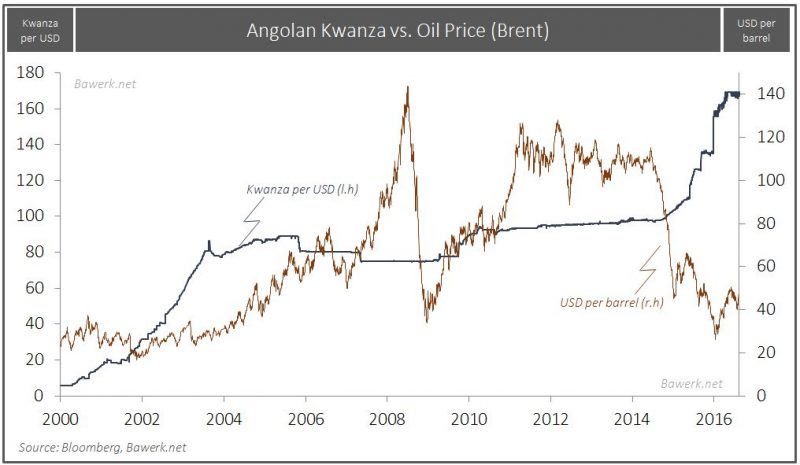

The Dos Santos Succession Saga

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August.

Read More »

Read More »

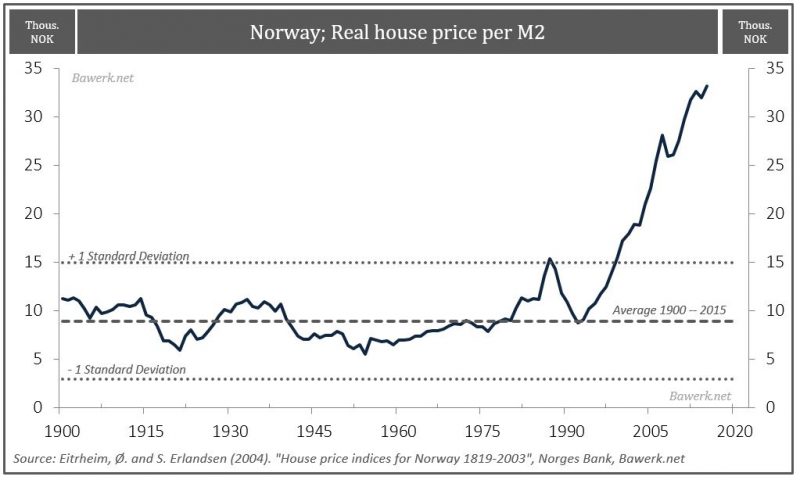

Norway: Towards Stagflation

We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades.

Read More »

Read More »

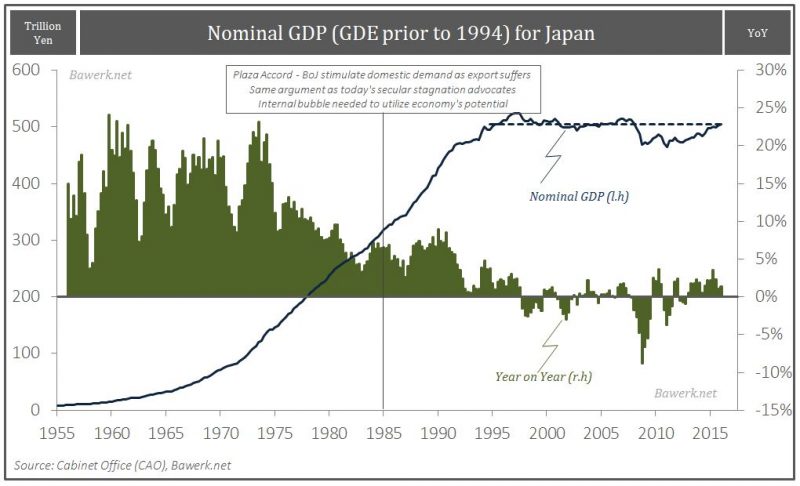

Stupid is What Stupid Does – Secular Stagnation Redux

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries.

Read More »

Read More »

The FOMC Butterfly that Will Ruin the World

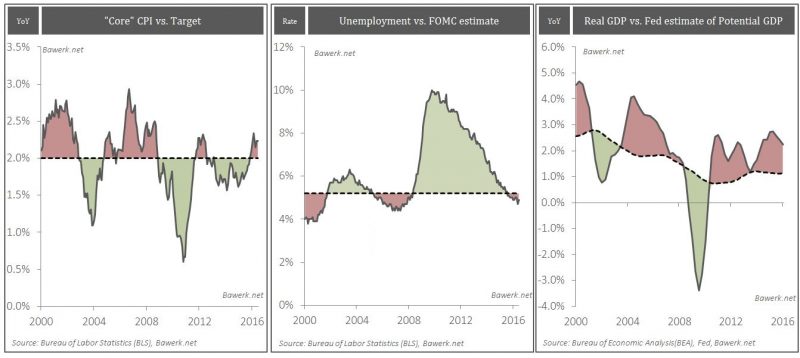

Given the fact that the core CPI is currently over the arbitrarily set 2 per cent target unemployment below what the FOMC regards as full employment and GDP running at a rate far above the Federal Reserve’s own estimates of so-called potential; you would say the Federal Funds rate would be in the vicinity of five per cent.

Read More »

Read More »

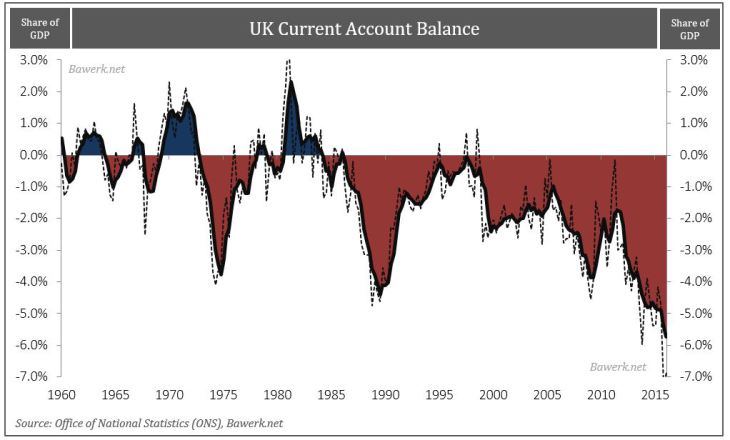

Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience.

Read More »

Read More »

Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized.

Read More »

Read More »

South China Sea: Storm in an Indian Ocean Teacup

With global attention focused on BREXIT calamity, potentially more important questions are being overlooked, and especially in the South China Sea where storms are currently brewing between China and a range of littoral states for strategic control of territorial waters.

Read More »

Read More »