Category Archive: 5) Global Macro

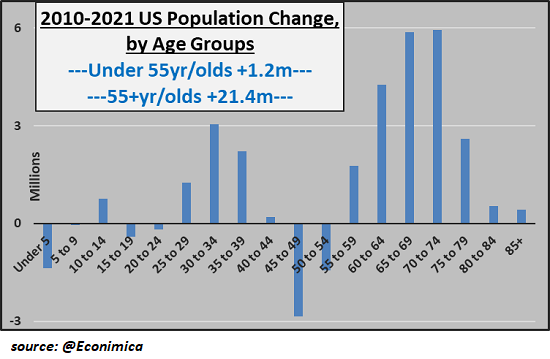

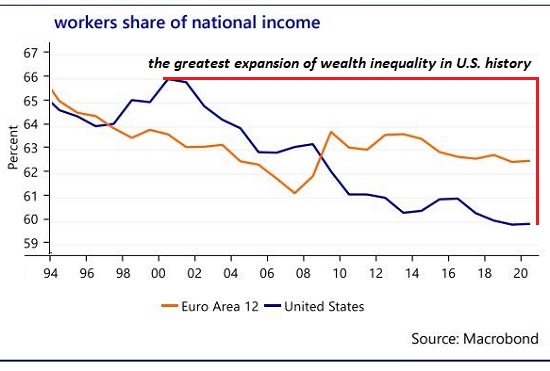

Why the Labor Shortage Isn’t Going Away

It's getting hard to fill toxic low-pay jobs, and that's not going to change. The nature of work and the labor market are changing in ways few discern or perhaps are willing to discern because these changes are disrupting the exploitive system they want to remain unchanged. But refusing to discern change doesn't stop change.

Read More »

Read More »

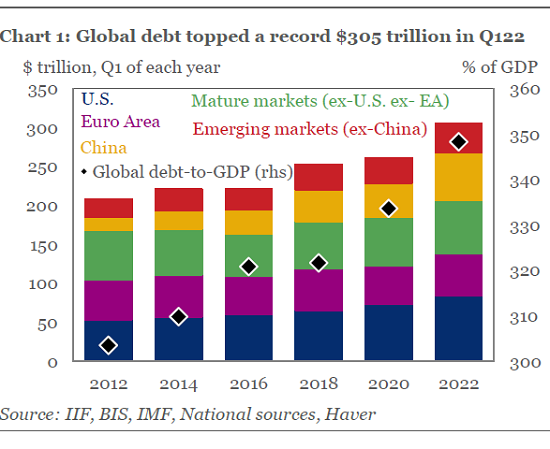

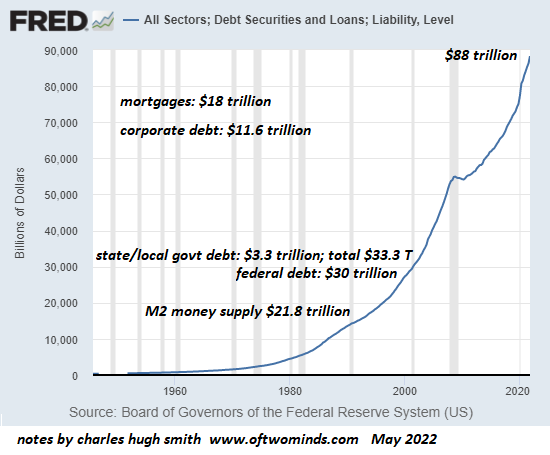

The Real Policy Error Is Expanding Debt and Calling It "Growth"

Waste is not growth, and neither are the unlimited expansion of debt and speculative bubbles. The financial punditry is whipping itself into a frenzy about a Federal Reserve "policy error," which is code for "if the music finally stops, we're doomed!"

Read More »

Read More »

Ask Bob: Is Maxing Out Your 401k A Good Investment Decision?

Since the beginning of 401(k) plans in 1978, people have considered it to be the quintessential retirement plan—you get to save money before taxes and in most cases, the company puts money into your account, too. What could be better than that? But now, 44 years later, it’s time to take a broader look at 401(k)s that considers taxes on 401(k) distributions.

Read More »

Read More »

The Only Real Solution Is Default

The destruction of 'phantom wealth' via default has always been the only way to clear the financial system of unpayable debt burdens and extremes of rentier / wealth dominance. The notion that the world could always borrow more money as long as interest rates were near-zero was never sustainable.

Read More »

Read More »

Weekly Market Pulse: There Is No Certainty In Investing

Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record.

Read More »

Read More »

4 Social Security Changes to Expect in 2023

Looking into a crystal ball and prognosticating the future is always a risky endeavor, but when it comes to Social Security and the year 2023 there are 4 things that have a high probability of happening.

Read More »

Read More »

US Dollar Strength: “Unintended Consequences” Or “The Empire Strikes Back”?

How unintended can these consequences be? My guess: not very. A great many people got the U.S. dollar trade wrong. The conventional view held that "printing money", i.e. expanding the supply of money, would automatically devalue the currency. It isn't quite so simple, it seems.

Read More »

Read More »

Calm Before the Tempest?

Is it beyond conception that the core actually strengthens for a length of time before the unraveling reaches it?Let's start by stipulating the obvious: no one knows the future, and most of the guesses--oops, I mean forecasts--will be wrong. Arguing about the forecasts now won't make any difference as to which ones are correct and which ones are wrong.

Read More »

Read More »

Why Nations Fail

The irony is that the suppression of dissent is the suppression of competing ideas that generate systemic stability via rapid adaptation. Nations that appear stable may fail once they're under pressure.

Read More »

Read More »

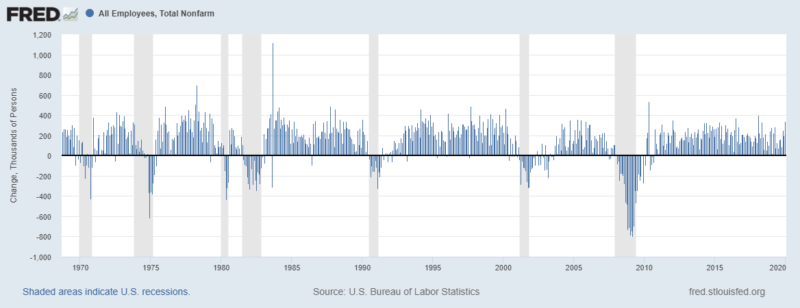

Weekly Market Pulse: A Most Unusual Economy

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy.

Read More »

Read More »

You Know What Would Be Really Irritating? A Crazy Rally to New Highs

It would be very irritating to have a rally suck in all the bears salivating for a crash from a bear-market rally peak and then decimate the shorts with a rally that soars rather than collapses to new lows. As a contrarian, I'm always squinting at the consensus and wondering if it is really that easy to be right.

Read More »

Read More »

Wasting Money on Medicare

How would you like to waste a lot of the money you spend on Medicare coverage and miss a bunch of the benefits Medicare provides? Crazy question. But that’s exactly what’s happening to millions of Medicare beneficiaries. In October 2021, the insurance website MedicareAdvantage.com published the results of its most recent survey of Medicare beneficiaries.

Read More »

Read More »

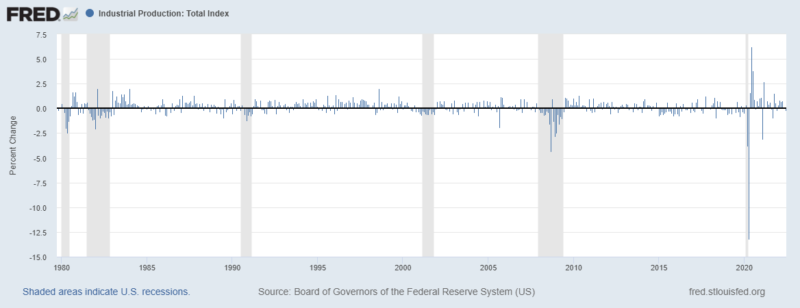

The One Solution to All Our Problems

Pick one, America: national security of the essential material foundation of everything, the industrial base, or "global markets," maximizing greed / corporate profits.Sorry about the clickbait title.

Read More »

Read More »

Weekly Market Pulse: Things That Need To Happen

Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view.

Read More »

Read More »

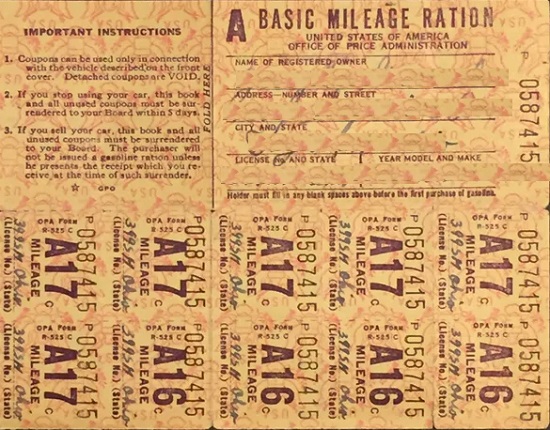

The Most Valuable Form of Money Nobody’s Seen–Yet

What is "money"? "Money" is a claim on the essentials of life. Ration cards are claims on essentials.Many people expect "money" will soon be tied to commodities. Agreed. It's called a ration cardthat grants the holder the right to buy a specific quantity of essential goods at a specified price.

Read More »

Read More »

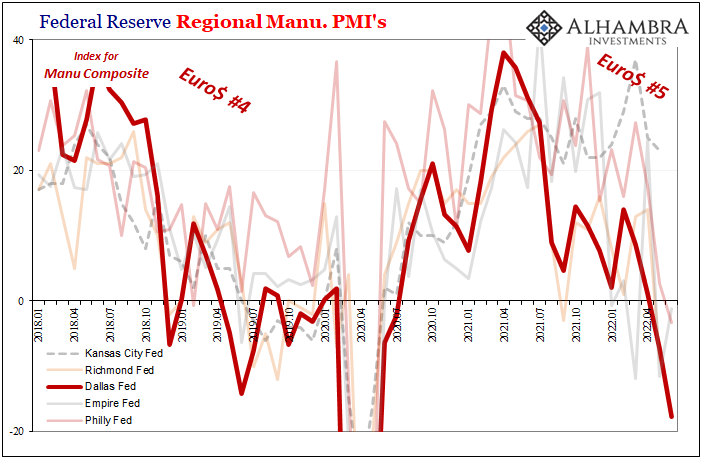

Demand Down, Supply Down, Ugly Up

Well, that was a mess. The Richmond Fed’s Manufacturing Survey was at first released before being taken back. Initially reported as a plunge in the headline number, it was quickly scrapped once the statisticians remembered they had just discontinued their average workweek component – but had kept a zero in its place when tallying the overall PMI.

Read More »

Read More »

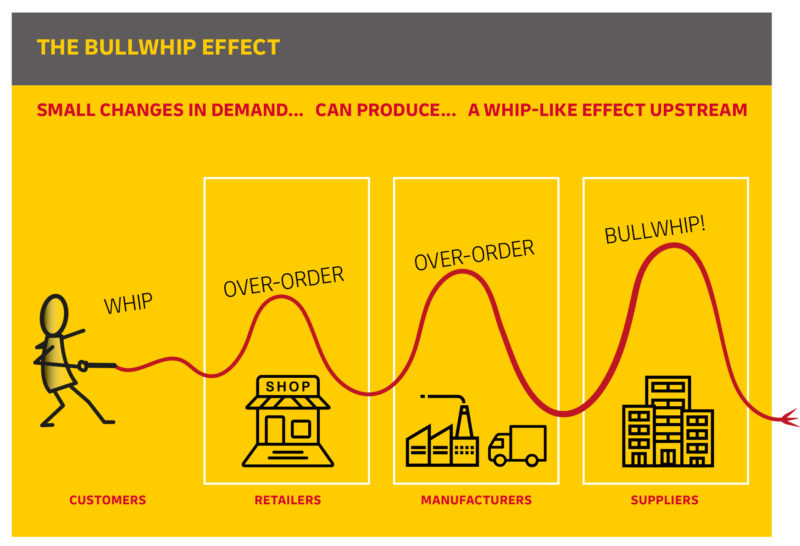

Getting Whipped Will Really Hurt

The Federal Reserve’s various branches don’t just do manufacturing surveys anymore. This is a modern economy, after all, meaning industry isn’t the same top dog as what it used to be. While still important, and still able to tear down even the global-iest synchronized of growth-y, services are the big macro enchilada.

Read More »

Read More »

Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed.

Read More »

Read More »

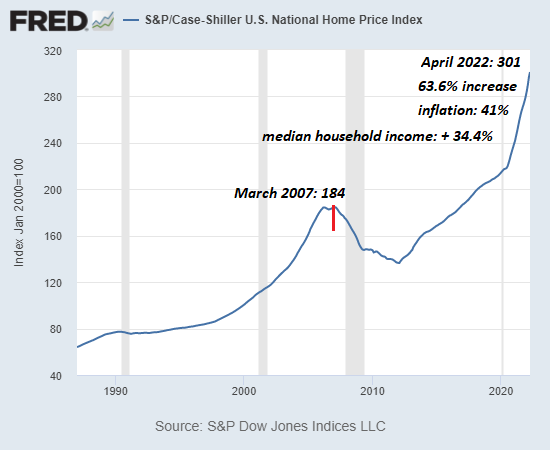

Why the Housing Bubble Bust Is Baked In

Putting this all together, it's clear that the source of the current housing bubble is the explosion of financial speculation fueled by central bank policies. Those benefiting from speculative bubbles have powerful incentives to deny the bubble can bust.

Read More »

Read More »

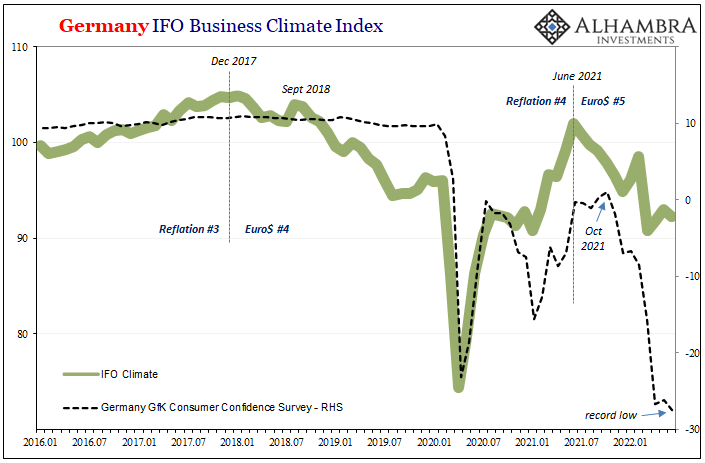

Eurodollar Futures Interpretation Is Everywhere

Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation.

Read More »

Read More »