Category Archive: 5) Global Macro

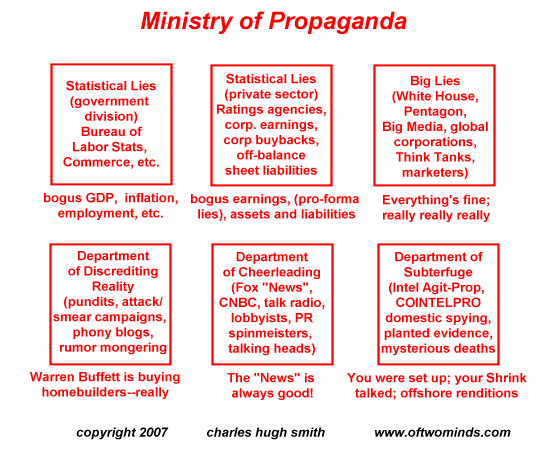

Make Sure You Download the Latest Ministry of Propaganda Updates

While it's fun to sort all the propaganda into various boxes, we would do well to look for what all the marketers / MoP players seek to mystify. It's time once again to check for Ministry of Propaganda updates, which like Windows and iOS is constantly being updated to counter new threats and enhance the user experience (heh).

Read More »

Read More »

Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

From Silver Blaze by Arthur Conan Doyle, 1892

Read More »

Read More »

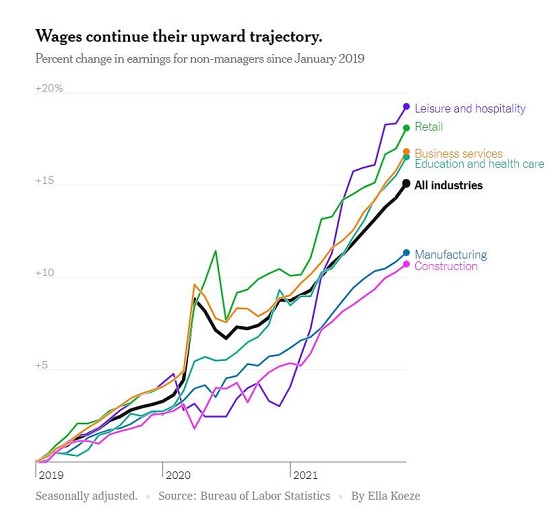

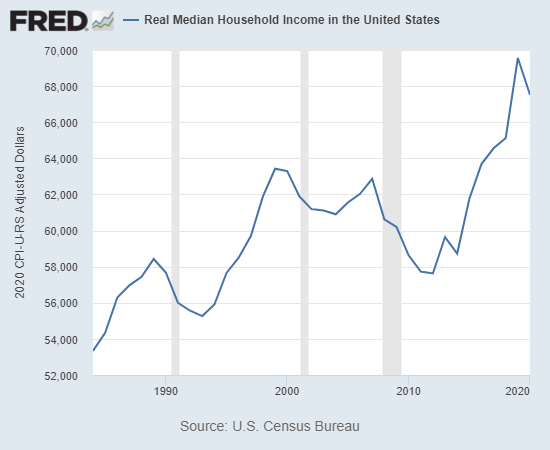

What’s Worse Than Inflation? Depression + Inflation

If "markets" controlled by the rich are allowed to distribute essentials, the result will be civil disorder and the overthrow of regimes. What's worse than inflation? Depression + Inflation. And that's where we're heading. As I explained yesterday in The Fed Can't Stop Supply-Side Inflation, central banks are trying to reduce inflation by crushing demand.

Read More »

Read More »

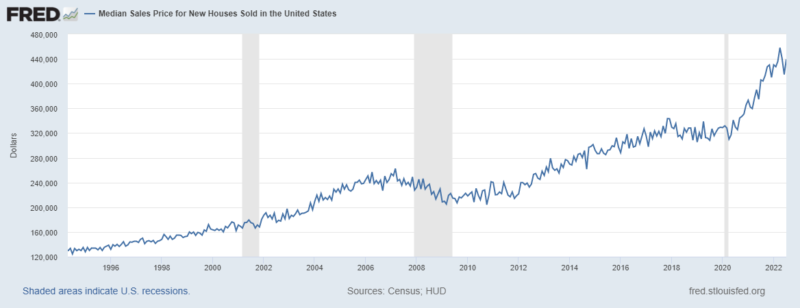

Rate Hikes Are Working

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%.

Read More »

Read More »

The Fed Can’t Stop Supply-Side Inflation

The Fed and other central banks have zero control of supply-driven inflation, period. America's financial punditry is bewitched by four fatal fantasies: 1. Inflation is demand-driven. If the Federal Reserve (or other central banks) reduce demand with monetary tools like raising interest rates, inflation will cool. 2. Substitution of high-cost goods with lower-cost goods reduces inflation, and substitution is infinite: there's always cheaper...

Read More »

Read More »

The Real Story of America Abandoning the Gold Standard

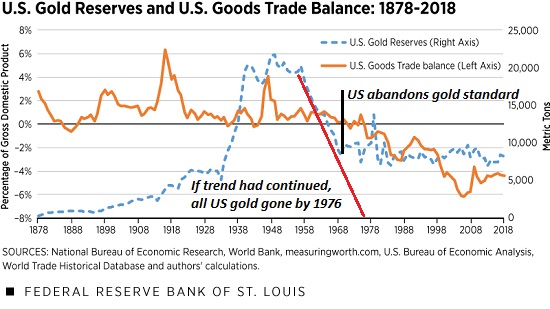

Even currencies maintaining convertibility to gold are still subject to bond yields, interest rates, trade and capital flows. It's widely held that all of our financial woes are the result of abandoning the discipline of the gold standard in 1971. The premise here is that if the U.S. had maintained the gold standard, the excesses of the fiat currencies regime could not have arisen.

Read More »

Read More »

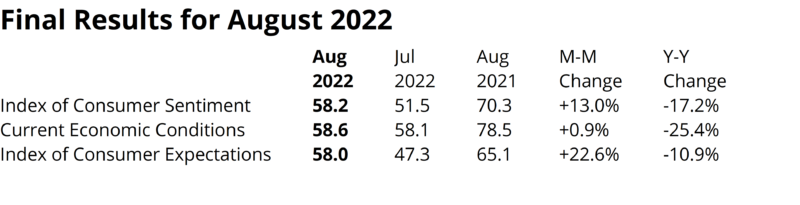

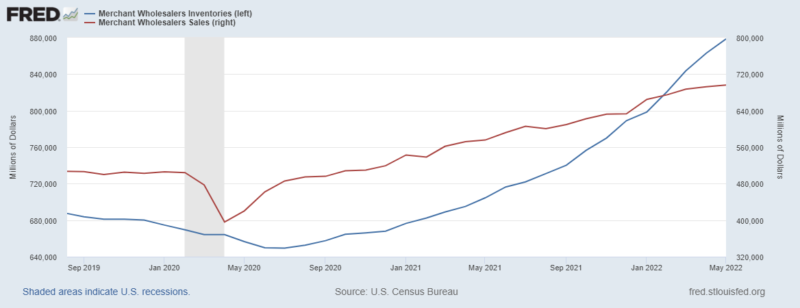

The Economy Improved In July

The Chicago Fed National Activity Index rose to 0.27 in July with all four categories of indicators rising. The 3 month average was unchanged at -0.09. That indicates growth is slightly below trend and is far from the recession threshold of -0.7.

Read More »

Read More »

Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine.

Read More »

Read More »

Tips for Buying a Medicare Supplement Policy

The clock is ticking and it gets louder the closer you get to the magic age of 65. That’s when you sign up for Medicare. But there’s more than one way to receive Medicare coverage. There are Medicare Advantage plans, sometimes referred to as all-in-one plans, because they provide medical coverage and can also provide benefits for vision, dental, hearing, and prescriptions.

Read More »

Read More »

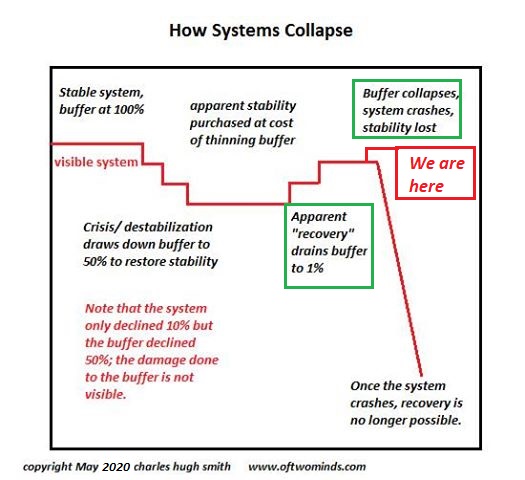

A Tale of Two Recessions: One Excellent, One Tumultuous

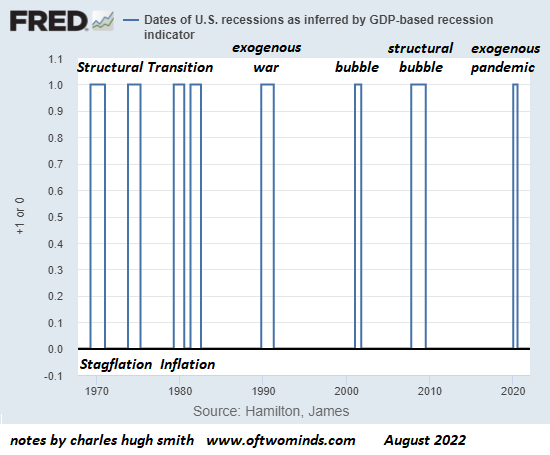

Events may show that there are no winners, only survivors and those who failed to adapt.Some recessions are brief, necessary cleansings in which extremes of leverage and speculation are unwound via painful defaults, reductions of risk and bear markets. Some are reactions to exogenous shocks such as war or pandemic.

Read More »

Read More »

A Most Peculiar Recession

So what are conventional pundits missing today? I would start with three dynamics. Only old people experienced real recessions--those in 1973-74 and 1980-82. Recessions since then have been shorter and less systemic. In the good old days, a recession laid waste to entire industries which never recovered their previous employment.

Read More »

Read More »

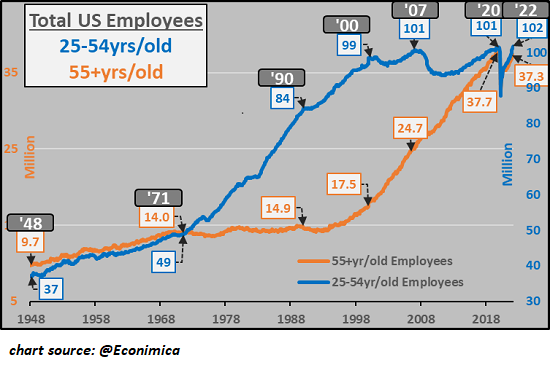

Are Older Workers Propping Up the U.S. Economy?

Are 55 and older workers propping up the U.S. economy? The data is rather persuasive that the answer is yes.The chart of U.S. employment ages 25 to 54 years of age and 55 and older reveals a startling change.There are now 20 million more 55+ employed than there were in 2000, an equivalent of the entire workforce of Spain.

Read More »

Read More »

Another Historic Social Security Cost of Living Increase is on the Way

It’s almost time for the Social Security Administration to break out pencil and calculator to find out how much more it costs to live this year than it did last, and then decide how much of a raise Social Security beneficiaries will get in 2023. For 2022, the Social Security Cost of Living Adjustment (COLA) was 5.9%, the largest increase since 1982.

Read More »

Read More »

Can We "Export Inflation?" Yes We Can, Yes We Are

A strong currency exports inflation to those nations which do not issue the currency. Though it's difficult to be confident of anything in the current flux, I am pretty confident of three things: 1) price is set on the margins 2) currencies are the foundation of every economy 3) the financial forecasts issued to calm the public do not reflect operative geopolitical goals.

Read More »

Read More »

How Much of "Inflation" Is the Price Being Jacked Up Under the Excuse of "Inflation"?

The problem for global corporations feasting on "Inflation" profiteering is that the vast majority of consumers can't afford another lavish vacation, overpriced vehicle or specious subscription.

Read More »

Read More »

What Can The Beatles Teach Us about Management?

Own your work. Don't give it away or let others profit at your expense. Leverage it when opportunities arise. What can The Beatles teach us about management?Young readers may wonder why The Beatles still matter 52 years after the band broke up. It's a fair question.

Read More »

Read More »

Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong.

Read More »

Read More »

There Won’t Be Any Winners Because The Status Quo Is Corrupt Everywhere

Systemic corruption on this vast scale optimizes failure and collapse. Debating which nations will "win" as the global economy unravels is a popular but pointless parlor game.Since the status quo in every nation is deeply, profoundly, systemically corrupt, there won't be any "winners," there will only be losers.

Read More »

Read More »

What’s Truly Important? The Global Revaluation Is Accelerating

How much gold will you trade for a few eggs? It depends on how hungry you are. Two ideas will help us understand the rest of this tumultuous decade: core-periphery and the revaluation of what's truly important: systemic adaptability, transparency, accountability, risk, capital and resources.

Read More »

Read More »