Category Archive: 5) Global Macro

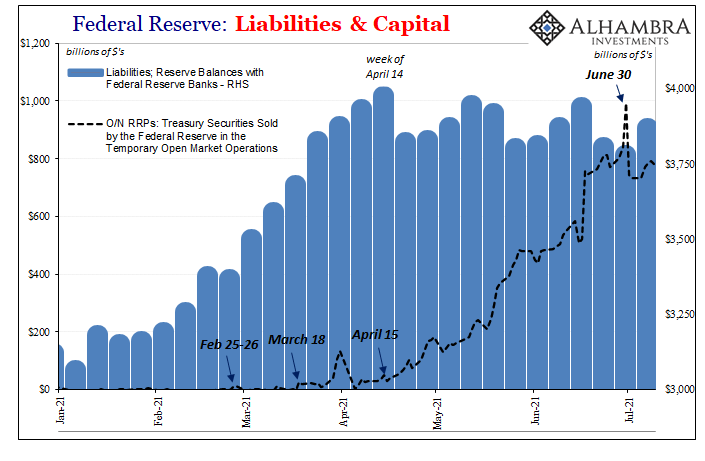

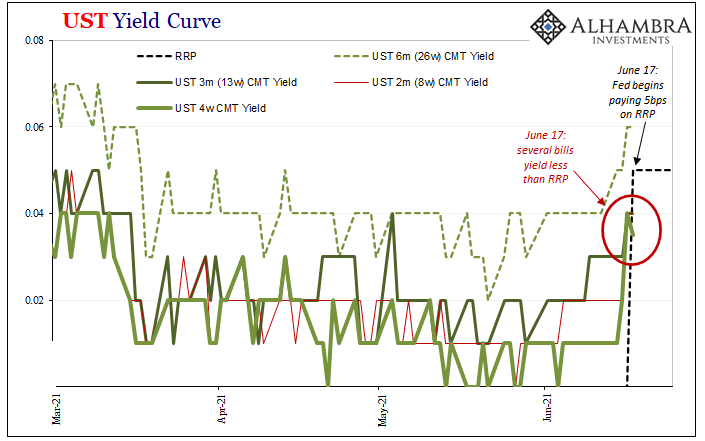

RRP No Collateral Coincidences As Bills Quirk, Too

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big.

Read More »

Read More »

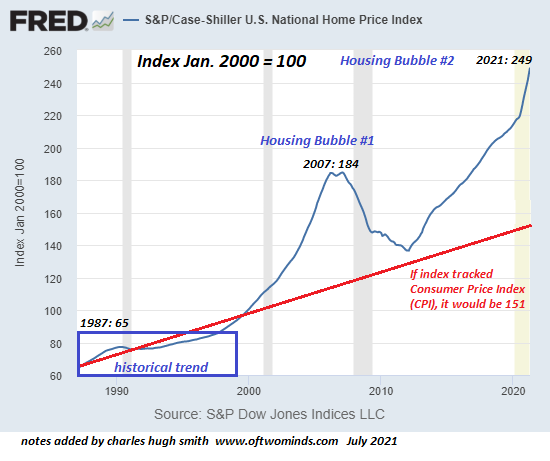

Housing Bubble #2: Ready to Pop?

The expansion of Housing Bubble #2 is clearly visible in these two charts of house valuations, courtesy of the St. Louis Federal Reserve database (FRED). The first is the Case-Shiller Index, which as you recall tracks the price of homes on an "apples to apples" basis, i.e. it tracks price movements for the same house over time. Note that this is an index chart where the index is set at 100 as of January 2000. It is not a chart of median housing...

Read More »

Read More »

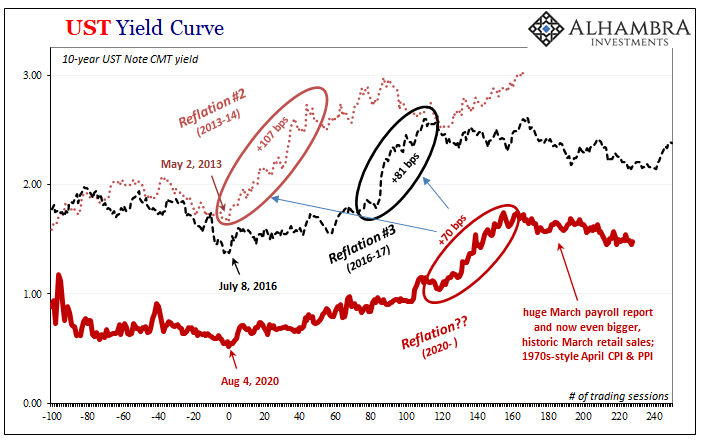

Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change.

Read More »

Read More »

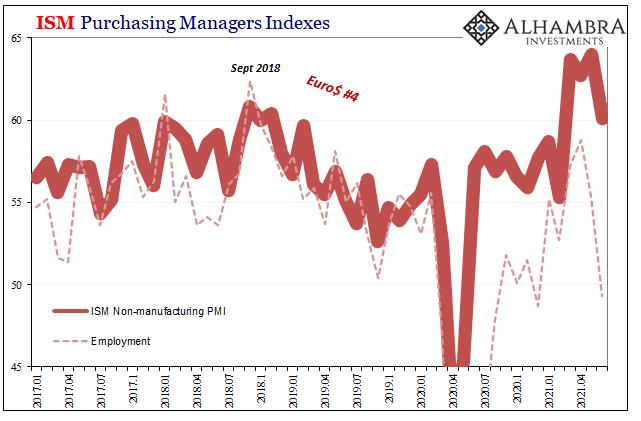

ISM’s Nasty Little Surprise Isn’t Actually A Surprise

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention.

Read More »

Read More »

A Few Things About Reinforced Concrete High-Rise Condos

The second most remarkable thing about the sudden collapse of the Florida condo building was the rush to assure everyone that this was a one-off catastrophe: all the factors fingered as causes were unique to this building, the implication being all other high-rise reinforced concrete condos without the exact same mix of causal factors were not in danger.

Read More »

Read More »

Virus Z: A Thought Experiment

Let's run a thought experiment on a hypothetical virus we'll call Virus Z, a run-of-the-mill respiratory variety not much different from other viruses which are 1) very small; 2) mutate rapidly and 3) infect human cells and modify the cellular machinery to produce more viral particles.

Read More »

Read More »

Anyone Remember That Whole SLR Cliff?

Does anyone remember the SLR “cliff?” Of course you don’t, because in the end it didn’t seem to make any difference. For a few weeks, it was kind of ubiquitous if only in the sense that it was another one of those deep plumbing issues no one seems able to understand (forcing all the “experts” to run to Investopedia in order write something up about it).

Read More »

Read More »

The Systemic Risk No One Sees

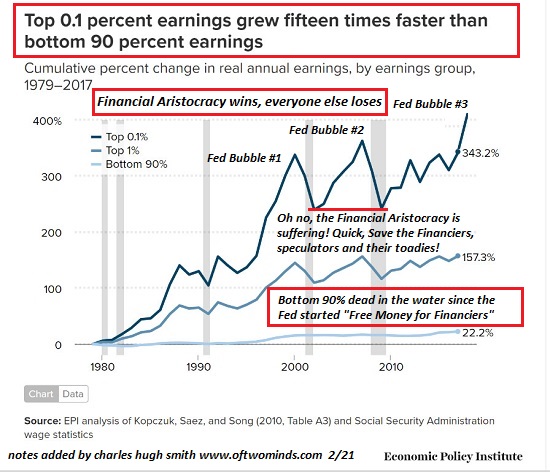

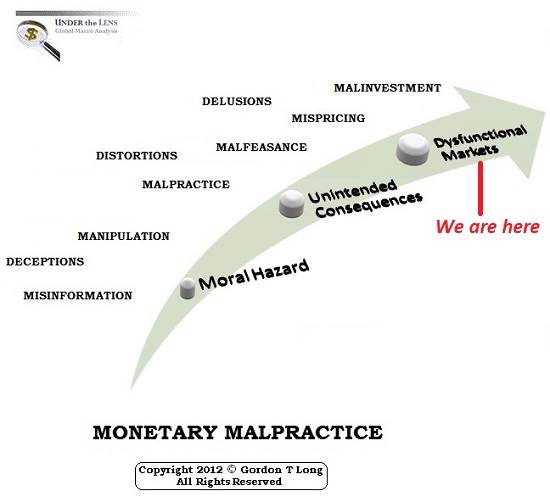

My recent posts have focused on the systemic financial risks created by Federal Reserve policies that have elevated moral hazard (risks can be taken without consequence) and speculation to levels so extreme that they threaten the stability of the entire financial system.

Read More »

Read More »

When Expedient “Saves” Become Permanent, Ruin Is Assured

The belief that the Federal Reserve possesses god-like powers and wisdom would be comical if it wasn't so deeply tragic, for the Fed doesn't even have a plan, much less wisdom. All the Fed has is an incoherent jumble of expedient, panic-driven "saves" it cobbled together in the 2008-2009 Global Financial Meltdown that it had made inevitable.

Read More »

Read More »

A Clear Balance of Global Inflation Factors

Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years.

Read More »

Read More »

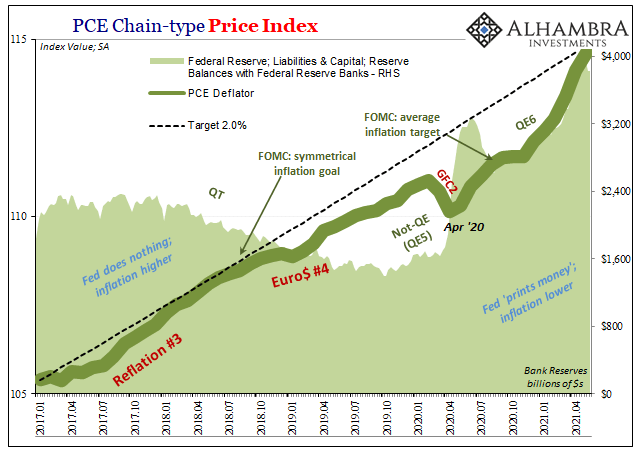

Inflation Isn’t Just The Outlier, The Inflation In It Is, Too

Following the same recent pattern as the BLS and its CPI, the Bureau of Economic Analysis’s (BEA) PCE Deflator ran up hotter in May 2021 than its already high increase during April. The latter’s headline consumer basket rose 3.91% year-over-year, its fastest pace since August 2008.

Read More »

Read More »

America’s Social Order is Unraveling

What kind of nation boasts a record-high stock market and an unraveling social order? Answer: a failed nation, a nation that has substituted artifice for realism for far too long, a nation that now depends on illusory phantoms of capital, prosperity and democracy to prop up a crumbling facade of "wealth" that the populace now understands is largely in the hands of a few families and corporations, most of which pay little to support the citizenry...

Read More »

Read More »

It Always Ends The Same Way: Crisis, Crash, Collapse

One of the most under-appreciated investment insights is courtesy of Mike Tyson: "Everybody has a plan until they get punched in the mouth." At this moment in history, the plan of most market participants is to place their full faith and trust in the status quo's ability to keep asset prices lofting ever higher, essentially forever.

Read More »

Read More »

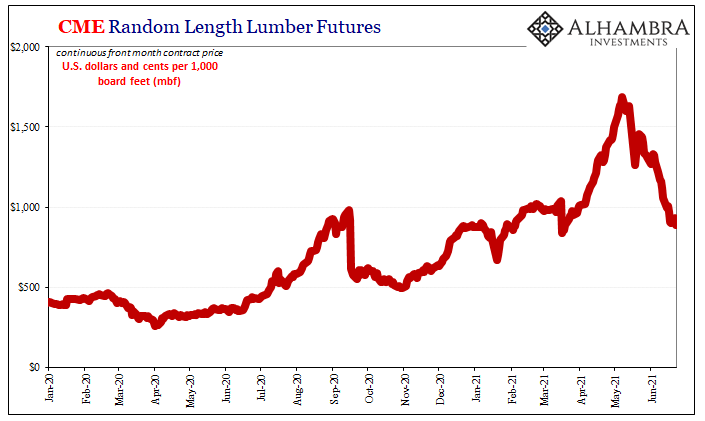

Sure Looks Like Supply Factors

If it walks like a duck and quacks like a duck, then it must be inflationary overheating. Or not? As more time passes and the situation further evolves, the more these recent price deviations conform to the supply shock scenario rather than a truly robust economy showing no signs of slowing down.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Weekly Market Pulse on June 21, where we look at significant things from last week's events with Joe Calhoun.

Read More »

Read More »

Front-Running the Crash

We have a fine-sounding word for running with the herd: momentum. When the herd is running, those who buy what the herd is buying and sell what the herd is selling are trading momentum, which sounds so much more professional and high-brow than the noisy, dusty image of large mammals (and their trading machines) mindlessly running with the herd.

Read More »

Read More »

The FOMC Accidentally Exposes Itself (Reverse Repo-style)

Initially, the dots got all the attention. Though these things are beyond hopeless, the media needs them to write up its account of a more fruitful monetary policy outcome because markets continue to discount that entirely.

Read More »

Read More »

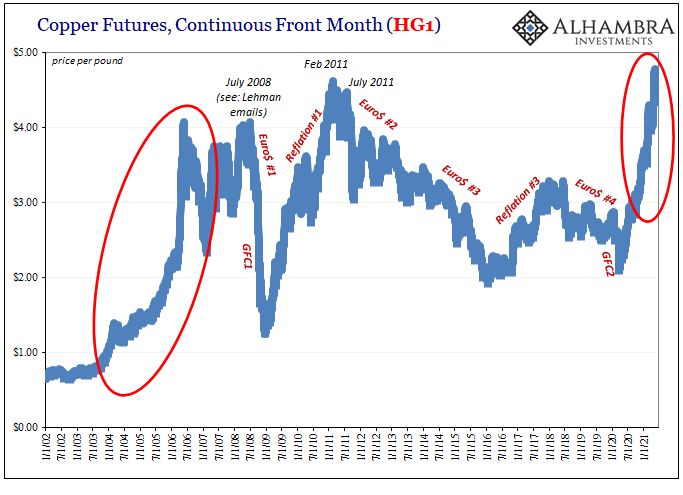

Copper Corroding PPI

Yesterday, lumber. Today, copper. The “doctor” has been in reverse for better than two months now, with trading in the current session pounding the commodity to a new multi-month low. Down almost $0.19 for the day, an unusual and eye-opening loss, this brings the cumulative decline to 9.2% since the peak way back on May 11.

Read More »

Read More »

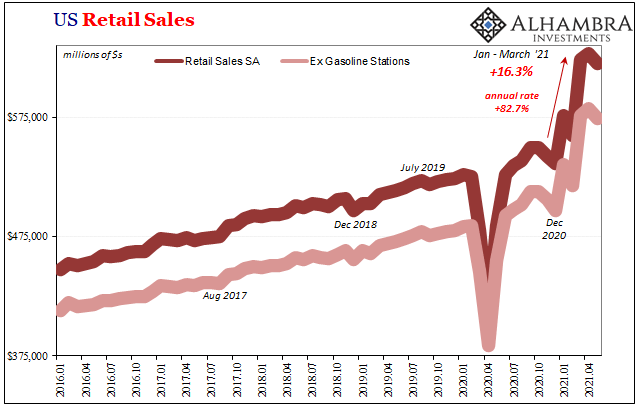

Another Round of Transitory: US Retail Sales & (revised) IP

Same stuff, different month. We can basically reprint both what was described yesterday about supply curves not keeping up with exaggerated demand as well as the past two months of commentary on Retail Sales plus Industrial Production each for the US. Quite on the nose, US demand for goods, anyway, is eroding if still artificially very high.

Read More »

Read More »