Category Archive: 5.) Emerging Markets

Emerging Markets: What has Changed

Malaysia’s central bank said it will allow investors to fully hedge their currency exposure. Egypt declared a 3-month state of emergency after two deadly church attacks. South Africa’s parliamentary no confidence vote has been delayed. Argentina central bank surprised markets with a 150 bp hike to 26.25%. Brazil central bank accelerated the easing cycle with a 100 bp cut in the Selic rate.

Read More »

Read More »

Emerging Markets Preview for the Week Ahead

EM FX ended the week on a soft note, as the weaker than expected US jobs data was unable to derail the dollar’s rally. For the week, the worst performers were ZAR (-3%), TRY (-2.5%), and RUB (-2%). CZK bucked the trend, rising after the CNB exited the cap. This week, higher inflation readings in the US could draw market focus back to Fed tightening, which would be negative for EM.

Read More »

Read More »

Emerging Markets: What has Changed

Reserve Bank of India surprised markets with the start of the tightening cycle. The Czech National Bank (CNB) ended the EUR/CZK floor. Israeli central bank said it won’t hike rates until Q2 2018. Both S&P and Fitch cut South Africa’s rating one notch to sub-investment grade BB+. Moody's put South Africa’s Baa2 rating on review for a downgrade.

Read More »

Read More »

Emerging Market: Preview for the Week Ahead

EM FX was mixed last week. The rebound in oil helped some, such as COP, RUB, and MXN. On the other hand, idiosyncratic political risks weighed on South Africa. This week could pose a challenge to EM, with lots of Fed speakers, FOMC minutes, and US jobs data.

Read More »

Read More »

Emerging Markets: What has Changed

Former Korean President Park was arrested. Hungary’s central bank was more dovish than expected. South African President Zuma finally fired Finance Minister Gordhan. Brazil’s meat industry may have seen the worst of the scandal. Banco de Mexico slowed the pace of tightening.

Read More »

Read More »

India: The next Pakistan?

India’s Rapid Degradation. This is Part XI of a series of articles (the most recent of which is linked here) in which I have provided regular updates on what started as the demonetization of 86% of India’s currency. The story of demonetization and the ensuing developments were merely a vehicle for me to explore Indian institutions, culture and society.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week on a firm note. Indeed, virtually all of EM was up against the dollar last week, led by ZAR and MXN. BRL and PHP were the laggards. It remains to be seen how markets react to the failure to pass the health care reform in the US. Will Trump move on the tax reform? Can the Republicans proceed with its agenda in light of the fissures within the party?

Read More »

Read More »

Emerging Markets: What has Changed

Reserve Bank of India will introduce a new monetary policy tool. Moody’s raised the outlook on Russia’s Ba1 rating from stable to positive. Fitch cut Saudi Arabia’s rating a notch to A+. Moody’s cut the outlook on Turkey’s Ba1 rating from stable to negative. China has temporarily suspended beef imports from Brazil.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX had a stellar week, ending on a strong note in the aftermath of what the market perceived as a dovish Fed hike Wednesday. Every EM currency except ARS was up on the week vs. USD, with the best performers ZAR, TRY, COP, and MXN. There are some risks ahead for EM this week, with many Fed speakers lined up and perhaps willing to push back against the market’s dovish take on the FOMC.

Read More »

Read More »

Emerging Markets: What has Changed

The PBOC increased the rates it charges for OMO and MLF by 10 bp. Indian Prime Minister Modi’s BJP won elections in the state of Uttar Pradesh. Czech central bank broached the possibility of a koruna cap exit later than mid-2017. Kuwait became the first OPEC member to call for extended output cuts.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a firm note despite the strong US jobs data, with the dollar succumbing to some “buy the rumor, sell the fact” price action. We think the dollar should recover as the week begins, as it seems risky to be short/underweight dollars going into the FOMC meeting. With the Fed poised to hike 3 or perhaps 4 times this year, we don't think EM FX can continue to rally the way it has so far this year.

Read More »

Read More »

Emerging Markets: What has Changed

North Korean banks subject to international sanctions have been banned from using Swift. Korea’s Constitutional Court upheld Parliament’s motion to impeach President Park. Singapore eased some property market curbs after a three-year decline in home prices. Egypt partially reversed a cut in bread subsidies. Nigeria’s President Buhari returned to the nation after spending nearly two months in the UK. Moody’s moved its outlook on Argentina’s B3...

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM FX was mostly softer last week, though it ended the week firmer, buoyed by outsized MXN gains Friday. The Fed is sending very strong signals for a March hike, which should keep EM FX on its back foot. However, with the March 15 FOMC embargo coming into effect, there will be no Fed speakers after Kashkari on Monday. Jobs data on Friday will be the highlight, but given the Fed’s signals, we do not think a soft report will derail a hike next...

Read More »

Read More »

Emerging Markets: What has Changed?

A Korean special prosecutor indicted Samsung chief Jay Y. Lee on bribery charges. Korean press is reporting that China has told its travel agents to halt sales of holiday packages to South Korea. Bulgaria’s interim government said it may apply to join the eurozone within a month. South Africa’s main labor union Cosatu accepted a government-proposed minimum wage.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a soft note despite lower US rates. The dollar regained some traction that it lost over the course of the week, when markets pushed out Fed tightening beyond March. Treasury Secretary Mnuchin also seemed to push out fiscal stimulus. There is a full slate of Fed speakers this week, and Wednesday sees the release of the Fed’s Beige book that was prepared for the March 15 FOMC meeting.

Read More »

Read More »

Emerging Markets: What has Changed

PBOC tweaked its process for determining the yuan reference rate. Singapore is reportedly studying measures to boost revenue, including higher taxes. Moody’s upgraded the outlook on Russia’s Ba1 rating from negative to stable. Nigerian President Buhari extended his stay abroad. Nigerian central bank tweaked its FX restrictions, but was aimed at retail demand. Brazil political risk is back on the table. Brazil’s central bank hinted at a faster pace...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a soft note, as some risk off sentiment crept back into the markets. The dollar gained broadly on Friday despite lower US rates as bonds rallied, the yen gained and equities sold off. Markit PMI for February Tuesday and FOMC minutes Wednesday could give the markets some further clues regarding Fed policy.

Read More »

Read More »

Emerging Markets: What has Changed

Head of Samsung Group Jay Y. Lee was formally arrested on allegations of bribery, perjury, and embezzlement. The assassination of Kim Jong Un’s half-brother suggests the political situation in North Korea may be heating up. The Polish central bank is tilting more hawkish. The Turkish central bank said it will allow domestic companies to use liras to repay export loans.

Read More »

Read More »

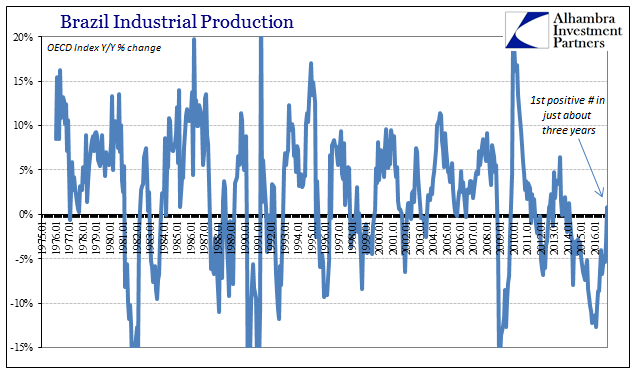

Brazil: Continuing Problems

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it.

Read More »

Read More »

Emerging Market Preview of the Week Ahead

EM FX ended last week on a firm note. Falling US rates allowed many foreign currencies to gain some traction. This week, a heavy US data slate is likely to test the market’s convictions on the Fed, with January PPI, CPI, IP, and retail sales all being reported. Yellen also testifies before Congress on Tuesday and Wednesday.

Read More »

Read More »

![The Modimobile is making the rounds amid a flower shower. [PT] Photo credit: PTI Photo](https://snbchf.com/wp-content/uploads/2017/03/Modi-Mobile.jpg)