Category Archive: 5.) Charles Hugh Smith

Checking In on the Four Intersecting Cycles

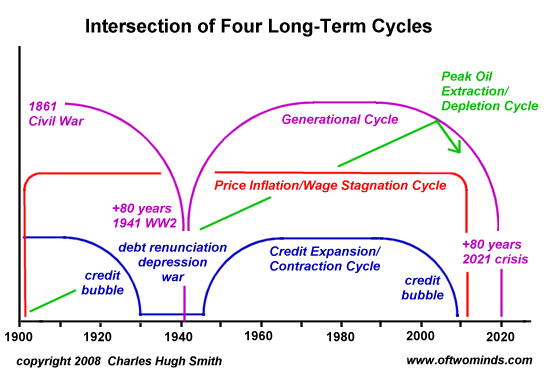

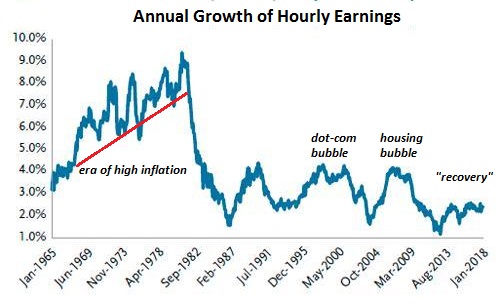

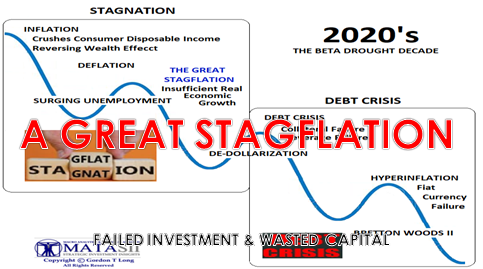

Correspondent James D. recently asked for an update on the four intersecting cycles I've been writing about for the past 10 years. Here's the chart I prepared back in 2008 of four long-term cycles: 1. Generational (political/social).2. Price inflation/wage stagnation (economic). 3. Credit/debt expansion/contraction (financial). 4. Relative affordability of energy (resources).

Read More »

Read More »

How Much Longer Can We Get Away With It?

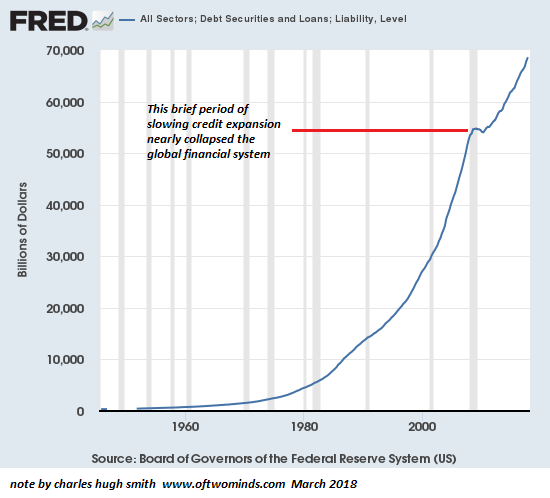

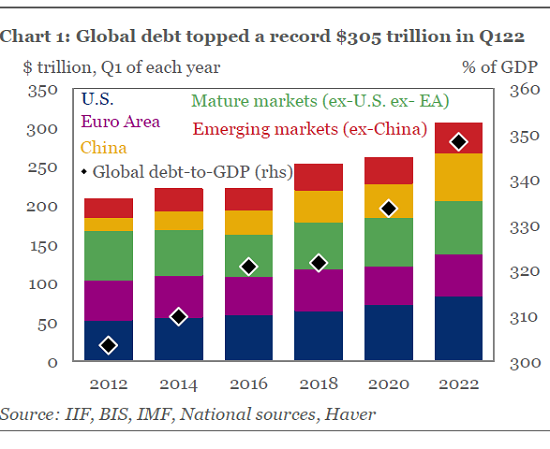

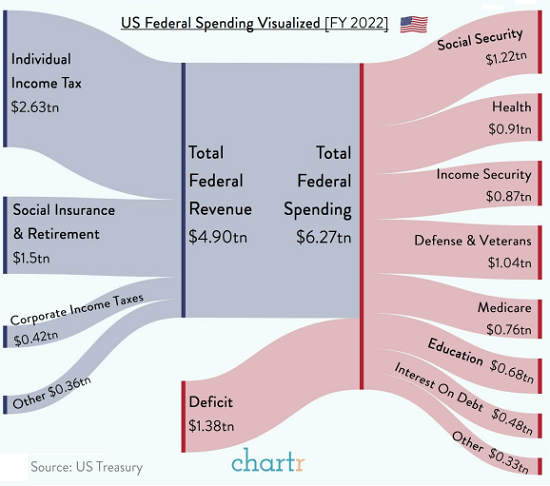

Alas, fakery isn't actually a solution to fiscal/financial crisis.. This chart of "debt securities and loans"--i.e. total debt in the U.S. economy--is also a chart of the creation and distribution of new money, as the issuance of new debt is the mechanism in our financial system for creating (or "emitting" in economic jargon) new currency: when a bank issues a new home mortgage, for example, the loan amount is new currency created out of the...

Read More »

Read More »

There is No “Free Trade”–There Is Only the Darwinian Game of Trade

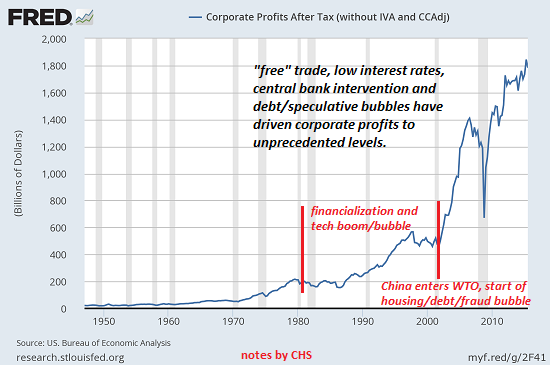

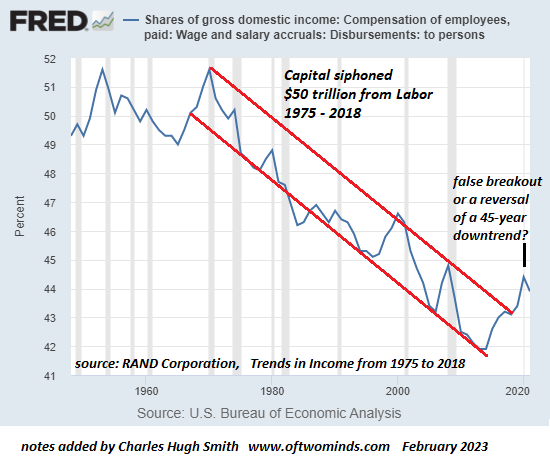

Rising income and wealth inequality is causally linked to globalization and the expansion of Darwinian trade and capital flows. Stripped of lofty-sounding abstractions such as comparative advantage, trade boils down to four Darwinian goals: 1. Find foreign markets to absorb excess production, i.e. where excess production can be dumped. 2. Extract foreign resources at low prices. 3. Deny geopolitical rivals access to these resources.

Read More »

Read More »

Forget “Free Trade”–It’s All About Capital Flows

Defenders and critics of "free trade" and globalization tend to present the issue as either/or: it's inherently good or bad. In the real world, it's not that simple. The confusion starts with defining free trade (and by extension, globalization).

Read More »

Read More »

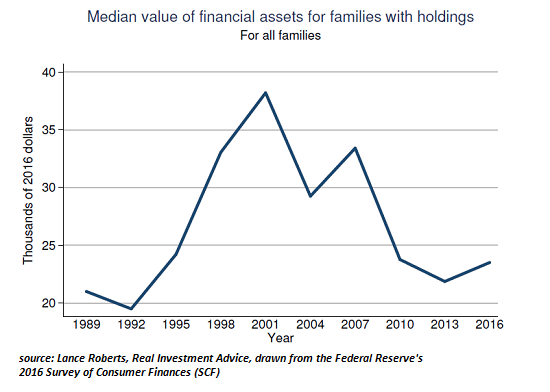

The Death of Buy and Hold: We’re All Traders Now

The percentage of household assets invested in stocks fell from almost 40% in 1969 to a mere 13% in 1982, after thirteen years of grinding losses. The conventional wisdom of financial advisors--to save money and invest it in stocks and bonds "for the long haul"--a "buy and hold" strategy that has functioned as the default setting of financial planning for the past 60 years--may well be disastrously wrong for the next decade.

Read More »

Read More »

Never Mind Volatility: Systemic Risk Is Rising

So who's holding the hot potato of systemic risk now? Everyone. One of the greatest con jobs of the past 9 years is the status quo's equivalence of risk and volatility: risk = volatility: so if volatility is low, then risk is low. Wrong: volatility once reflected specific short-term aspects of risk, but measures of volatility such as the VIX have been hijacked to generate the illusion that risk is low.

Read More »

Read More »

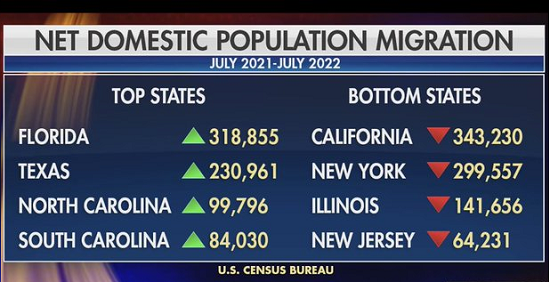

Our Fragmented Labor Markets Defy Outdated Conventions

There are hundreds of extraordinarily diverse labor markets in the U.S. economy, and it takes a much more granulated approach to make any sense of this highly fragmented and dynamic marketplace. onventional economists/media pundits typically view the labor market as monolithic, i.e. as one unified market. The reality is the labor market is highly fragmented. Thus it's little wonder that conventional measures are giving mixed signals on employment,...

Read More »

Read More »

Career Advice to 20-Somethings: Create Value as a Mobile Creative

Finding work that fits who you are is rarely easy, especially if you don't fit into the mainstream, and usually it requires a lot of compromises, hard work and dead-ends. But that’s the process. Establishing a satisfying career is difficult in today's economy, doubly so for those who find life within hierarchical institutions (corporate America and government) unrewarding, and triply so for those burdened with student loan debt and college...

Read More »

Read More »

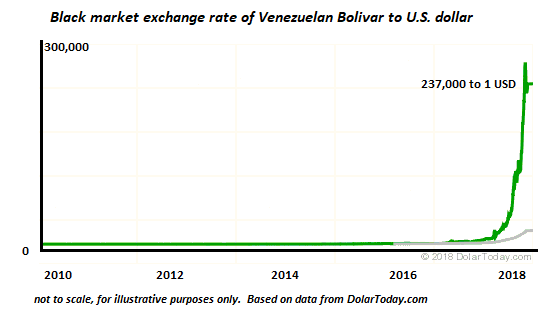

Venezuela’s New Cryptocurrency: Just Another Form of Control Fraud

The broke and broken country of Venezuela appears to be the first nation-state to issue a cryptocurrency token (the petro) as a means of escaping the financial black hole that's consuming its economy: Maduro Launches Oil-Backed Crypto "For The Welfare Of Venezuela".

Read More »

Read More »

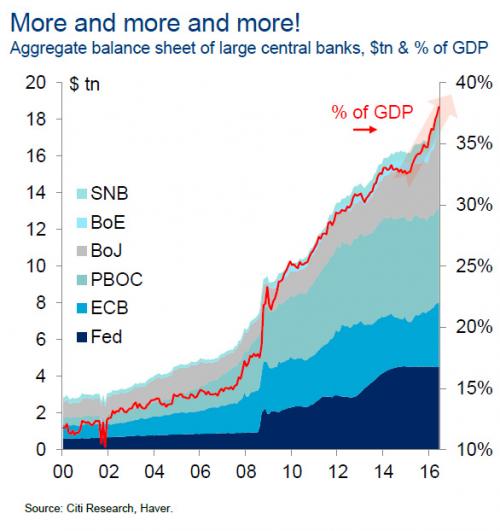

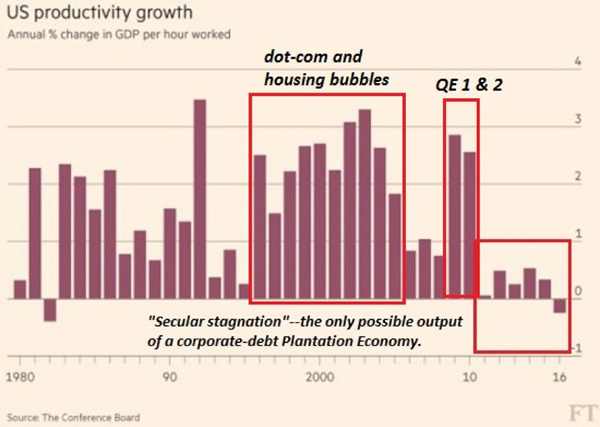

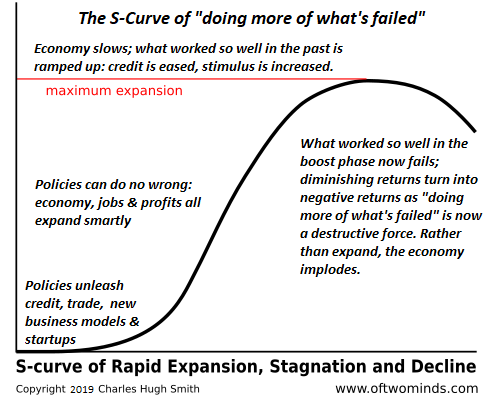

The End of (Artificial) Stability

The central banks'/states' power to maintain a permanent bull market in stocks and bonds is eroding. There is nothing natural about the stability of the past 9 years. The bullish trends in risk assets are artificial constructs of central bank/state policies. As these policies are reduced or lose their effectiveness, the era of artificial stability is coming to a close. The 9-year run of Bull-trend stability is ending as a result of a confluence of...

Read More »

Read More »

Our Approaching Winter of Discontent

The tragedy is so few act when the collapse is predictably inevitable, but not yet manifesting in daily life. That chill you feel in the financial weather presages an unprecedented--and for most people, unexpectedly severe--winter of discontent. Rather than sugarcoat what's coming, let's speak plainly for a change: none of the promises that have been made to you will be kept.

Read More »

Read More »

What Just Changed?

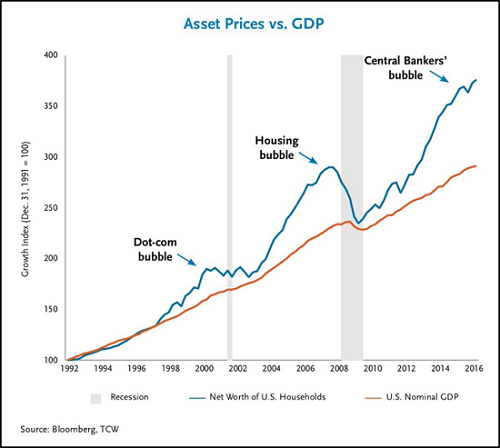

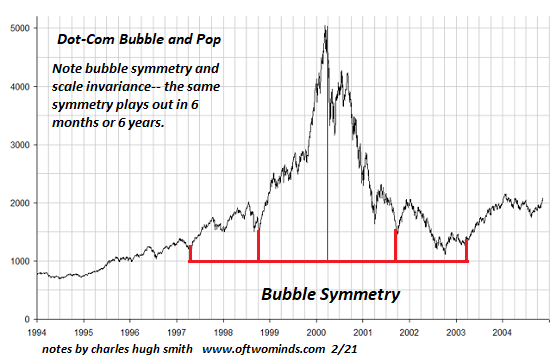

The illusion that risk can be limited delivered three asset bubbles in less than 20 years. Has anything actually changed in the past two weeks? The conventional bullish answer is no, nothing's changed; the global economy is growing virtually everywhere, inflation is near-zero, credit is abundant, commodities will remain cheap for the foreseeable future, assets are not in bubbles, and the global financial system is in a state of sustainable...

Read More »

Read More »

Three Crazy Things We Now Accept as “Normal”

How can central banks "retrain" participants while maintaining their extreme policies of stimulus? Human habituate very easily to new circumstances, even extreme ones. What we accept as "normal" now may have been considered bizarre, extreme or unstable a few short years ago.

Read More »

Read More »

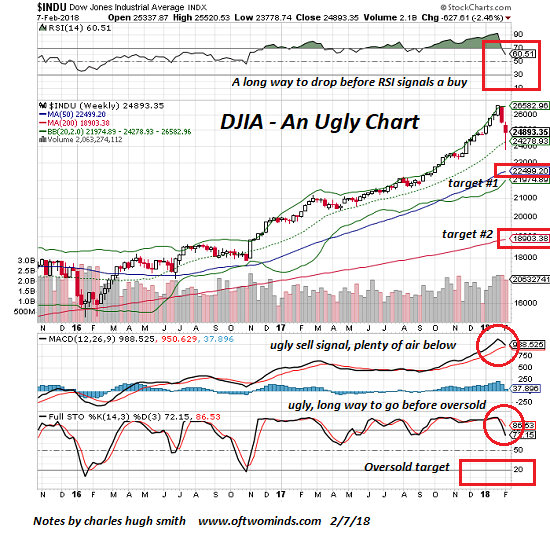

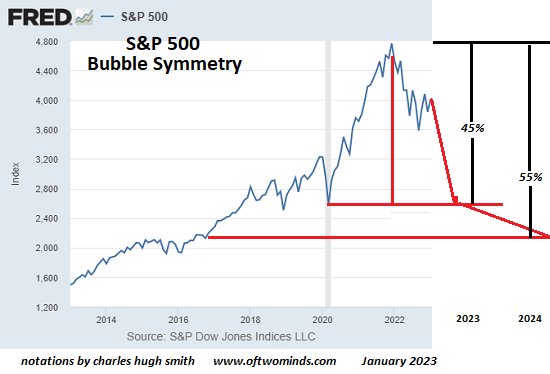

Before You “Buy the Dip,” Look at This One Chart

There's a place for fancy technical interpretations, but sometimes a basic chart tells us quite a lot. Here is a basic chart of the Dow Jones Industrial Average, the DJIA. It displays basic information: price candlesticks, volume, the 50-week and 200-week moving averages, RSI (relative strength), MACD (moving average convergence-divergence), stochastics and the MACD histogram. These kinds of charts are free (in this case, from StockCharts.com).

Read More »

Read More »

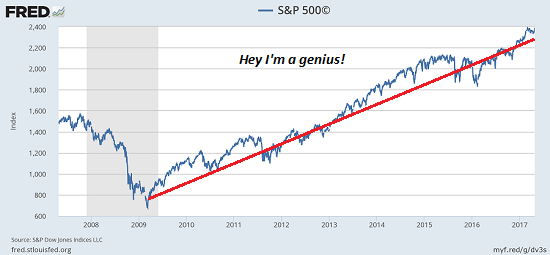

Is the 9-Year Long Dead Cat Bounce Finally Ending?

Ignoring or downplaying these fundamental forces has greatly increased the fragility of the status quo. The term dead cat bounce is market lingo for a "recovery" after markets decline due to fundamental reversals. Markets tend to bounce back after sharp declines as participants (human and digital) who have been trained to "buy the dips" once again buy the decline, and the financial media rushes to reassure everyone that nothing has actually...

Read More »

Read More »

Is Congress Finally Pushing Back Against Security Agencies’ Over-Reach?

The last time the U.S. Congress pushed back against the Imperial Presidency and the over-reach of the nation's Security Agencies was 43 years ago, in 1975. In response to the criminal over-reach of the Imperial Presidency (Watergate) and to the criminal over-reach of the security agencies (FBI, CIA, et al.), the Church Committee finally resusitated the constitutional powers of the Congress to serve the interests of the citizenry rather than the...

Read More »

Read More »

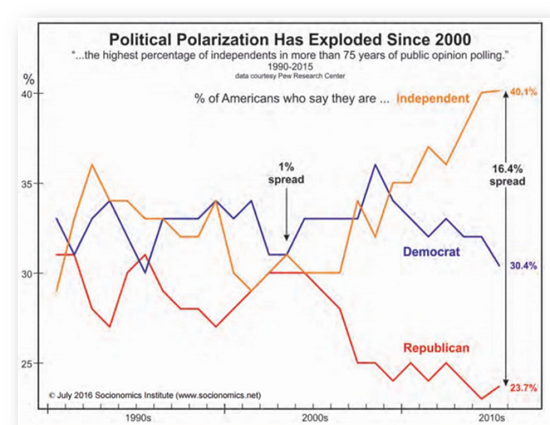

Political Correctness Serves the Ruling Elite

No wonder the Ruling Elites loves political correctness: all those furiously signaling their virtue are zero threat to the asymmetric plunder of the status quo. The Ruling Elites loves political correctness, for it serves the Elite so well. What is political correctness? Political correctness is the public pressure to conform to "progressive" speech acts by uttering the expected code words and phrases in public.

Read More »

Read More »

The Pie Is Shrinking for the 99 percent

The ensuing social disunity and disruption will be of the sort many alive today have never seen. Social movements arise to solve problems of inequality, injustice, exploitation and oppression. In other words, they are solutions to society-wide problems plaguing the many but not the few (i.e. the elites at the top of the wealth-power pyramid).

Read More »

Read More »

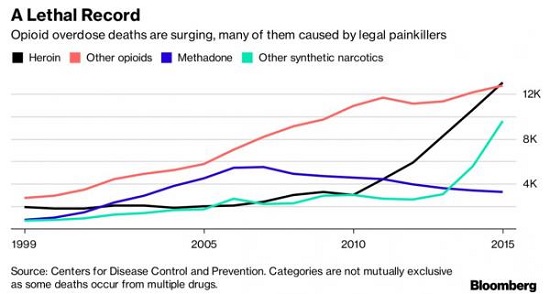

Can We Finally Have an Honest Discussion about the Opioid Crisis?

The economy no longer generates secure, purposeful jobs for the working class, and so millions of people live in a state of insecure despair. The opioid epidemic is generating a lot of media coverage and hand-wringing, but few if any solutions, and this is predictable: if you don't face up to the causes, then you can't solve the problem.

Read More »

Read More »

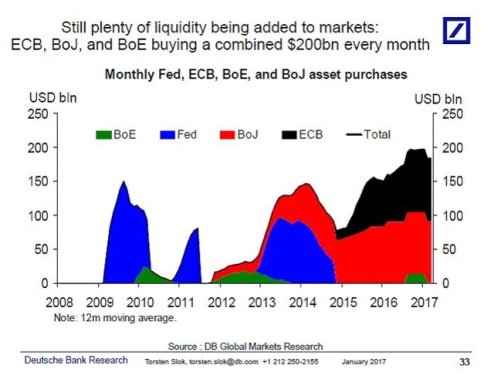

Central Banks: From Coordination to Competition

This is one reason why I anticipate "unexpected" disruptions in the global economy in 2018. The mere mention of "central banks" will likely turn off many readers who understandably have little interest in convoluted policies and arcane mumbo-jumbo, but bear with me for a few paragraphs while I make the case for something to happen in 2018 that will impact us all to some degree.

Read More »

Read More »