Category Archive: 1.) FXStreet on SNB&CHF

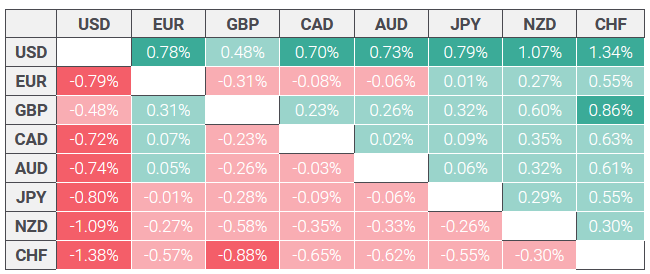

CHF appears well placed to extend its advance in the near-term – MUFG

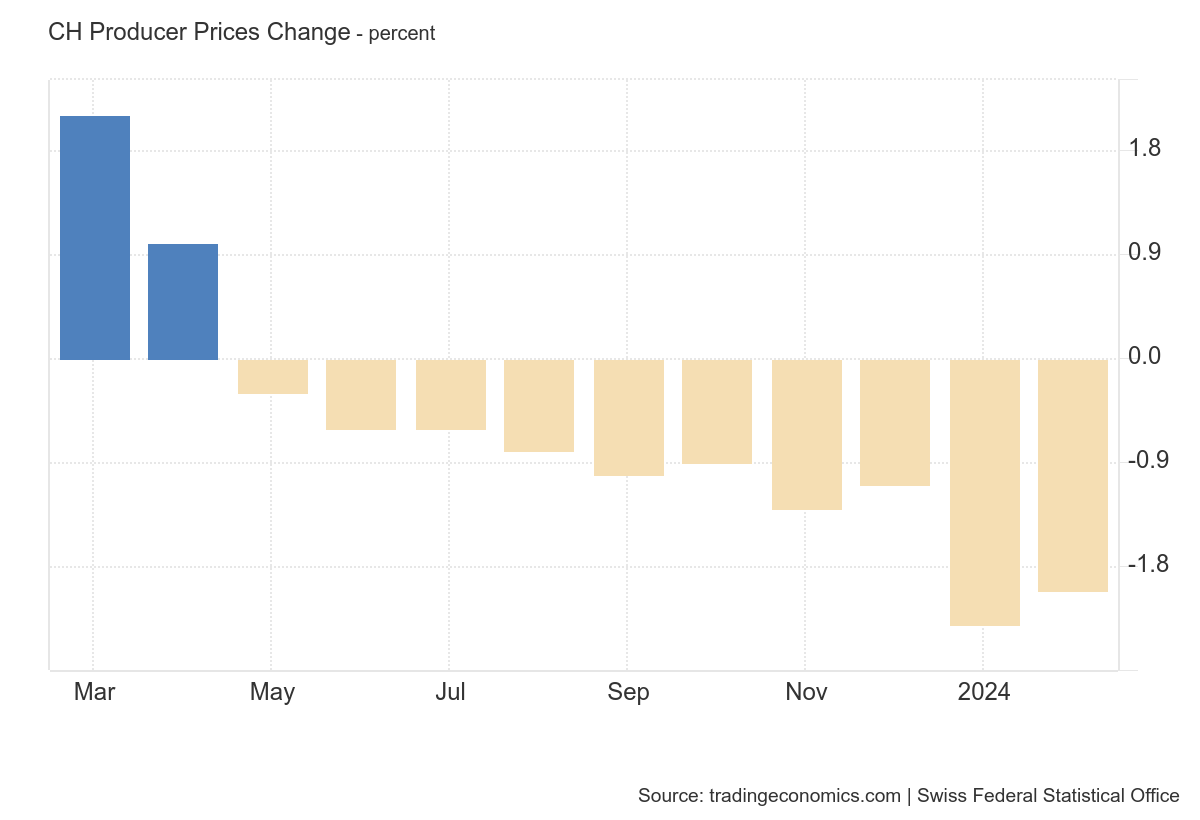

Analysts at MUFG Bank, point out that the Swiss franc has strengthened alongside the price of gold, perhaps reflecting debasement fears. They argue market participants are also questioning Swiss National Bank’s appetite for maintaining negative rates and intervening to dampen CHF strength.

Read More »

Read More »

SNB can leverage its balance sheet if needed, Schlegel says

The Swiss National Bank (SNB) retains the ability to wage currency market interventions if necessary, Martin Schlegel, one of the SNB’s alternate governing board members, said on Wednesday, according to Bloomberg.

Read More »

Read More »

EUR/CHF Price Analysis: Attempting corrective bounce amid oversold conditions

EUR/CHF is looking oversold, as per key daily chart indicator. The hourly chart is reporting a triangle breakout. A corrective bounce to the 5-day average hurdle could be in the offing. EUR/CHF is looking to regain some poise from three-year lows reached on Wednesday.

Read More »

Read More »

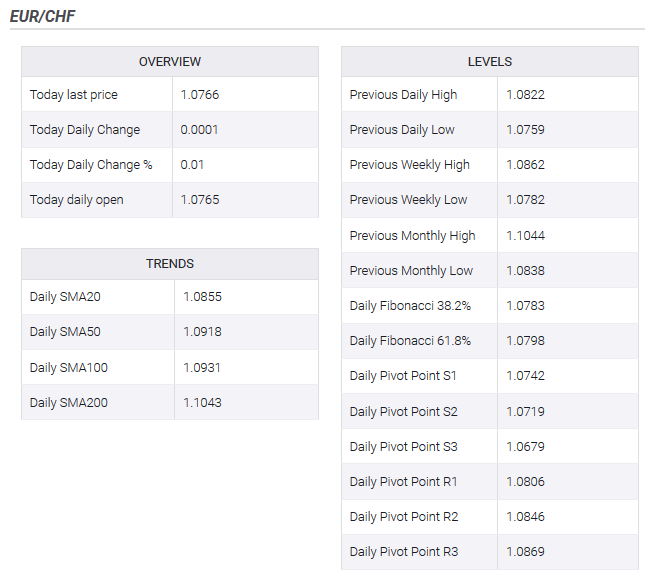

EUR/CHF: Franc at 33-month high five years after SNB removed the cap

EUR/CHF is trading at 33-month lows near 1.0759. The US added Switzerland to its current manipulators' list. The SNB removed the cap on the euro on Jan. 15, 2015. Five years after the Swiss National Bank (SNB) shocked the financial markets by abandoning the euro cap, the Swiss Franc is trading at 33-month highs against the single currency.

Read More »

Read More »

US Treasury adds Swiss Franc back to its currency watch list – Bloomberg

The US Treasury on Monday added Swiss Franc (CHF) back to its currency watch list and urged Switzerland to adjust its macroeconomic policies to more forcefully support domestic economic activity, according to Bloomberg.

Read More »

Read More »

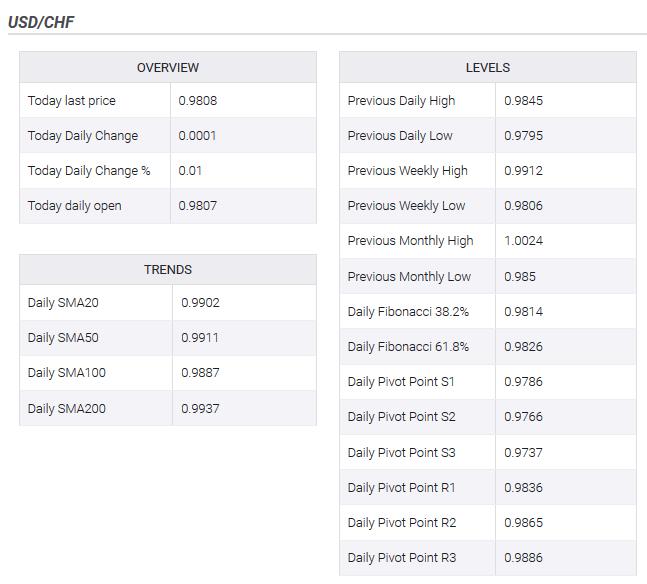

USD/CHF finds support near 0.9800 before SNB’s Quarterly Bulletin

Major European stocks post modest losses on Wednesday. US Dollar Index clings to gains above 97.30. Coming up: Swiss National Bank's (SNB) Quarterly Bulletin. The USD/CHF pair dropped to its lowest level since late August at 0.9798 on Wednesday but staged a technical recovery in the last hour. As of writing, the pair was up 0.05% on the day at 0.9808.

Read More »

Read More »

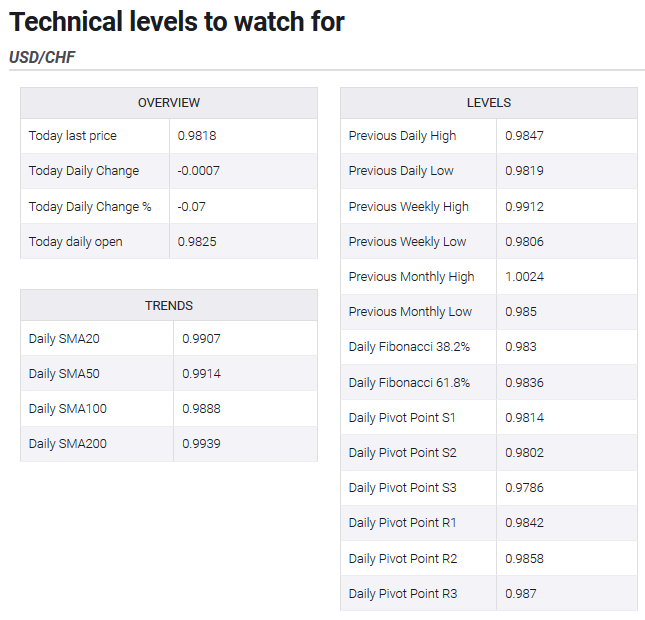

USD/CHF retreats to 0.9820 area as USD loses strength

US Dollar Index erases daily recovery gains ahead of American session. European equity indexes stay in the negative territory. Coming up: Building Permits, Housing Starts and Industrial Production data from US. The USD/CHF lost its traction in the last couple of hours and retraced its daily recovery gains pressured by the sour market mood and the broad USD weakness.

Read More »

Read More »

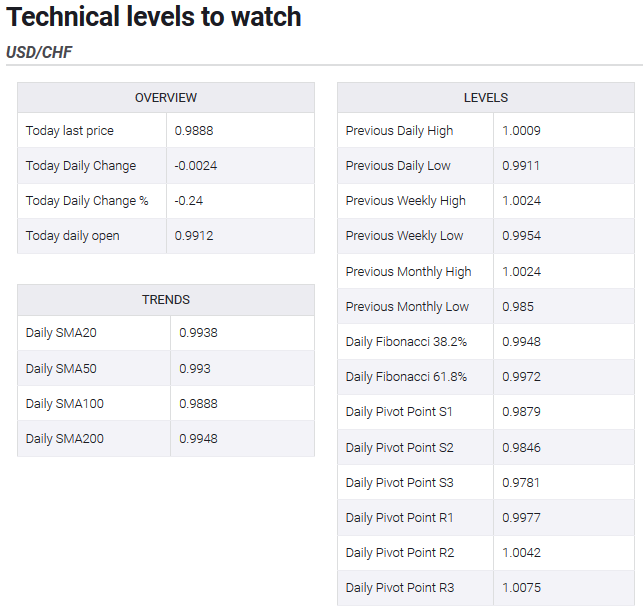

USD/CHF hammered down to sub-0.9900 levels, 2-week lows

USD/CHF lost some additional ground for the second straight session on Tuesday. A subdued USD demand, stability in equity markets did little to provide any respite. Trump’s latest remarks opened the room for a further intraday depreciating move. The USD/CHF pair witnessed some follow-through selling on Tuesday and dropped to near two-week lows, below the 0.9900 handle in the last hour.

Read More »

Read More »

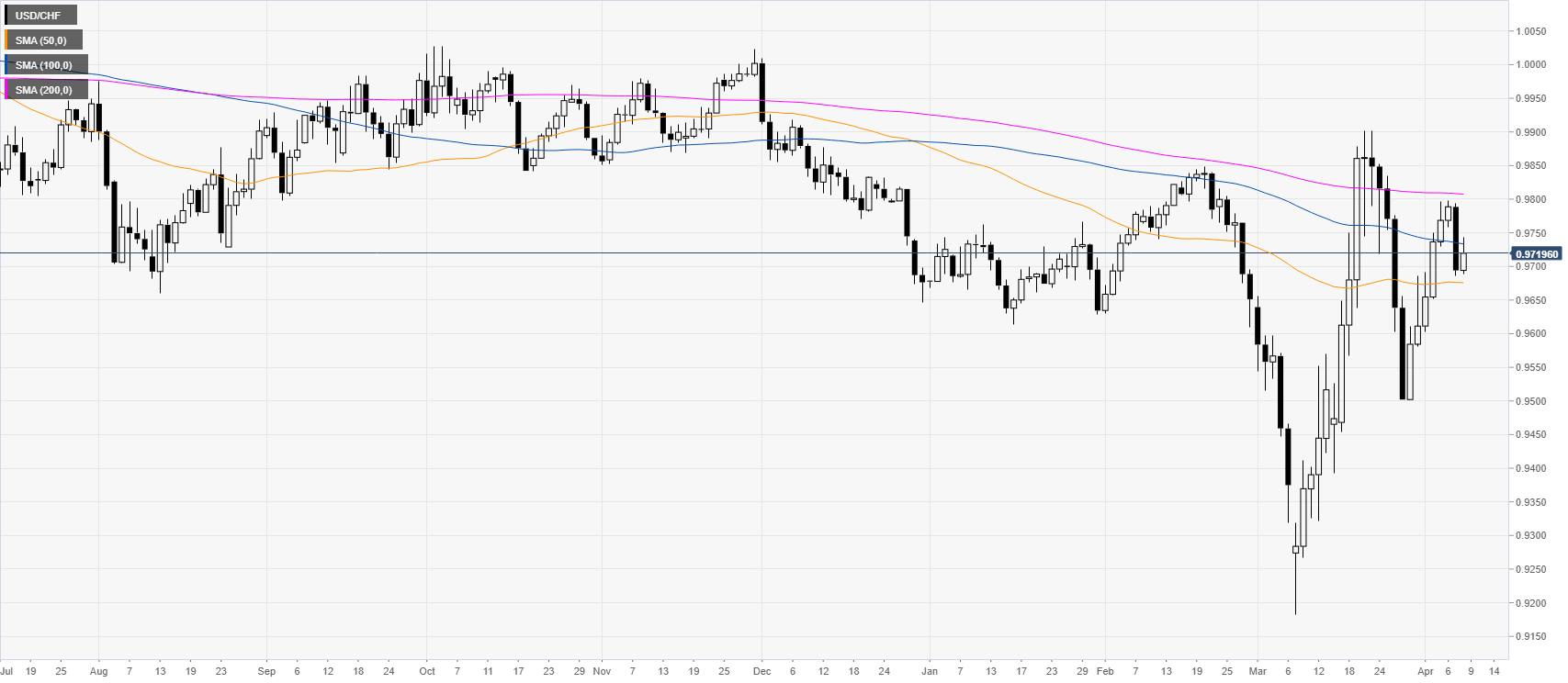

USD/CHF technical analysis: Bulls struggle to extend the recovery beyond 0.9900 handle

Renewed US-China trade optimism helped regain some traction. The uptick lacked bullish conviction and warrants some caution. The USD/CHF pair stalled its recent pullback from levels beyond 200-day SMA and regained some traction on the last trading day of the week. Renewed trade optimism weighed on the Swiss franc's safe-haven status and led to a modest recovery, though bulls struggled to extend the momentum beyond the 0.9900 handle.

Read More »

Read More »

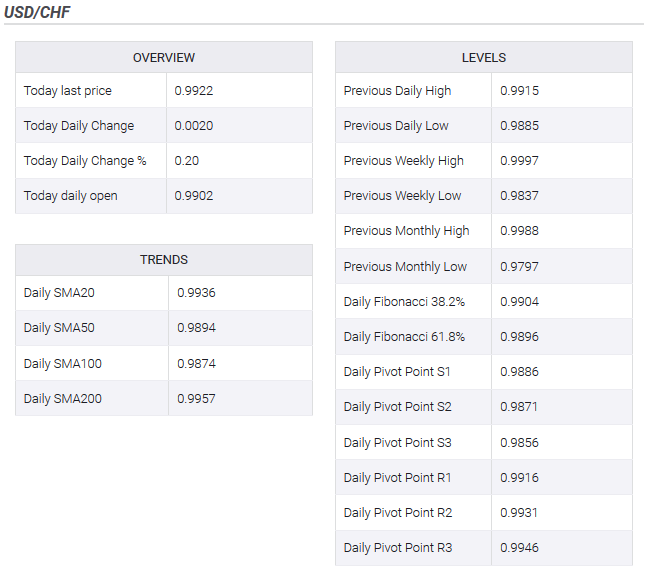

USD/CHF technical analysis: Greenback loses steam against Swissy, trades near 0.9930 level

USD/CHF erased its intraday gains, settling near the 0.9930 level. Support is seen at the 0.9920 level. On the daily chart, USD/CHF is trading in a range below its 200-day simple moving average (DMA). The spot is holding just above the 50 SMA today at the 0.9921 level.

Read More »

Read More »

USD/CHF extends rally to 0.9975, highest since mid-October

Swiss Franc amid the worst performers on Thursday amid positive trade headlines. US dollar rises supported by higher US yields; Wall Street hits a new record. The USD/CHF pair broke to the upside after trading sideways around 0.9925 for hours. It climbed to 0.9975, reaching a three-week high. Near the end of the session, it is consolidating gains, holding above relevant short-term technical levels.

Read More »

Read More »

USD/CHF technical analysis: Greenback hanging near the November highs against CHF

USD/CHF is trading flat on the day, consolidating the gains of the last two days. The level to beat for bulls is the 0.9940/0.9956 resistance zone. On the daily chart, USD/CHF is trading in a range below its 200-day simple moving average (DMA). The market is holding just above the 50 SMA today at the 0.9916 level.

Read More »

Read More »

SNB’s Jordan: Without negative rates, CHF would be more attractive and rise in value

In his prepared remarks delivered to pension managers on Thursday, Swiss National Bank Chairman Thomas Jordan said negative interest rates and readiness to intervene in the forex market was still essential to ease the pressure on the Swiss Franc.

Read More »

Read More »

USD/CHF technical analysis: Greenback nearing the October lows, consolidating near 0.9870 level

USD/CHF is consolidating its losses this Thursday. The level to beat for bears is the 0.9855 support. On the daily chart, USD/CHF is trading in a range below its main daily simple moving averages (DSMAs). The market is approaching the October low, currently at the 0.9837 price level.

Read More »

Read More »

EUR/CHF technical analysis: Bounces up from key support, eyes Oct. 17 high

EUR/CHF is looking north, having bounced up from key MA support. The 4-hour chart indicators are also reporting bullish conditions. EUR/CHF is better bid at 1.1030 press time and could challenge the Oct. 17 high of 1.1059 in the next 24 hours.

Read More »

Read More »

USD/CHF technical analysis: Jumps back closer to over 1-week tops

The intraday pullback finds decent support ahead of 0.9900 handle. Move beyond 0.9935 will set the stage for additional near-term gains. The USD/CHF pair did witness some intraday pullback but showed some resilience below 38.2% Fibonacci level of the 1.0028-0.9837 recent downfall. The pair managed to find decent support near 200-hour SMA and has now moved back closer to over one-week tops set earlier this Friday.

Read More »

Read More »

USD/CHF rises to one-week highs at 0.9930

US Dollar strengthens during the American session after US data. Swiss Franc fails to benefit from the demand for safe-haven assets. The USD/CHF pair rebounded at 0.9890 and climbed to 0.9930, the highest level since October 17. As of writing, trades at 0.9920, up almost 20 pips for the day, on its way to the fourth daily gain in-a-row.

Read More »

Read More »

USD/CHF technical analysis: Greenback hits fresh October lows against the Swiss Franc

USD/CHF remains under heavy pressure after the London close. The level to beat for bears is the 0.9871 level. On the daily chart, USD/CHF is trading in a sideways trend, now challenging the 50 and 100-day simple moving averages (DSMAs) below the 0.9900 handle. the near term. Resistances can be seen at the 0.9881

Read More »

Read More »

USD/CHF technical analysis: Breaks below 0.9940 confluence support, turns vulnerable

The pair remains under some selling pressure for the second straight session. The ongoing slide dragged it below a two-month-old ascending trend-channel. Bears might now aim towards challenging the 0.9900 round-figure mark. The USD/CHF pair extended this week's rejection slide from the vicinity of the key parity mark and remained under some selling pressure for the second consecutive session.

Read More »

Read More »

USD/CHF technical analysis: Intraday uptick falters just ahead of parity mark

Despite the intraday pullback, the pair has managed to hold above 200-DMA. The near-term technical set-up support prospects for some dip-buying interest. The USD/CHF pair failed to capitalize on its intraday positive move and faced rejection near the key parity mark, albeit has still managed to hold above the very important 200-day SMA.

Read More »

Read More »

-637147386339434788-800x347.png)

-637094243479377368-800x391.png)

-637078290921470787-800x326.png)

-637076048529841650-800x391.png)

-637068826263809659-800x353.png)

-637067377269597535-800x353.png)

-638453232816314704.png)

-638351136132631444.png)

-637217795705356366.png)

-637211742211799359.png)