Category Archive: 2.) Other Periphery

Why Portugal Matters

DBRS reviews its investment grade rating of Portugal on Oct 21. A cut in its rating would have far reaching implications. A cut in the outlook is more likely than a cut the rating.

Read More »

Read More »

The Upcoming Spanish Lost Decade(s)

To us, the big theatre surrounding Greece was just a preview of a much bigger crisis that will happen in the coming years in Spain, the upcoming Spanish lost decade(s). Greece was an absolutely desperate case; therefore, everything was quick. It took just two years till we arrived at the official sector participation and yearly German transfer …

Read More »

Read More »

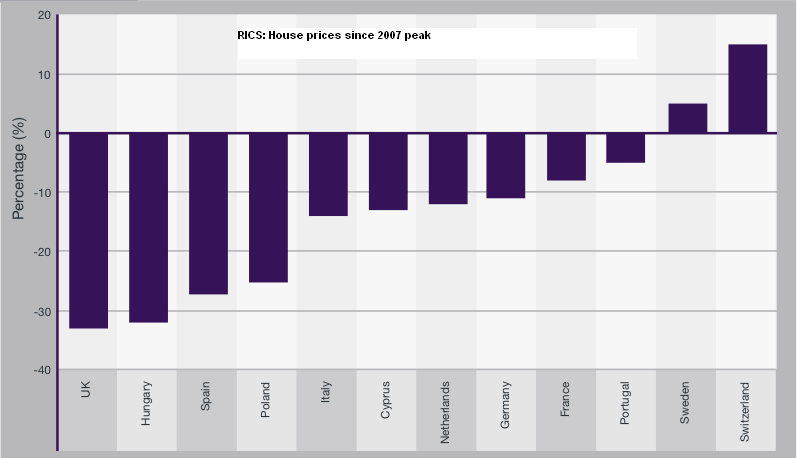

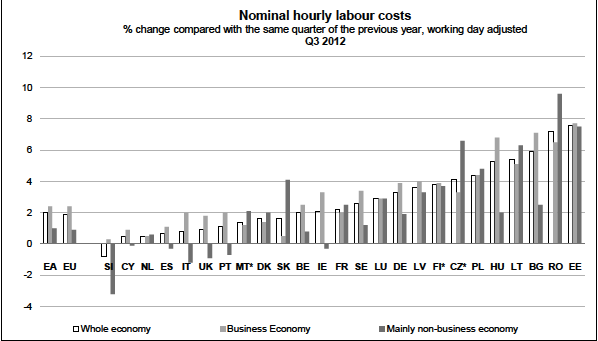

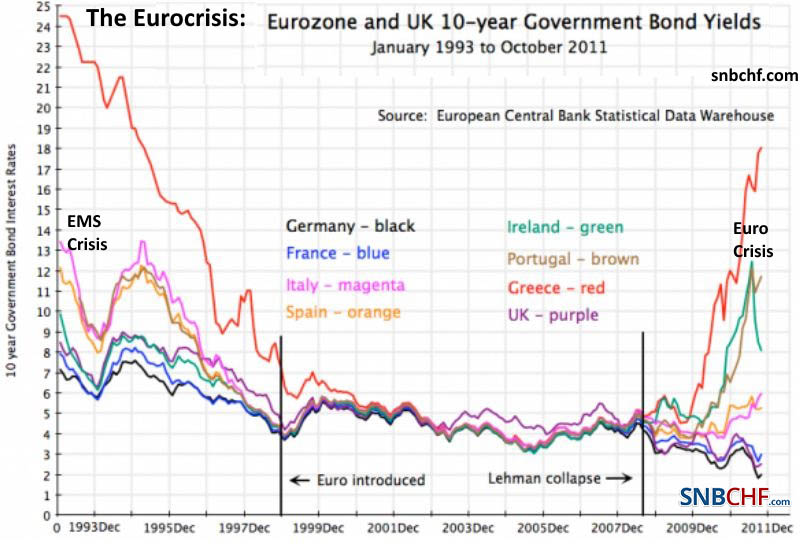

The Fairy Tale of Rising Competitiveness in the European Periphery

In our post we look on two questions concerning competitiveness for the European periphery: When will local production be cheaper than imported products? Do people have the money to buy these local products? It does not help reducing labor costs if local production costs still more than imported products. The second aspect is: even if …

Read More »

Read More »

Euro Morons: Hyperinflation Successfully Avoided, Stagflation Successfully Created

Keeping Greece in euro zone, eurocrats or better “euro morons” have successfully avoided a weak drachma and a following Greek hyperinflation. Instead they successfully created stagflation. Currently European HICP inflation is at 2.5%, far above the max. 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% …

Read More »

Read More »

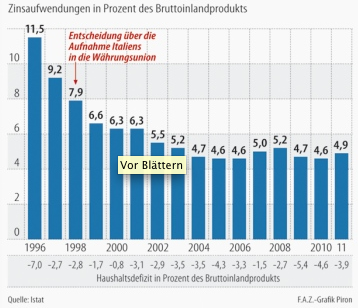

Italy: About the Hypocrisy of Politicians and the Blindness of the English-Speaking Financial Papers

Just a little wrap-up of two tweets read in 5 minutes, to which I finally added a bit more out of my recent Tweets. One Tweet: The British finance minister Osborne has emphasized that the euro zone needs to protect its peripheral economies. “The whole of Europe needs to become more competitive and productive. That …

Read More »

Read More »

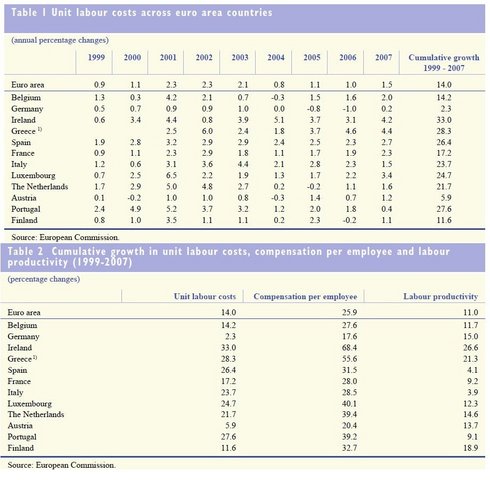

Jürgen Stark’s resignation and the ECB 2005 warning about labor cost divergence in the Euro-zone

The Wirtschaftswoche reports about the real reasons of ECB Chief economist Jürgen Stark’s resignation. The reasons are rather political, namely a protest against European governments:

Read More »

Read More »

The Spanish Ailing Car Industry

Extracts from Think Spain. October 2005. Foreign companies who manufacture cars in Spain are facing a fresh crisis. In addition to the problems of VW subsidiary Seat, various others are being forced to take decisions about the renewal of a number of different models which are reaching the end of their life-cycles. While …

Read More »

Read More »