Category Archive: 6b) Austrian Economics

The Consequences of Good Intentions

Between the ongoing war in Gaza and Houthi attacks on Western shipping in the Red Sea, the media has had plenty of gruesome foreign policy fodder for the content mill. However, this coverage has come at the expense of the ongoing grinding conflict in Ukraine, which has quickly gone from a euphoric cause célèbre to a now embarrassing catastrophe that is best shoved in the closet and forgotten like all the rest of America’s decades of costly foreign...

Read More »

Read More »

FDR and the End of Gold: 2,500 Percent and Counting

The world is full of scraps of paper today.- Benjamin Anderson, economist, Chase Manhattan Bank (1920 - 1939)April 1933 found America mired in a crushing economic depression, and newly elected president Franklin DeLano Roosevelt -- who had declared the previous month he had a legal power derived from the Trading with the Enemy Act to assume control of our monetary system -- responded by taking America off the gold standard. That the Act, an...

Read More »

Read More »

Fixing FDR’s Biggest Blunder: From Gold Standard to Fiat Folly and Back

Today, states across the country are beginning to actively embrace prosound money legislation, inviting a critical examination of how America abandoned the gold standard of money and racked up $34.5 trillion in debt. To understand how we got here, it’s important to understand the policy that initiated our monetary decline.More than ninety years ago today, April 5, 1933, President Franklin D. Roosevelt issued Executive Order 6102, forever reshaping...

Read More »

Read More »

Are American Libertarians Unduly Pessimistic?

Nick Gillespie, editor-at-large for Reason, recently got into a friendly dispute with Bob over whether American libertarians were being too pessimistic. He joins Bob to make the case for optimism, while Bob demurs.Human Action Podcast listeners can get a free copy of Dr. Guido Hülsmann's How Inflation Destroys Civilization: Mises.org/HAPodFree

Read More »

Read More »

The Most Important Price of All

In The Price of Time, Edward Chancellor has given us a colorful and provocative review of the history, theory, and the profound effects of interest rates, the price that links the present and the future, which he argues is “the most important price of all.” The history runs from Hammurabi’s Code which in 1750 BC was “largely concerned with the regulation of interest,” and from the first debt cancellation, which was proclaimed by a ruler in ancient...

Read More »

Read More »

How the “Informal” Economy Creates Free Markets in Bolivia

In today's discourse on Bolivia, notions of liberalism, free markets, or traditional capitalist ideals don’t ever come to mind in contrast with mainstream discussions of 21st-century socialism, Keynesian policies, and a notable lack of economic freedoms. In fact, Bolivia was ranked 117 in 2021 by the Fraser institute in the Economic Freedom of the World: 2023 Annual Report. And it scored 43.4 in the Economic Freedom Index by the Heritage...

Read More »

Read More »

An Optimistic Strategy for Liberty

A strategy for liberty must be both optimistic and realistic.Perennial optimists are sometimes tempted to ignore or minimize hazards, their answer to every challenge being somewhat lackadaisical: “Don’t worry, it will be fine.” They make the mistake of supposing all that is needed to surmount any challenge is a good bout of optimism. They can be heard, for example, assuring us that simply pronouncing the slogan “go woke, go broke” will scatter the...

Read More »

Read More »

Why Average Goods Prices Cannot be Established

The price or the rate of exchange of one good in terms of another is the amount of the other good divided by the amount of the first good. In the money economy, price will be the amount of money divided by the amount of the first good.Suppose two transactions were conducted. In the first transaction, one TV set is exchanged for $1,000. In the second transaction one shirt is exchanged for $40. The price or the rate of exchange in the first...

Read More »

Read More »

Abolish all Treason and Sedition Laws

The word "treason" has enjoyed something of a renaissance in recent years—on the Left. It used to be more popular on the Right. During the Cold War, conservatives frequently employed the word to demand their ideological enemies be exiled or executed. Nowadays, anti-immigration activists frequently denounce their opponents as "the treason lobby." But it's on the Left that the word appears to have its most devoted advocates at the...

Read More »

Read More »

Why Genocide?: Every Law of War Has Been Violated in Gaza

Why, then, are Israel’s 2023-2024 actions in Gaza genocidal? In a November 14, 2023 essay, "Bibi Netanyahu May Find Himself In the Dock, In The Hague,” your columnist explained why, logically at least, Israel has met the threshold for criminal intent, mens rea.“If you know in advance that your actions will cause the deaths of thousands-upon-thousands of civilians; attached to your criminal actions (actus reus) is a guilty mind (mens rea),...

Read More »

Read More »

The Intellectual Humility of the Spontaneous Order

Statists demand that proponents of the free market explain in painstaking detail how every conceivable service would be provided without the heavy hand of government coercion. How would law be administered? How would security be maintained? How would charity and education function? And of course, the tiresome refrain—who will build the roads? While Austrian economists have offered satisfactory answers to these questions, entertaining them may...

Read More »

Read More »

James Bovard on the Ron Paul Liberty Report

Marketing Permissions

Please select all the ways you would like to hear from Mises

Institute:

Email

You can unsubscribe at any time by clicking the link in the footer of

our emails. For information about our privacy practices, please visit

our website.We use Mailchimp as our marketing

platform. By...

Read More »

Read More »

Treason and Sedition Laws Have No Place in a Free Society

The word "treason" has enjoyed something of a renaissance in recent years—on the Left. It used to be more popular on the Right. During the Cold War, conservatives frequently employed the word to demand their ideological enemies be exiled or executed. Nowadays, anti-immigration activists frequently denounce their opponents as "the treason lobby." But it's on the Left that the word appears to have its most devoted advocates at the...

Read More »

Read More »

US Job Growth is Slower than Reported

The news media has been reporting steady job growth in the US economy since the Covid 19 crisis. Employment has grown steadily. However, data on employment represents progress in the number of jobs filled. The total number of jobs in business plans is the sum of all filled and unfilled jobs, total employees plus total job openings (see the red line in the top-left graph below).The total number of jobs in the US economy increased rapidly up to March...

Read More »

Read More »

Is Europe in Crisis?

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Artificially Low Interest Rates Are Creating Economic Chaos

If you asked him, Edward Chancellor wouldn’t say he’s particularly Austrian. Yet The Price of Time: The Real Story of Interest, the dense book he most timely published during the height of the inflation summer of 2022, is as obsessed with centrally planned interest rates as your average Misesian. Like many before him, and many in the Austrian camp, Chancellor identifies the many ills that trouble the world and locates their cause in a dysfunctional...

Read More »

Read More »

Connecticut’s Housing Shortage Is Rooted in Government Policies

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Marx, Class Conflict, and the Ideological Fallacy

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

California’s Minimum Wage Increase is Inefficient and Unfair

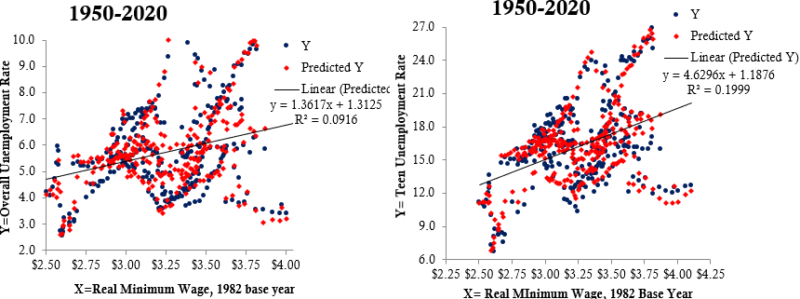

California raised its minimum wage rate for the fast food industry to 20$ today. US Politicians haven't targeted specific industries with minimum wage increases since the Great Depression. There are already signs that some fast food places in California are cutting back on employment. The specific effects of this fast food minimum wage will become clear during the rest of this year. For the time being, we should recall the general effects of...

Read More »

Read More »

Bitcoin vs. Gold: The Debate Continues

In a few short weeks since SEC approval Inflows into Bitcoin ETF funds had reached just over $59 billion on Good Friday, according to btcetffundflow.com. Meanwhile the unloved and disrespected GLD [gold] ETF holds $54 billion, despite its thousand year pedigree. Gold fan and crypto disser Peter Schiff debated crypto evangelist Raoul Pal on Real Vision for nearly three hours with neither combatant giving an inch. The calm Mr. Pal is the co-founder...

Read More »

Read More »