Category Archive: 6b) Austrian Economics

The Establishment Is Unmasking Itself

American political and economic elites insist that they should have authority over everyone else. As people rebel, the elites are only doubling down on their original demands.

Original Article: The Establishment Is Unmasking Itself

Read More »

Read More »

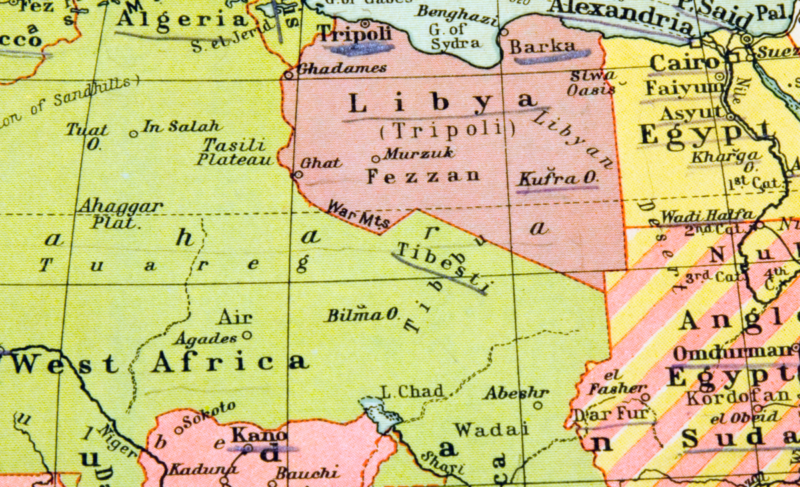

“Humanitarianism” as an Excuse for Colonialism and Imperialism

Spreading civilization and human rights has long been used as an excuse for state-building through colonialism and imperialism. This idea dates back at least to early Spanish and colonial efforts in the New World, and the rationale was initially employed as just one of many. The importance of the conquest-spreads-civilization claim increased, however, as liberalism gained ground in Europe in the nineteenth century. Liberals were more skeptical of...

Read More »

Read More »

What Is Inflation for 2024?

In this week's episode, Mark compares two definitions of inflation and what this means for policy-makers and the productive population in 2024. The mainstream view creates nothing but confusion and smokescreens, while the Austrian definition shows that the true definition shows a much higher level of economic pain and uncertainty and more economic problems to come in 2024.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Get your...

Read More »

Read More »

Government Employee Pensions Are Underfunded. Taxpayers Will Make Up the Difference

People aren’t messing with their 401(k)s enough, according to the The Wall Street Journal. It used to be “Set it and forget it.” Now, according to the Wall Street Journal’s Jon Sindreu, if you forget it, you might miss it.

Inspired by a BlackRock thought experiment which included perfect knowledge, Sindreu looked backward between 2020 and the present at a person making yearly changes (moving funds to the previous year’s strongest sector) which...

Read More »

Read More »

Bastiat versus MMT

Proponents of modern monetary theory (MMT) are back in action after a quiet spell during the embarrassing (for them) record price inflation of 2021–23. They are here to tell us that the mountain of government spending and debt is nothing to worry about; the government’s red ink is the private sector’s black ink, they say. Private sector growth emanates from public sector deficits, and since the US government has a gigantic money printer, there’s no...

Read More »

Read More »

Does Government Spending and Money Expansion Create New Wealth or Destroy It?

Many economists claim that economic growth is driven by increases in the total demand for goods and services, additionally claiming that overall output increases by a multiple of the increase in expenditures by government, consumers, and businesses. Thus, it is not surprising that most economic commentators believe that a fiscal and monetary stimulus will strengthen total demand, preventing the US economy from falling into a recession.

These...

Read More »

Read More »

Are Capital Gains Income? The Connection with Mises’s Calculation Problem

Bob goes solo to discuss a recent Twitter controversy, in which opponents of a proposed tax argued that unrealized capital gains couldn't possibly be a form of income. Bob cites both Austrian theory and corporate accounting practice to respond that all capital gains are income, which is not to say that they ought to be taxed. The dispute is important because understanding the definition of "income" sheds light on the role of market prices...

Read More »

Read More »

Jacobin Capitalism?

In his important book The Failure of American Conservatism (2023), the political theorist and philosopher Claes G. Ryn offers some criticisms of libertarianism and free-market capitalism, and in this week’s column, I’d like to examine these.

Ryn is not an opponent of all forms of the free market, but he fears an extreme version of it can be dangerous. He defends what he calls “value-centered historicism,” according to which people’s values stem not...

Read More »

Read More »

Rising Interest Rates and the “Great Reset” Bubble

Even though many deny it, the “Great Reset” exists, referring to a set of ideas that range from “stakeholder capitalism” to “wokeness” and “fourth industrial revolution” to “transhumanism.” It is effectively popularized especially through the World Economic Forum. The fight against viruses and epidemics and particularly the politically driven move away from fossil fuels to “save the global climate” are probably the most visible footprints of the...

Read More »

Read More »

Corrupt Money = Corrupt Society

Share this article

Discussion with Sean from SGT Report about the corruption of our money which has led to the corruption of society.

to watch the video click on this link: https://rumble.com/v44t52f-corrupt-money-corrupt-world-claudio-grass.html

Read More »

Read More »

How to Free Ourselves from Government Money (Part III)

To save our economy from destruction and from the eventual holocaust of runaway inflation, we the people must take the money-supply function back from the government. Money is far too important to be left in the hands of bankers and of Establishment economists and financiers. To accomplish this goal, money must be returned to the market economy, with all monetary functions performed within the structure of the rights of private property and of the...

Read More »

Read More »

History vs Economics: Explaining the Causes of the Great Depression

While economics textbooks are weak on causes of the Great Depression, American history texts are even worse. It's time for some truth telling.

Original Article: History vs Economics: Explaining the Causes of the Great Depression

Read More »

Read More »

Resurrecting the Failed Policy of Rent Control

When it comes to housing, the solution to the problem of affordability is rather straightforward: build more. Slapping price controls on housing in the form of “rent control” only makes things worse.

Original Article: Resurrecting the Failed Policy of Rent Control

Read More »

Read More »

The Anti-Semitism Controversy on College Campuses Is the Direct Result of Identity Politics

The recent campus protests following the Hamas-Israel conflict have been framed as either antiapartheid or anti-Semitic. The conflict is much deeper, being rooted in toxic identity politics.

Original Article: The Anti-Semitism Controversy on College Campuses Is the Direct Result of Identity Politics

Read More »

Read More »

Why Argentina Needs Free Cities

For most of the past century, Argentina has seen the destruction wrought by collectivism. To reverse the damage, the nation must allow decentralization, beginning with free cities.

Original Article: Why Argentina Needs Free Cities

Read More »

Read More »

Reflections on the Libertarian Role in Society

With the advent of language artificial intelligence like ChatGPT that are trained on online information, one can find backing for a hypothesis regarding society. General political thought is leftist leaning since the political answers given by the app are left oriented. The victory of self-proclaimed anarchocapitalist Javier Milei in the presidential elections of Argentina seems to be showing a pushback against the progressives, but the same is not...

Read More »

Read More »

Censorship and Official Lies: The End of Truth in America?

"Truth is treason in an empire of lies." – George Orwell

The State is tightening its stranglehold on its own narrative as its web of lies unravels. The government's lapdogs in the news media continue to bark and howl on TV even though a majority of American households have cut the cord. And of course, nothing resembling the truth can be heard in the softball press conferences at the White House and the Federal Reserve.

Newspapers, both...

Read More »

Read More »

The War on Producers and Entrepreneurs Is Based on False Notions of Profits

The war on the producer is raging on, and the assault on free enterprise and the entrepreneur is hitting an all-time high. Whether it be politicians, academics, or the mainstream media, there’s a relentless effort to paint those who create wealth and prosperity as villains who do nothing but exploit the masses.

This is not just a misguided moral crusade, but it also amounts to an egregious intellectual fraud as it completely ignores fundamental...

Read More »

Read More »

Fractional Reserve Banking (Part II)

We have already described one part of the contemporary flight from sound, free market money to statized and inflated money: the abolition of the gold standard by Franklin Roosevelt in 1933, and the substitution of fiat paper tickets by the Federal Reserve as our “monetary standard.” Another crucial part of this process was the federal cartelization of the nation’s banks through the creation of the Federal Reserve System in 1913.

Banking is a...

Read More »

Read More »

The Decisive Driving Force to Victory for Javier Milei

Much has been written in the international press, including within Argentina, about recently inaugurated Argentinian president Javier Milei, mostly about how he is an extreme right-winger (really wanting to taint him as a fascist among left-wing circles). Some independent journalists and observers have commented on how his announced plans could transform Argentina into a prosperous country by following classical liberal policies. One significant...

Read More »

Read More »