Category Archive: 6b) Austrian Economics

Fractional Reserve Banking (Part II)

We have already described one part of the contemporary flight from sound, free market money to statized and inflated money: the abolition of the gold standard by Franklin Roosevelt in 1933, and the substitution of fiat paper tickets by the Federal Reserve as our “monetary standard.” Another crucial part of this process was the federal cartelization of the nation’s banks through the creation of the Federal Reserve System in 1913.

Banking is a...

Read More »

Read More »

The Decisive Driving Force to Victory for Javier Milei

Much has been written in the international press, including within Argentina, about recently inaugurated Argentinian president Javier Milei, mostly about how he is an extreme right-winger (really wanting to taint him as a fascist among left-wing circles). Some independent journalists and observers have commented on how his announced plans could transform Argentina into a prosperous country by following classical liberal policies. One significant...

Read More »

Read More »

The Government Is Making the Economy Appear Better than It Is

As the 2024 general election gets closer, Democrats and proestablishment pundits are growing frustrated with the American public for not feeling as good about the economy as the so-called experts say they should. The elitism of this view aside, it is true that traditional economic indicators are pretty good and that, at the same time, people aren’t feeling good about the economy.

Center-left economists have been locked in a debate over whether...

Read More »

Read More »

Taking Money Back (Part I)

Money is a crucial command post of any economy, and therefore of any society. Society rests upon a network of voluntary exchanges, also known as the “free-market economy”; these exchanges imply a division of labor in society, in which producers of eggs, nails, horses, lumber, and immaterial services such as teaching, medical care, and concerts, exchange their goods for the goods of others. At each step of the way, every participant in exchange...

Read More »

Read More »

Spring 2024 Mises Book Club

By special request, the Mises Institute will hold its next in-person Mises Book Club, our new program to promote deep reading in Austrian economics, on campus at Oklahoma State University beginning Tuesday, February 6.

In celebration of the 80th anniversary of F. A. Hayek's Road to Serfdom, this classic work in political philosophy, intellectual and cultural history, and economics will be the focus of the next meeting.

For eight riveting weeks, ten...

Read More »

Read More »

Mises Circle in Fort Myers

Save the date!

Join the Mises Institute for a special Circle in Fort Myers, FL this November.

Registration, speaker details, and agenda forthcoming.

Read More »

Read More »

2024 Political Circus Begins in Iowa

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop discuss the results of the Iowa Caucuses. What does Trump's overwhelming win mean for American politics, and what is the future for candidates like Vivek Ramaswamy and Ron DeSantis? Also, did anyone know Asa Hutchinson was still around? Ryan and Tho discuss this and more.

Claim your free book: Mises.org/RothPodFree

Be sure to follow Radio Rothbard at Mises.org/RadioRothbard....

Read More »

Read More »

Can Classical Economics Explain the Approaching Fiscal Disaster?

Today’s US fiscal predicament includes unprecedentedly high federal spending financed by inadequate tax revenue and high federal budget deficits. There is a lack of sufficient buyers of US Treasury debt. Rating agencies have recently downgraded the US debt, and entitlement benefits are forecast to outstrip their trust funds in a few years. How might a nineteenth-century English economist be relevant to this predicament?

Might this fiscal...

Read More »

Read More »

The Oregon Problem: It’s Not Drugs! It’s the Socialistic Political Culture

Not many people know that Oregon decriminalized all drugs through a ballot initiative. The Wall Street Journal recently ran an article: “Oregon Decriminalized Hard Drugs: It Is Not Working.” The question here is, why not?

In 2020, the State of Oregon decriminalized all drugs, including hard drugs such as heroin, crystal meth, which you will remember as the centerpiece of the hit series Breaking Bad, and fentanyl, a highly dangerous synthetic...

Read More »

Read More »

Why You Should Read Human Action—Very Carefully

May 16–18, 2024: Join Dr. Joseph T. Salerno, Dr. Thomas J. DiLorenzo, Dr. Jörg Guido Hülsmann, Dr. Joseph T. Salerno, Dr. Mark Thornton, and more for a conference in honor of the 75th anniversary of Human Action at our campus in Auburn.

Read More »

Read More »

Forget the Alleged Social Contract: Taxes Are Coercive

Taxes are not a contractual obligation between the state and the individuals it governs. By definition, taxes are noncontractual debts in which the state is the creditor, and the payment of these debts is demanded through coercion and violence.

Read More »

Read More »

Introduction to the Chinese Edition of How to Think about the Economy: A Primer

To the Chinese reader:

It is safe to say that economics suffers at least as many fallacies and misunderstandings as any other field of study. Had physics suffered the same level of issues, we would not have seen much—if any—of the progress that we have made over the past centuries. Yet, economics—the queen of the social sciences—keeps being misrepresented, if not abused, and we suffer the consequences.

Those consequences are primarily in the form...

Read More »

Read More »

Reflections on the Rothbard Graduate Seminar

The Rothbard Graduate Seminar (RGS) provides an opportunity to learn about Austrian economics at a high level.

Original Article: Reflections on the Rothbard Graduate Seminar

Read More »

Read More »

The Escalating Tensions in the Red Sea Are a Bad Omen

With the Houthis in Yemen firing on commercial ships in the Red Sea, the US is contemplating yet another Middle East conflict. As we see again, aggression leads to more aggression.

Original Article: The Escalating Tensions in the Red Sea Are a Bad Omen

Read More »

Read More »

Privatizing Roads Solves the Problem of Road Closures

All of us have experienced government road closures and the traffic and safety nightmares they create. Private roads may be the answer to solving the problem.

Original Article: Privatizing Roads Solves the Problem of Road Closures

Read More »

Read More »

What is a “Fed Pivot,” And When Is It Likely to Happen?

Chairman of the Federal Reserve, Jerome “Jay” Powell, recently sent mysterious shock waves into financial markets with comments that suggested that Fed rate cuts might come sooner than expected.

Stock and bond markets took this as a good sign. They were already in a Santa Claus rally and broke out to new highs for the year. The interest rate on ten-year government bonds, which had already fallen by almost 1 percent since October, threatened to...

Read More »

Read More »

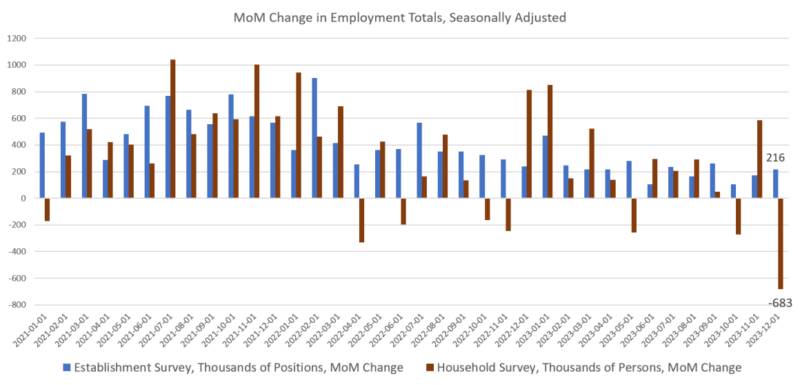

The December Jobs Report Is Mostly Bad News

According to a new report from the federal government's Bureau of Labor Statistics last Friday, the US economy added 216,000 jobs for the month while the unemployment rate held at 3.7%. NBC news was sure to tell us that this "beat expectations." Market estimates suggested total jobs added at 170,000 with the unemployment rate at 3.8%. The media's general consensus on the report is that the jobs economy is "robust" and...

Read More »

Read More »

The Draconian Budget Slashing Act of 2024

On this week's episode, Mark opens the Congressional Political Playbook to examine the proposed Congressional compromise spending legislation—and what they might name it.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Get your free copy of Murray Rothbard's Anatomy of the State at Mises.org/IssuesFree.

Read More »

Read More »

Are You an Enemy of the State? Most likely

Donald Trump, Julian Assange, Alex Jones, and Rudy Giuliani are in deep trouble with the US state. How about you?

Most likely you feel safe because your voice hasn’t attracted a large following. What would the state’s enforcers gain by attacking a little guy? They’re big-game hunters. Pull the plug on the big guys and their everyday followers float away like bathtub water down a drain.

Possibly you believe you aren’t really attacking the state with...

Read More »

Read More »

Expect More Currency Destruction and Weak Economies in 2024

Markets closed 2023 with the strongest rally for equities, bonds, gold, and cryptocurrencies in years. The level of complacency was obvious, registering an “extreme greed” level in the Greed and Fear Index.

2023 was also an unbelievably bad year for commodities, particularly oil and natural gas, something that very few would have predicted in the middle of two wars with relevant geopolitical impact and significant OPEC+ supply cuts. It was also a...

Read More »

Read More »