ECB begins to rotate forward guidance

|

|

Author: Frederik Ducrozet

Categories: Pictet Macro Analysis, Swiss and European Macro

|

|

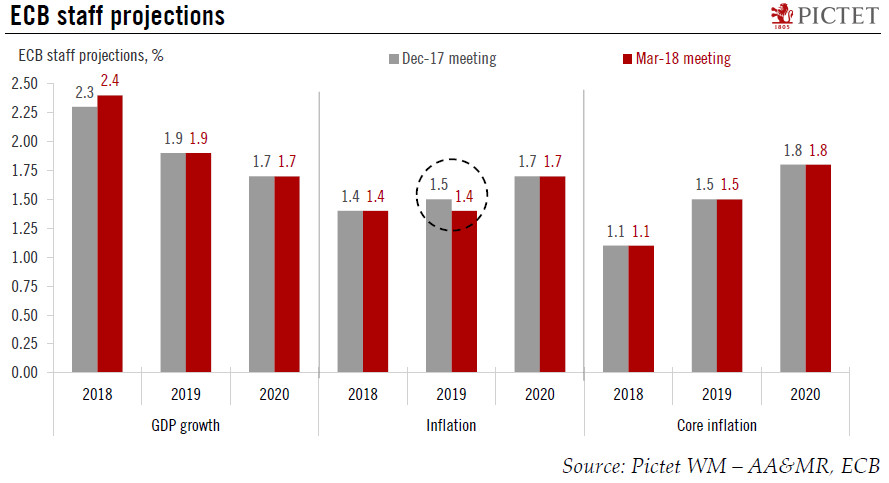

The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway.

|

|

|

|

|

|

FX Weekly Preview: Another Goldilocks Moment

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

Spring is around the corner in the Northern Hemisphere, and with it, a sense of a Goldilocks moment. Growth is sufficiently strong to see employment grow and absorb the economic slack. In the US, the participation rate of the key 25-54 aged demographic group has risen and now stands at 89.3%, the highest since 2010.

|

|

|

|

|

|

Drive for women in top jobs suffers setback

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

The percentage of women in top executive positions dropped slightly in Switzerland last year, a report has found. The annual survey by the Schilling human resource consultancyexternal link shows a 1% drop to 7% in 2017 compared with the previous year. In 2016, the share of women in company executive positions had risen by 2%, raising hopes of a strong increase over the years to come.

|

|

|

|

|

|

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

|

|

Author: Jan Skoyles

Categories: GoldCore, Stock Markets

|

|

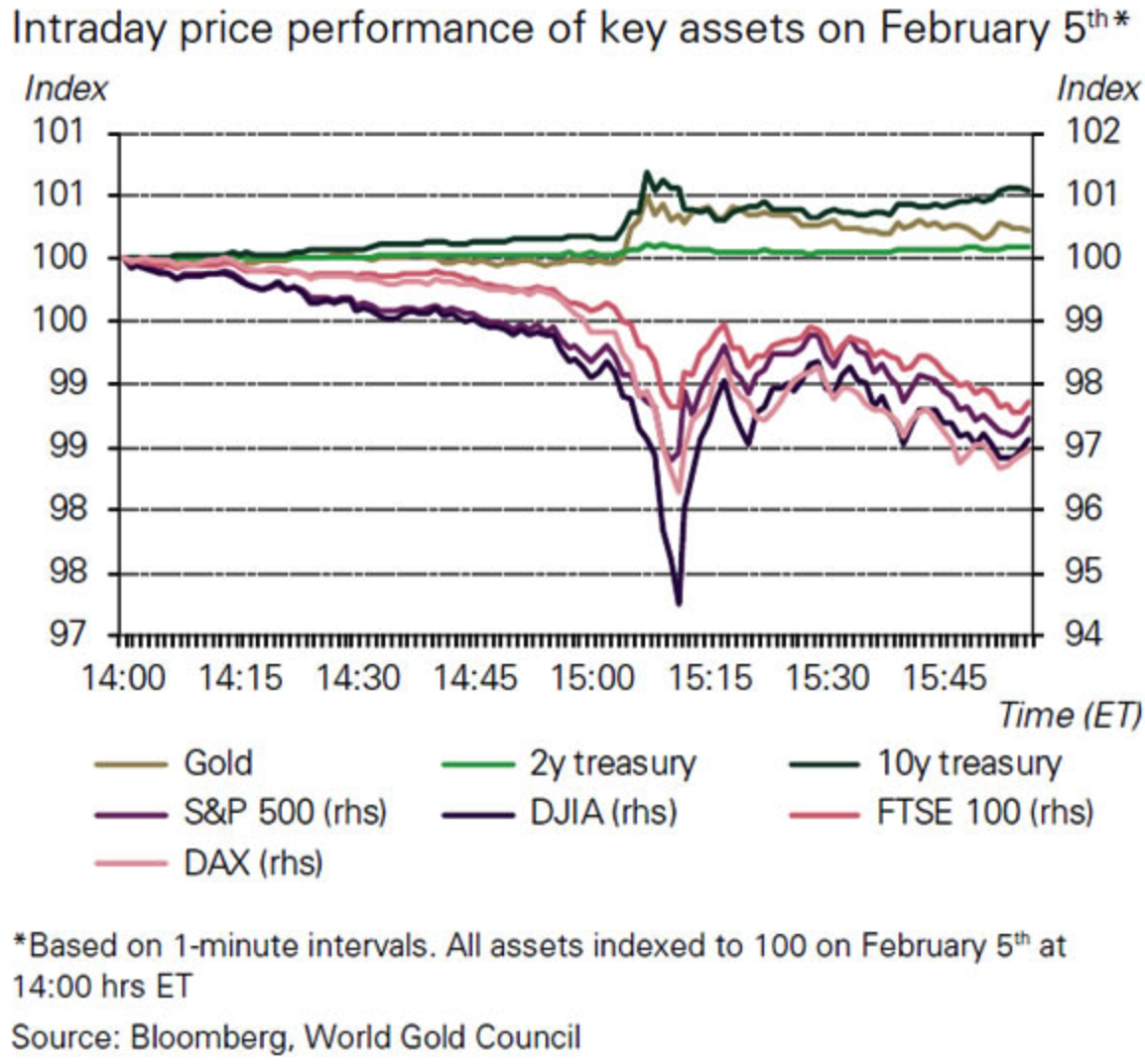

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk. Recent stock market selloff showed gold can deliver returns and reduce portfolio risk. Gold’s performance during stock market selloff was consistent with historical behaviour. Gold up nearly 10% in last year but performance during recent selloff was short-lived. The stronger the market pullback, the stronger gold’s rally. WGC: ‘a good time for investors to consider including or adding gold as a strategic component to their portfolios.’.

|

|

|

|

|

|

Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

|

|

Author: Joseph Y. Calhoun

Categories: The United States

|

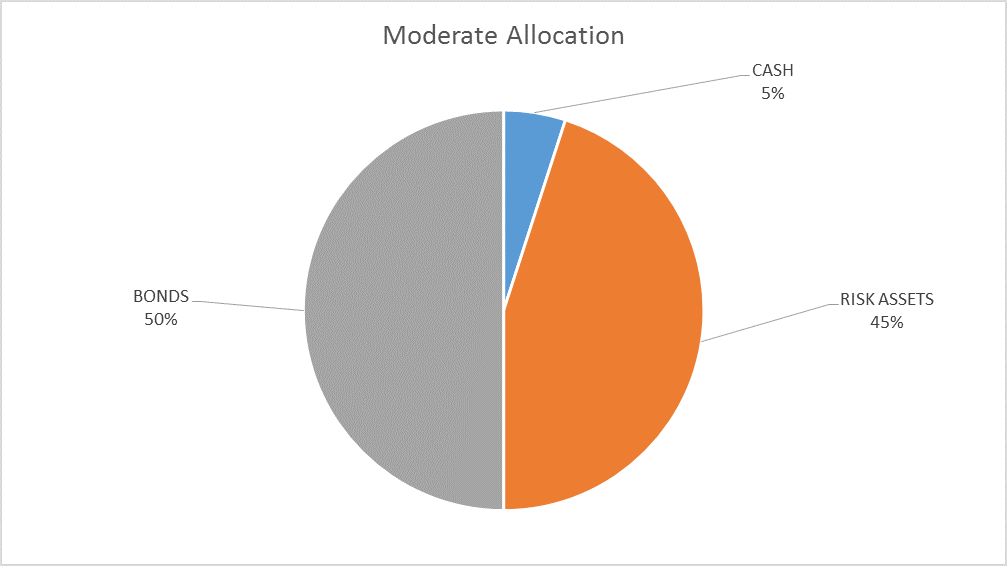

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average. That is about “as expected” as you can get for a stock market correction. We did have another bout of selling that was halted above the initial low and that too is pretty classic market action. All in all, what we’ve seen over the last month is a textbook case of a correction. At least so far.

While the overall allocation is unchanged, there are changes to the composition of some of the asset classes. Momentum is part of our

|

|

|

|

Emerging Markets: Preview Week Ahead

|

|

Author: Win Thin

Categories: Emerging Markets

|

|

EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month.

|

|

|

|

|

|

|

|